- According to Galaxy Research, transactions on Ethereum Layer 2 have more than doubled since Denkun, most likely due to bots.

- The Ethereum mainnet also saw a significant decline in total revenue and ETH was burned.

that Ethereum (ETH) The Dencun upgrade began in March of this year. While it had the desired effect of making Layer 2 scalable and cost-effective, it also had some unintended downsides.

According to Galaxy’s in-depth analysis, the EIP-4844 upgrade significantly reduced Ethereum rollup fees, driving adoption. It also shifted revenue away from the Ethereum mainnet.

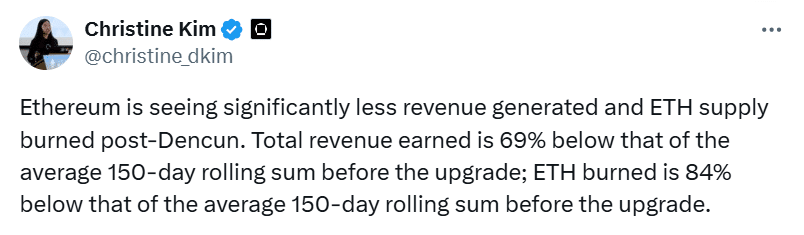

Galaxy researcher Christine Kim points out that the Ethereum network’s yield and burn rate have decreased since this upgrade.

Source: X

In the data Ultrasonic money Since the Dencun upgrade was implemented on March 13, the ETH burn rate has decreased by approximately 0.18%.

Are bots driving the surge in trading?

The TVL (Total Locked Value) of Ethereum rollups is $33 billion. Eltubeat Data. This TVL has grown by over 200% in the past year.

In addition to the surge in TVL, Galaxy also noted that transactions on Layer 2 have more than doubled to 6.6 million since Dencun. This increase was also driven by a significant reduction in transaction costs.

However, the high number of trades corresponded to an increase in the failure rate. Base had the highest failure rate at 21%, followed closely by Arbitrum at 15.4% and Optimism at 10.4%.

The study attributed this failure rate to bot activity: low transaction fees led to an increase in addresses making more than 100 transactions per day (presumably bots).

Impact on ETH

Ethereum’s declining revenue and slowing burn rate have restrained ETH price growth. Ether is down 22% over the past 30 days, a far cry from Bitcoin’s 7.5% drop.

At the time of writing, ETH was trading at $2,668 after a 1.3% gain over the past 24 hours. Looking at Chaikin Money Flow, there is buying pressure, but the trend is weakening.

Although the index was positive, the CMF line was declining at the time of writing, showing that sellers are entering the market.

Source: TradingView

Traders should be wary of the key support level of $2,572. If ETH fails to hold this support, liquidity is likely to be swept below $2,200.

Ether’s uptrend also faces a key barrier at $2,689, a level the price has not broken since August 19.

