- Lido’s market dominance fell to its lowest point last year.

- This protocol has been shown to significantly increase withdrawals.

The market share of Lido Finance (LDO), a liquid staking protocol, in the Ethereum staking market fell to its lowest level in a year.

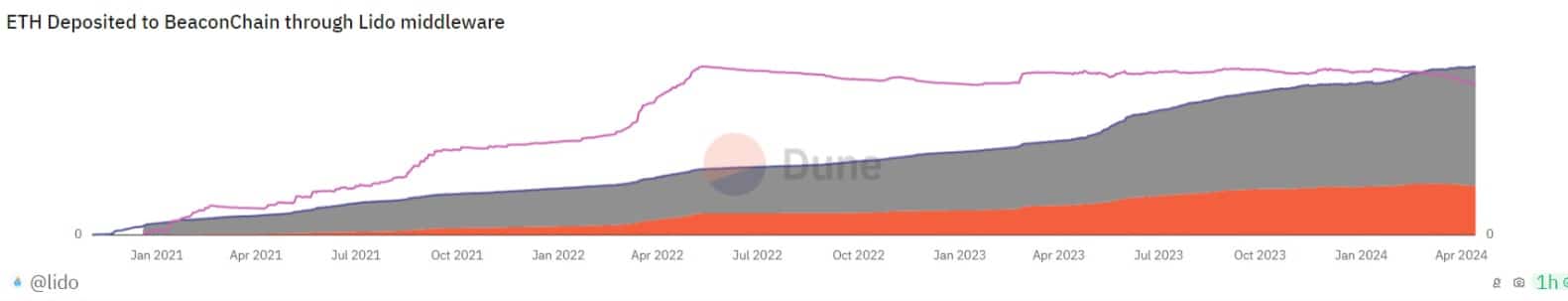

According to the Dune Analytics dashboard, the percentage of ETH deposited into the beacon chain via the Lido middleware was 29.1% at press time. The last time it was below 30% was in February 2023.

Source: Sand Analysis

On a year-to-date (YTD) basis, Lido’s market share has decreased by 8%. This decline is due to a surge in withdrawals from liquid staking protocols over the past month.

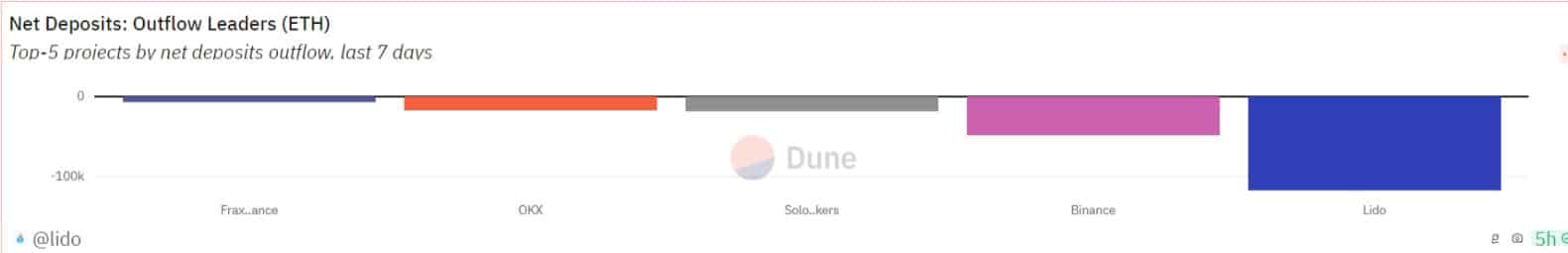

According to on-chain data from Dune Analytics, since March 12, withdrawals from Lido have exceeded deposits through the protocol.

The withdrawals from Lido, which ranked as the most leaked staking platform last week, totaled 117,000 ETH at press time, valuing it at $35.69 million.

Source: Sand Analysis

Lido has seen a surge in withdrawals as the Annual Percentage Rate (APR) offered to users staking on the platform has fallen.

As of April 10, the user APR, assessed by the 7-day moving average, was 3.28%, a decrease of 14% compared to March 11.

