“Let him cook” was the expression all the young whippersnappers used these days to describe someone or something that shouldn’t be disturbed because it was in progress.

I know this post will come across as annoying to some, especially since I’ve been somewhat enthusiastic and bullish on Bitcoin over the past few months (although I first pointed this out to readers in December 2022). ~ Of church Dear Bitcoin community, I would be remiss if I didn’t put my voice to the test a little bit.

I apologize in advance for opining on something that many members of the Bitcoin planet have been talking about and discussing ad nauseam for the past decade. But I need to speed things up somehow, and I do my best to make writing a cathartic experience. As a result, you, the reader, suffered. So don’t forget to renew your paid subscription. Fringe finance.

I’ll leave the overture to this. We all know that it was a breathtaking week for Bitcoin, rising more than 20% in just a few days.

This move, along with the launch of ETFs last month, has been effective in generating even more interest in cryptocurrencies. Even Morgan Stanley came out this week and said they were thinking of launching their own Bitcoin fund.

I have received numerous calls and texts about Bitcoin, but I am neither a prominent member of the community nor a well-known bull. So I can’t even imagine the outreach we’ve seen from maximalists and longtime advocates this week.

It’s undoubtedly very interesting. I can’t even imagine how long people have been waiting to enjoy this moment, after years of abuse from my family and ignorant idiots like me, and general suspicion about the asset class. But if there is one small lesson I have learned over my decades in capital markets that translates across asset classes, it is this: Celebrate humbly and prepare for the worst.

It may seem like it’s the furthest thing from people’s minds this week, but for me it’s always been the best way to taste success. Many of you who listened to the podcast I did a few weeks ago with Peter McCormack know that it was arrogance and arrogance that drove me away from Bitcoin in the first place. Maybe it’s my fault for not being open enough and not doing my job enough. Missing out on big profits is a mistake. But today I am speaking as one of those people who can visualize Bitcoin as a long-term success and who is truly excited about joining the world.

Last week my Twitter feed was filled with people triumphantly celebrating, bragging and taking shots at anyone who doubted prices would go up again. Here is an example from my brother James Lavish. He knows that I respect him, so he knows that I won’t mind using him as an example. Look at Exhibit A: James is talking nonsense to Vanguard.

Does James have a point? Yes he does. Will things be right 50 years from now? Yes, it could have happened. But is it karma-sound to mock the $7.7 trillion bear? Not for me. I’d rather quietly savor the satisfaction of temporary dubbing.

Everyone has the right to celebrate this short-term action however they wish. But what I propose today is karmic and psychological The less we force the issue and the more humility we show, the more evenly and consistently Bitcoin will spread around the world.

Consider this: Celebrating making a ton of money or tweeting angrily about your success will do two things: (1) It will turn off people like me who think the behavior is generally synonymous with fraud . and (2) it will stimulate investors with below-average sophistication in their pursuit of quick riches and not the steady hand needed for Bitcoin to become a lasting success.

Rather, what I’m suggesting is that we allow the news media to do what they do (which is usually useless and chase a story long after it happens) and allow people to enlighten themselves about Bitcoin the same way I did. my own, oSo I felt like I wasn’t suffocating on that thought. No longer by external sources.

My interest in Bitcoin in early 2024 was completely organic. News reports about this have disappeared, and I’ve blocked or unfollowed enough people who overestimate Bitcoin to have some clarity and peace of mind about it. When I first sat down to seriously consider how it worked. It was a calming, relaxing, blank slate that allowed me to grasp the relatively complex concepts of how it works and trust the way I do it.

I think considering the astronomical week we’ve just had, it’s better for us to “act as if we’ve been here before” and remember that sometimes the more you push an idea, the more people tend to resist rather than bark. I think it will get better. Hyenas and people mocking people. If Bitcoin’s market capitalization were $50 trillion, the story would be different. But we’re still in the early stages of courtship with the rest of the world, and like any good relationship or friendship in life, there has to be a real organic interest that “shows” the idea that it’s happening. Anyone who has been smothered by a partner or friend in the past knows that it creates distortion and an unhealthy dynamic. Such delicate things are not something you can force, but rather embrace them willingly, like taking a slow, deliberate deep breath outside on a winter day.

