- Jupiter broke above local resistance at $0.95, and the price was just below $1.15 resistance at press time.

- There is a possibility that it may fall to $1.06 in the near future.

Jupiter (JUP) returned 36.76% on Saturday, January 18th. In the last 24 hours, Jupiter’s daily trading volume has increased by 34% and its daily trading volume has increased by 678%. This appeared to be a strong bullish signal for altcoins.

The altcoin market structure was strong on both the daily and 4-hour charts. However, there is a possibility of a reversal in the $1 direction. How deep can this dip go? Strong support was at $1.06, almost 9% below market price at the time of press.

JUP Bulls Challenge $1.15 Resistance

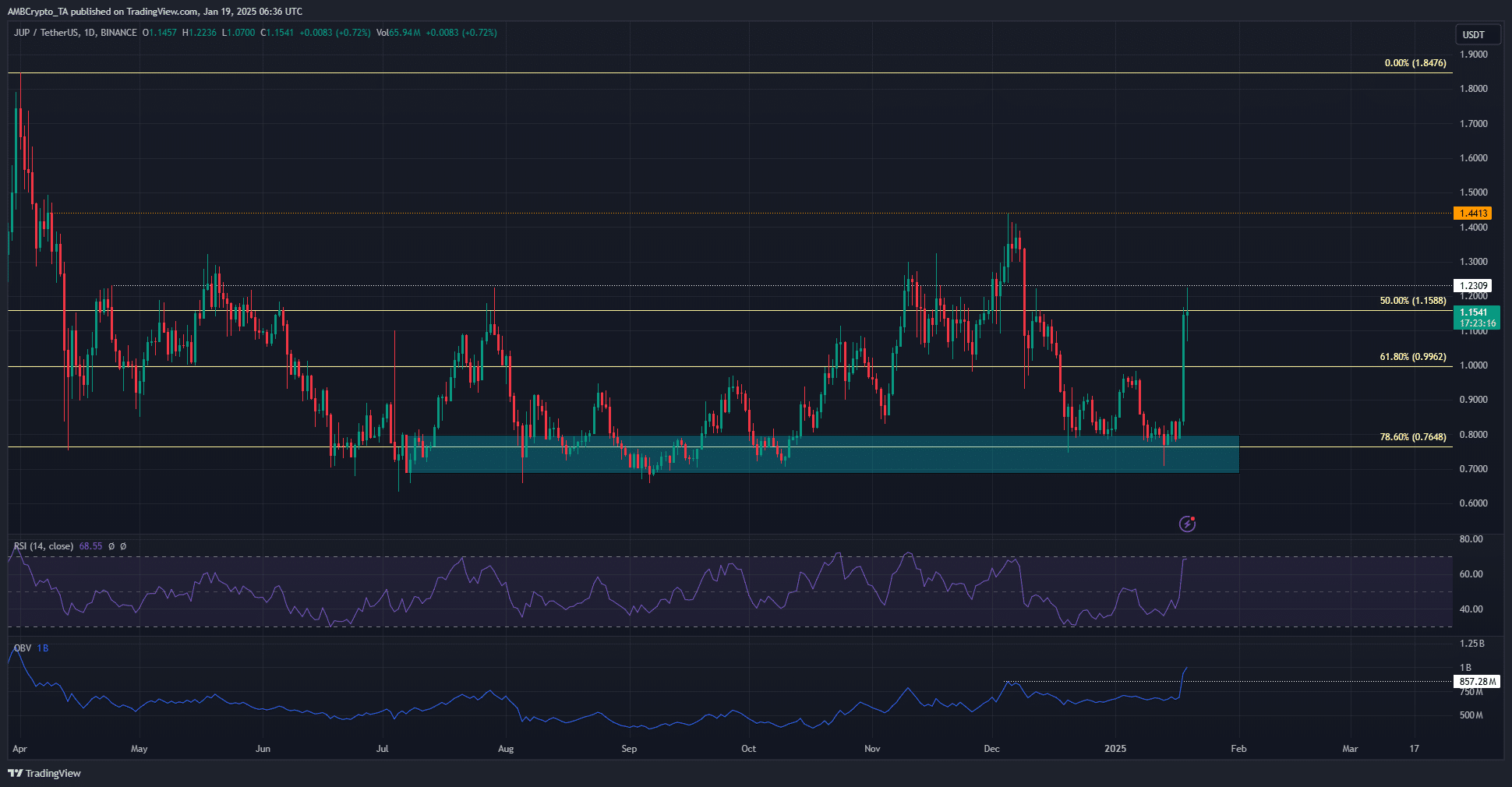

Source: JUP/USDT on TradingView

Over the past nine months, bulls have firmly defended the 78.6% retracement level of $0.76. This retracement level was marked based on Jupiter’s rally from $0.47 to $1.84 in March.

The bullish daily structure was encouraging and RSI was well above neutral 50, indicating strong upward momentum. This momentum was accompanied by increased demand. OBV also rose above local highs, reflecting increased buying pressure.

