- Cardano’s price is hovering near $1, with long-term holders providing significant support against selling pressure.

- ADA’s recovery was limited due to declining profit generation and network activity.

In recent weeks, Cardano (ADA) has faced significant price volatility and struggled to regain solid ground above the crucial $1 level. Broader market sentiment tilted from neutral to bearish, limiting any significant upside momentum. But even through this turmoil, long-term holders held firm, providing much-needed support and preventing a major decline in prices.

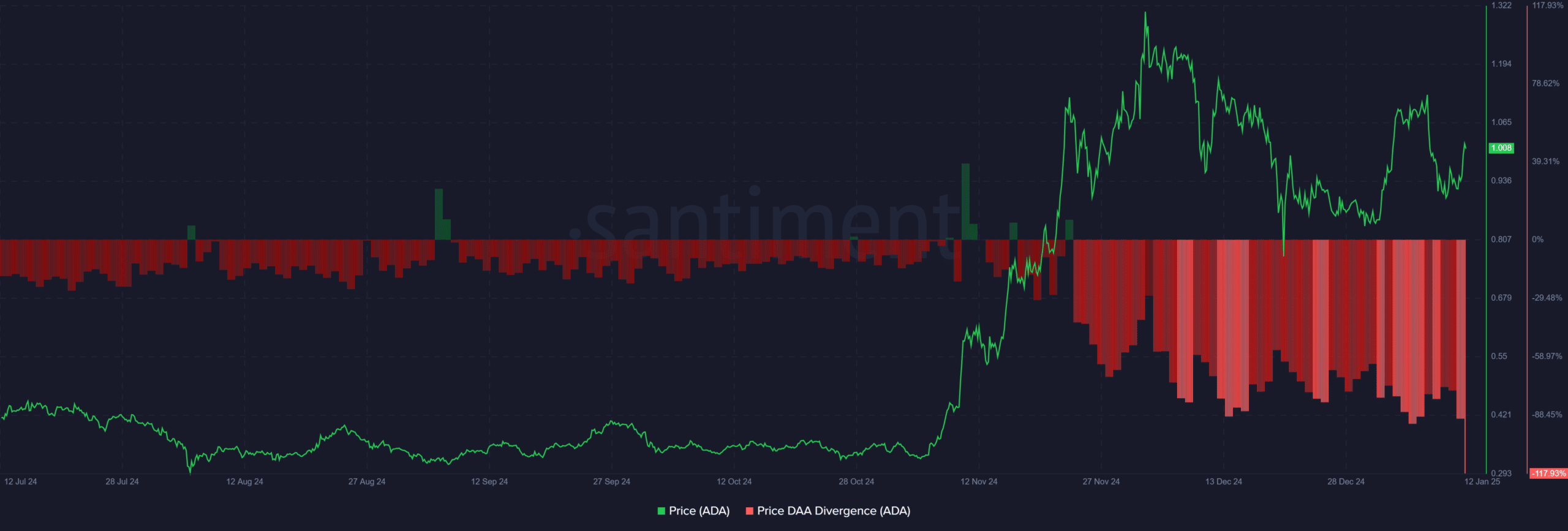

ADA’s Price-DAA Difference Highlights Investor Caution

Source: Santiment

Cardano’s price DAA divergence indicator has been showing consistent sell signals in recent weeks, indicating a disconnect between price action and network activity. A negative divergence indicates that ADA’s price is struggling to maintain momentum above $1, while its daily active address does not match the level of enthusiasm needed to support a bullish breakout.

This decline in investor participation reflects growing market concerns, which are exacerbated by broader bearish sentiment. Absent an increase in network participation or a decisive change in market dynamics, ADA’s recovery prospects may remain limited and buyers may remain on the sidelines.

