- SOL has been trading sideways recently after being one of the most volatile cryptocurrencies this year.

- It is worth looking at how the slowdown of the Solana network has affected the current state of SOL.

Solana’s native cryptocurrency SOL has been one of the most active coins this year in terms of volatility and demand. However, volatility has virtually disappeared over the past five days.

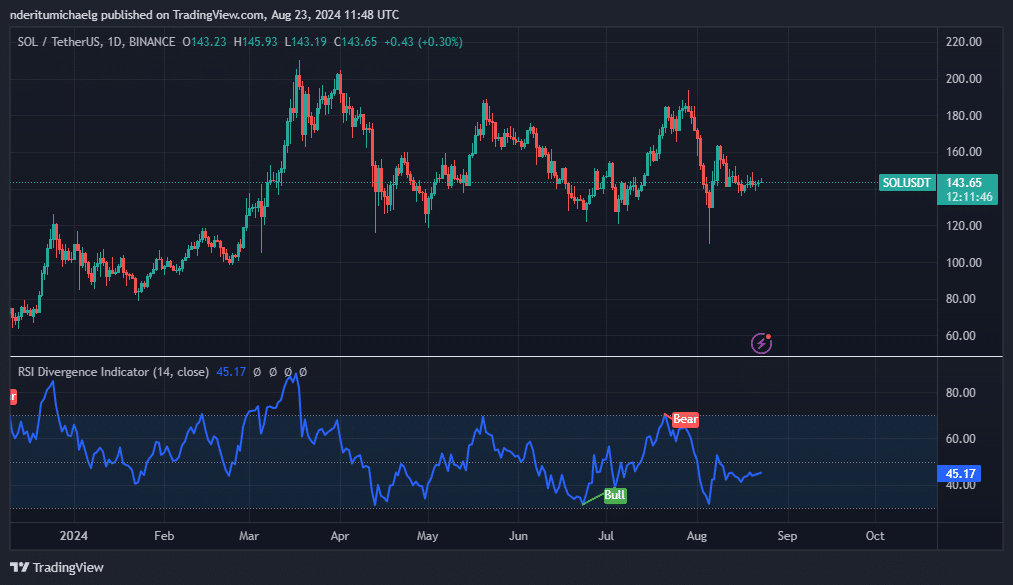

SOL’s price action has hovered around the $143 level for the past seven days, officially making it SOL’s least volatile week of the year.

The low volatility price performance is a surprising turn of events, especially considering that SOL has recently made a strong recovery from its 4-week low. The RSI initially bounced strongly but then fell back below the 50% level, confirming that the bulls have lost momentum, and the altcoin is trading at $143.65 at the time of writing.

Source: TradingView

Will SOL recover and regain volatility? This is the question that SOL investors and traders want to know. The reality is that SOL’s downturn is not an isolated observation. In fact, Bitcoin has also been down over the past few days.

Meanwhile, some altcoins have seen significant demand this week, leading to bullish performance. This means that liquidity has flowed from major cryptocurrencies like Solana and Bitcoin to other altcoins. In short, volatility will eventually return.

Assessing the state of the Solana ecosystem

The performance of SOL, especially its ability to bounce back after a drawdown, has been a good measure of demand over the past few months. Therefore, the sideways price movement indicates a decrease in demand for SOL in the Solana ecosystem.

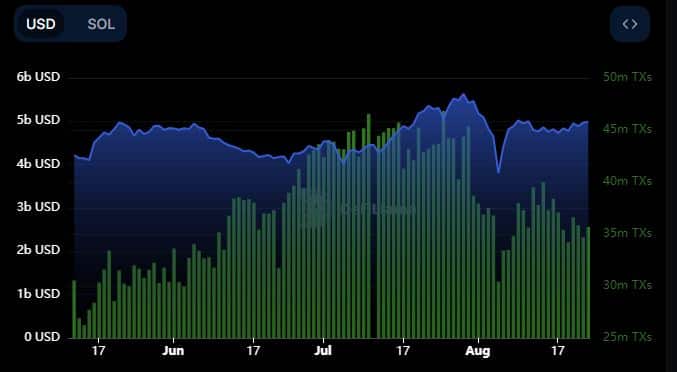

Unsurprisingly, on-chain data confirms that Solana transactions have dropped significantly over the past four weeks. For perspective, the network recorded 46.83 million transactions as of July 25. The same figure dropped to 30.41 million on August 5.

Source: DeFiLlama

Although transactions have recovered somewhat over the past two weeks, the number of transactions is still well below 40 million. In fact, this number has been declining somewhat since mid-August. This confirms that the Solana network is experiencing a phase of reduced network demand.

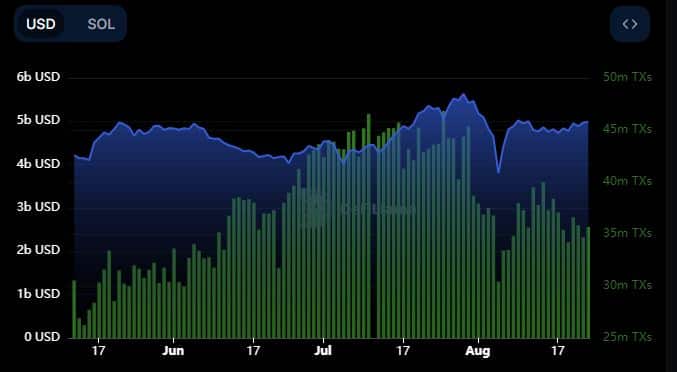

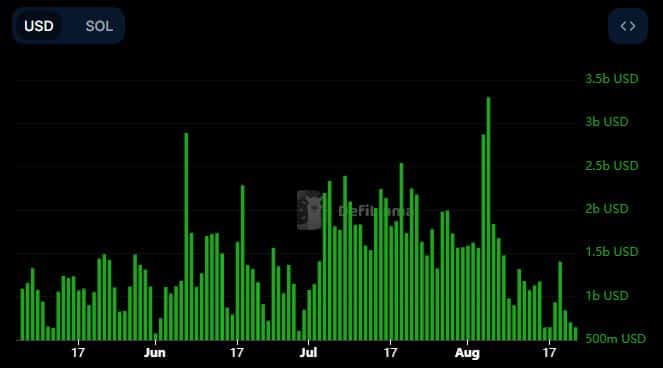

Despite the decline in transactions, Solana’s TVL has remained relatively stable, a sign of network trust. On-chain volume, however, is not. Solana’s peak volume was $3.3 billion at the peak of the crash on August 5.

Source: DeFiLlama

The network’s trading volume has since fallen to its lowest level in the past three months. Additionally, Solana’s daily on-chain trading volume averaged $646.78 million over the past 24 hours.

This is a sign that Solana’s on-chain activity is slowing down, which is in turn impacting SOL.