The world of memecoins continues to be a roller coaster ride, and Pepe (PEPE) is no exception. Recent on-chain data shows a surge in tokens moving out of exchanges, potentially creating optimism among investors. However, conflicting indicators cast doubt on the sustainability of this upward trend.

Pepe has surged on the exchange, suggesting investor confidence.

An important development for PEPE is that a large number of tokens will move across exchanges. According to blockchain analysis platform Santiment, as of April 7, PEPE supply outside exchanges reached $243 trillion. The sharp rise compared to March 12 indicates that selling pressure is likely to ease.

Source: Santiment

Price recovery, increased volume hints at potential upside

Further supporting PEPE’s strength is recent price increases. In the past 24 hours, Memecoin has experienced a surge of nearly 10%, suggesting a potential recovery from the recent decline.

In addition to the observed price movements and expected price range for Pepe, it is worth noting that there has been a significant increase in trading volume surrounding the cryptocurrency. This surge in trading activity not only reflects heightened levels of engagement within the Pepe community, but also suggests growing interest from external investors and traders.

Bitcoin is now trading at $71.879. Chart: TradingView

Increasing volume serves as a key indicator of market sentiment and could potentially act as a catalyst for further price increases. Historically, increases in trading activity have been associated with periods of rising prices. This is because it signals increased levels of market participation and liquidity. In turn, this increased liquidity can attract new buyers to the market, further strengthening demand and potentially driving prices higher.

Investor sentiment tells a different story

But not all signs point to a clear path to success for PEPE. Token movements suggest some bullishness, but important indicators paint a contrasting picture. Weighted Sentiment, which reflects investor sentiment toward PEPE, has recently declined.

This could herald a weakening of investor confidence and potentially a decline in demand for memecoins. If this indicator continues to decline, the current bullish bias surrounding PEPE could be nullified, making a significant price hike less likely.

Quick technical overview

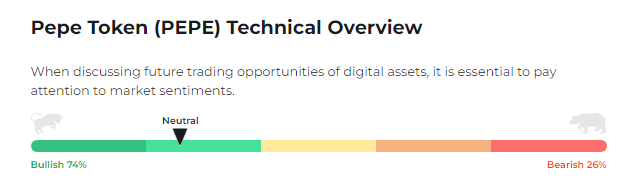

On the brighter side, PEPE shows strong bullish momentum with a 74/26 split favoring positive sentiment. This is consistent with recent price increases and suggests continued investor optimism.

However, it is important to monitor social media conversations and news articles for potential changes in sentiment that could influence price movements. Although the current outlook is positive, it is important to remain vigilant in this volatile market.

Source: Changelly

PEPE Price Forecast

Meanwhile, amid volatility in the cryptocurrency market, Pepe’s price movements have caught the attention of cryptocurrency experts and prompted predictions about its trajectory in April 2024. Our analysis shows that the expected average PEPE ratio for this period is $0.0000140. This reflects both growth potential and growth potential. Uncertainties inherent in the market.

Although these forecasts provide insight into expected average prices, it is important to acknowledge the range of possibilities. Experts suggest that Pepe’s lowest and highest prices in April 2024 could vary significantly. 0.00000745~ .

Featured image from Pexels, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.