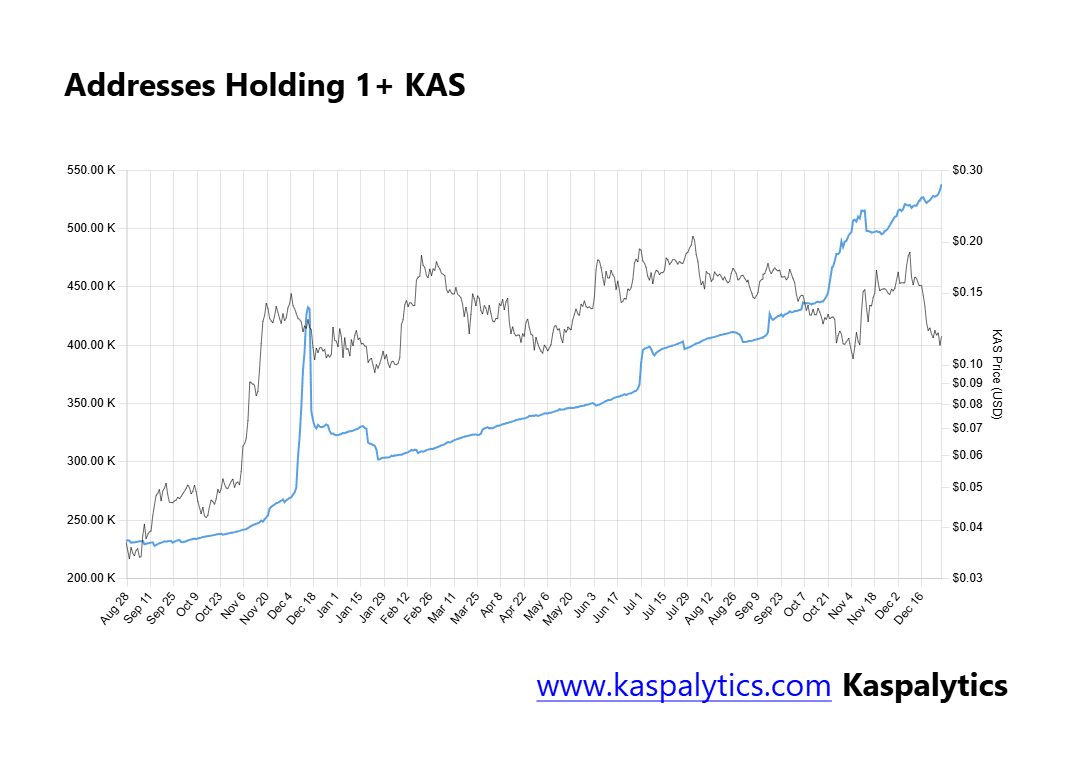

- KAS recently hit a record, with more than 538,000 addresses now holding assets.

- However, this milestone had little to no impact on the price performance of the cryptocurrency asset.

Kaspa (KAS) has underperformed recently, especially after the market-wide correction. In fact, the asset has fallen 21.92% over the past month, and further analysis suggests that the decline may not be over yet. At press time, forecasts suggest KAS could see a bigger decline on the charts.

Some forecasts predict a potential 93% price crash if a critical support level is breached.

A new milestone – KAS holders reach an all-time high.

The number of addresses holding KAS has surged in the last 24 hours, with the same number hitting a new record.

Data from Kaspalytics shows that 538,030 addresses currently have at least one KAS. Typically, this growth means traders are accumulating assets, which is often a precursor to price increases. However, it is worth noting that despite this milestone, KAS recorded a slight decline of 0.47% in the last 24 hours.

