- AAVE’s new yield options can compete with popular fintech solutions such as Wise and Revolut.

- Since the market has increased over the last 24 hours, the market has reacted positively since the market has been developed.

AAVE (AAVE) can appeal to the market investors shortly after the price of ALTCOIN has fallen 19.42%with a one -month major selling. In response to this positive emotion, did encryption rose 3.57% soon? Like Press Time, there were more signs that the rally could continue.

At this stage of the market, traders bought a large amount of AAVE. The value of ecosystems generated during this period continues to increase.

The AAVE protocol is better than the Fintech solution

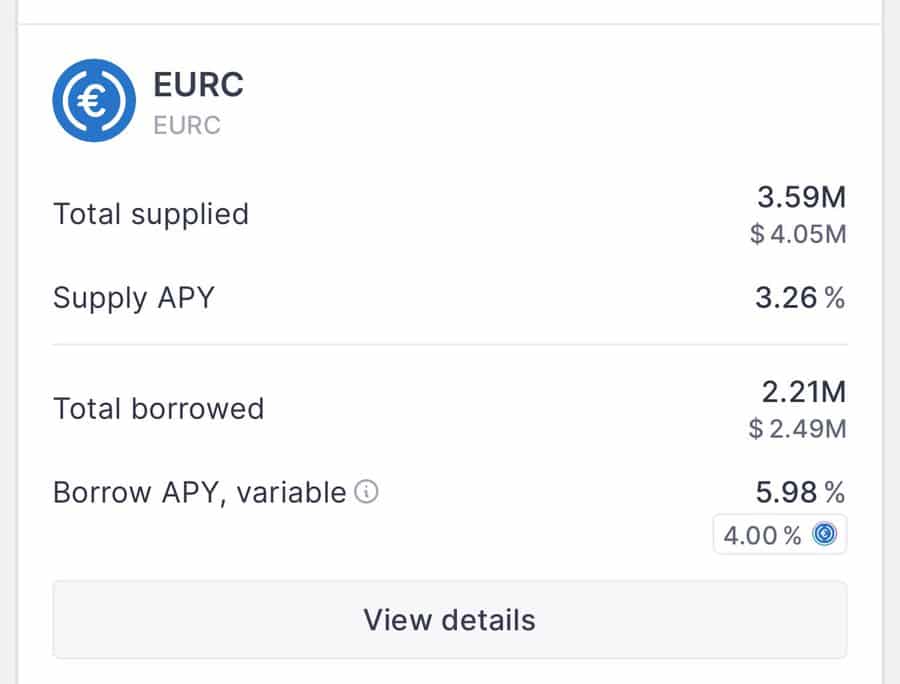

According to a recent post by the founder, Stani Kulechov, AAVE is now lowering the interest rate by providing more yields to EUR coins than the popular FINTECH solution Wise and Revolut.

Source: AAVE

AAVE’s lending agency is now earning up to 3.28% Apy.

Naturally, these high returns reconstruct AAVE into a profitable magnet for a lot of yields that seek AAVE better capital efficiency.

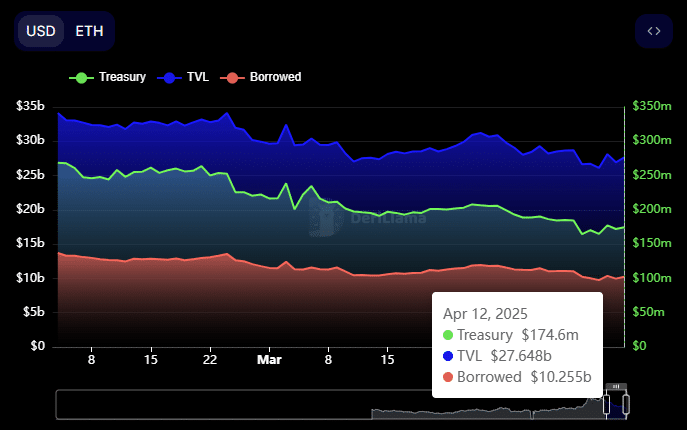

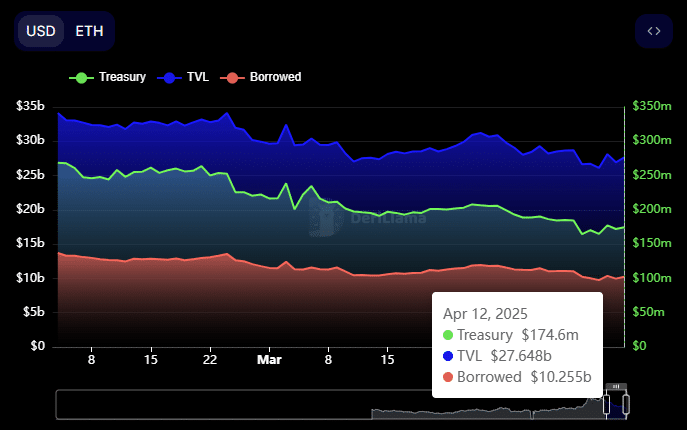

In addition, Defillama data has surged with the entire protocol and liquidity inflow has noticeable. AAVE’s borrowing rises to $ 10.255 billion, indicating that user participation is generally increased.

