- Cryptocurrency analysts suggest that Lido (LDO) could rise to $8.8, $16.6, and even $36.9.

- Despite the downtrend, key indicators indicate a potential change in LDO market direction.

Lido (LDO) has been in a downtrend over the past year, down 35% since the beginning of the year. This bearish momentum has been more short-lived, with LDO down 3.3% over the past 24 hours, falling below the key psychological level of $1.

Currently, LDO is trading at $0.9919, down significantly from its 24-hour high of $1.03. Despite this continued bearish performance, some analysts believe a potential reversal is looming.

Lido, on the verge of a strong reversal

According to a recent analysis of X from CryptoBullet, LDO appears to be gearing up for a multi-month rally. According to the analyst, LDO’s weekly chart shows a “beautiful leading diagonal” pattern, which suggests that it could be a good time to buy the asset.

Source: CryptoBullet on X

The analyst noted:

“I like this chart. Beautiful leading diagonal. If you want to buy LDO, I think this is the best time to do so. I expect a rally for a few months.”

CryptoBullet has given three targets for a potential rally: $8.8, $16.6 (the main target), and $36.9 if bullish momentum strengthens. While this outlook looks promising, it is worth looking into LDO’s fundamental indicators to assess the likelihood of such a rally.

Active addresses and outstanding interest

Looking at the fundamentals of LDO can give us insight into the current state of the asset. One important indicator is retail interest, which is reflected in the number of active addresses interacting with the network.

