- Toncoin is testing the failure of the triangle of the triangle of the triangle of the triangle on the vacation of PAVEL DUROV.

- Despite the rejection and integration of the price, the warm -chain metric reveals new optimism and potential escape among traders.

According to CoinmarketCap, Toncoin (TON) has surged 3.04% and trading volume has soared 20.83% over the last 24 hours.

This returns to Dubai’s return to Telegram founder and CEO, Pavel Durov, after the French authorities give him a vacation.

The coin tested the failure on the triangle of the triangle and faced a temporary rejection. As network activities increase, traders are wondering if the rally is scheduled.

Toncoin’s price behavior and technical indicators

If you look at the chart for one hour, TON is traded for $ 3.567 for optimistic triangle formation and press time.

Altcoin attempted the third brake out beyond $ 3.60 key resistance and faced temporary rejection as the price was integrated.

Successful rally on this optimistic pattern was $ 3.90, which was at $ 3.90.

Source: TradingView

Toncoin’s relative strength index (RSI) stood at age 58 and increased purchasing pressure. In addition, the MACD 12, short -term and medium -term movement average showed powerful ‘purchase’.

TON’s long -term moving average sent a ‘sales’ signal, and the average direction index (ADX, 14) was neutral. This means that a high purchase pressure is needed to break the $ 3.60 resistance and start the rally of TON’s upward trend.

Take a look at the warmth insight

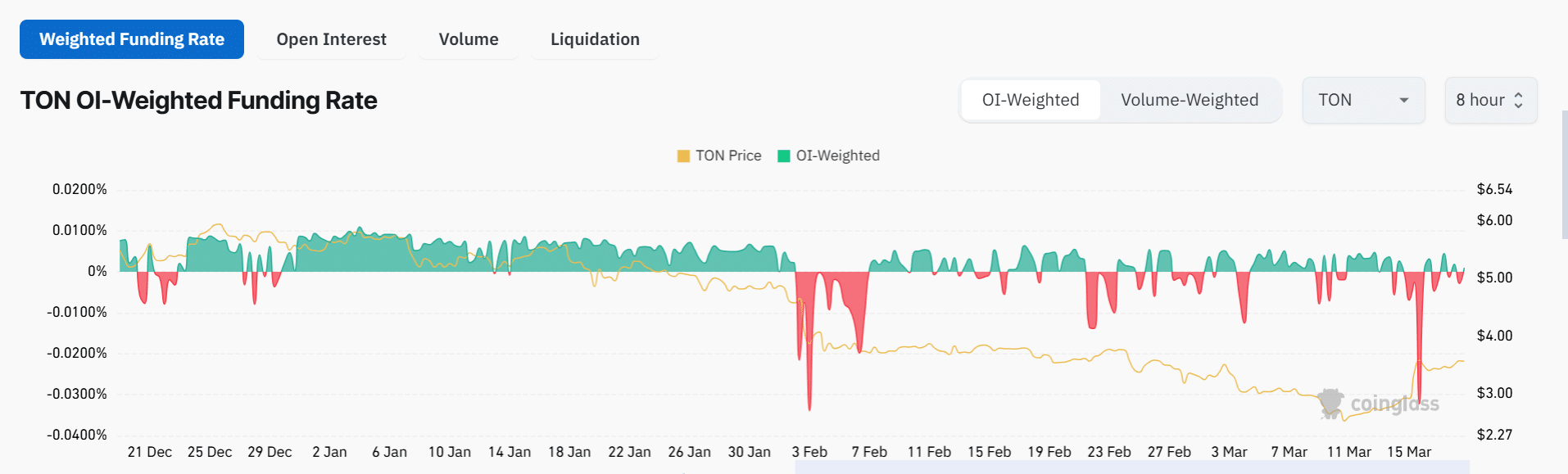

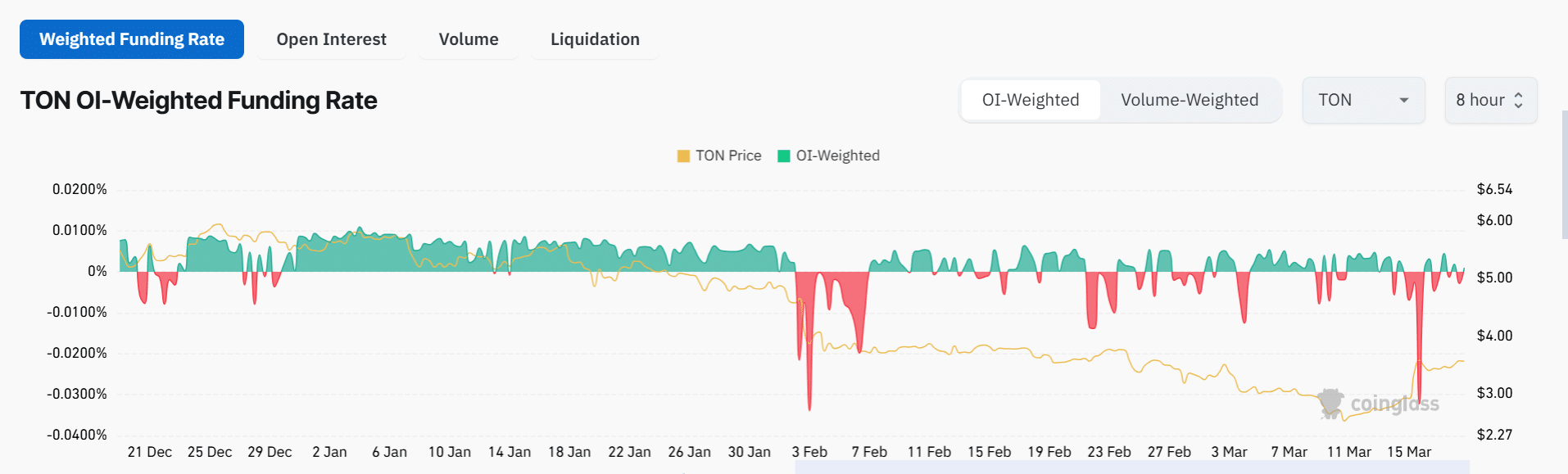

According to CoingLass, Toncoin’s public interest has risen by 10.55% as the rate of interest (OI) weighted funds, which were held in the last 24 hours, changed to positive. This suggests the investor’s trust in PAVEL DUROV.