Is your portfolio green? Check out our ETH yield calculator

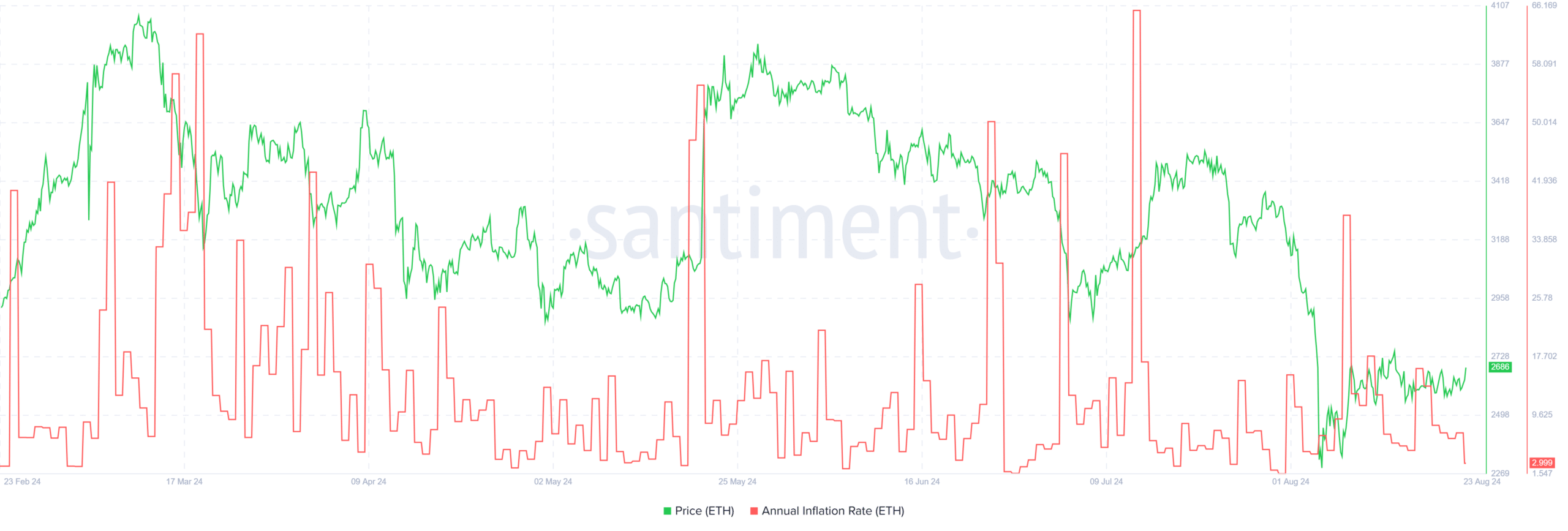

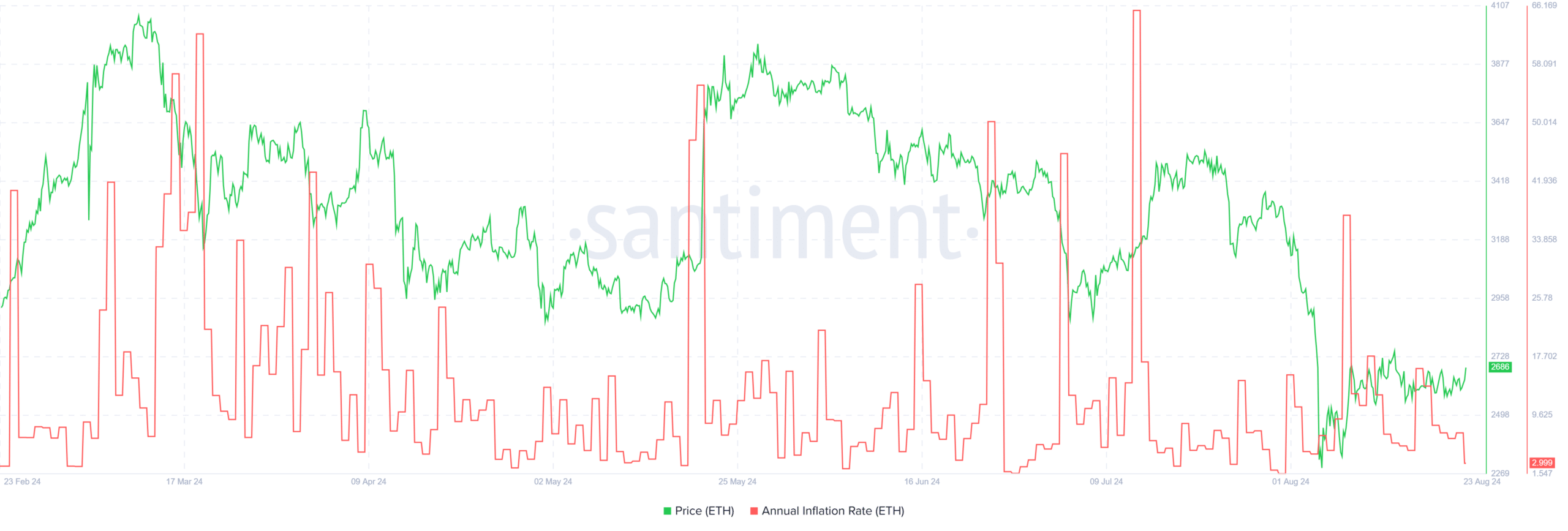

While the increasing supply may be hindering ETH price action, the annual inflation rate, which is approaching its monthly low, paints a positive picture.

When this indicator falls, investor confidence increases, which in turn tends to push prices higher.

Source: Santiment