Meanwhile, the protocol’s TVL rose to $ 27.6 billion, suggesting more deposits and strong trust in AAVE’s ecosystems.

Source: Defillama

This suggests that interest among market participants tends to increase. It can be extended to affect the value of AAVE on the chart, which is the default token of the platform.

How did the market react to AAVE?

Market buyers continued to accumulate AAVE according to the news of development and attractive yields.

In fact, INTOTHEBLOCK’s data emphasized a remarkable impression with the amount of AAVE purchased as a long -term exchange. At the time of writing, about $ 1 million AAVE was purchased from the market.

Source: INTOTHEBLOCK

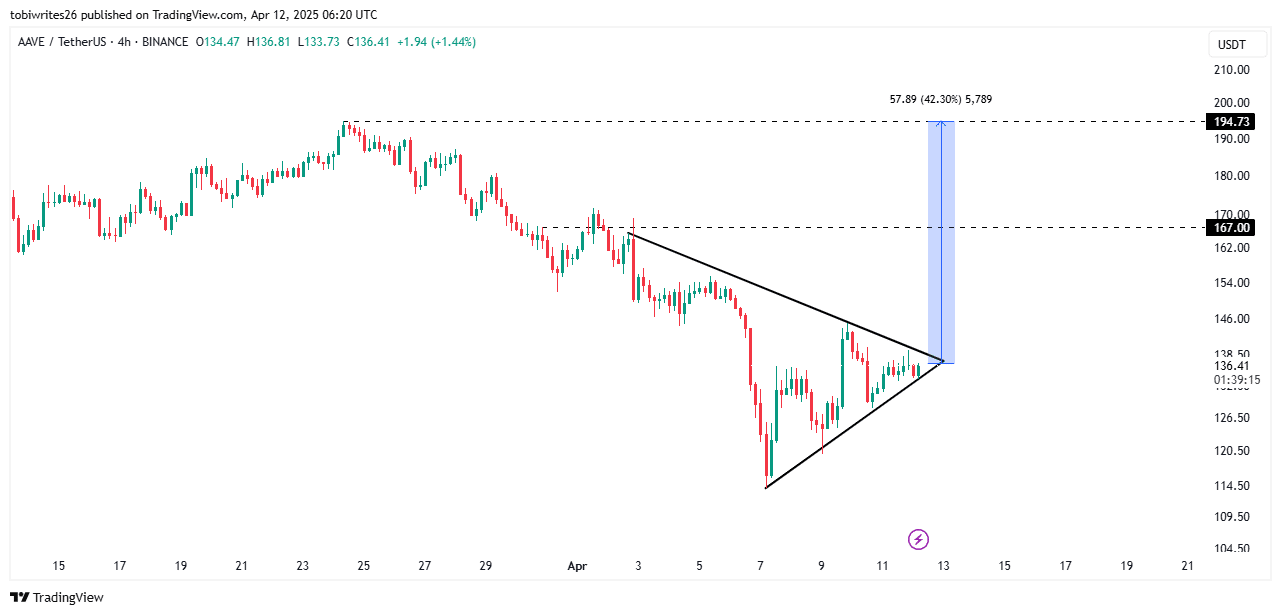

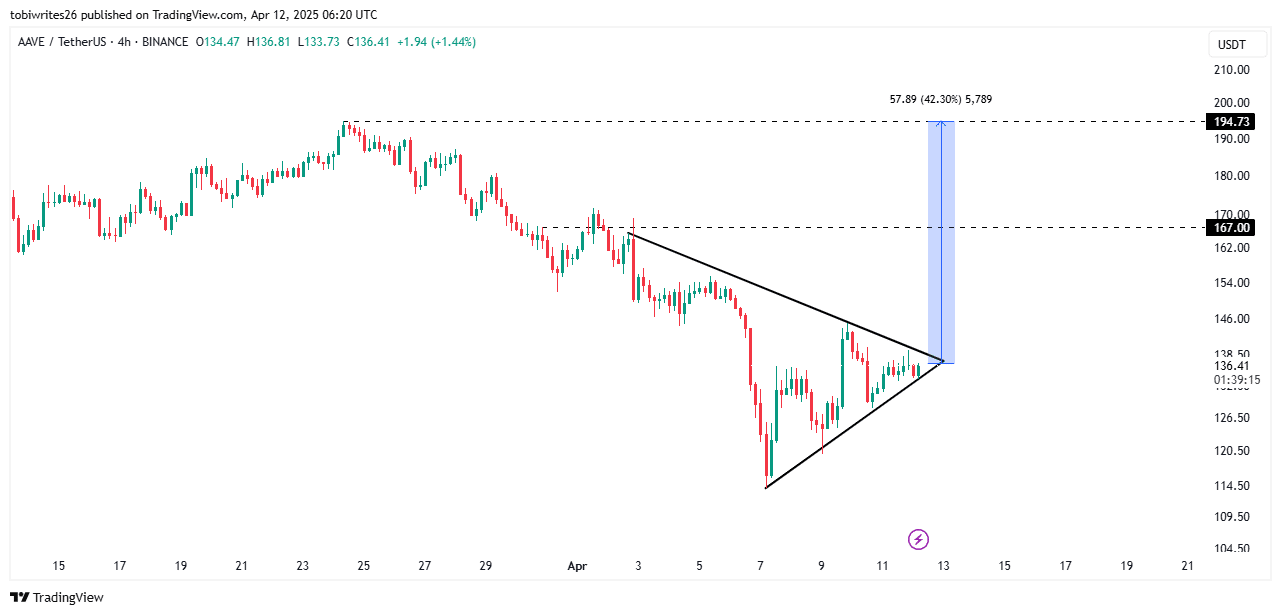

If this continues, if this interest grows, large rally can lead to 42%, and Altcoin will rise to $ 194. This is the same because the assets are traded within the symmetry triangle pattern known as an optimistic pattern.