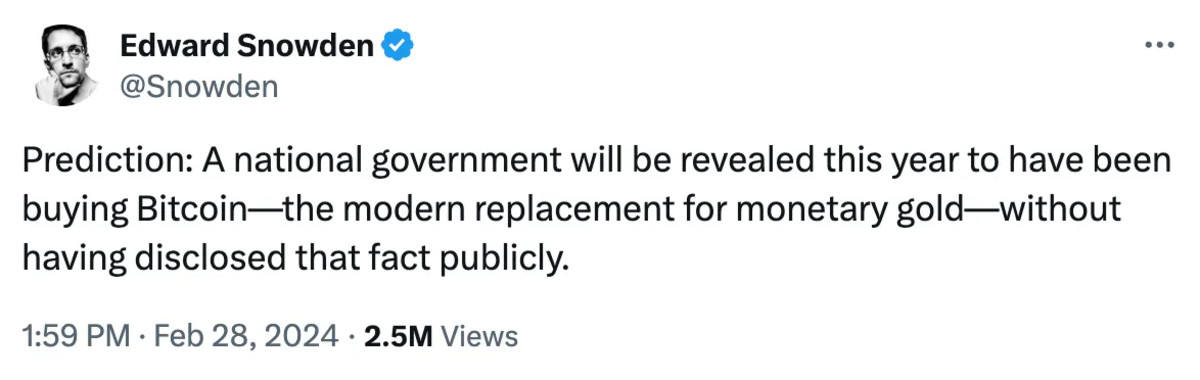

That’s not to say I don’t believe this week is the start of much greater adoption that will likely push the price of Bitcoin higher. As I said in the “What Bitcoin Has Done” podcast, there is at least one (if not several) countries that want to include Bitcoin on their sovereign balance sheets, and I believe this will be the beginning of game theory. A digital asset revolution the likes of which we have yet to see. Just a few days after I said that, yesterday Edward Snowden came out and made the same claim.

Try to keep up with me, Eddie.

But seriously, we know what will happen if prices keep rising. The hype will continue to spread, as will interest and adoption. People will have the same realization that it took me 10 years to figure out. This isn’t going anywhere anytime soon. But if you ask me, I think the community would be better off focusing more on how we’re going to do this rather than trying to spike the football here, especially considering we all know how quickly price fluctuations can turn downward in the short term. do. We will be able to clearly explain and communicate the changes unfolding before our eyes calmly, thoughtfully, and comprehensively.

After all, whose questions do you want to address about the next 20% overnight whipsaw decline? Either the unsophisticated lunatic or the cautious investor who already knows and expects volatility as a certainty.

And the more time we spend setting reasonable expectations that Bitcoin could easily exceed, the less time we have to brag that we’re right. Travel is a reward. Or as the Bible says:

“With pride comes disgrace, but with humility there is wisdom.”

— Proverbs 11:2

But if Jesus were around today, he would tell us, “Let Bitcoin cook.”

QTR Disclaimer: I’m an idiot and often do things wrong and lose money. I may own or trade in any name mentioned in this article at any time without warning. I haven’t double-checked any figures or numbers in this post, and I’m generally lazy with my research. Contributor posts and aggregated posts have not been fact-checked and represent the opinions of the authors. Contributor posts and curated content are published with permission from the author or under a Creative Commons license. This is not a recommendation or recommendation to buy or sell any stock or security and is merely my opinion. I often lose money on the positions I trade/invest. Sometimes you misplace it and lose money. I am generally irresponsible. I may add names mentioned in this article and sell any names mentioned in this article at any time without further warning. These positions are subject to change immediately upon posting of this article, with or without notice. You are on your own. Please do not make decisions based on my blog. Please do your research elsewhere. I exist on the outskirts. The publisher does not guarantee the accuracy or completeness of the information provided on this page. This is not the opinion of my employer, partner or colleagues. I have tried my best to be honest about what I disclose, but I cannot guarantee that I am correct. I sometimes write this after having a few beers. Also, I got a lot of shit wrong right away. I mention it several times. Because you are that important.

This piece was originally published here on Quoth the Raven’s Substack.

This is a guest post by Quoth the Raven. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.