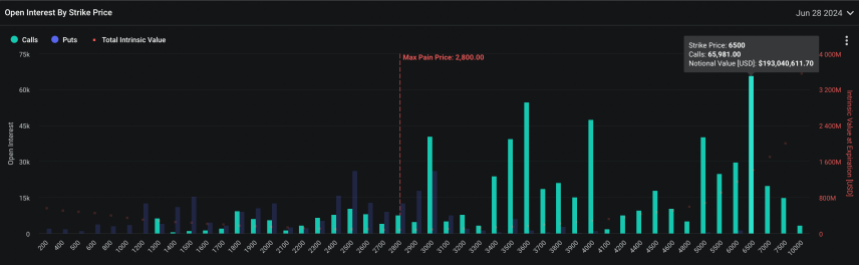

June Ethereum (ETH) options are showing significant interest in higher strike prices, with a focus on levels above $3,600.

Data from Deribit shows that traders are betting heavily on currencies exceeding this price, indicating bullish sentiment about Ethereum’s near-term trajectory. Among these bullish bets, the favorite strike price is an ambitious $6,500.

Related Reading

The options market is showing strength for Ethereum.

Specifically, an option is a contract that gives the trader the right (but not the obligation) to buy (for a call) or sell (for a put) an underlying asset at a specified strike price until the expiration date.

Call options are typically purchased by traders who believe the price of an asset will rise, allowing them to buy at a lower price and potentially sell at a higher market price. Conversely, put options are preferred by those who expect the price of an asset to fall and want to sell it at the current price and repurchase it at a lower price.

Currently, the Ethereum options market is leaning heavily towards calls, with open interest (representing the total number of outstanding contract options) favoring higher strike prices.

This concentration of currencies, primarily above $3,600, suggests that an important market segment could position Ethereum to move higher by the end of June.

According to Deribit data, approximately 622,636 Ethereum currency contracts are scheduled to expire by the end of June, with a notional value of over $1.8 billion. This practical positioning highlights the market’s confidence in Ethereum’s potential upside.

The data also shows that the most substantial open interest is concentrated around the strike price of $6,500, with a notional value of $193 million.

This concentration reflects trader optimism and supports Ethereum’s market price. This is especially true if these options are exercised when the asset price approaches or exceeds the exercise level.

Despite the optimism inherent in these options, Ethereum is currently experiencing a bit of a downturn. It fell 5.4% over the past week and 2.2% over the last 24 hours, falling below $2,900. This decline puts more focus on upcoming market catalysts that could significantly impact the price of ETH.

Regulatory decisions and technical indicators: dual impacts on the ETH path

One important upcoming event is the U.S. Securities and Exchange Commission’s (SEC) decision on several applications for Ethereum-based exchange-traded funds (ETFs), which are due by May 25.

This decision is critical as approval could unleash a wave of institutional investment in Ethereum, potentially sending its price skyrocketing. Conversely, a rejection could weaken bullish sentiment and lead to further declines.

From a technical analysis perspective, there are signs that a rebound is possible. A “bullish cypher pattern” identified by analyst Titan Of Crypto suggests that Ethereum may be at a turning point. Ethereum is currently at the 38.2% Fibonacci retracement level, a key support zone for many bull markets.

Related Reading

This level has historically served as a springboard for upward price movements, suggesting that Ethereum could be primed for a significant rally.

#altcoin #Ethereum Bounce reception.

The Bullish Cypher Pattern went perfectly and we reached all our goals 🎯.#ETH It is currently at the 38.2% Fibonacci retracement level, also known as the “1st stop”. In a bull market, this level will remain.

We expect a rebound from these levels. 🚀 pic.twitter.com/o9e6VLEREz

— Cryptocurrency Titan (@Washigorira) May 12, 2024

Featured image by Unsplash, chart by TradingView