- Solana may lack steady purchase pressure to rebuild the driving force seen in the fourth quarter of 2024.

- The liquidation heat map warned that the potential price dropped to $ 160.

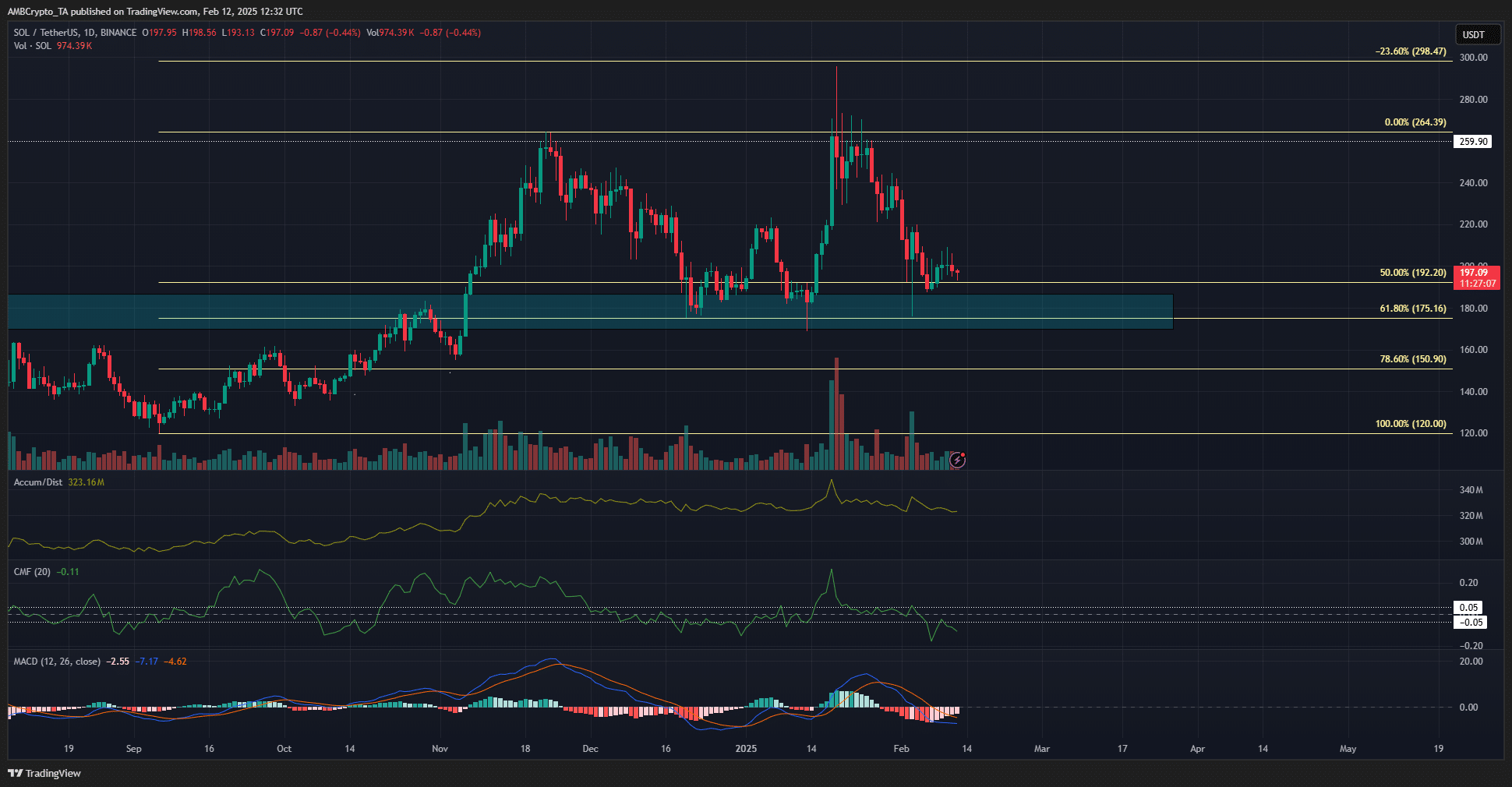

At the time of writing, Solana (SOL) was resisted around $ 205 Zone, a short -term resistance area for a week. In fact, the daily chart was highly volatile after gaining strong profits at the end of 2024.

SOL has vibrated between $ 180 and $ 260 since November and has not been checked by market participants. Daily Chart’s $ 180 strong order block remained an important support area for the prestime time.

The high percentage of long positions among the top traders can be a encouraging short -term signal. Whale activities seemed to give some optimistic signs.

Solana Bulls lacks $ 220 extensions.

Source: TradingView SOL/USDT

Despite the price of $ 188 a week ago, it was not enough to promote recovery on the chart. The CMF was less than -0.05 to indicate a large capital flow out of the market. The A/D indicators lacked trends since November, reflecting vibration prices.

In the press time, the MACD was lower than zero and emphasized that the weakness was dominant in the daily chart. This has been closely related to the market structure since it went to less than $ 242 in the last week of January.

However, despite the depression of the higher price chart, Solana maintained a strong long -term prejudice. The $ 175 and $ 150 FIBONACCI RETRERESSION Level also remained the same. In this case, as long as the remaining, another rally for more than $ 260 can be realized.

Source: COINGLASS

For three months, the liquidation heat map had a lot of liquidation levels in the $ 160- $ 165 area. This self -area can pull Solana when the price is pulled up to liquidity.

Swing traders and investors should be careful about falling below $ 190 zone. Bitcoin (BTC), which has a sour flavored waves around, can open a way for jolly falls. In the bright side, the re-test of $ 150- $ 160 will be a long-term purchase opportunity for those who believe that this cycle has not yet been done.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.