Bitcoin price is hovering near $70,000, bouncing off an important dynamic support line as seen on the daily chart. The bulls have yet to break $72,000 or the March 2024 high, but traders are optimistic about what lies ahead.

Bitcoin Bulls in Charge: Analyst Targets $85,000

Let’s look at one analyst, X. Believe The world’s most valuable coin is poised for a decisive break above local resistance levels and an all-time high of around $74,000. The analyst pointed out in the post that Bitcoin has been consolidating, moving sideways and even moving lower over the past three months since mid-March.

Related Reading

If the buyers are successful, a nearly 100-day consolidation could set the stage for a price surge, opening the “next stage” that could push BTC as high as $85,000. But even amidst the optimism, traders must be cautious.

Technically, upward momentum has weakened. Despite the increase on June 3, the upward trend is slowing as buyers were unable to confirm the increase on May 20. For further gains, the upper level of $72,000 must be conquered by now. The lower support level is $66,000.

Nonetheless, the dynamic 20-day moving average is emerging as a valuable support line. A breakout in either direction will be fundamentally driven, most preferably in line with first quarter 2024 profits.

Fan demand increases due to inflation and spot BTC ETF inflows

Looking at US fundamental data streaming, the stage is being set for bullish buyers. cooling inflation and rising trend M2 Money Supply could do It suggests that the buyer is ready.

The U.S. Federal Reserve has been closely monitoring inflation, among other indicators. As inflation falls, the Federal Reserve may decide to cut interest rates, fueling a bull market like it did in 2021.

Related Reading

Another key driver will be encouraging inflows into spot Bitcoin ETFs. BTC surged, hitting a March 2024 high, with inflows surging primarily due to institutional demand. Inflows gained momentum after prices rose on May 20.

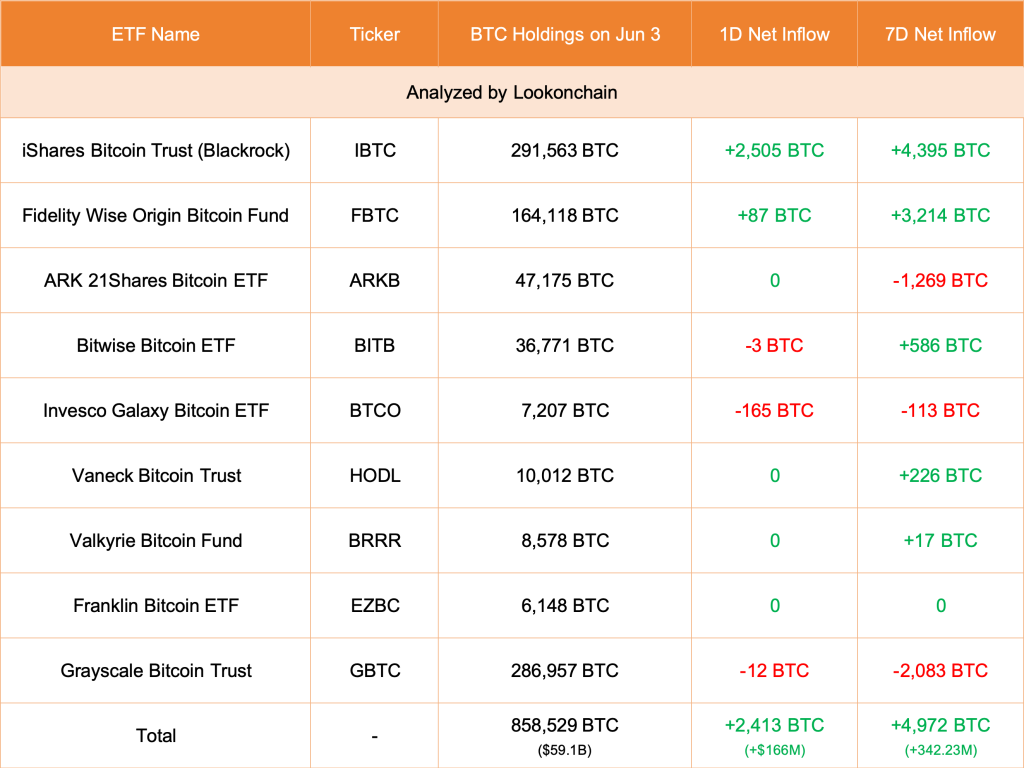

June 3 Lookonchain data exposed US spot BTC ETF issuers added 2,413 BTC. Grayscale’s GBTC is down just 12 BTC.

The launch of the Monochrome Bitcoin ETF (IBTC) in Australia and similar products in Hong Kong and globally will only increase demand for BTC. The newly launched IBTC spot ETF in Australia will directly hold BTC, which will be managed by Coinbase.

Featured image by DALLE, chart by TradingView