Source: Kaspalytics

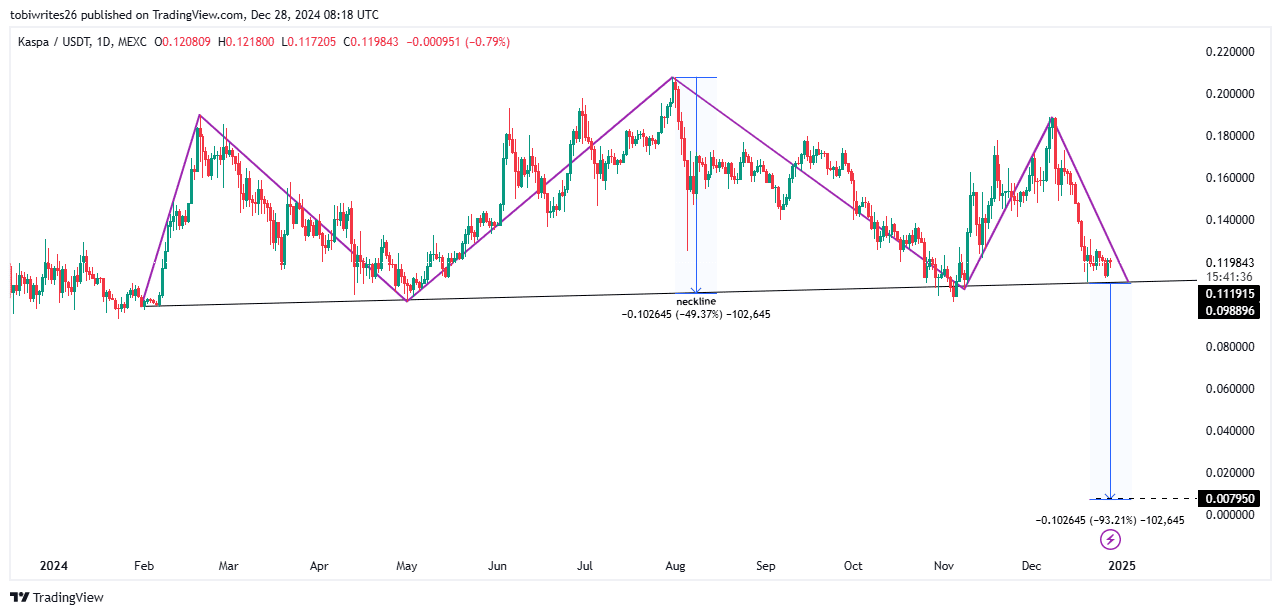

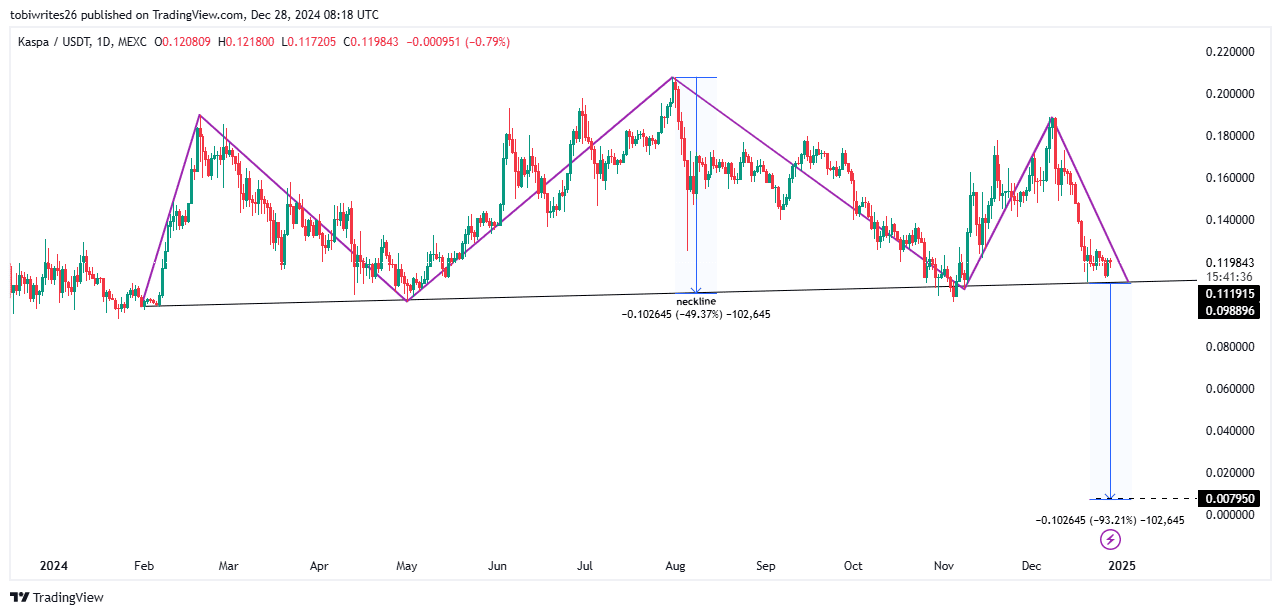

A broader analysis of the price movement suggests that a downtrend could still be on the horizon and there could be further declines depending on the asset’s ability to maintain critical support levels.

KAS, possibility of 93% decline?

At the time of this writing, KAS looked poised for a significant price drop, showing a classic head-shoulders pattern on the charts. Especially with prices approaching the neckline.

The neckline appears to be an important support line preventing a sharp decline. However, if this level is violated, the KAS chart may show a sharp decline.

Source: TradingView

Using TradingView price range data, the expected decline could be around 93%, potentially taking the asset’s value as low as $0.00795. AMBCrypto’s analysis of technical indicators supported this outlook, confirming that the market is trending bearish and that a downtrend could eventually materialize.

