- Whale activity and rising indicators indicate bullish momentum as VIRTUAL targets $3.58 resistance.

- Market fundamentals strengthened with 1,290 active addresses and 763 transactions.

In a dramatic move, an unknown investor withdrew $2.9 million worth of 854 Ethereum (ETH) from Coinbase, acquiring 851,387 VIRTUAL, sparking speculation about the token’s future potential.

This important purchase raises questions such as: Virtual Protocol (Virtual) We are preparing for a breakthrough.

Amid mixed trends in the cryptocurrency market, VIRTUAL’s surge in activity and key indicators have captured the attention of traders and analysts alike.

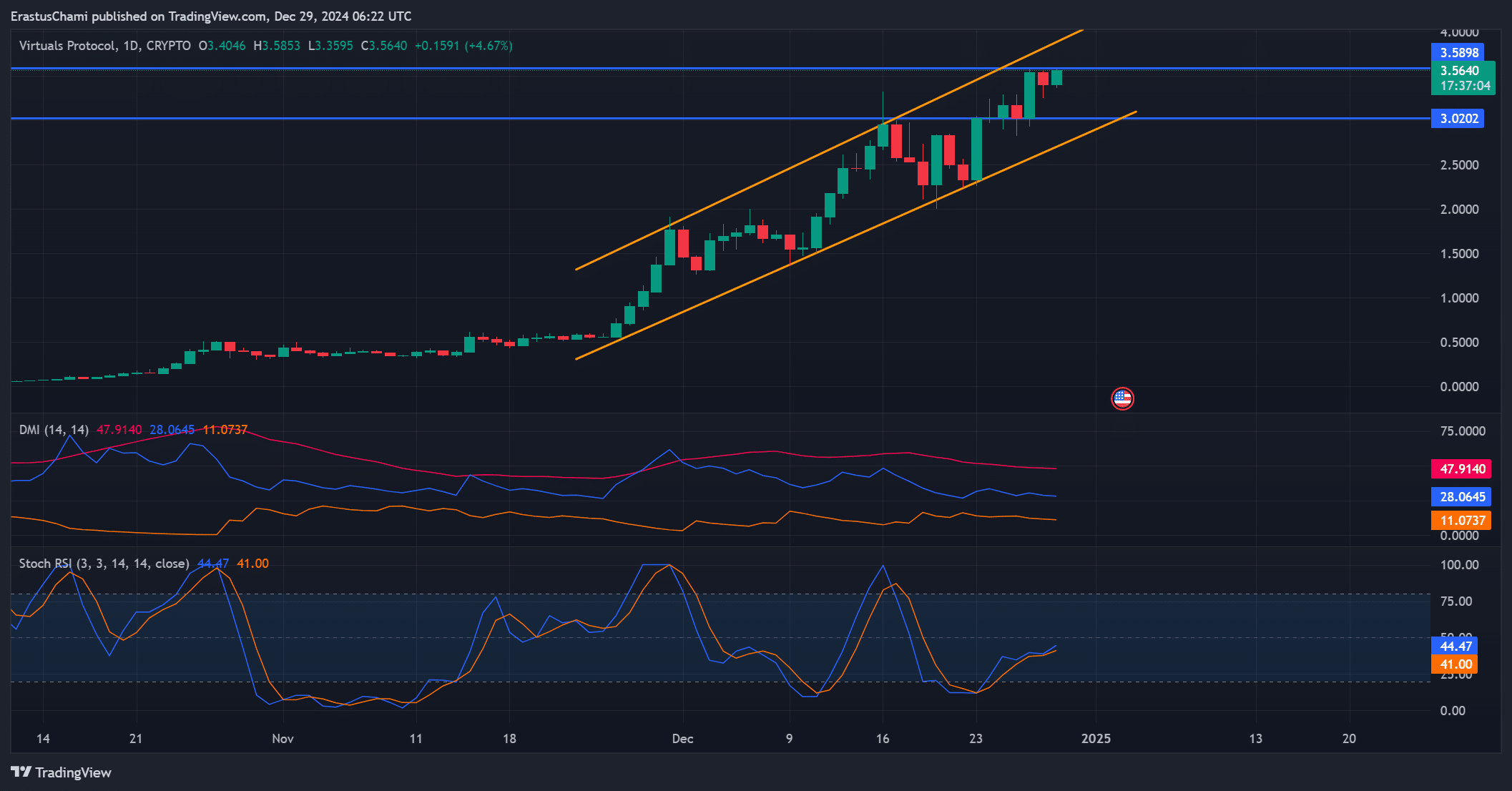

Hypothetical price analysis shows steady strength

At press time, VIRTUAL was trading at $3.57, up 3.40% in the last 24 hours.