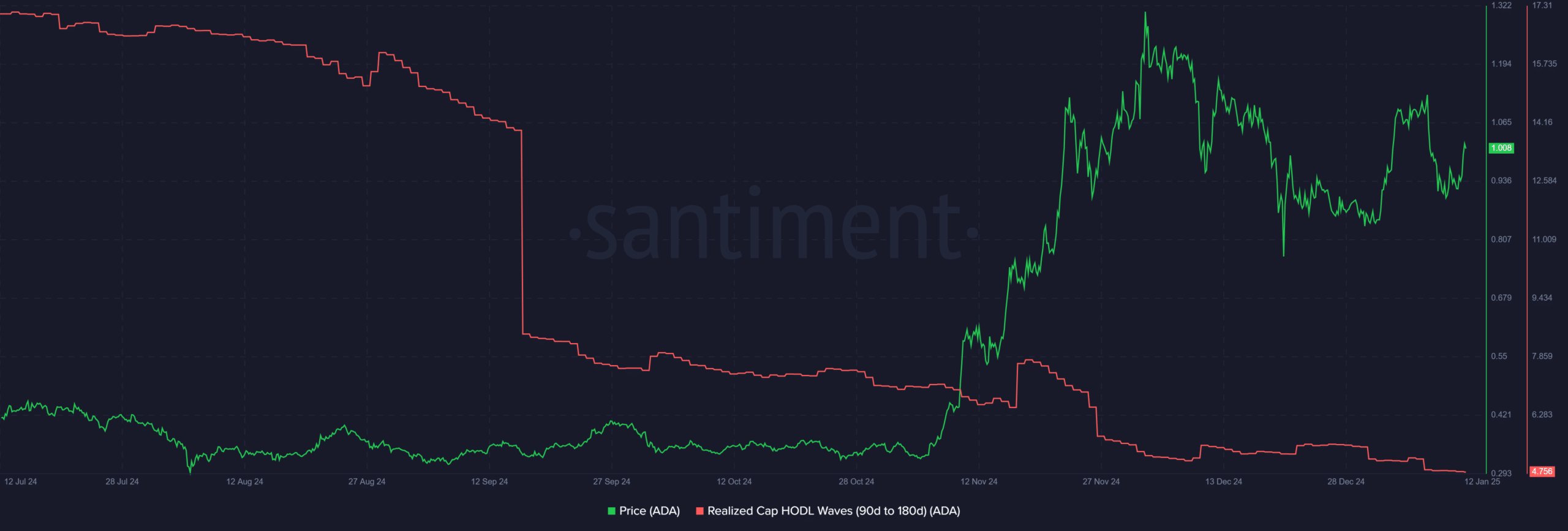

Realized capital HODL waves reflect changing market dynamics.

Cardano’s Realized Capital HODL Waves are showing a sharp decline, indicating that intermediate-term holders have exited their positions due to the recent price surge.

This decline suggests profit-taking behavior as ADA reaches a critical resistance level near $1, further highlighting the cautious sentiment in the market.

Source: Santiment

Meanwhile, long-term holders have remained relatively stable despite short-term volatility, underscoring their commitment. This difference in medium- to long-term holder behavior is a sign of ongoing uncertainty among some investors, with a clear preference for de-risking.

Without renewed confidence or a stronger market catalyst, ADA’s momentum could face additional hurdles.

