- According to analysts, SOL’s oversold condition could present a great buying opportunity.

- Despite weak market sentiment, SOL hit key confluence support at $175.

Solana (SUN) It has been the most oversold top altcoin, but according to some experts, a drop of more than 30% could be a good buying opportunity.

According to pseudonymous analyst Marty Party, SOL’s daily Relative Strength Index (RSI) has fallen to levels last seen in mid-2023. According to Marty, this was an ideal place to buy altcoins.

Source: X

Will $180 hold up?

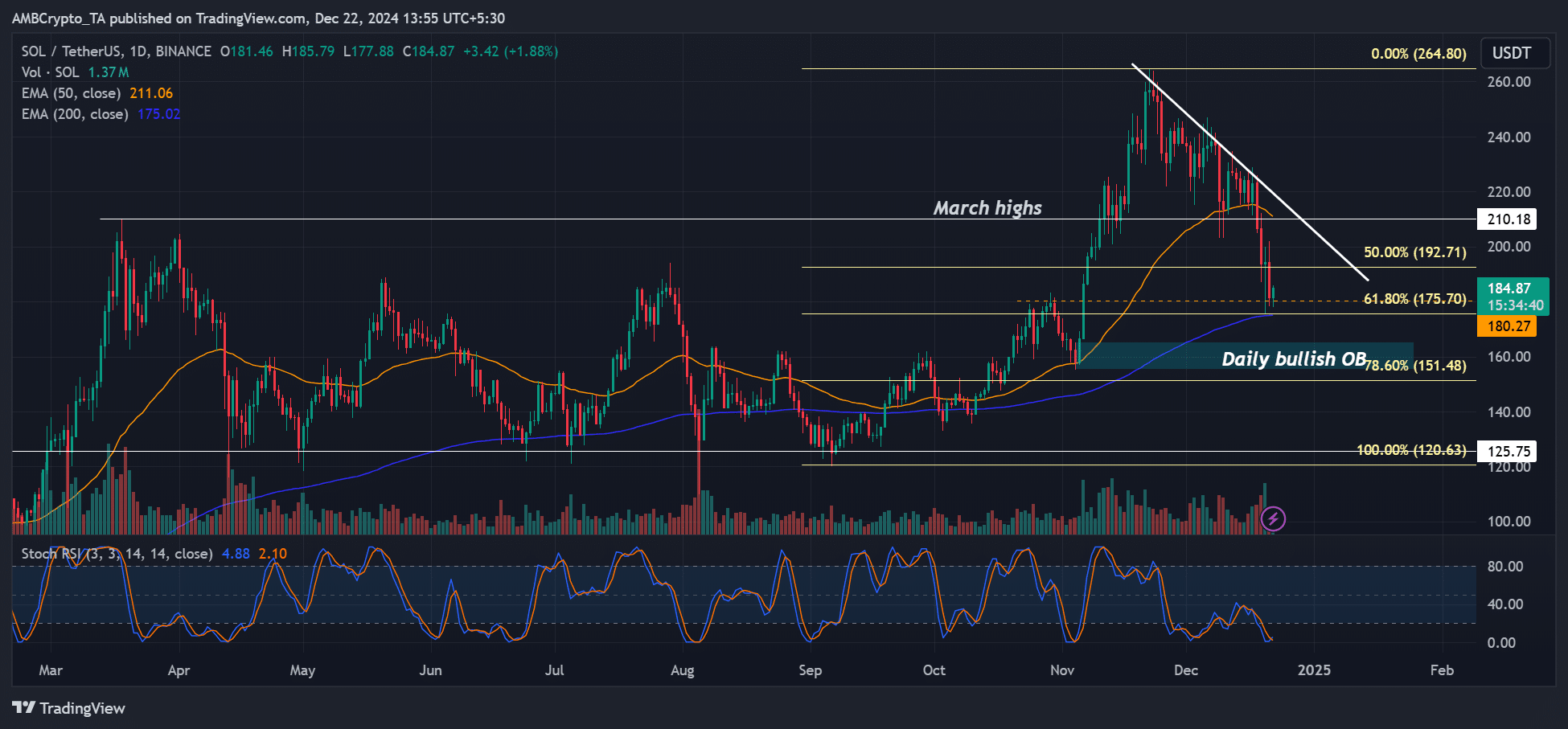

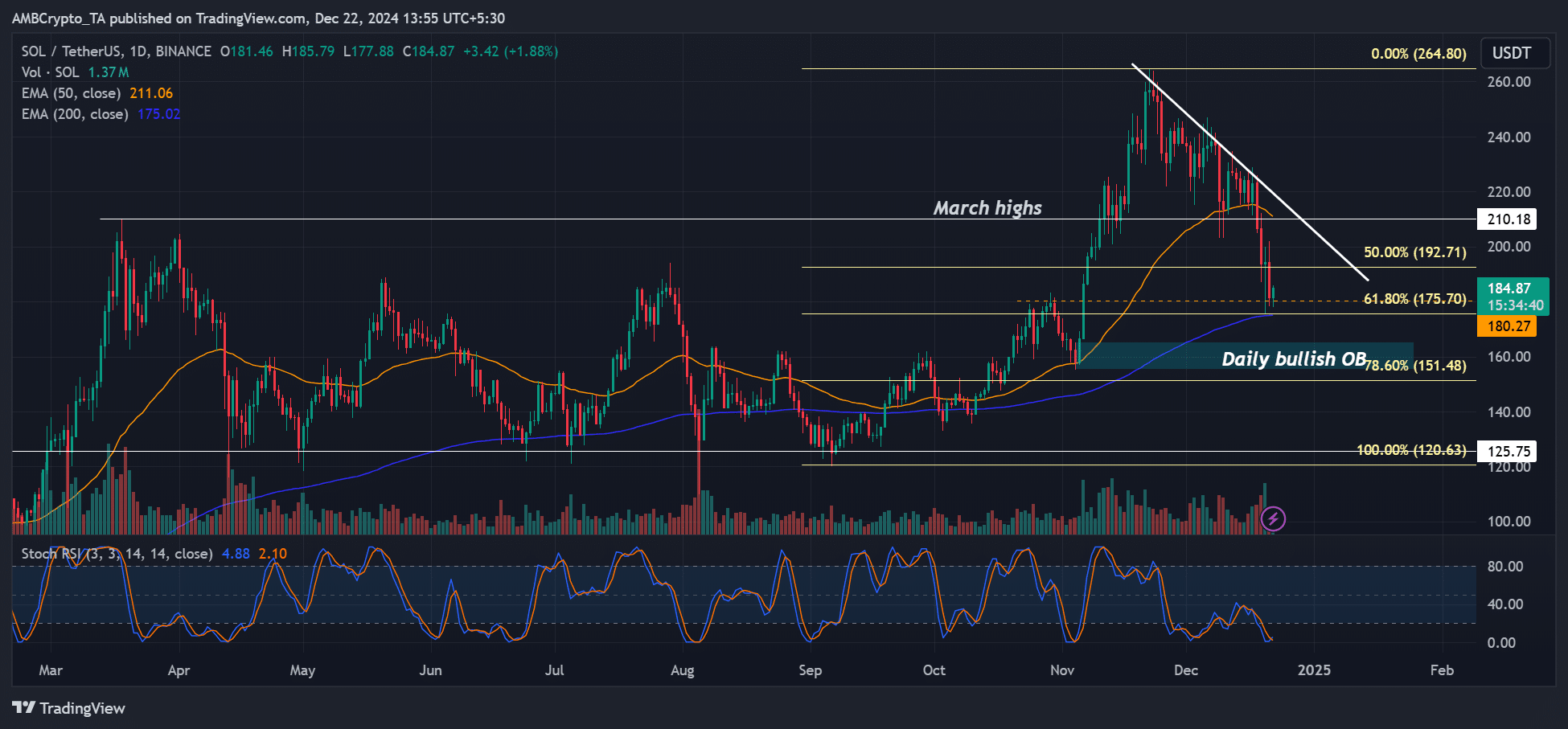

Since the November high, SOL has fallen from $264 to a low of $175. But the decline has reached a key confluence that, if maintained, could prove Marty’s claim.

Throughout 2024, SOL’s dump has reversed at the 100-day EMA (exponential moving average, blue). This pattern was repeated in June, July and October.

source: SOL/USDT, TradingView

As of this writing, the recent decline has stabilized around the moving average ($175). Interestingly, this level also coincided with the Fibonacci retracement tool’s golden level (61.8%) measured against the September low.

Most often, price trend reversals occur at golden ratio levels. So, if the pattern repeats, SOL could bottom at $175, with a potential deviation of $160.