The token continues to follow a bullish trajectory within the rising channel, with the main resistance being $3.58.

The Directional Movement Index (DMI) showed a strong buying trend, with +DI at 28, far ahead of -DI (11).

Moreover, the average directional index (ADX) was 47, indicating strong trend strength. Additionally, the stochastic RSI of 44.47 suggests that the token is approaching overbought territory, indicating potential short-term caution.

However, a sustained uptrend signals momentum and any correction could present a buying opportunity.

Source: TradingView

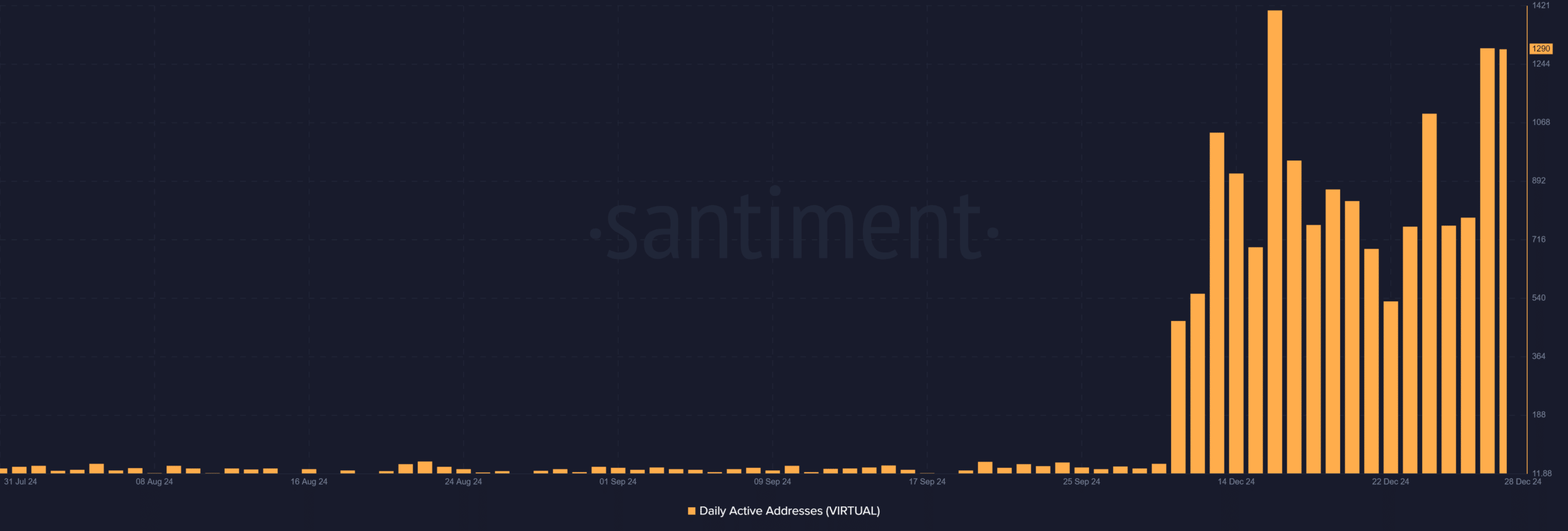

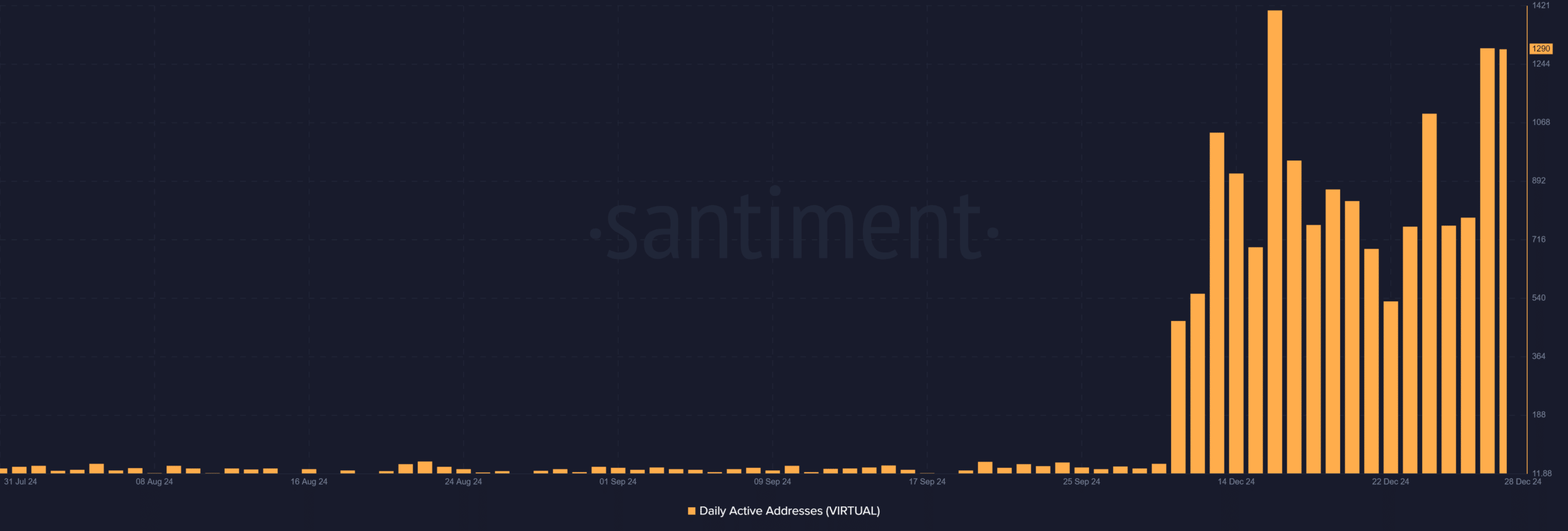

Daily active addresses have increased significantly.

The surge in daily active addresses reflects increased network activity, with a recent peak of 1,290 addresses.

This rapid increase is indicative of increased user engagement, which may come from speculative interest or expanding use cases within the virtual protocol ecosystem.

A continued increase in active addresses often signals strengthening fundamentals of the token. As a result, increasing on-chain activity supported talk of a potential bullish breakout for VIRTUAL.

