- Sygnum Bank highlights Solana’s strong performance.

- The chain is well positioned to challenge Ethereum.

- Ethereum is underperforming in major indicators.

Known as the Ethereum killer, Solana has long established itself as a major challenger to the largest DeFi networks. However, it continues to lag behind Ethereum in key indices.

A recent Sygnum Bank report analyzed whether Solana has the potential to challenge Ethereum’s dominance. Thanks to its remarkable recovery following the FTX collapse, Solana is in a better position than ever.

Can Solana challenge Ethereum?

Despite many challenges in recent years, Solana has shown remarkable resilience. On Tuesday, October 1, digital asset-focused Sygnum Bank released a report looking at Solana’s potential to challenge Ethereum. The notable recovery following the FTX collapse suggests that may be the case.

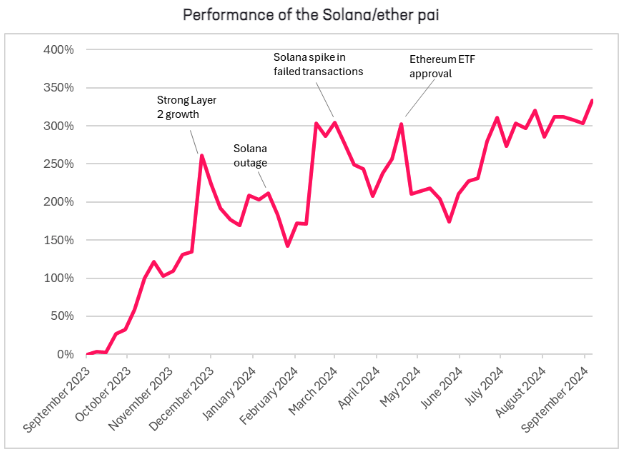

According to the report, Solana outperformed Ethereum by 300% year-over-year. This is due to several factors related to Solana and Ethereum. On Solana’s side, the release of the Firedancer update was a major driver of positive response. This update aimed to improve Solana’s efficiency and processing power while introducing key new features.

At the same time, Ethereum faces its own challenges. Layer 2 scaling solutions are growing, but the same is not true for the base chain. In fact, Ethereum’s network traffic has decreased by 15%, which has contributed to ETH’s recent poor performance. Sygnum Bank pointed out that while layer 2 networks are key to maintaining Ethereum scalability, they also eat into network traffic.

How did Solana bounce back after the FTX collapse?

At the end of 2022, Solana faced several challenges, especially due to its association with FTX. The failed exchange was a major investor in Solana and one of the network’s largest validators. After the collapse, Solana suffered network-wide outages and investors lost confidence in the token.

Despite these difficulties, Solana showed independent potential. Thanks to numerous technical improvements, the network has shown its commitment to building. Solana has created several successful campaigns to improve its image, including the “Only Possible on Solana” campaign. This slogan was intended to demonstrate Solana’s unique speed and scalability.

At the time, Solana also launched a mobile division that included its own Android phone with Web3 capabilities. Despite poor initial sales, the phone eventually sold out. This coincided with a surge in Solana memecoin traffic. This allowed memecoins like Bonk to rise to prominence, with Bonk specifically becoming the largest memecoin on the network.

On the flipside

- Despite its optimism about Solana, Sygnum Bank does not expect high demand for Solana. Solana ETF.

- Solana has the potential to surpass Ethereum in terms of trading volume, but it is still far behind in terms of total value locked (TVL).

- Solana faces ongoing criticism for its centralization. Most recently Edward Snowden exploded Network for problems.

Why This Matters

Solana’s recent performance suggests that it could challenge Ethereum’s dominance. If Solana continues to gain ground, institutional interest could grow.

Learn more about Solana’s recent challenges:

Risk of worsening centralization issues due to lower Solana revenue

Learn more about Snowden’s criticism of Solana.

Is what Snowden said about Solana correct? How centralized is the network?