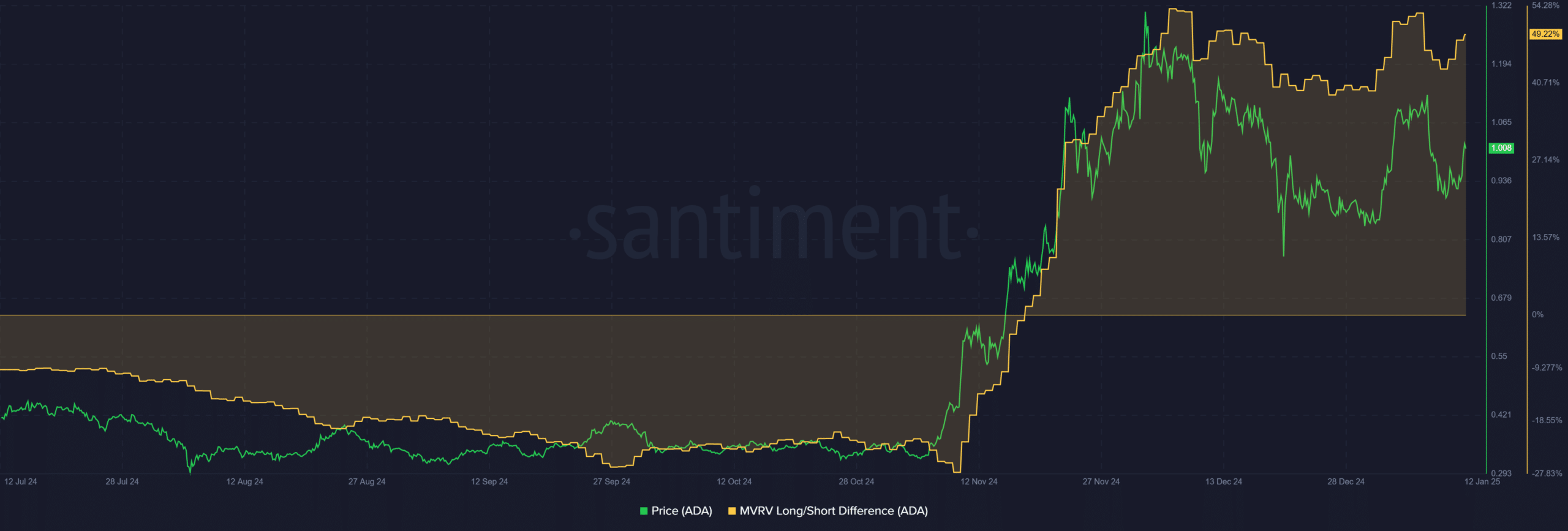

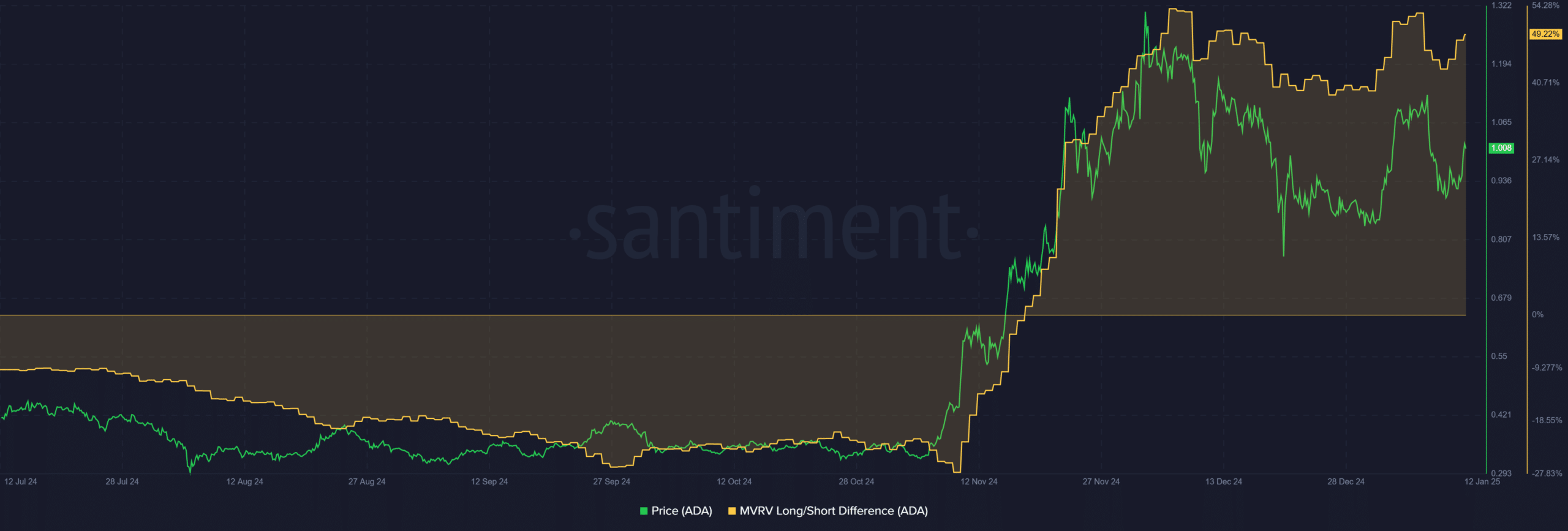

Tension between short-term profit seekers and long-term holders

Source: Santiment

Additionally, the MVRV long/short differential revealed important changes in profitability dynamics. As the price of ADA surged past $1, the MVRV gap widened, indicating a significant difference in unrealized profits between long-term and short-term holders. This indicator indicates increased profit-seeking pressure from short-term holders who may have accumulated at lower levels during the consolidation phase of ADA.

Meanwhile, long-term holders appear to be more resistant to selling. This indicates greater confidence in continued price increases. These differences highlight the polarized sentiment in the market, with players driving short-term volatility clashing with entrenched long-term investors. However, if short-term profit-taking continues, ADA may face headwinds in maintaining its upward momentum.

