- A bullish descending wedge pattern has appeared on the price chart of NOT.

- Technical Indicators Hinting Future Consolidation Stages for Altcoins

Notcoin (NOT) Its performance over the past 24 hours has been impressive, with its value soaring into double digits on the charts. Now, these large increases can be attributed to strong market conditions, but they have also opened up the opportunity to recover previous losses.

Notcoin caught investors off guard.

CoinMarketCap’s data Notcoin said it recorded gains of more than 10% last week. But that’s not all. This is because the token price has surged by almost 15% in the last 24 hours alone. At the time of this writing, NOT is trading at $0.007155, with a market capitalization of over $733 million.

However, despite the price increase, only 479,000 NOT addresses were profitable, or 17% of the total number of NOT addresses. Into the Block. That said, the trend may soon change.

Consider this – the meteoric rise of altcoins has pushed their values to major levels. Renowned cryptocurrency analyst World Of Charts also recently shared the following: tweet NOT’s price chart highlights a bullish falling wedge pattern.

This pattern first appeared in June. Since then NOT has been integrated into it. At press time, Notcoin was consolidating in a narrow zone and was looking to test the pattern’s resistance. If a breakout occurs, investors may not expect to recover from previous losses.

Source: X

Aren’t they finally breaking up?

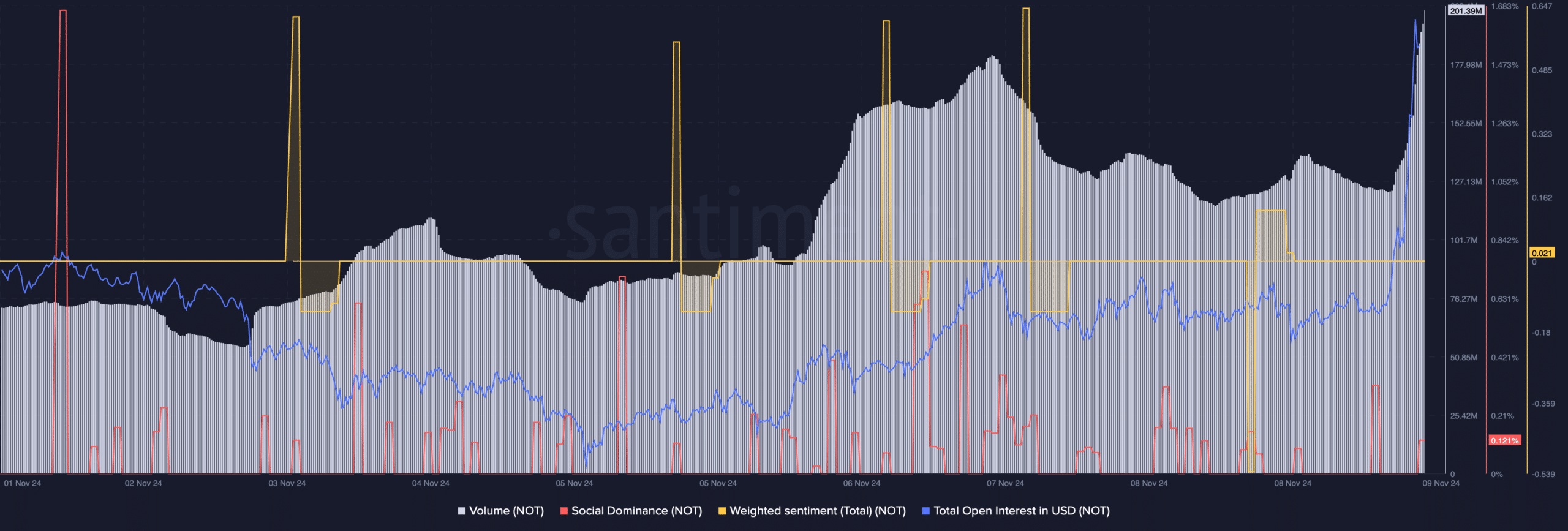

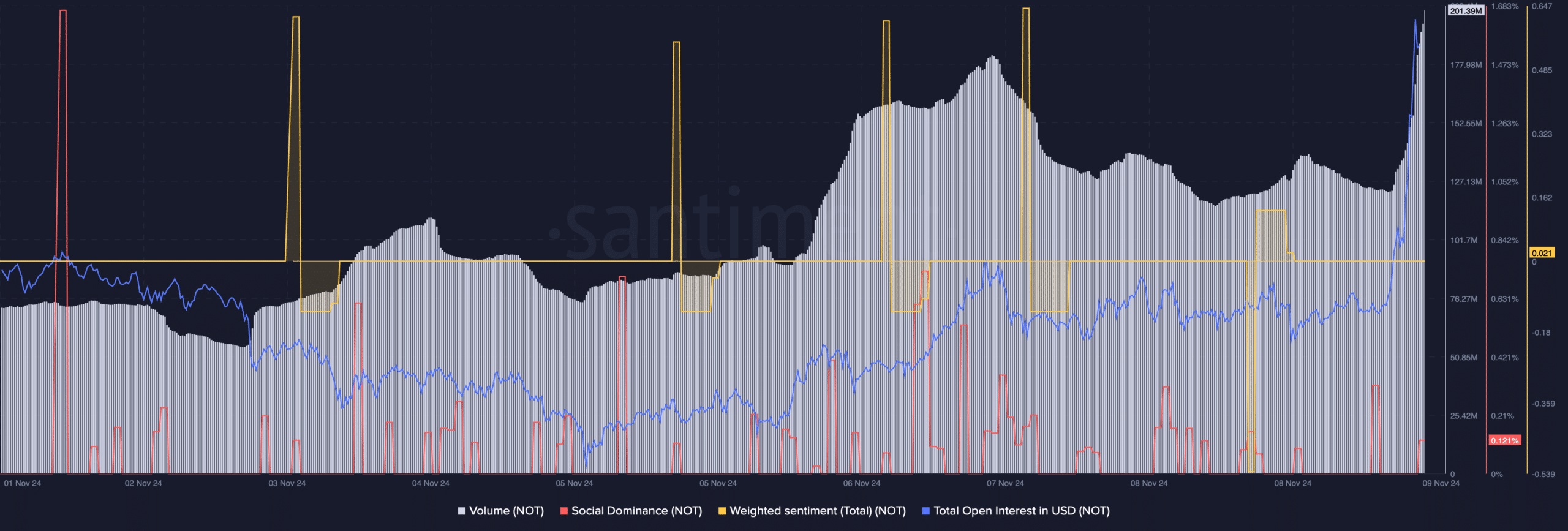

As the altcoin was looking to test an important resistance level, AMBCrypto looked at on-chain data to determine the probability of Notcoin breaking above the pattern. According to Santiment’s data analysis, NOT’s social volume dropped significantly last week. This is a sign of declining popularity.

Weighted emotions followed a similar path. This highlighted the dominance of bearish sentiment in the market.

Additionally, Notcoin’s long/short ratio has also decreased. This means that there are more short positions than long positions in the market. This is a bearish signal.

Source: Coinglass

Still, not everyone is against NOT.

For example, volume increased along with price, laying the groundwork for a bullish rally. Additionally, open interest also rose. Whenever an indicator rises, it means that an ongoing price trend is likely to continue.