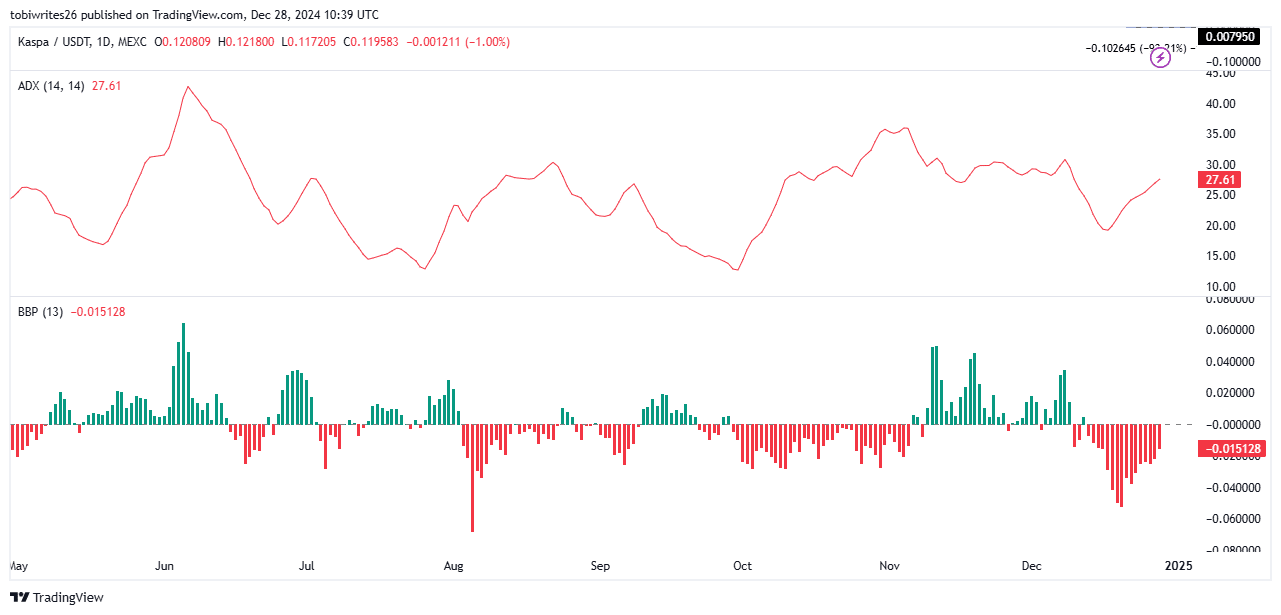

Confirming the bearish trend of KAS

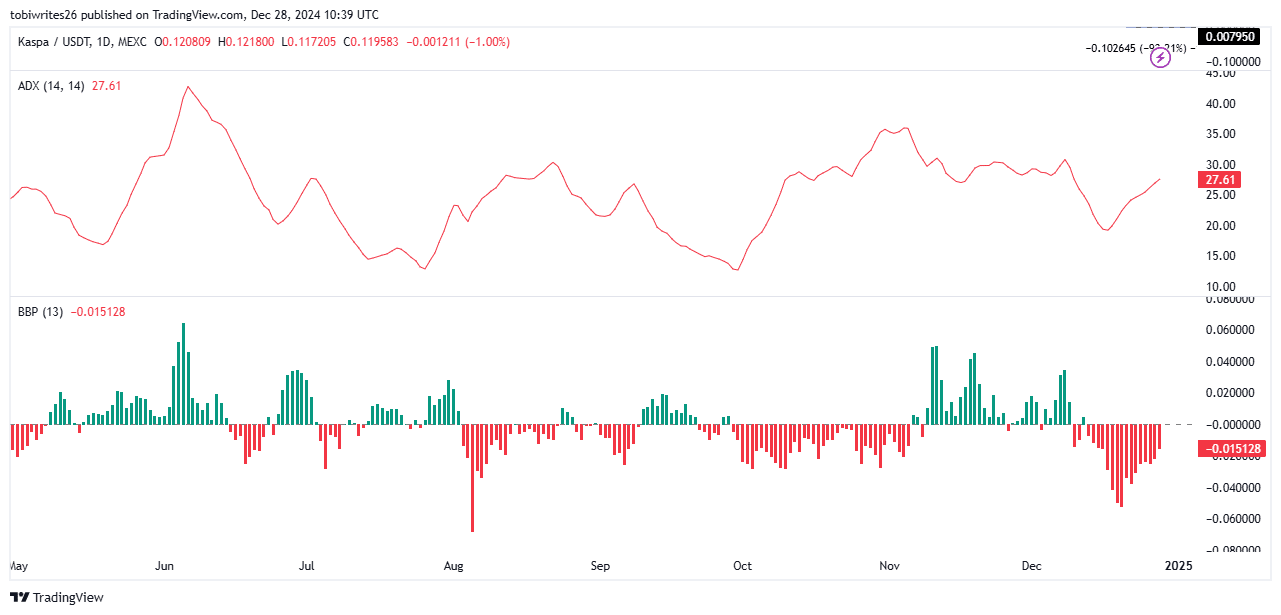

Key market indicators Average Directional Index (ADI) and Bull Bear Power (BBP) confirmed KAS’ bearish outlook.

ADI, which measures the strength of a market trend, indicates that the downside direction may be gaining momentum. A rise in ADI reflects a stronger trend correction. At press time, ADI’s reading was 27.61. If this trajectory continues, KAS is likely to fall further down the charts.

Source: TradingView

Meanwhile, BBP, which identifies whether buyers or sellers dominate the market, showed that sellers are firmly in control of the market. Finally, the bearish momentum bar remained in the red and continued heading south, reinforcing the bearish sentiment in the Kaspa market.