- Investors paid $ 775 million last week from encryption funds.

- Only XRP and multiple funds are low in demand, while the rest faced the sale.

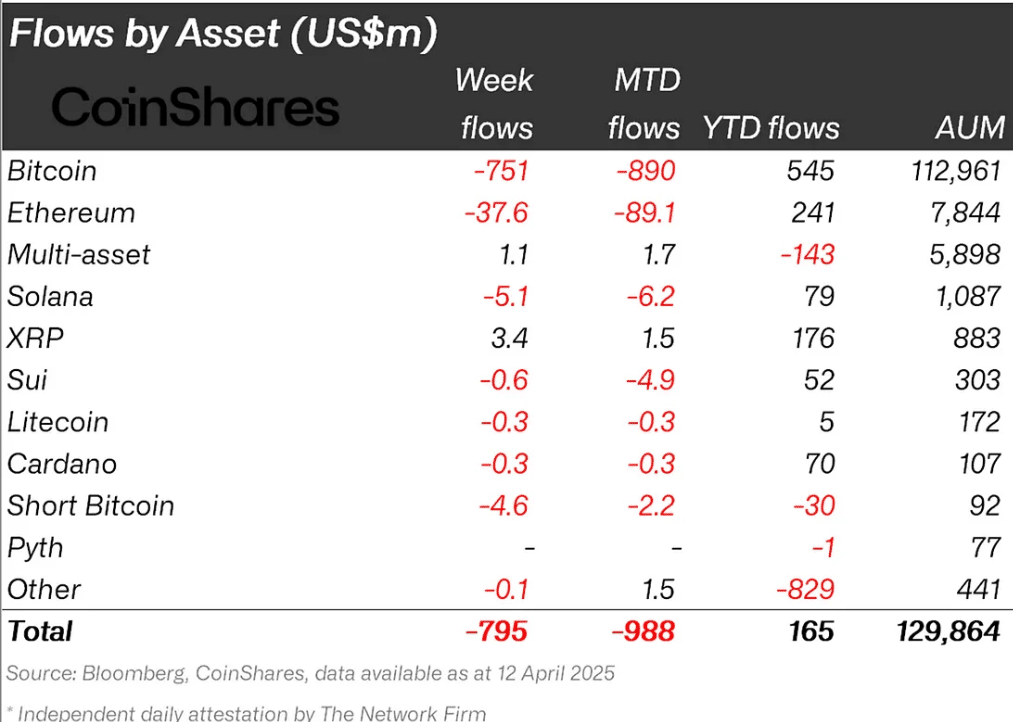

Investors earned $ 775 million last week, scoring three weeks of selling. In fact, ABitcoin (BTC) led the leak of $ 755 million to CCORDER for Coinshares’ weekly asset flow report, while Ether Leeum blank $ 37.6 million. The report has extended the tariff uncertainty.

“Digital Asset Investment Products has been leaked for three consecutive weeks last week, and the recent customs activity continues to put weight on the evaluation of feelings of asset classes.”

Source: Coinshares

Investors prefer XRP

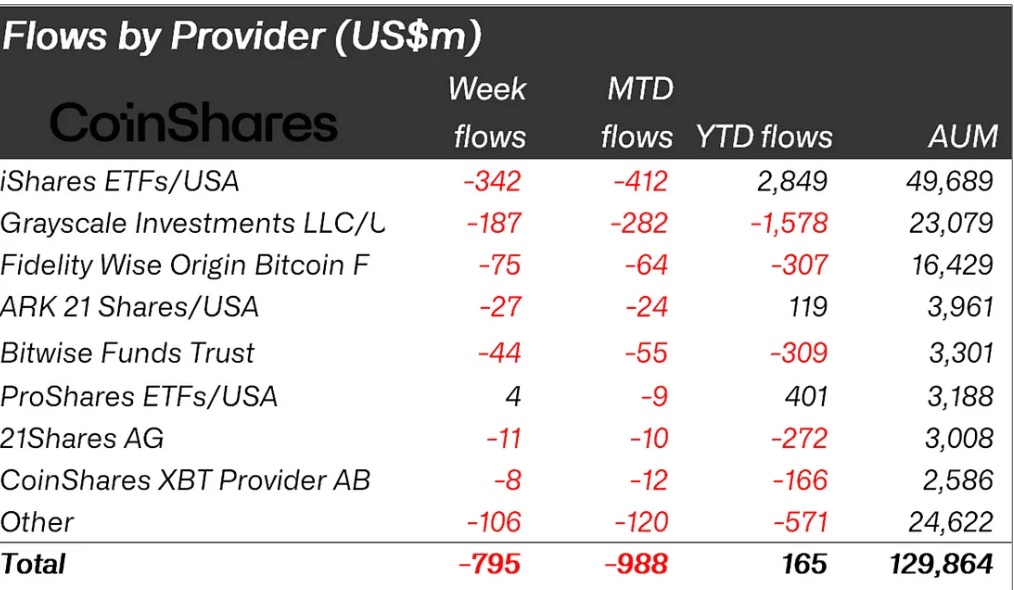

Blackrock’s Ishares ETF product has the highest investor withdrawal (selling). According to the report, ISHARES’s BTC ETF and ETH ETFs have leaked a total of $ 332 million last week.

Blackrock has smoked nearly $ 550 million over the last two weeks from a monthly MTD.

Source: Coinshares

GrayScale products are closely related to the leak of $ 180 million, almost half of the dumps of Blackrock.

In Altcoins Front, Solana -based products ranked third after ETH from leaks. This product has been selling $ 5.1 million. Surprisingly, XRP -based and multiple funds were unique during last week’s decline.

The report pointed out that XRP has seen $ 3.4 million last week and the overall MTD flow is $ 1.5 million. In short, investors preferred XRP and multi -assets (Crypto Index ETF) over individual assets such as BTC or ETH in the first half of April.

In addition, the idea mentioned above was more supported by the record. inflow New 2X TECRIUM XRP ETF.

But some macro analysts predicted that the decline could continue. Quinn Thompson, founder of macro -centered hedge fund Lekker Capital, stated Fed Chairman Jerome Powell’s recent speech will not be good for the May risk assets, including encryption.

“Except for the collapse of economic data before that, they prefer patience as they have increased uncertainty. This is good for bonds but not good for dangerous assets.”