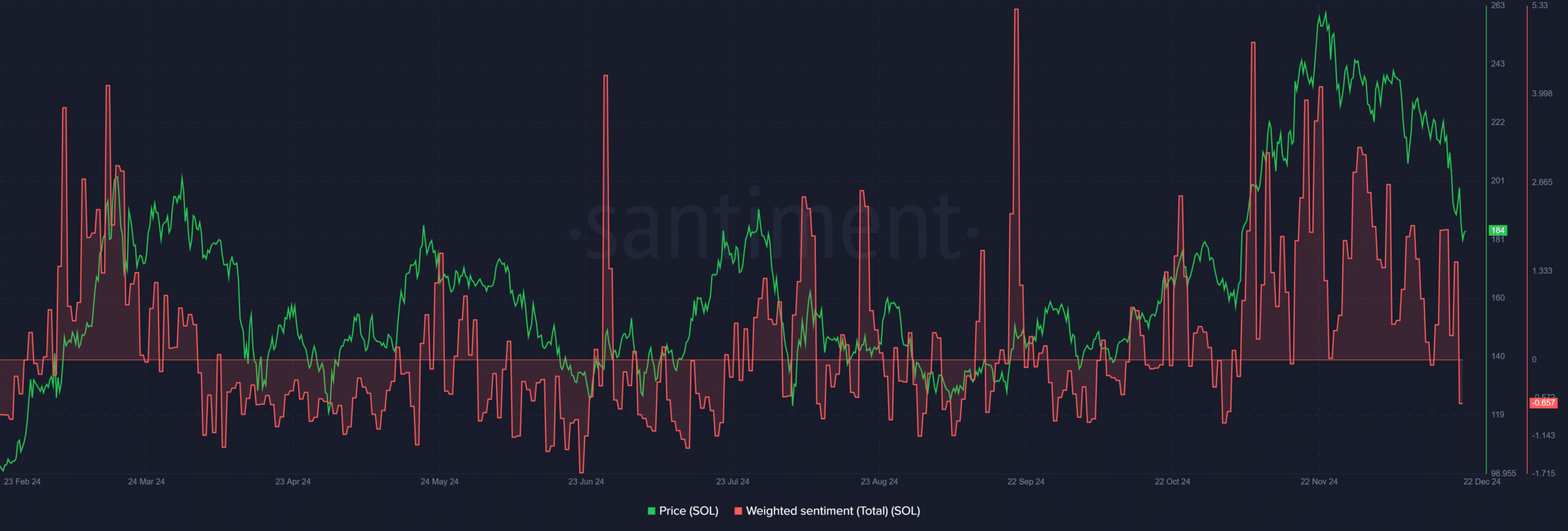

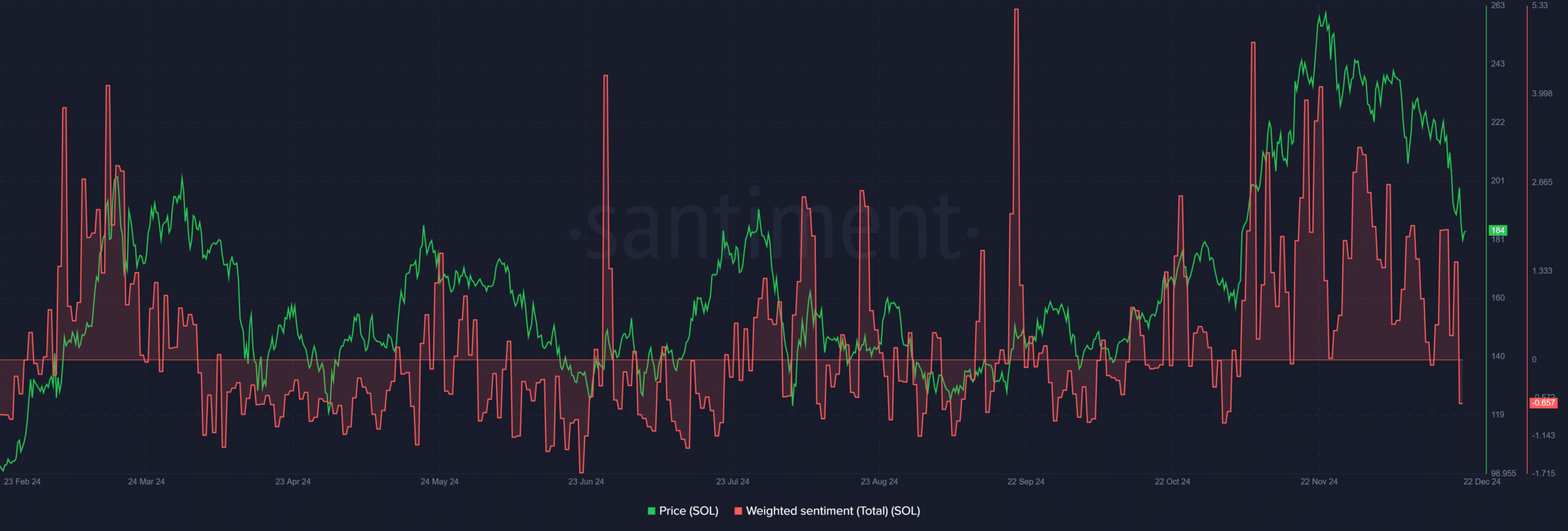

That said, overall market sentiment is still negative toward SOL, which could make it ideal for long-term investors looking for discounted SOL.