Source: Santiment

read Notcoin (NOT) price prediction 2024~2025

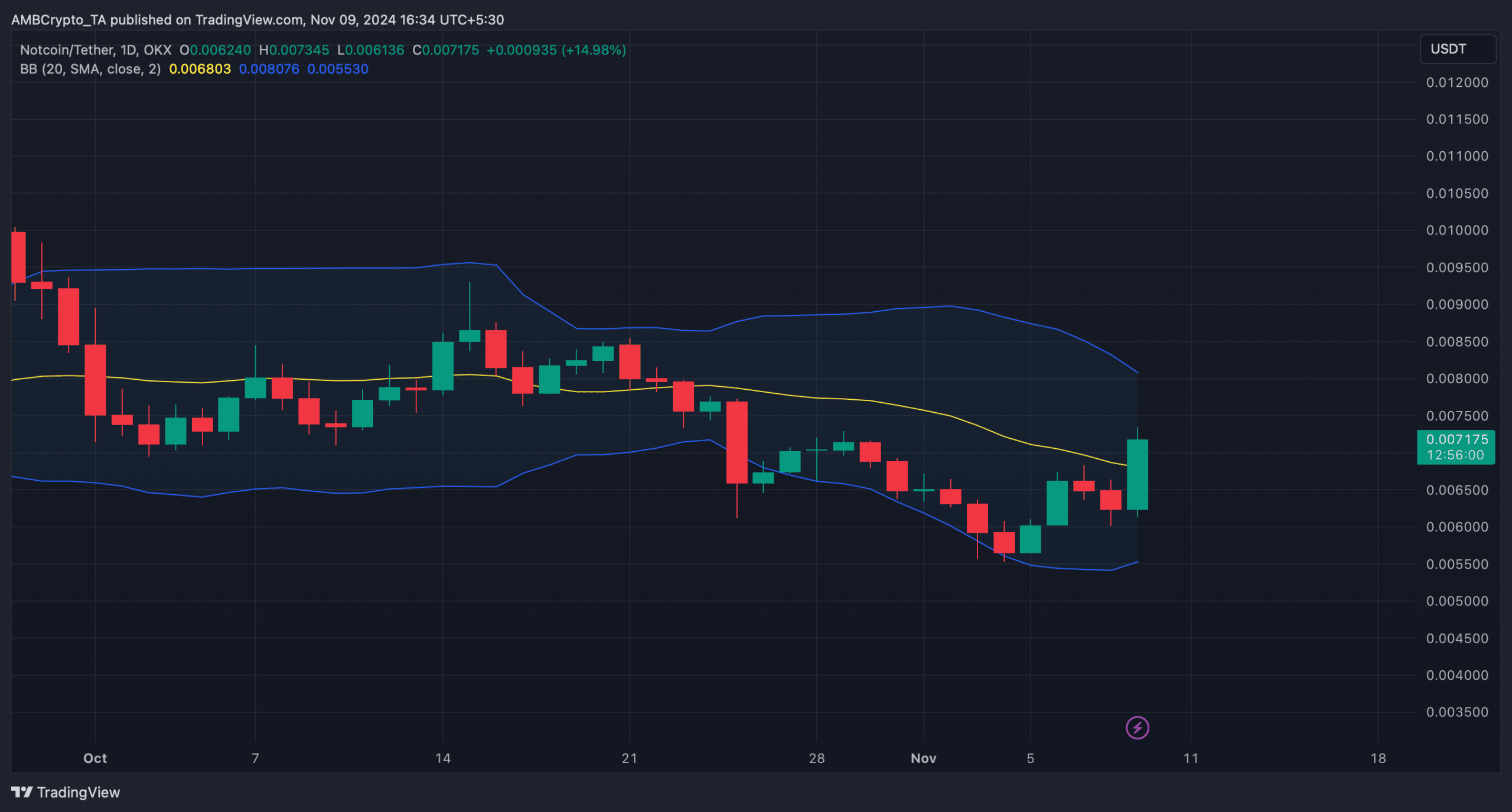

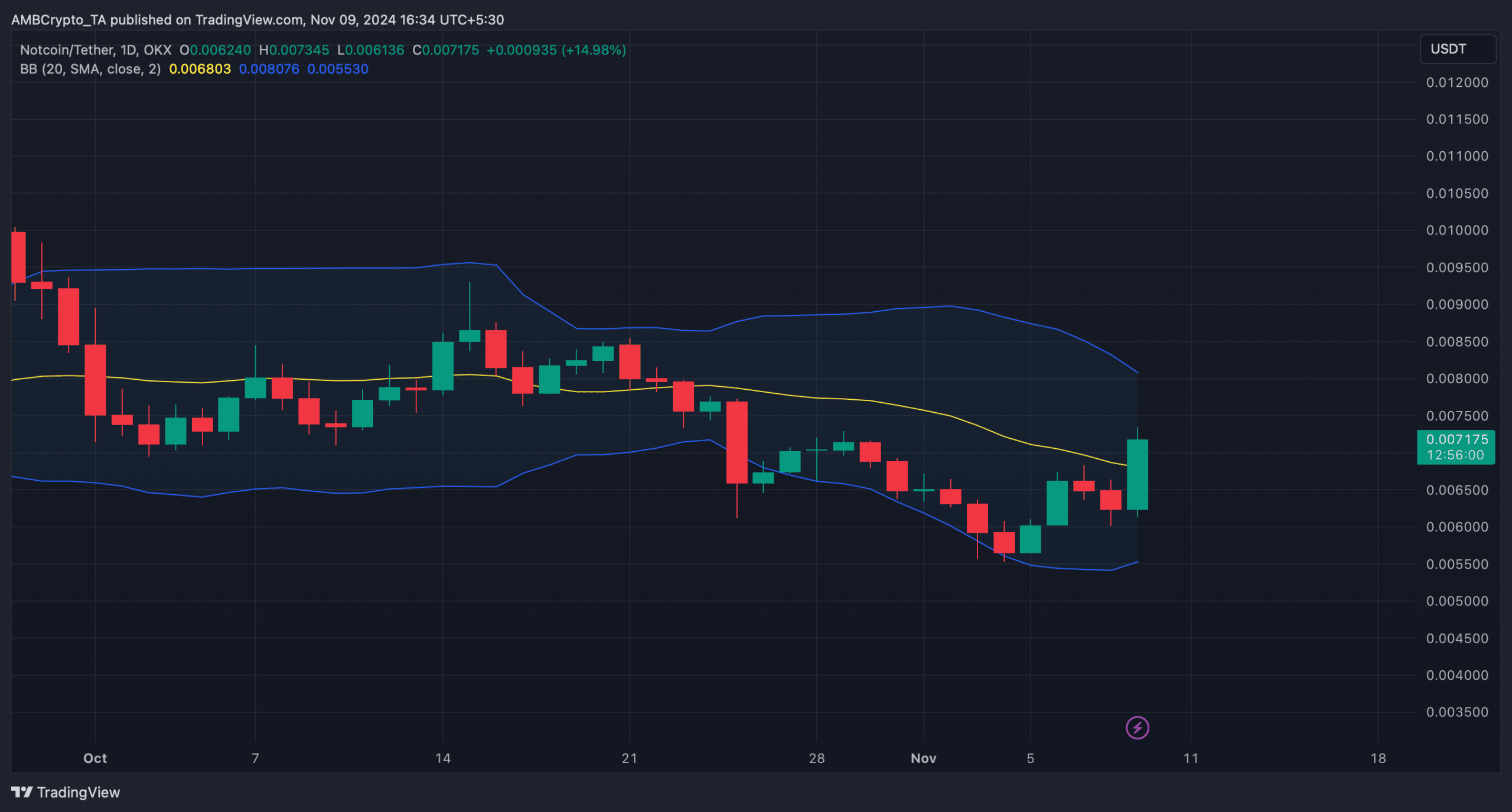

AMBCrypto then checked NOT’s daily chart to get a better understanding of which direction it was heading in the near term.

We found that the 20-day SMA was not exceeded. However, Bollinger Bands pointed to consolidation in the coming days. Therefore, investors must be patient to avoid deviating from the pattern before recovering past losses.

Source: TradingView