Source: Santiment

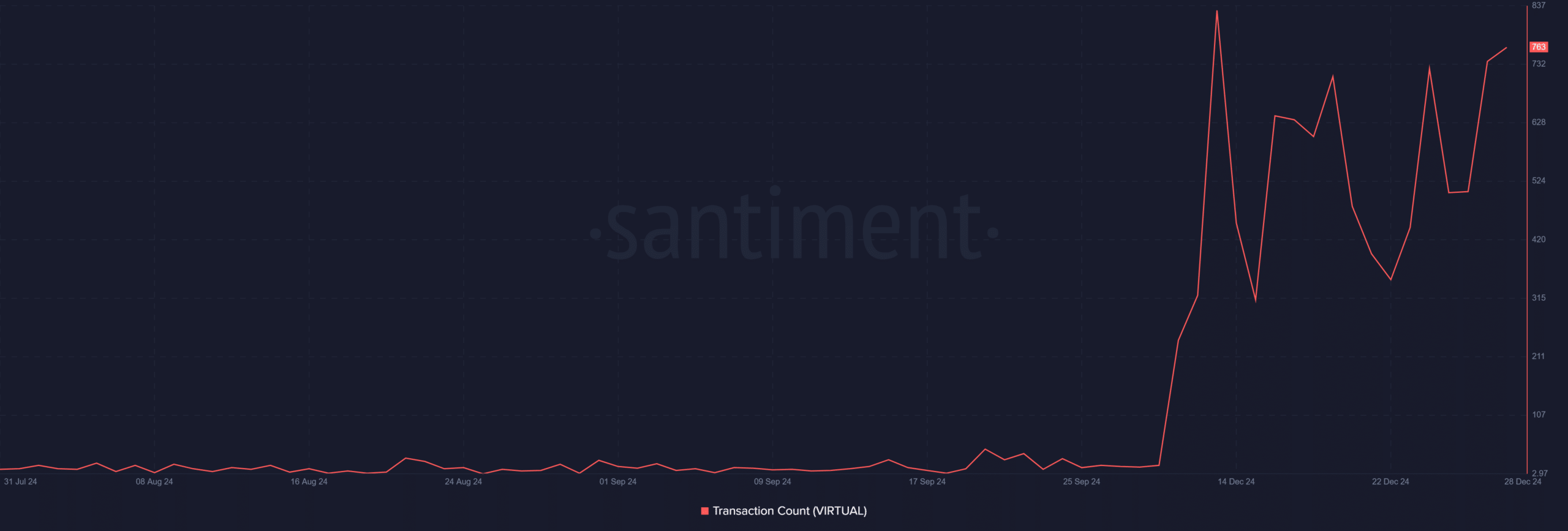

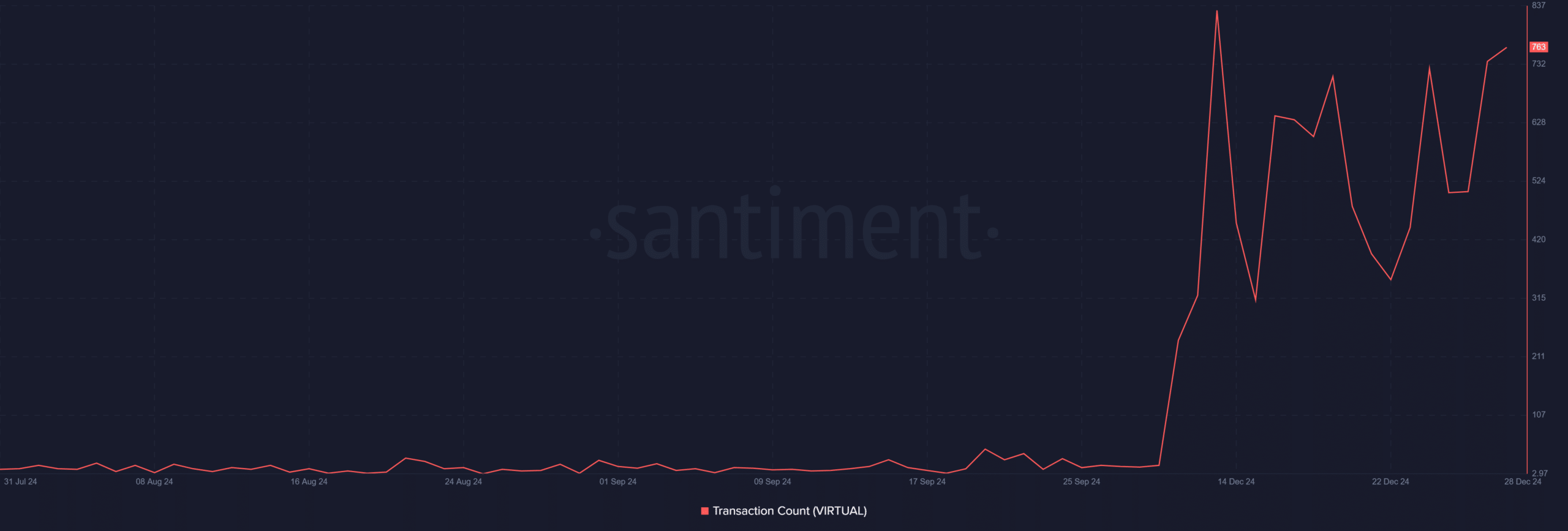

network utility growth

VIRTUAL’s trading activity has increased significantly, with the number of transactions reaching 763 as of the latest available data.

This marks a significant rise from levels below 200 in early December and shows a nearly four-fold increase in activity.

The sharp spike reflects the growing utility of the network due to the intensification of transactions and interactions in virtual protocols.

This surge suggests that both speculative and real-world use cases are gaining traction.

Therefore, the continued increase in volume is consistent with other bullish indicators, strengthening optimism about further price momentum.