What to Expect from LDO

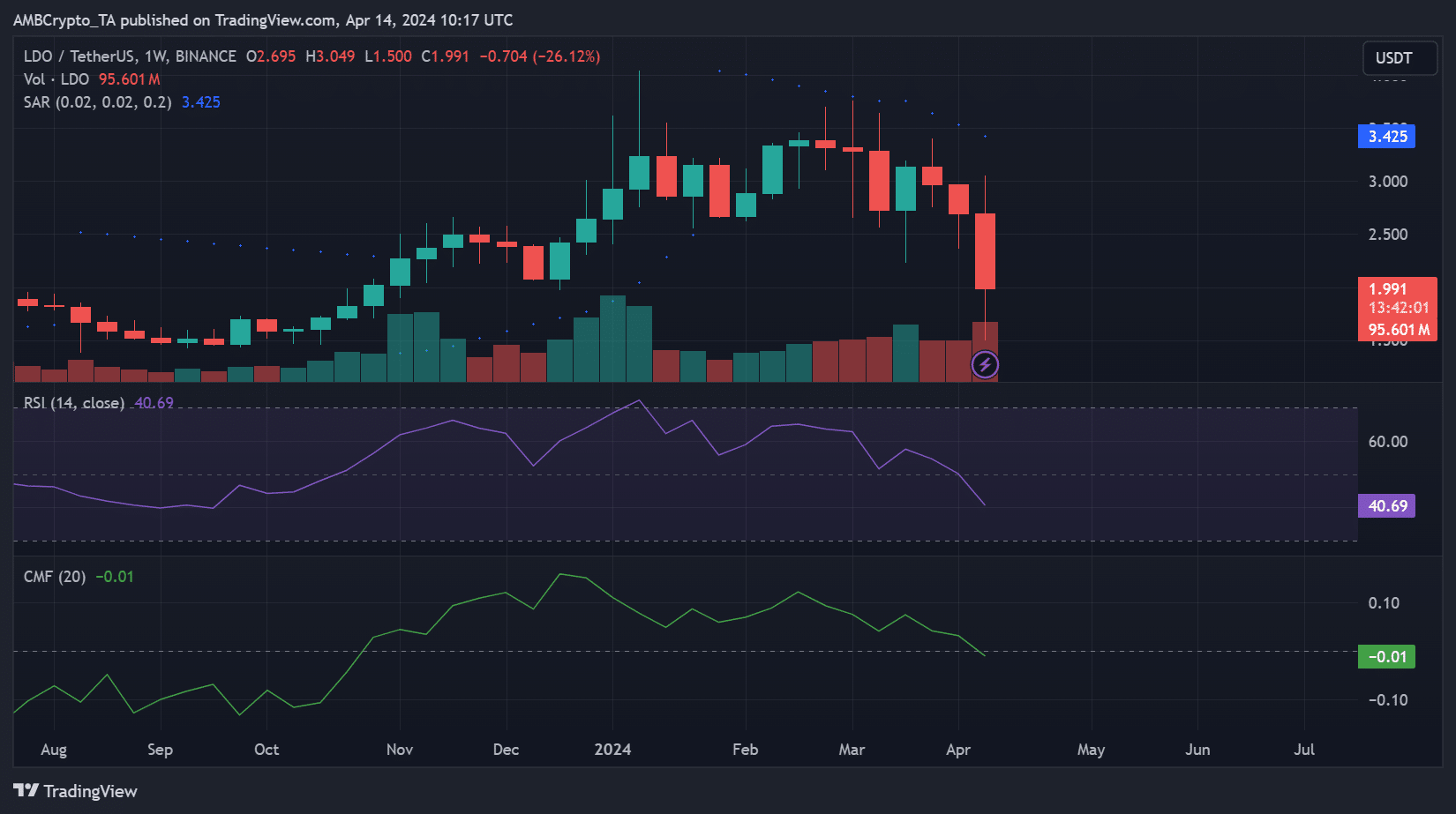

At press time, the protocol’s native token LDO was trading at $2.61. It is said that its value has fallen by more than 20% in the past month. CoinMarketCap’s data.

