In a groundbreaking move, payment processor PayPal has incentivized PYUSD liquidity on Curve Finance, the world’s largest stablecoin decentralized exchange (DEX) by trading volume.

PayPal Encourages PYUSD Liquidity Through Curves

This development of staking the DAO first capture On January 10, it sent shockwaves through the cryptocurrency community, with many experts predicting that Curve would establish itself as a platform for institutional and corporate trading of on-chain stablecoins.

PayPal’s decision to incentivize PYUSD liquidity on Curve is an important step forward in promoting the adoption of stablecoins and decentralized finance (DeFi) protocols in general. By offering attractive rewards to liquidity providers, PayPal is demonstrating its commitment to growing this rapidly evolving sector.

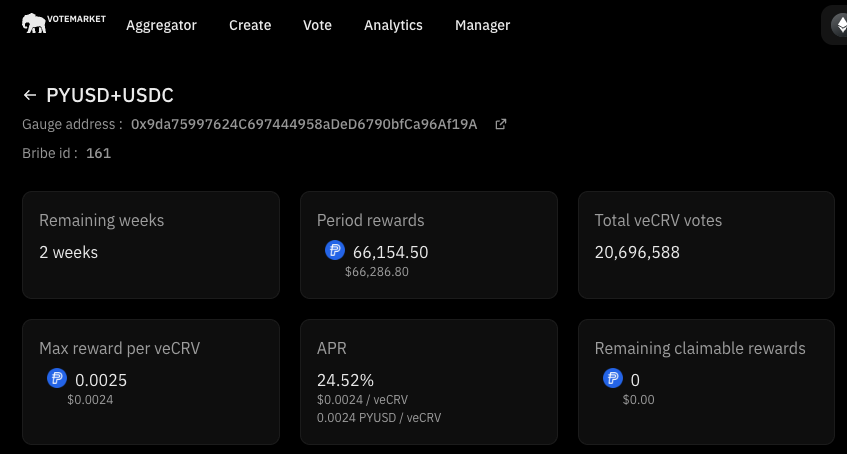

As part of the incentive program, PayPal deposited $132,000 worth of voting incentives in PYUSD on Votemarket, a voting incentive platform. These rewards are designed to encourage users to increase their liquidity on Curve. Additionally, PayPal directly rewards liquidity providers distributed in PYUSD with an APY of 11%.

Observers note that the $66,000 weekly allocation to Votemarket could send at least $55,000 in CRV, Curve Finance’s governance token, into the PYUSD-USDC pool.

Institutional Support: Will CRV Rise Above $0.75?

PayPal’s approval gives Curve more liquidity and solidifies its position as a leader in on-chain stablecoin trading. It is unclear whether other Wall Street heavyweights are ready to boost liquidity through Curve or other DeFi protocols. Their participation will validate the potential of Curve and DeFi and accelerate adoption among institutional investors.

According to DeFiLlama: data As of January 10, Curve’s total value locked (TVL) was $1.82 billion, a large portion of which is in Ethereum. The protocol has been deployed on Ethereum layer-2 and other Ethereum Virtual Machine (EVM) compatible platforms, including Arbitrum.

Currently, Curve’s native token, CRV, is still under pressure. Looking at the performance on the daily chart, the token is currently sliding at the time of writing, down 30% from its recent December highs.

Price technical analysis suggests that a break above $0.75 could trigger more demand, pushing the token to new 2024 highs. Currently CRV is trending inside a bearish candlestick, indicating overall weakness. In the short term, sharp losses below $0.45 could trigger selling. In this case, CRV risks falling to its September 2023 low of around $0.40.

Featured image from Canva, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.

Source: NewsBTC.com