His view of freedom, leadership and relationship with Ton networks can increase investors’ long -term conviction.

Source: COINGLASS

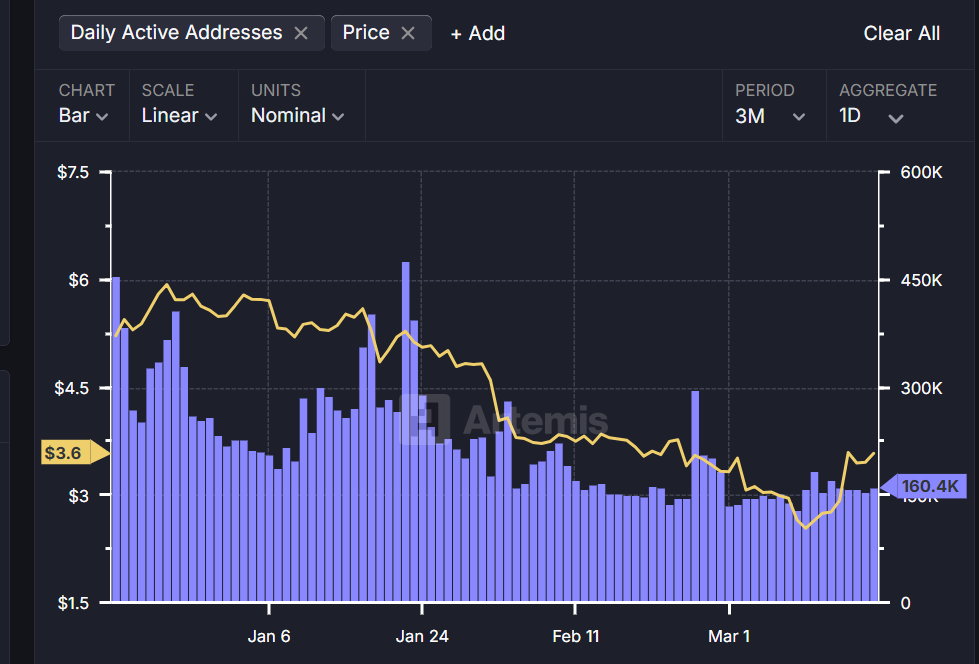

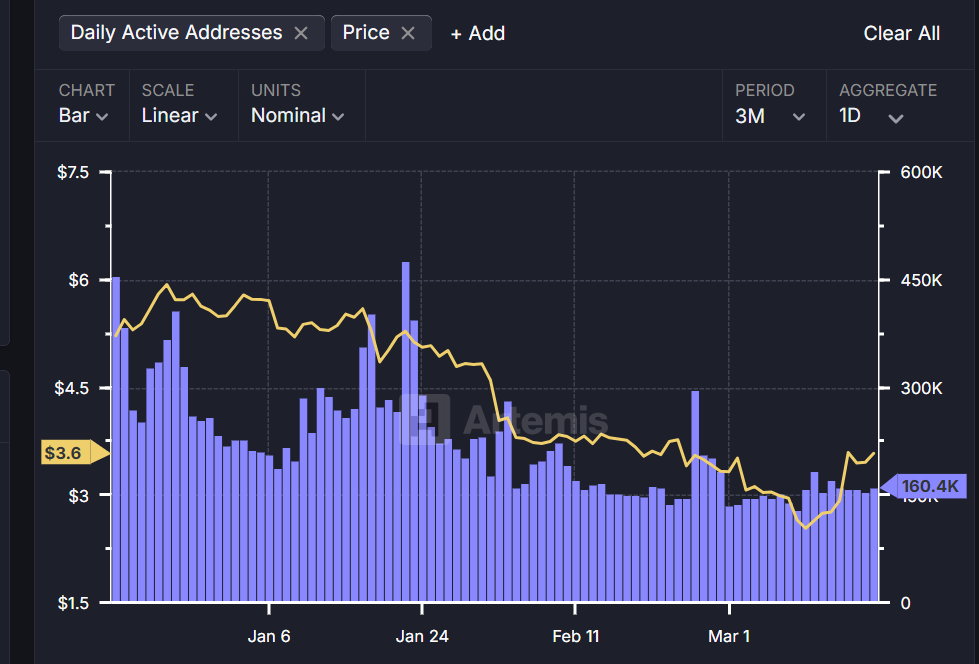

At the time of writing, TONCOIN has seen an increase in network activities as the activity address per artemis has soared 6.75% in the last 48 hours. Similarly, the total value lock (tvL) continues to increase, showing investor optimism.

Source: Artemis

According to INTOTHEBLOCK, last week’s net trading nets were proposed to sell a little at $ 46.23K. In addition, most TON holders are large investors.

Over the last 48 hours, the accumulation of exchange leaks has been soaring and reflected in the rising trading volume.

In the expected freedom and leadership of PAVEL DUROV, investors can escape tones with the goal of long -term benefits.

Merchants should watch the movements of Toncoin within the triangle pattern and whale activities. Brake outs can cause rally to $ 3.90, while breakdowns can lead to modifications of medium -term prices.