- ARB’s key indicator presented a buying opportunity on the chart.

- However, bearish sentiment remained dominant across markets.

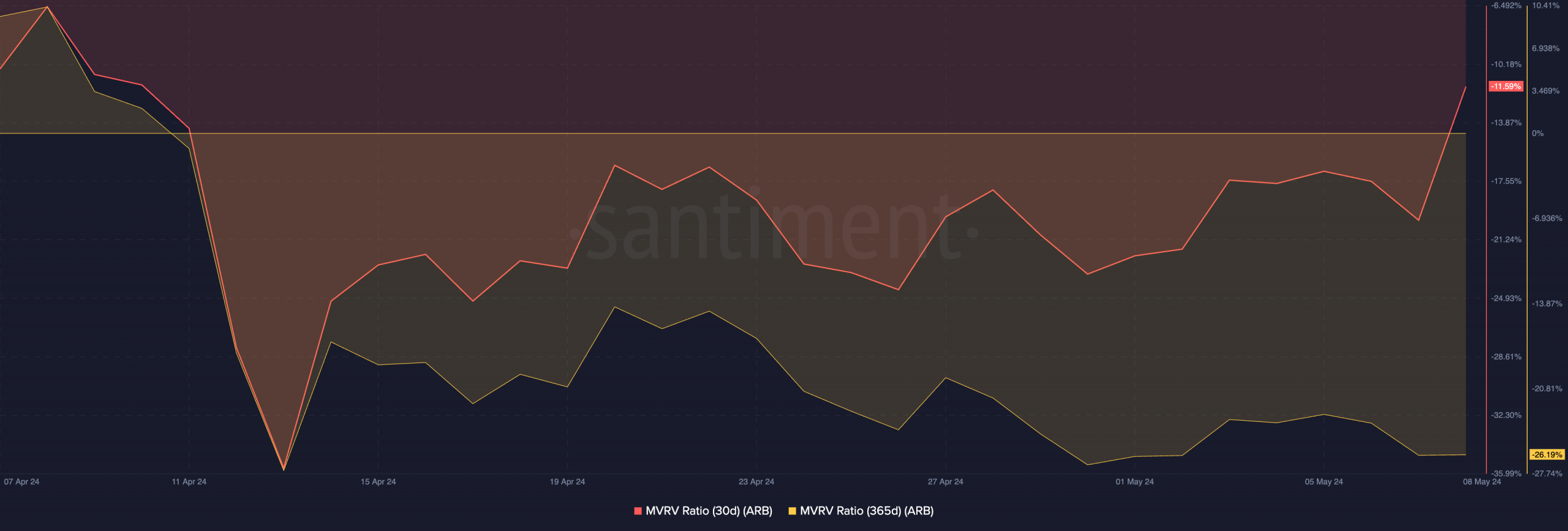

The Market Value to Realized Value (MVRV) ratio of leading Layer 2 (L2) token Arbitrum (ARB) has triggered a buy signal on the charts. in fact, AMBCrypto discovered that the native token’s MVRV ratio, evaluated against its 30-day and 365-day moving averages, had returned negative values at press time.

Source: Santiment

The MVRV ratio of an asset tracks the difference between the current market price and the average price of all coins or tokens acquired for that asset.

If the value is positive and higher than 1, the asset is said to be overvalued. This means that the current market value of the asset is much higher than the price at which most investors acquire their holdings. Conversely, a negative MVRV value indicates that the asset is undervalued. This means that the market value of the asset in question is lower than the average purchase price of all tokens in circulation.

If an asset’s MVRV ratio is negative, this is considered the perfect time to buy because at this point the asset is trading at a discount to its historical cost basis.