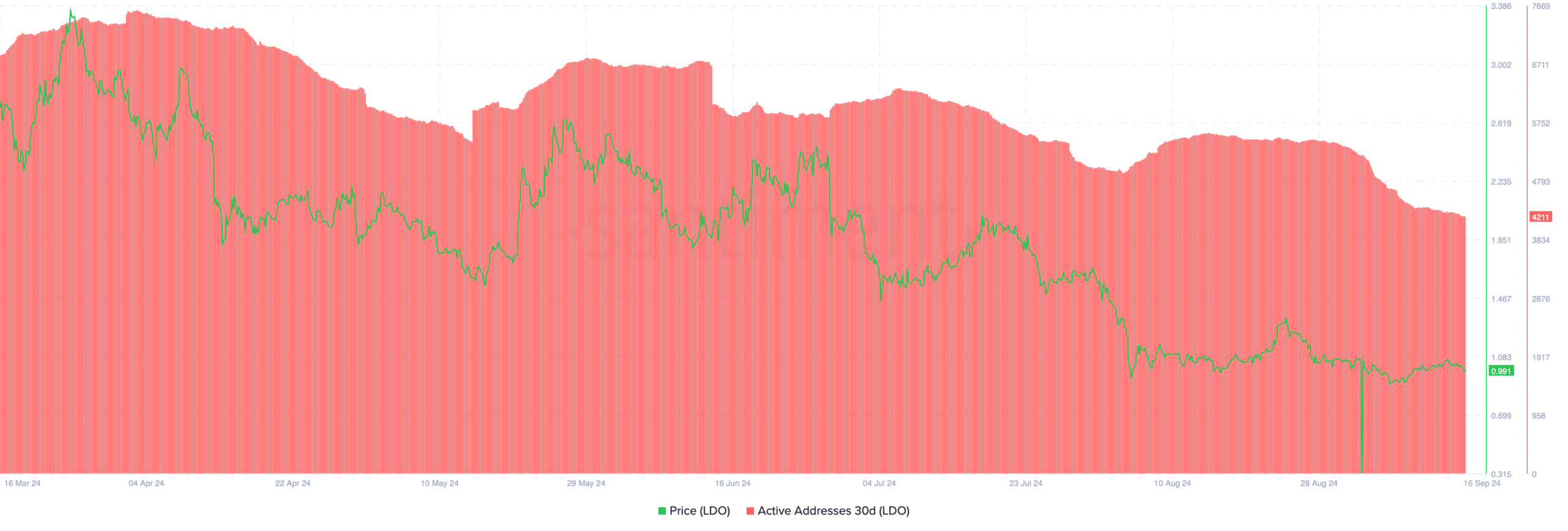

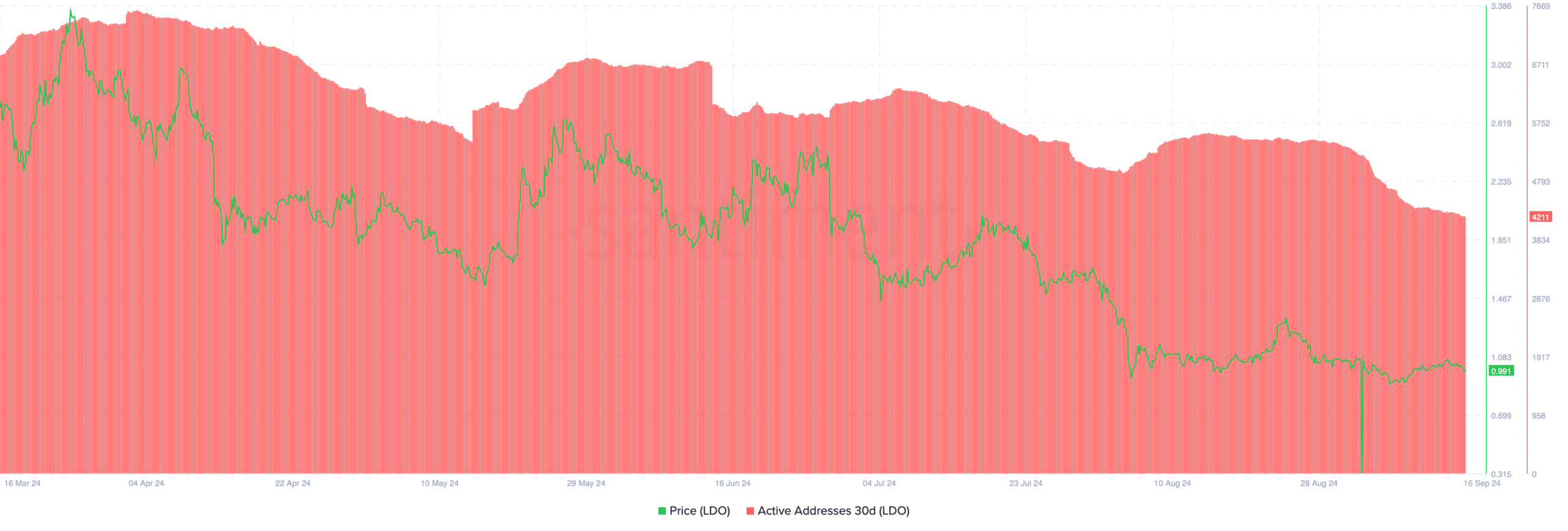

data According to a report from Santiment, active addresses on LDO have been steadily declining since peaking at over 7,500 in April. According to the latest figures, the metric currently stands at 4,211, down about 5% from the 5,000 active addresses recorded last month.

Source: Santiment

A decrease in active addresses suggests that retail interest in LDO is decreasing, which could impact price action. In general, a decrease in active addresses indicates a decrease in network activity, potentially indicating a lack of participation or trust among retail investors.

This decline could put additional downward pressure on the LDO price in the short term, making it difficult for the asset to break out of its current downtrend.

However, if the expected rally materializes and market sentiment changes, active addresses may increase, indicating renewed investor interest.

In addition to retail activity, examining outstanding commitments provides a broader view of market participants’ positions on LDOs.