Source: Santiment

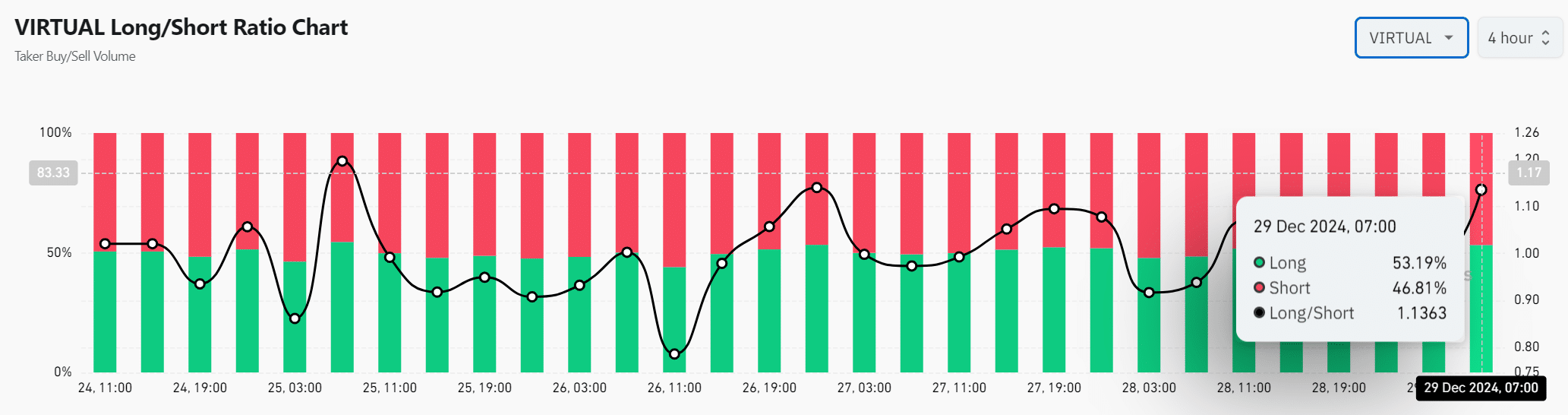

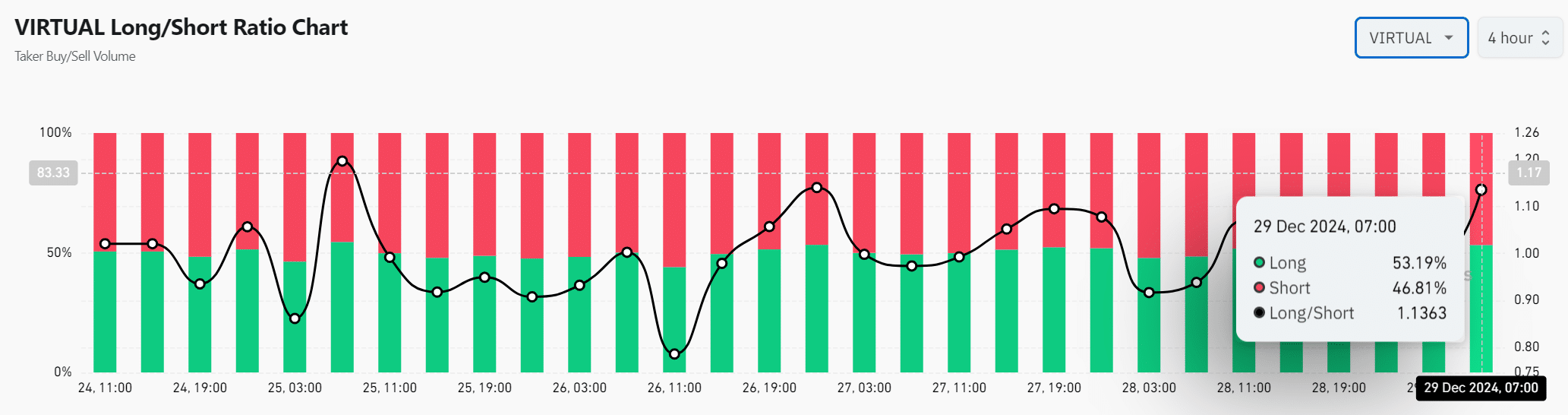

The long/short ratio indicates cautious optimism.

The long/short ratio added another layer to the analysis, with 53.19% of positions favoring the longs, while 46.81% favored the shorts.

The data showed a cautiously optimistic outlook from traders who expected VIRTUAL to maintain its upward trend.

Additionally, the steady accumulation of long positions highlighted growing confidence despite resistance levels.

However, external market factors can affect momentum, so traders should be wary of sudden changes in sentiment.

Source: Coinglass

Is your portfolio green? Check out our virtual profit calculator

So it looks like VIRTUAL will have a breakthrough. Whale purchases, increased daily activity, 1,290 addresses, and strong market sentiment suggest an optimistic outlook.

If VIRTUAL successfully breaks the $3.58 resistance, it could begin a significant rally in the near term.