There is no price bottom in sight

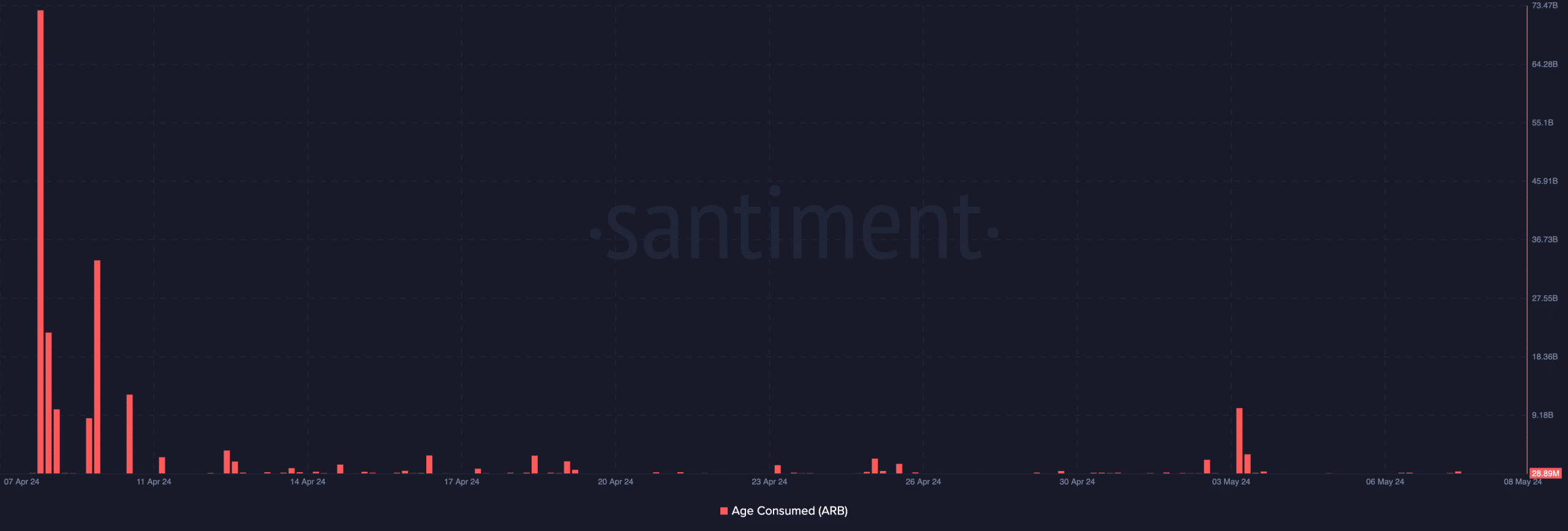

A good indicator of whether it is time for an asset price rebound is when local prices have bottomed. This is properly measured by evaluating indicators such as the age of the asset.

This indicator measures the movement of dormant tokens. ARB’s Age of Consumption indicator forecast slightly lower values from the beginning of May.

Source: Santiment

This is important here as it provides insight into changing behavioral patterns of long-term token holders. This group of ARB holders rarely move older coins, and when they do, they often trigger changes in market trends.

A spike in ARB’s Age Consumed indicator means that many tokens are changing ownership after being idle for long periods of time. On the other hand, if it falls, it means that idle coins remain motionless.

Realistic or not, ARB’s market cap in BTC terms is:

Since early May, ARB’s Age Consumed has been returning low values. This is a sign that long-term holders have barely moved their tokens.

This may mean that the price has not yet reached its bottom. Therefore, even though ARB’s MVRV ratio has indicated a buy signal, traders should proceed with caution.

