Encryption and financial markets experience the sense of Deja Vu, as analysts compare the current macroeconomic outlook, especially with the previous Trump’s trade war.

As merchants and investors wait for terrible breathing to recover the encryption market, all gaze is fixed by M2 currency supply for the US dollar index (DXY) and as possible.

Bitcoin, Altcoins & Tariffs: Is there a rally in 2017?

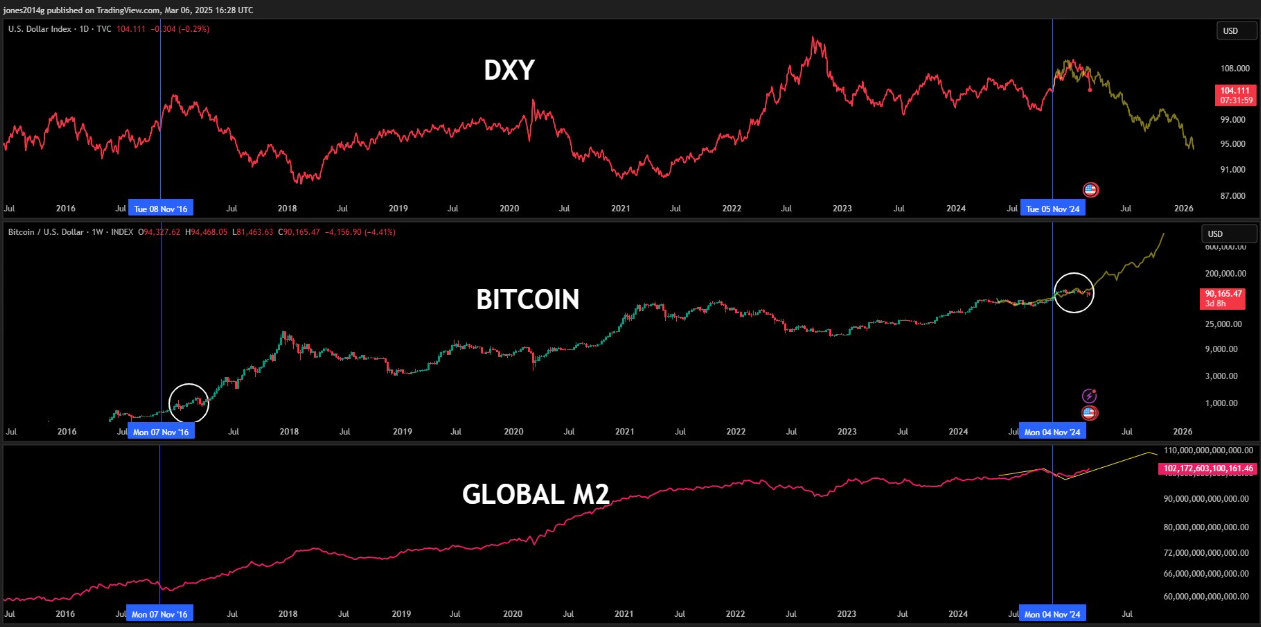

Zerohedge’s recent chart emphasizes how the US dollar index (DXY) reflects the 2016 movement in 2025. This adds trust to the idea that market trends reflect past patterns.

This parallel has attracted considerable attention from investors, especially in encryption. Analysts evaluate whether Bitcoin (BTC) and Altcoin will follow the trajectory similar to the 2017 Bulls.

Kobeissi Letter, a financial market commentary, emphasized the similarities of the Trump tariff war 1.0 and 2.0, weighing in this discussion.

This comment admits that today’s macroeconomic conditions are different from the previous Trump administration’s conditions. However, some technical movements of asset classes, including stocks, gold, oil and bitcoin, are surprisingly similar.

By this year, gold prices have soared by more than 10%, reflecting the transition to a safer asset. Bitcoin, meanwhile, decreased almost 10%. This radiance emphasizes the importance of risk appetite in forming market emotions.

Bitcoin’s recent price behavior further verifies these observations. On March 4, Bitcoin experienced a sudden drop in $ 2,000 in just 25 minutes, approaching $ 90,000 for resistance. Market participants mentioned that cryptocurrency evaluation will turn to more than $ 100 billion without any important news.

This suggests that liquidity -centered movement and technical resistance plays a dominant role in price fluctuations. In this regard, Kobeissi letter said that long -term investors using volatility during the Trump War 1.0 found excellent transaction opportunities. This suggests that similar conditions can occur again.

Altcoin season that matches the Trump Season

On the other hand, the story that grows in the encryption space is that the Altcoin Season can match the Trump Season. Encryption investor and analyst Bitcoindata21 emphasized how Bitcoin’s price behavior was similar to the 2017 cycle in 2025. This observation strengthens the belief that the main Altcoin rally can be on the horizon.

The historical trend suggests that the strengthening of the Bitcoin market is prioritized over the explosive growth of Altcoin as capital rotates. This increases the possibility of reflecting the Altcoin boom that can be seen during Trump’s first term.

In other places, a wide range of economic trends also point out the potential rise of Bitcoin. As reported by Beincrypto, DXY was lower than the recent level of support, which has historically been a strong signal of Bitcoin. The dollar weakening tends to push investors with alternative assets such as cryptocurrency and gold.

Analysts also emphasized the supply of M2 currency as another factor that can fuel the Bitcoin rally. Historically, the expansion of the M2 was consistent with Bitcoin Bull Runs, and experts predicted the surge in late March as the liquidity conditions improved.

Currently, uncertainty is still high due to macroeconomic factors and policy shifts. However, according to history, investors strategically deploy themselves and often receive considerable rewards for a period of time.

If the pattern of 2017-2020 is repeated, Bitcoin and Altcoin will be able to enter the new bullski in the next few months. Nevertheless, short -term volatility remains the main characteristics of the market environment, so traders must keep their boundaries.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.