This pattern consists of convergence support and resistance line. The violation of the resistance line is informed of AAVE’s rally and the short -term goal is $ 167 and the long -term goal is $ 194.

Source: TradingView

These rally also depends on the strength of market exercise. If it is high, it is more likely that the violation is more likely.

On the contrary, AAVE can continue to be integrated within this pattern, where accumulation continues.

Adoption is still high

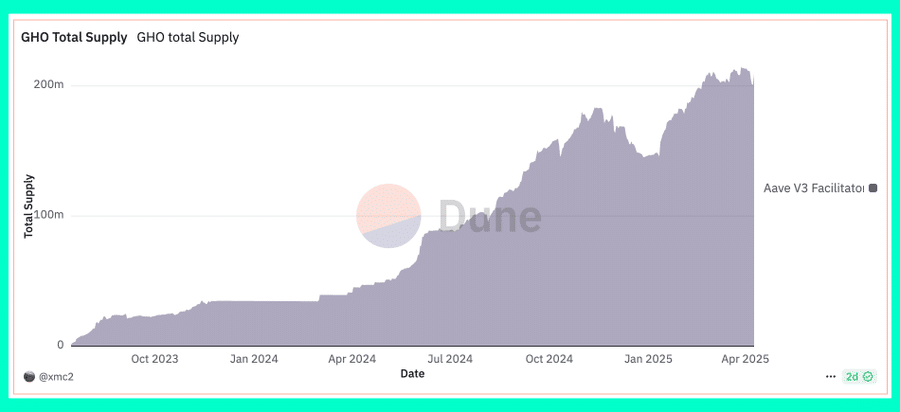

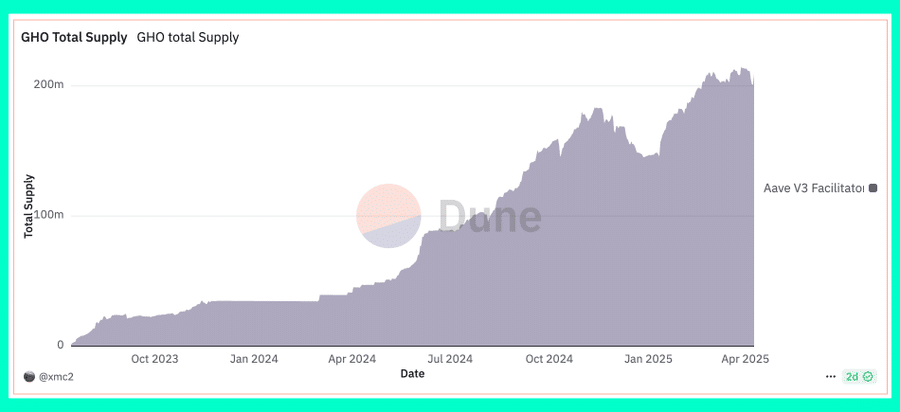

The adoption of AAVE’s native Starble Leco is increasing, and over the past year, 442% of growth has increased by 442%.

This rise in stablecoin supply is useful by expanding the continuous usefulness of Stablecoin and the AAVE protocol. If the total supply is soaring, demand increases. This is probably likely to be reflected in the increase in the value of AAVE on the chart.

Source: Sand Hill Analysis

Finally, the feelings of the market have been optimistic recently. AAVE is likely to reach short -term target $ 167 if this trend is maintained.