Is your portfolio green? Check out the Cardano Profit Calculator

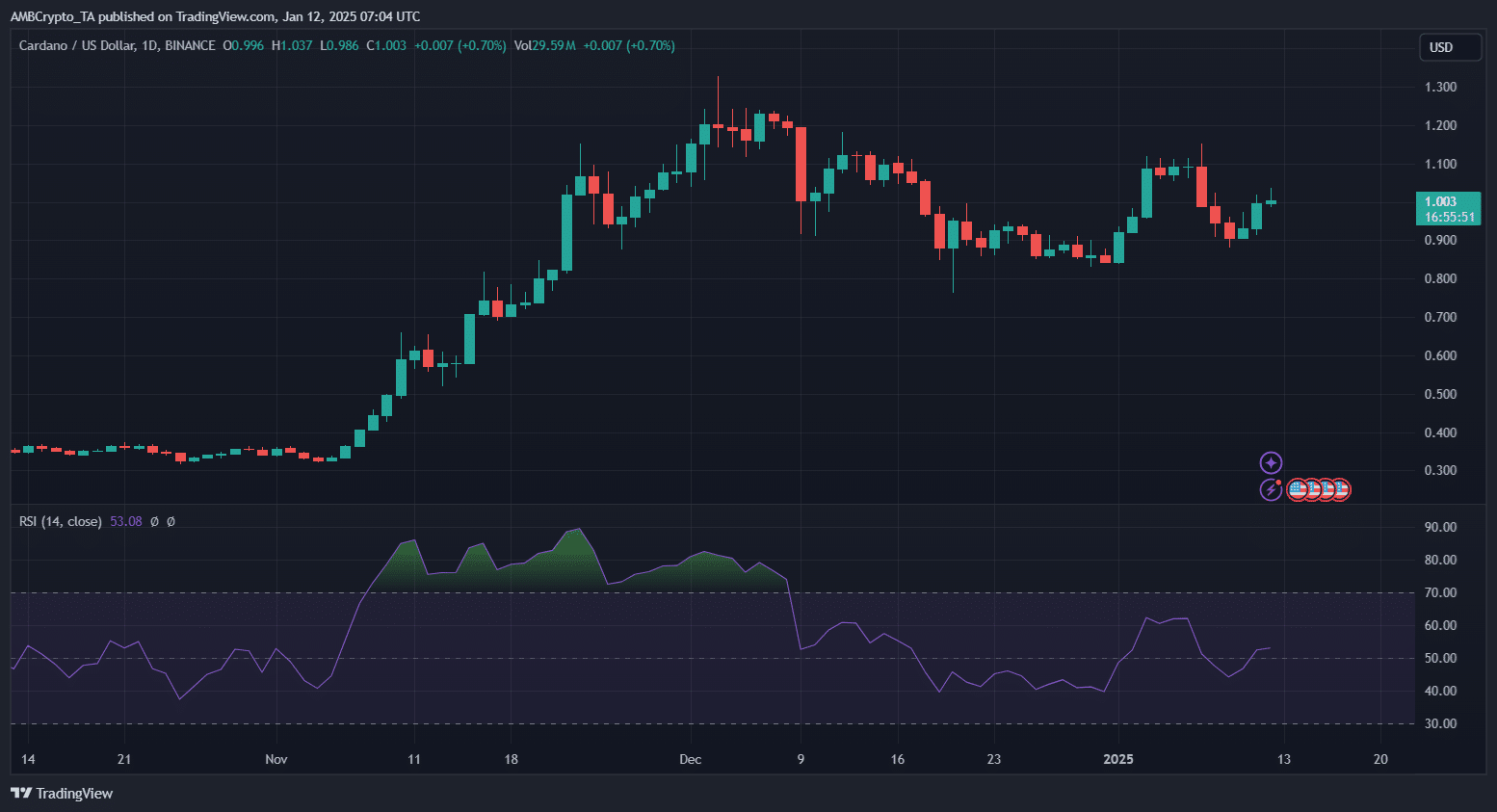

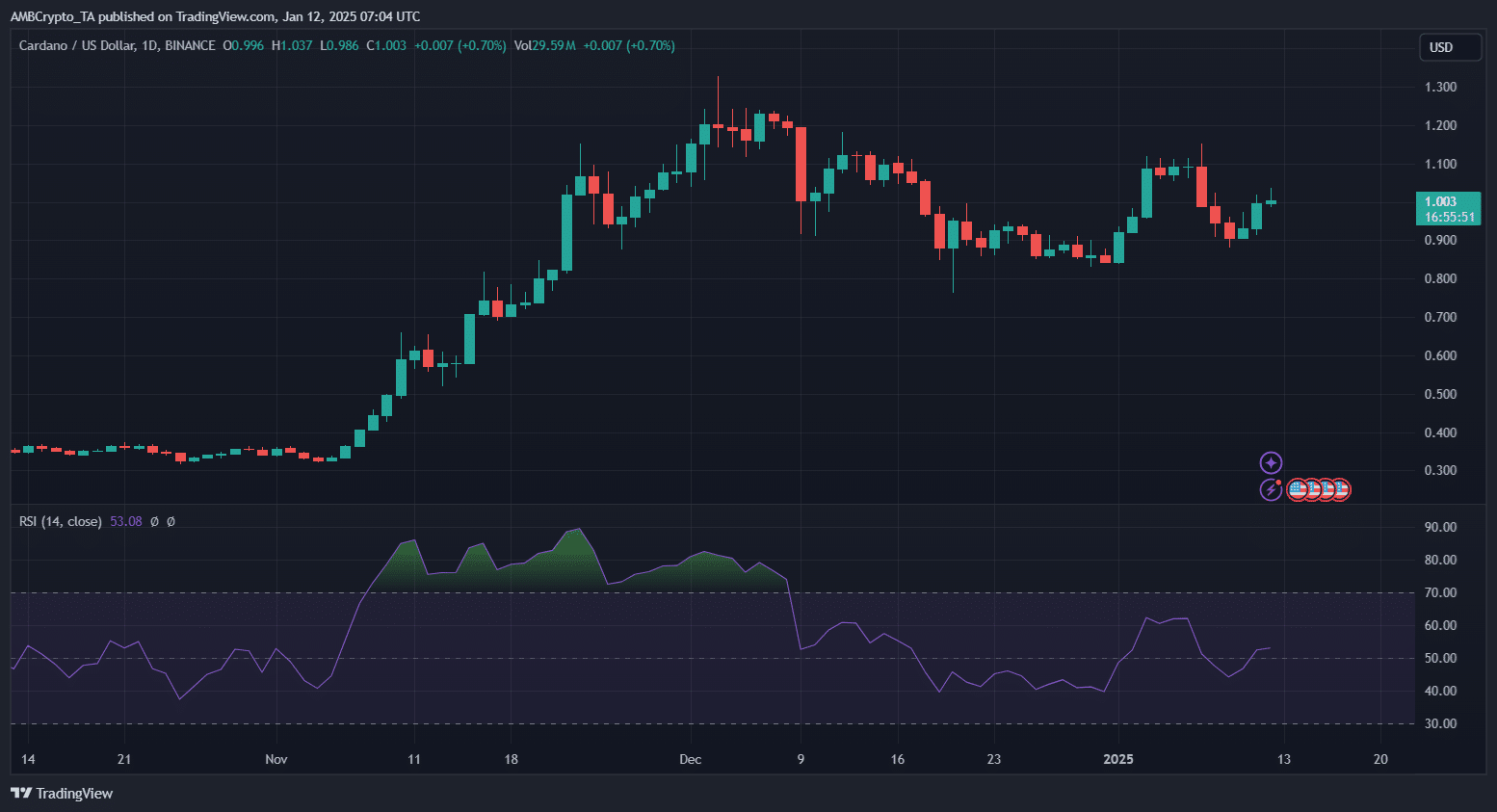

Pricing analysis and potential scenarios

Source: TradingView

At press time, Cardano’s price appeared to be caught between short-term selling pressure and long-term investor resilience. Amid growing market skepticism, it is important to build support at the $1 level. If ADA regains resistance at $1.10, a bullish scenario could unfold, potentially inspiring investor confidence. If broader market sentiment is consistent, increased network activity and daily active addresses will play a pivotal role in driving momentum towards $1.30 resistance.

On the downside, loss of support at $0.95 could lead to retests of $0.85 and $0.75, creating further downside risk. Persistent sell signals and profit-taking by medium-term holders increase bearish risk, especially if network participation is weak.

ADA’s price trajectory depends on balancing short-term volatility with long-term holder confidence. Monitoring key level and network indicators is essential to gauge your next move.