Surging demand and momentum could be enough to push JUP past local resistance levels of $1.15 and $1.23. It will likely challenge the local high of $1.44 once again over the next week or two.

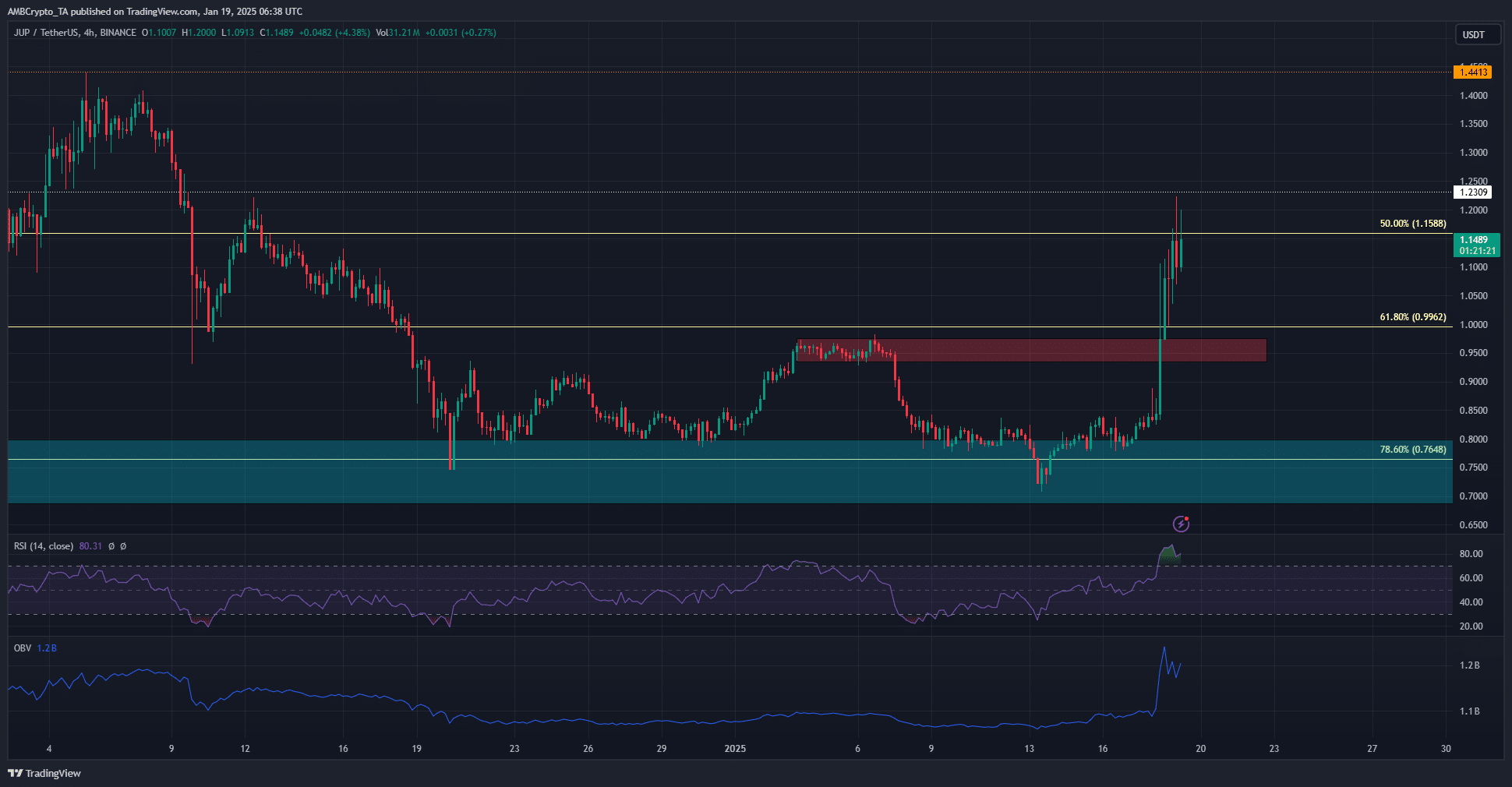

Source: JUP/USDT on TradingView

The H4 chart highlighted the strong momentum over the past few days. Local resistance at $0.95 and $0.99 was easily wiped out and faced few retests as the cryptocurrency price rose.

The momentum on the 4-hour chart was oversold and not necessarily bearish. However, the decline in OBV over the past few sessions indicates some profit taking. A move towards the $0.95-$1 support area may be possible in the coming days. If tested, this area could be a buying opportunity.