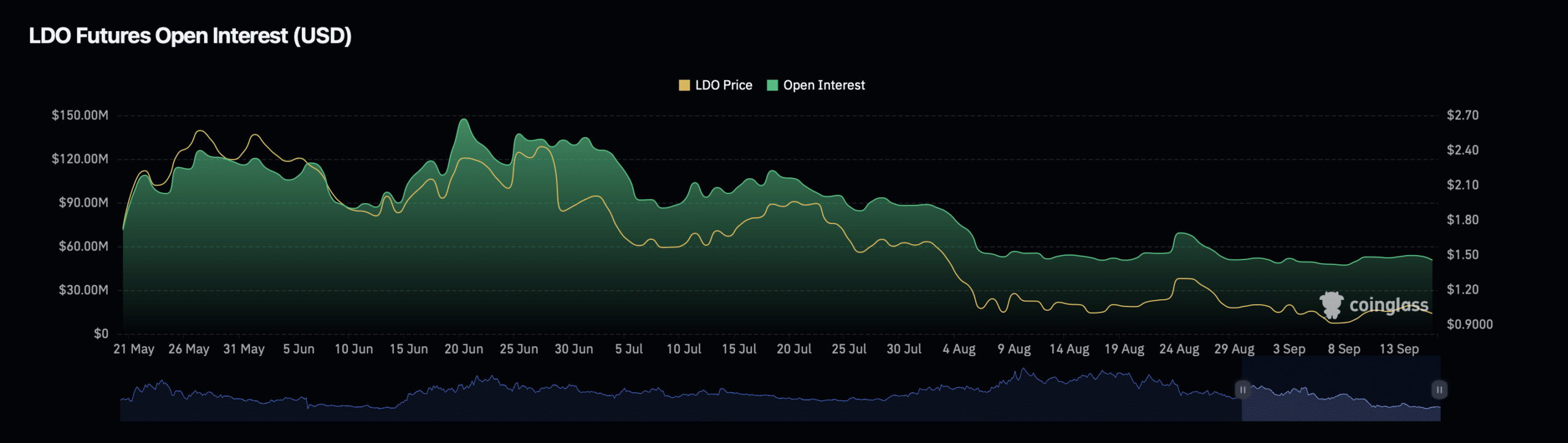

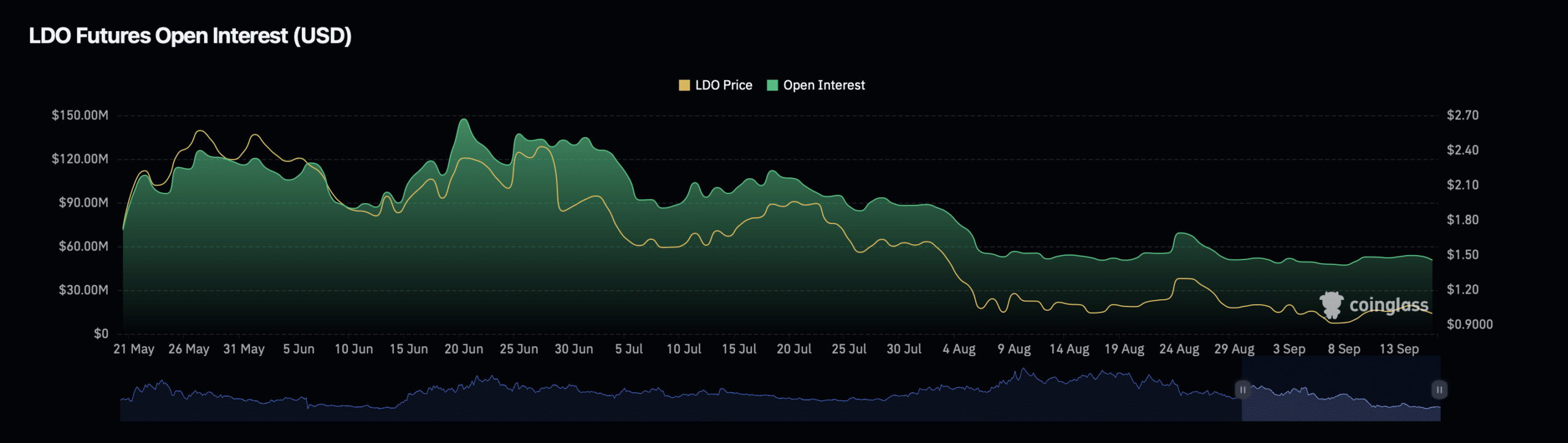

data According to Coinglass, LDO’s open interest has decreased by 3.95%, currently standing at $49.95 million. Conversely, the asset’s open interest volume has increased significantly, by 68.91%, to $63.21 million.

Source: Coinglass

How about the price?

This difference in the open contracts indicator suggests that while the total value of active contracts has declined, the number of contracts being traded has surged.

This scenario may indicate heightened speculative activity, with traders increasing their positions in anticipation of potential price moves.

Realistic or not, here is LDO’s market cap in BTC terms.

Despite a decline in overall open interest value, the increase in open interest volume may indicate that traders are preparing for potential market changes.

If CryptoBullet’s bullish prediction comes true, this increased trading activity could provide LDO with the momentum it needs to reverse its current downtrend.