- Whale inflow and rising point exchange net flow hints for short -term distribution.

- Strengthen feelings and 33% NVT drop signals make the hot chalk foundation stronger.

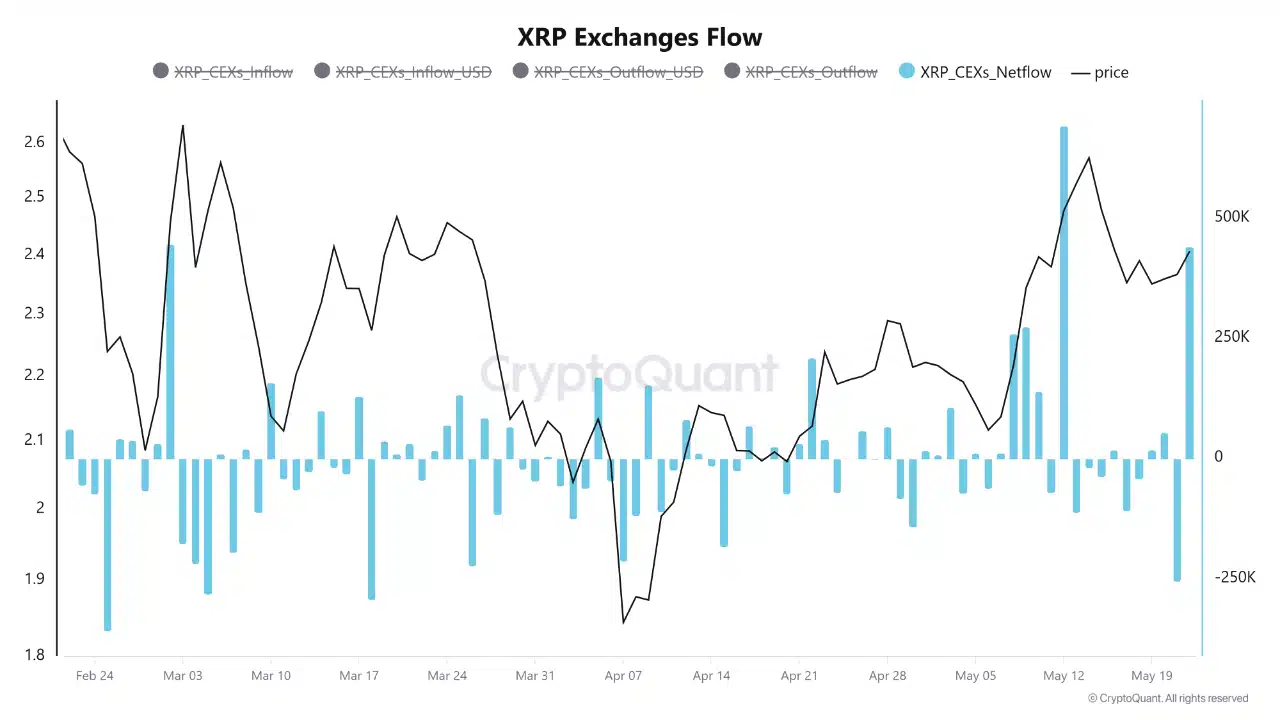

Ripple (XRP) Although it has soared to $ 2.43 due to its strong short -term exercise, Exchange activity now suggests potential benefits.

Whale inflows and centralized exchange net flow were recorded almost 440K XRP a day, rising rapidly.

This operation often indicates the distribution step after accumulation. Historically, such inflows especially suggest changes in emotions among large holders when prices approach the resistance level.

This does not guarantee immediate modifications, but it suggests that the influx and scale should be careful.

Source: cryptoquant

Even though the signs of profits are growing, emotions are still positive. Market Profhit data shows 0.25 crowds and 0.09 smart money feelings. Both represent optimistic expectations.

Such dysfunction between emotions and warmth flow data creates a mixed picture.

Did XRP broke for good things?

The XRP has been out of the channel of descending and confirmed the optimistic anti -war pattern. But the token is now faced with a resistance of $ 2.60 and the other ceiling is $ 3.00.

Recently, more than $ 2.43 strengthens the case of Bulls. Especially if the buyer maintains control. On the contrary, this level of rejection can attract short sellers.

Therefore, the structure of the XRP may seem promising, but the subsequent action should last longer than the brake out.

Until $ 2.60 passes, traders must observe the potential reversal signals that can appear in this key resistance area.

Source: TradingView

Settings for display or volatility?

According to Spot Exchange data, the inflow of $ 195.25 million is sold for $ 25 million.

Such changes arise after the period of leakage and self -use trend, suggesting potential shifts to the distribution.

These changes often take precedence over market paragraphs. Especially when a large holder starts off -road with intensity.

Source: COINGLASS

XRP derivatives rose 58.5% and increased to 25.26% open interest.

In addition, the amount of options increased by 10.95%and the optional interest rate increased 13.73%. This figure is growing in speculation demand and leverage.

This often supports exercise, but when emotions change, it can lead to quick liquidation.

Are you setting up for pressure or leading the fee?

According to the long/short ratio of Binance, 74.63%of the XRP traders have a longer position compared to 25.37%in the short side.

This imbalance shows a strong market conviction, but sets the stage of vulnerability. When the long position is dominant, the amazing movement of the trend can lead to liquidation, which can increase disadvantages.

Source: COINGLASS

The NVT (Network Value to Transactions) ratio of XRP plunged 33.14% to 136.01 in 24 hours.

This decline suggests that XRP’s on -chain trading volume is growing faster than its market cap.

Low NVT ratios often indicate a healthier network use, especially during meetings. Therefore, this development adds optimistic shades to the current technology structure.

Does the optimistic conviction absorb the distribution pressure?

XRP is technically powerful and improves the feelings of strong and chain utility metrics. However, if the obedience to exchange and whale activities rise, sales pressure increases.

Thus, optimism is still dominant, but the potential of short -term volatility has increased. Movement of more than $ 2.60 can restore the amount of exercise, but rejection can strengthen the distribution signal.

The trader must measure the feelings of selling pressure in this important range.