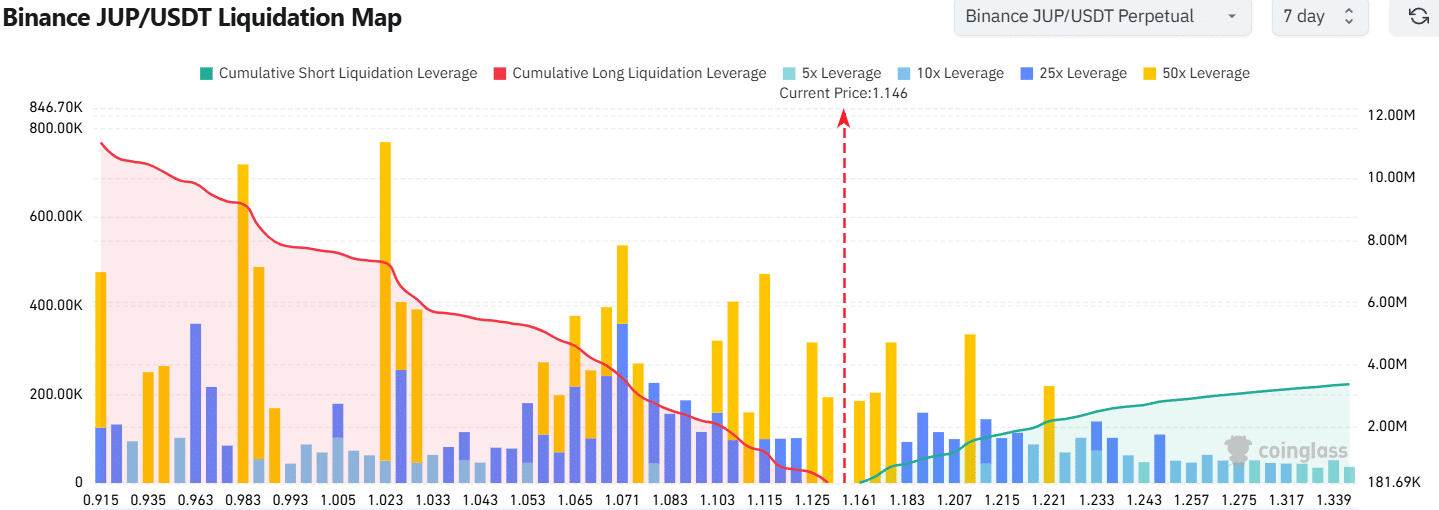

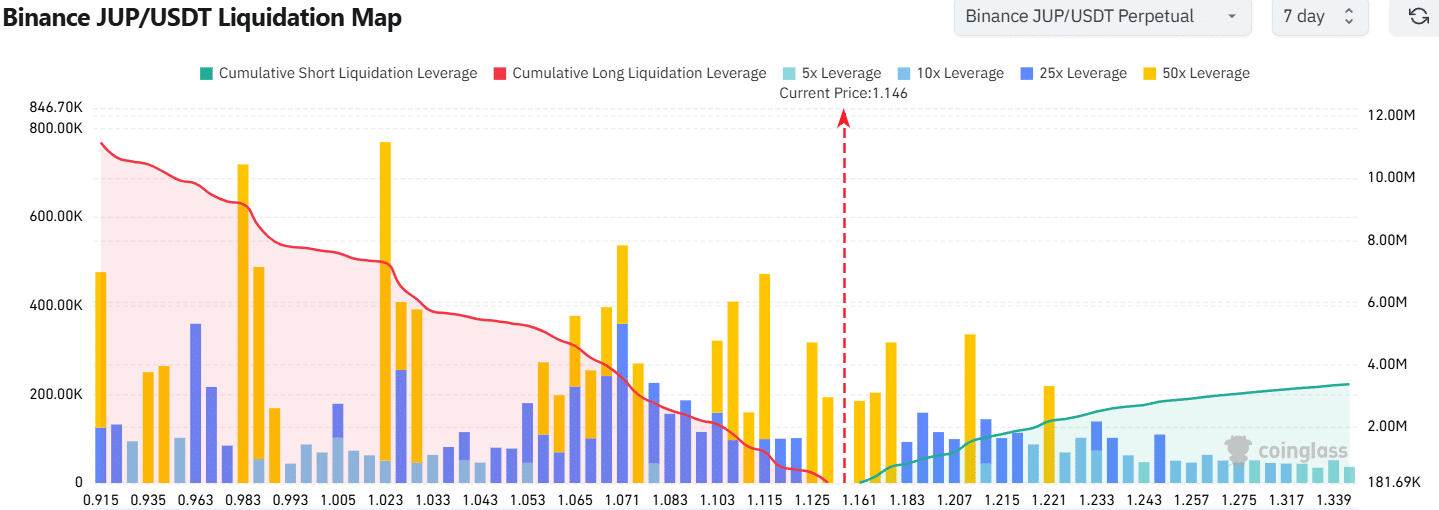

Source: Coinglass

Read Jupiter (JUP) price prediction for 2025-26

The clearing map shows that there is more cumulative clearing leverage in the south than in the north. Therefore, there is a possibility that liquidity will increase and a short-term price decline may begin. If such a decline occurs, the $1.11 and $1.06 levels would be near-term targets.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.