Source: Santiment

However, it is also worth noting that SOL sentiment has turned negative for the first time since November.

So what is the market positioning at this key confluence level and weak sentiment?

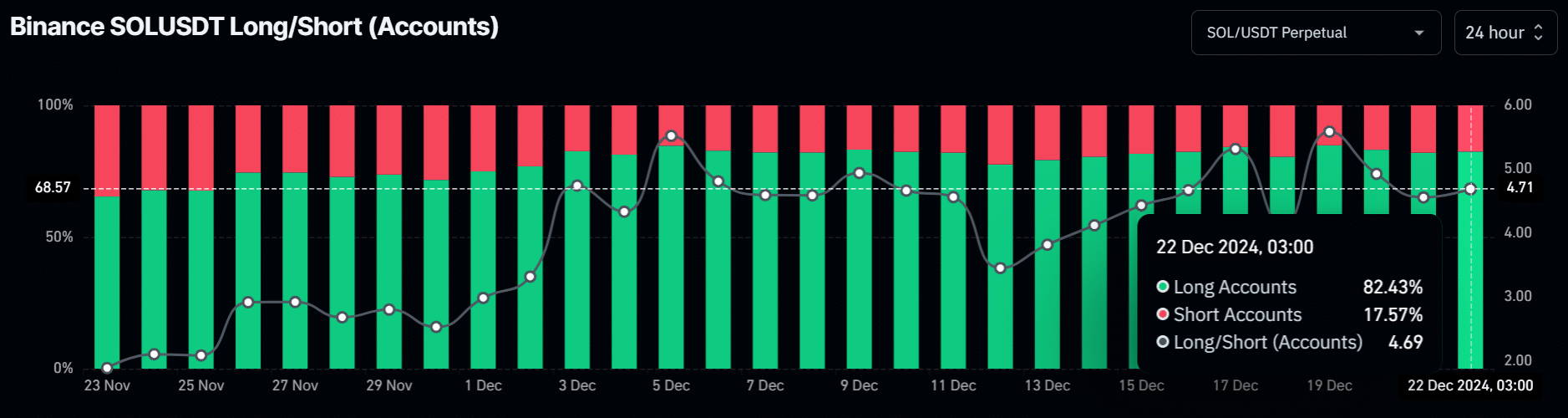

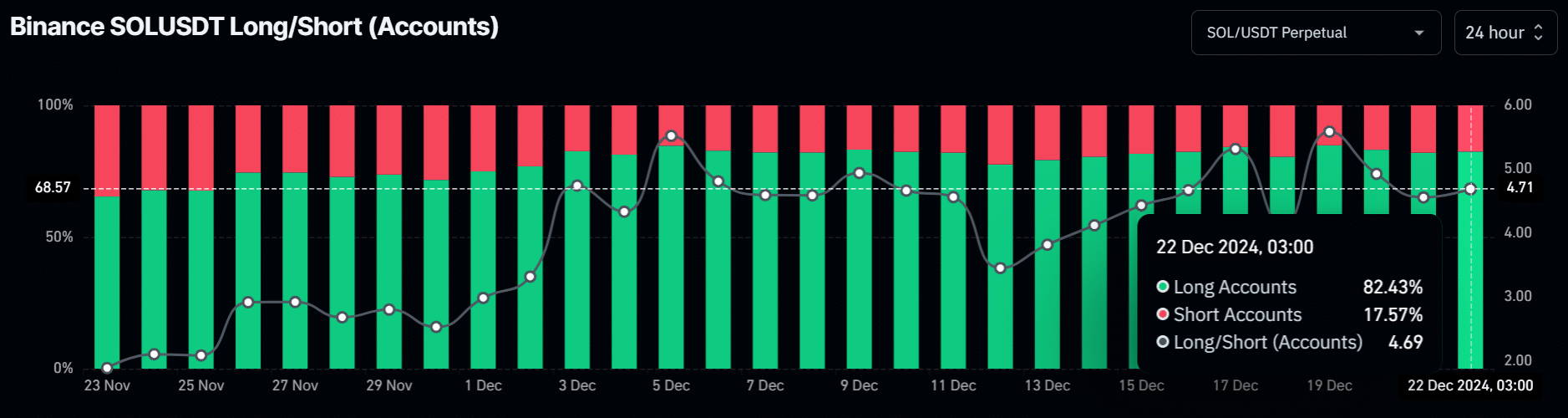

According to Coinglass, more than 82% of top traders on the Binance exchange held long SOL positions.

read Solana (SOL) Price Prediction From 2024 to 2025

This is a slight drop from the 84% level on December 19th, but it suggests that most players are still optimistic about SOL. recovery view.

Source: Coinglass