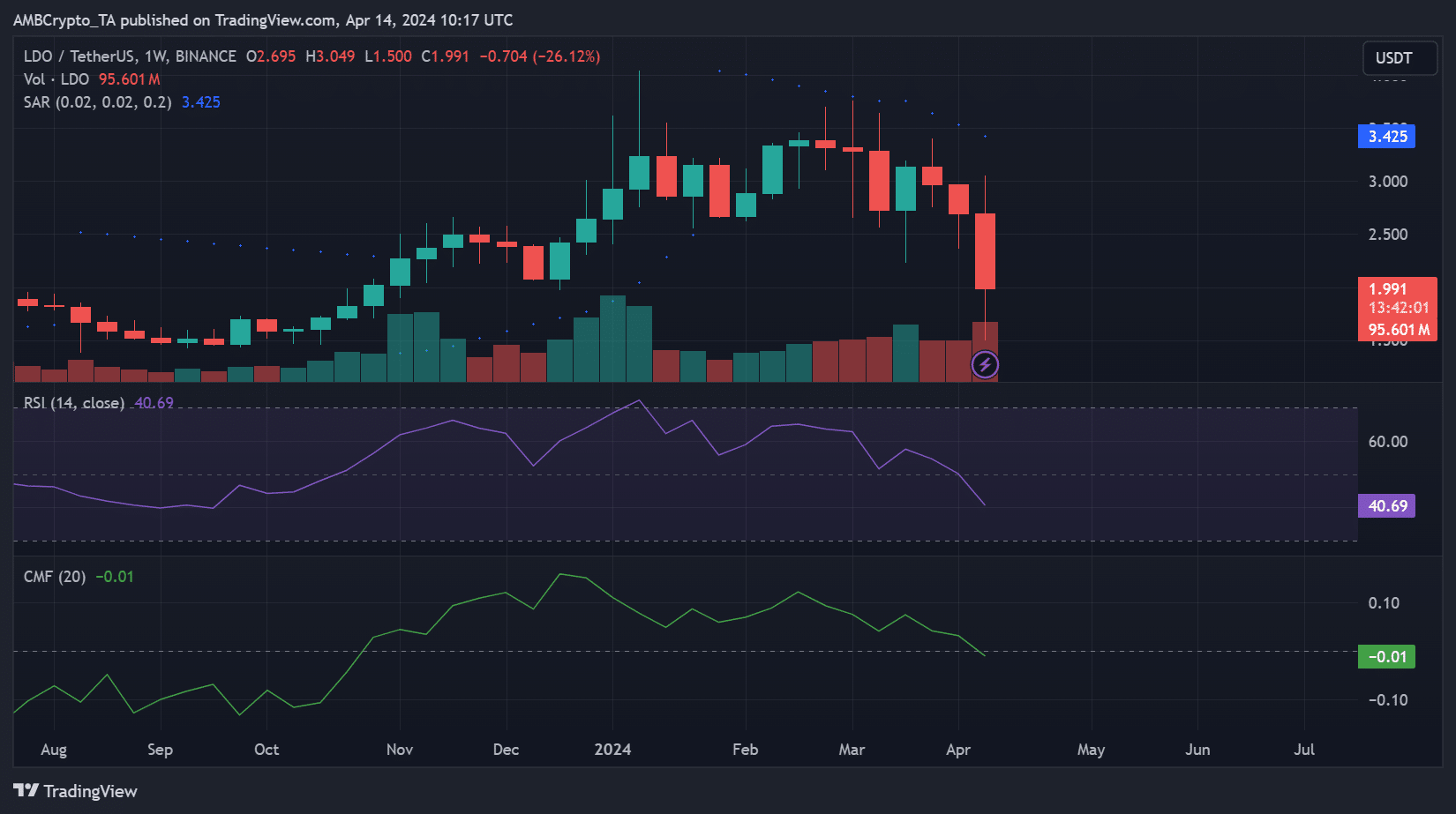

Performance on the weekly chart hinted at the possibility of further decline in the medium term.

Chaikin Money Flow (CMF), which measures the flow of funds into and out of assets, crossed the zero line at press time and is expected to trend downward.

A CMF value below 0 is a sign of market weakness. This means market liquidity outflows will rally and selling pressure will increase.

Confirming the increase in the LDO distribution, the Relative Strength Index (RSI) was 40.69 and has decreased further at the time of writing.

This RSI value showed that market participants prefer selling their LDO holdings rather than accumulating more tokens.

Additionally, the dotted line of LDO’s parabolic SAR indicator was above the price at press time.

Source: BNB/USDT on TradingView

Realistic or not, the market cap of LDO in BTC terms is:

This indicator measures potential reversal points in the price direction of an asset. If the dotted line is above the price of the asset, it is a bearish signal.

This confirms that asset prices are falling, and if sentiment remains the same, the decline will continue.