- Linking in a $ 12.5 brake out area has been implied in a row.

- Onchain and liquidation data supported additional and unloading potential for $ 10 and $ 7.5.

After a one -week reduction, ChainLink (link) tests a major resistance area of about $ 12.5, which has previously been a major support. Altcoin’s price measures seemed to be a re -test of brake out zones that can now be transferred to resistance. In fact, it also implied the lack of beliefs.

But if Bulls don’t maintain this important price level, LINK can see more important fullback. The wider market is still determined, and the recent support of ChainLink (link) depends on expectations.

Source: TradingView

In addition, the price did not record the highest after the toppings of nearly $ 16.

It is a sign of the weakening structure to test the descent tendency to about $ 12.5 without convincingly popping out.

Set weakness of links enhanced by onchain data

At the time of writing, the hot chain data seemed to have little relief about Link’s bull.

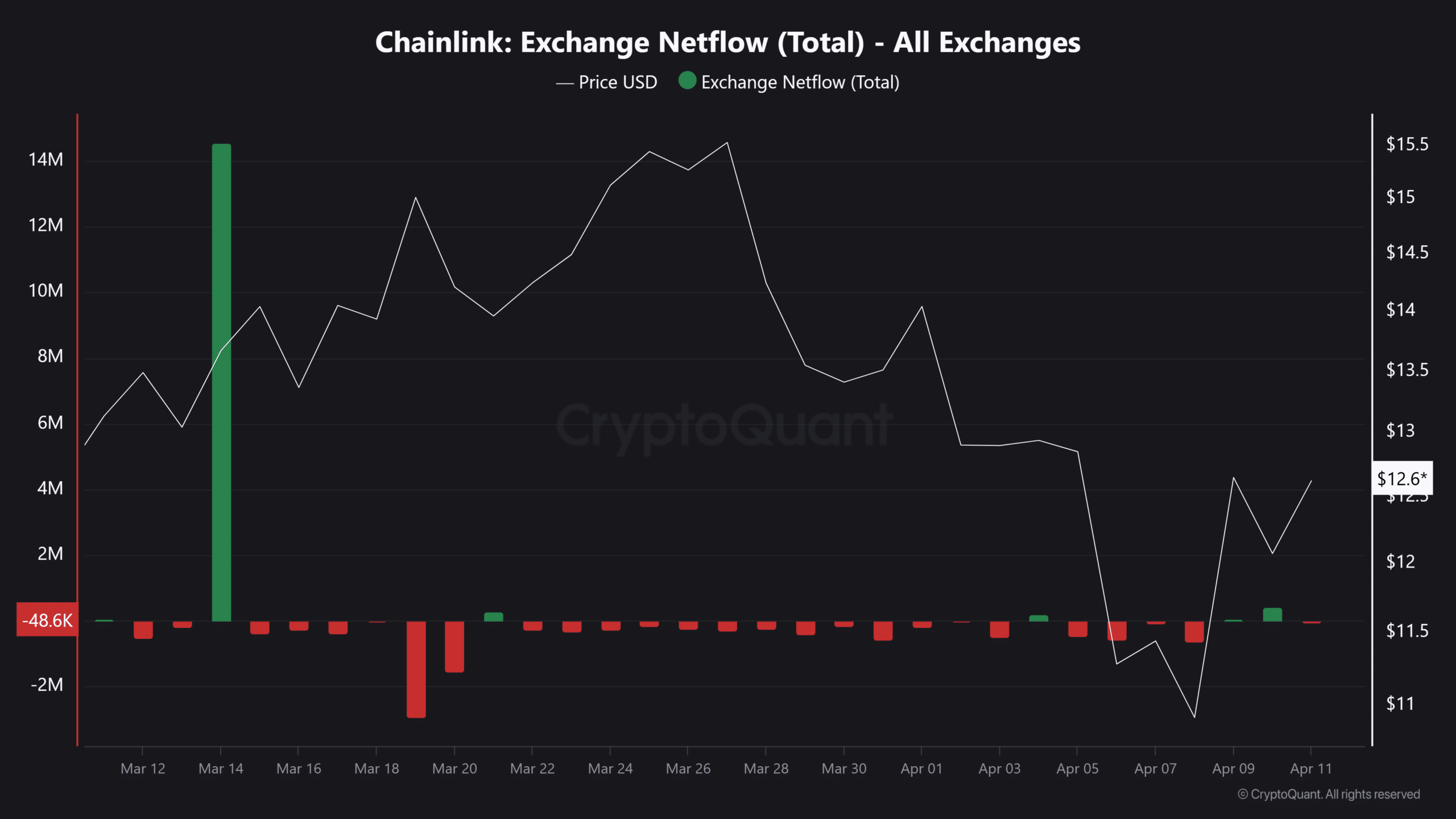

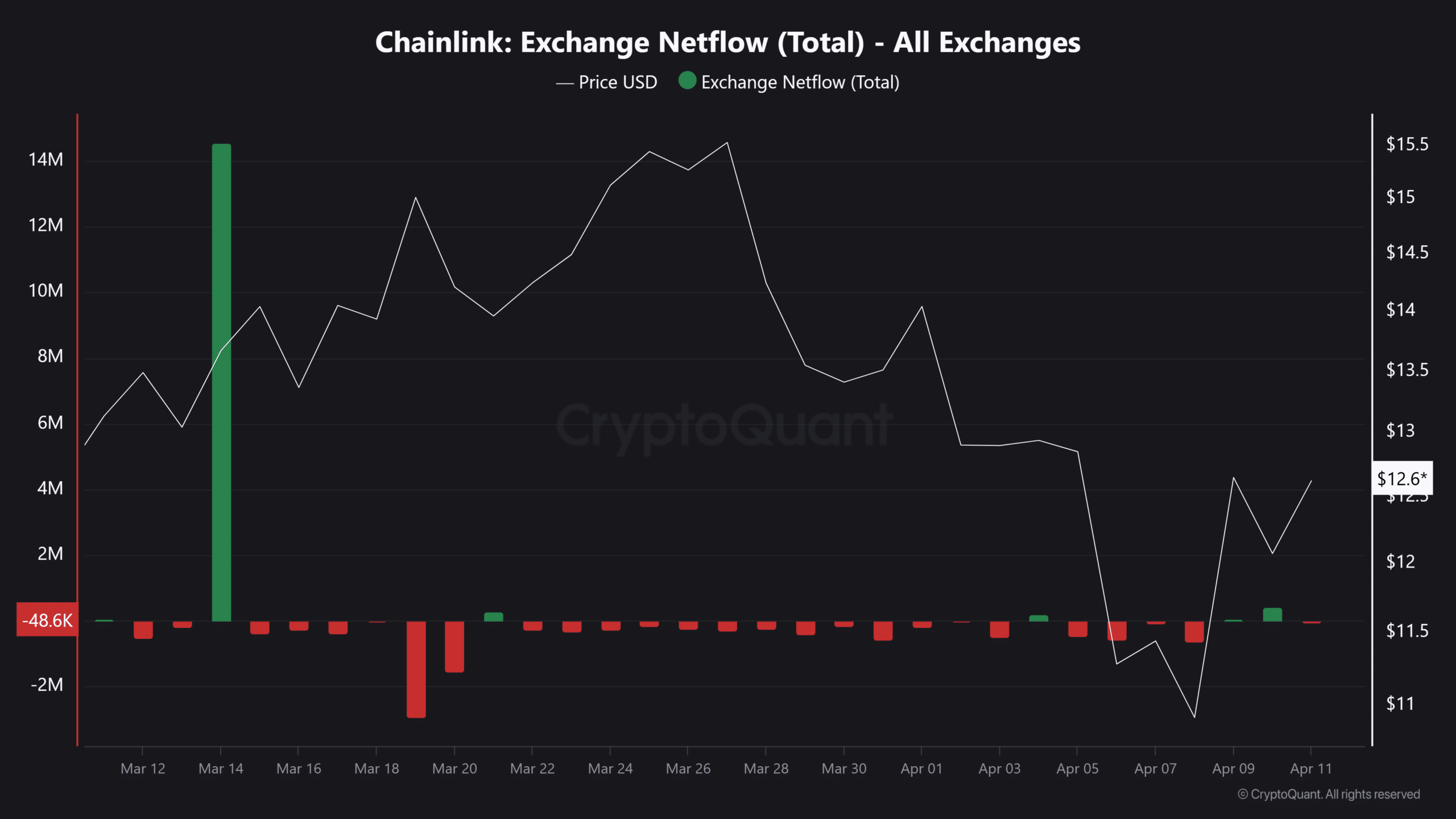

According to Cryptoquant, Altcoin’s net reserves in exchange are slightly higher than the 7th average. It is usually a signal that increases sales pressure.

More net deposits represent investors who are sent to centralized exchanges from the point of view of the distributed exchanges and selling them.

Uptick is no longer exceeding the limit, but it matched the weak technology outlook. This convergence can justify the weak bias of the link on the chart.

Source: cryptoquant

The liquidation cluster hints more than $ 10

Finally, the leverage trader can have a greater impact on the price trajectory of Link.

The liquidation heat map also showed a long liquidation cluster near $ 10 mark. Market manufacturers like to hunt these liquidity zones for uncertain periods.

Source: COINGLASS

If the link is moved to $ 10, causing liquidation can lead to cascade due to the sales pressure. Then another promotion of $ 20 (4Q2023) will be possible.

To avoid deeper losses, you must have a $ 12.5 zone. If the exchange deposits and thorns clearing are increasing below, the path of resistance is currently south.