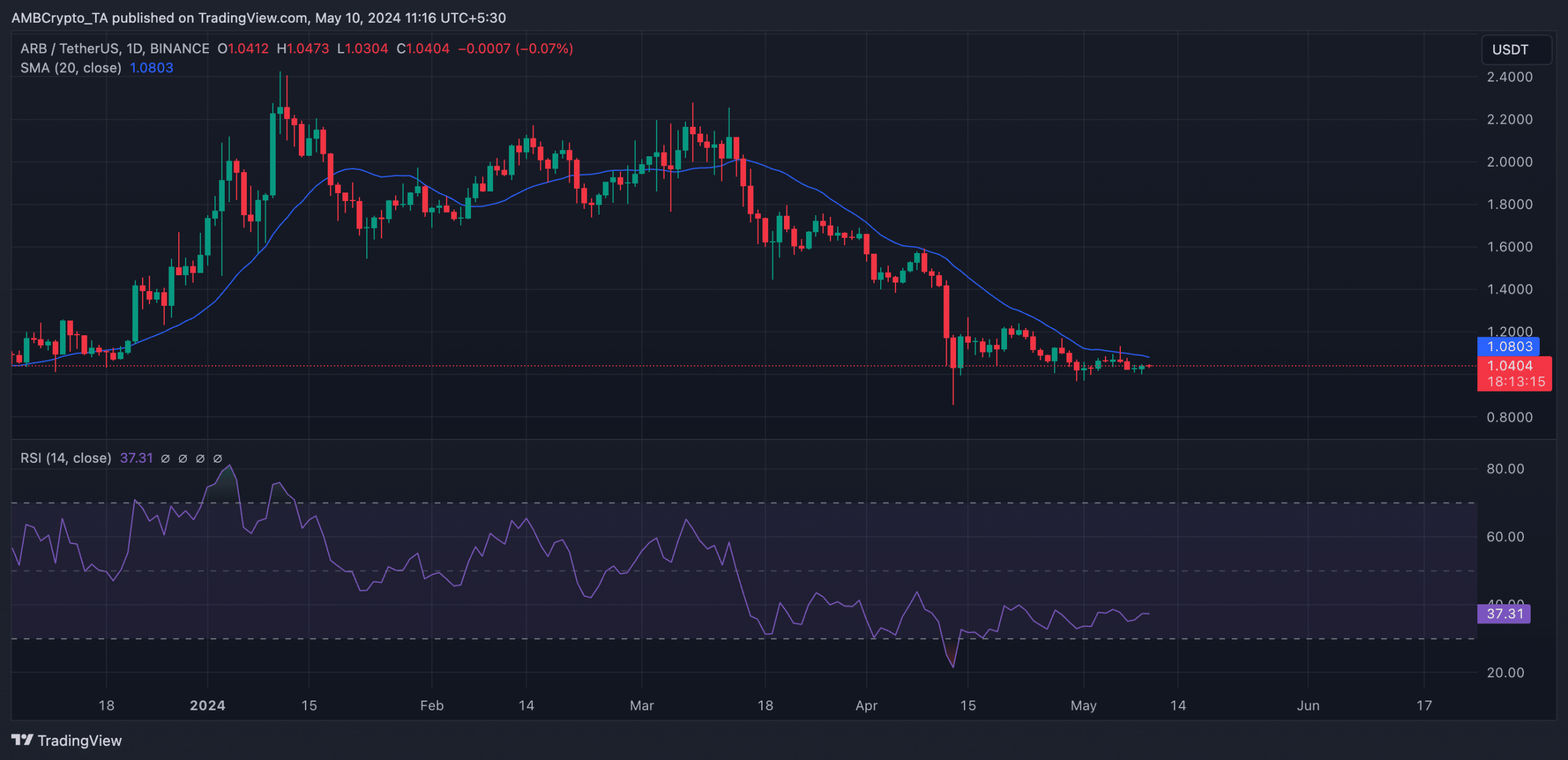

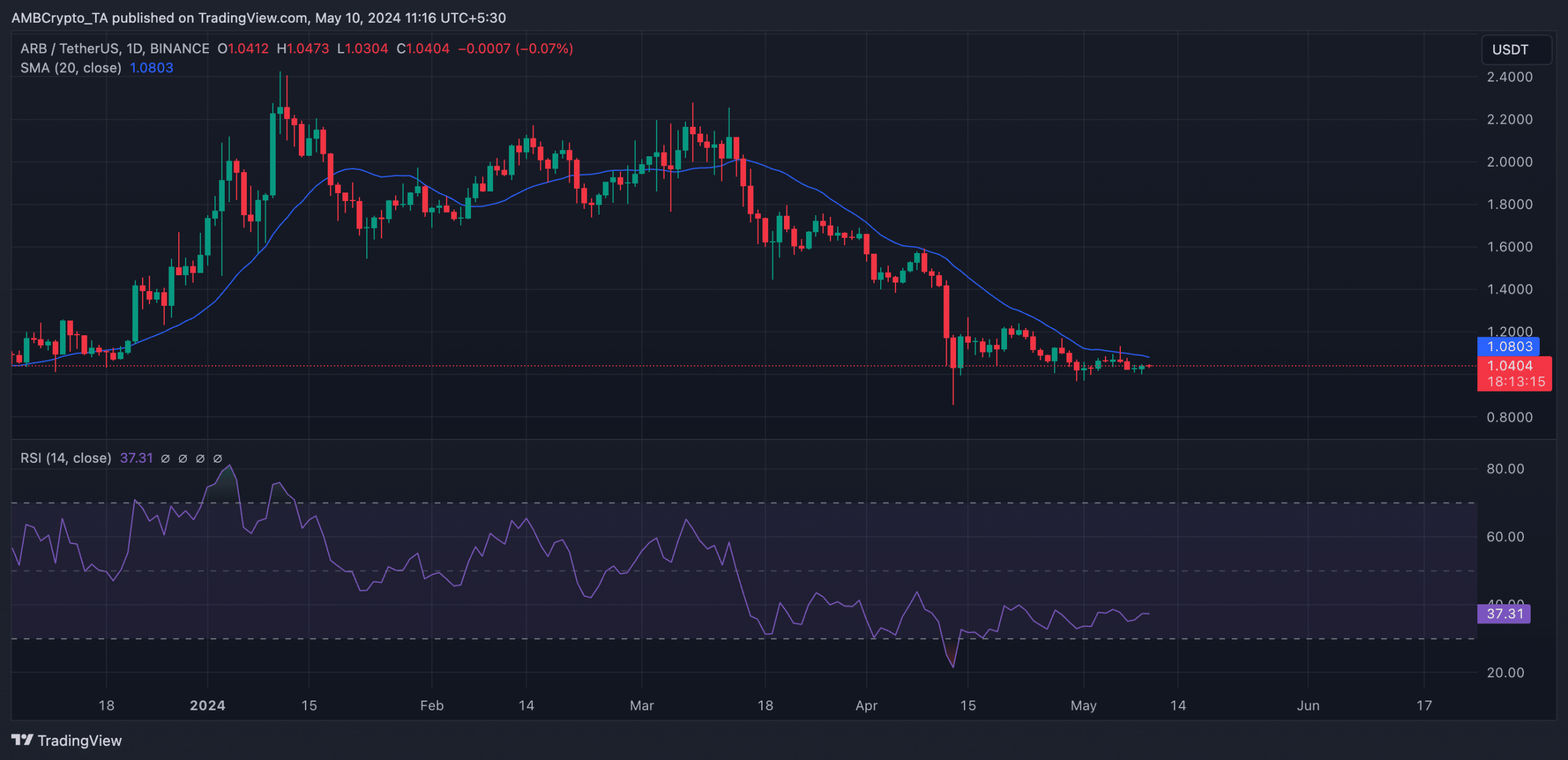

Additionally, the price movement of ARB observed on the 1-day chart showed that the bearish sentiment remains significant.

Source: ARB/USDT on TradingView

At press time, ARB’s price remained below its 20-day simple moving average (SMA), confirming the risk of further downside.

When the price of an asset falls below its 20-day SMA, it indicates that the short-term trend for that asset is downward. Traders interpret this as a sign that sellers are in control and that asset prices will continue to fall.

Likewise, the token’s Relative Strength Index (RSI) returned a value of 37.31. This is a sign that market participants prefer distribution over accumulation of ARB.