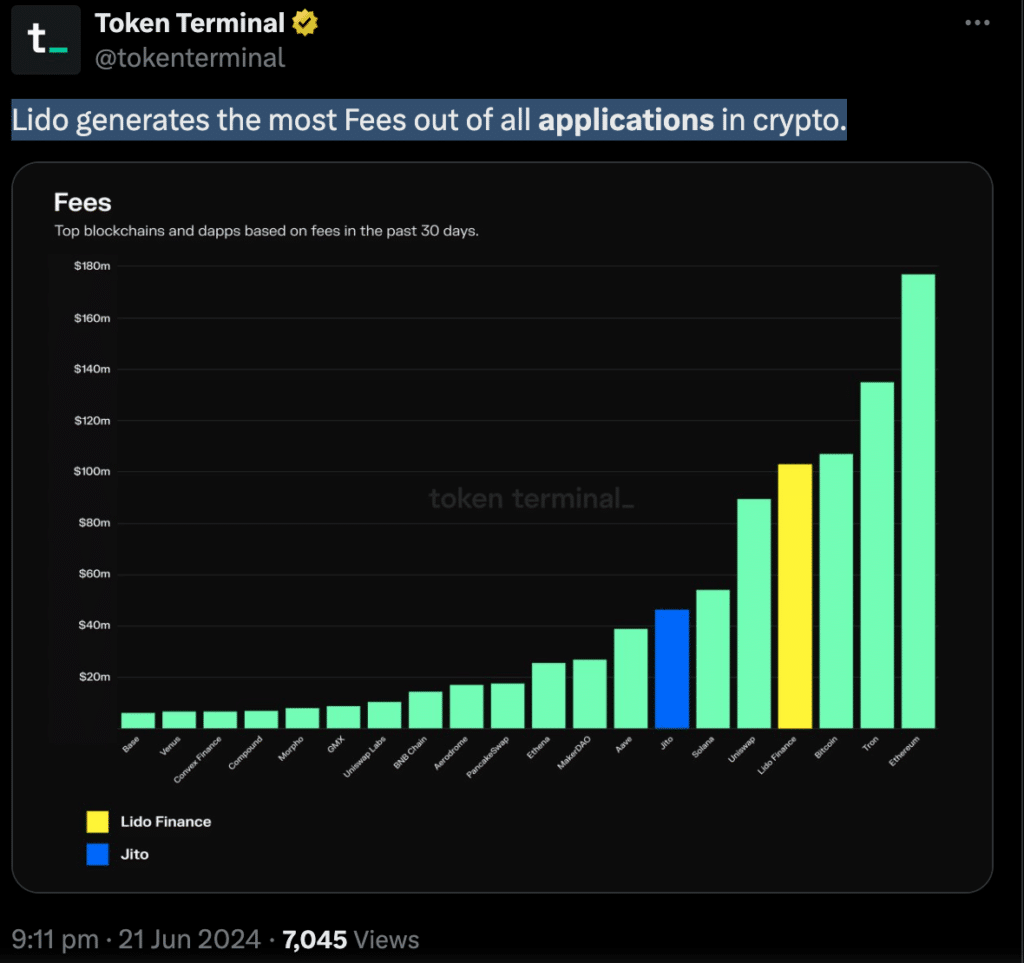

- Lido earned the highest fees compared to other protocols.

- As the network grows, LDO prices also fall significantly.

Lido (LDO) has been one of the most dominant protocols in the staking space. But despite this, the protocol and its tokens were not as popular as other networks in the cryptocurrency industry.

Lido surpasses them all

According to the latest data, Lido generates the highest fees among all cryptocurrency applications. This surge in fees coming from Lido suggests that network activity is relatively high and users are consistently using this platform for staking services.

Source: X

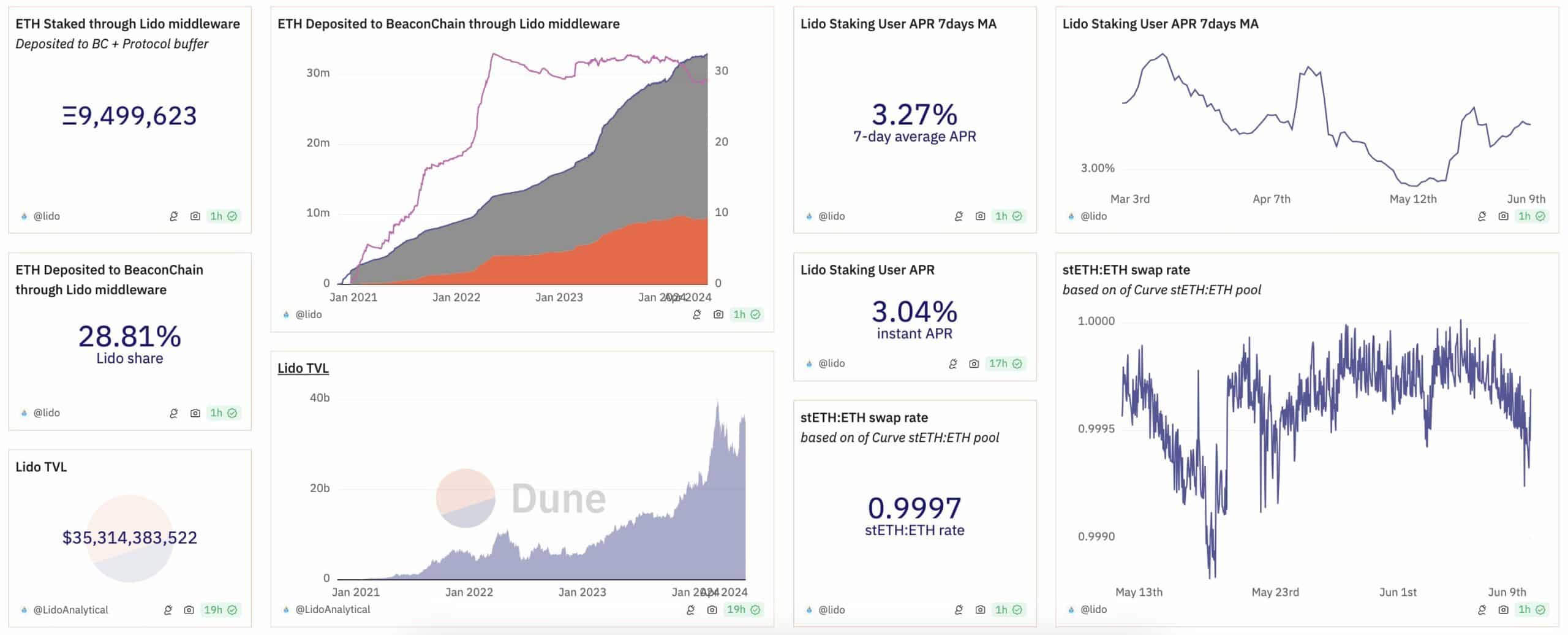

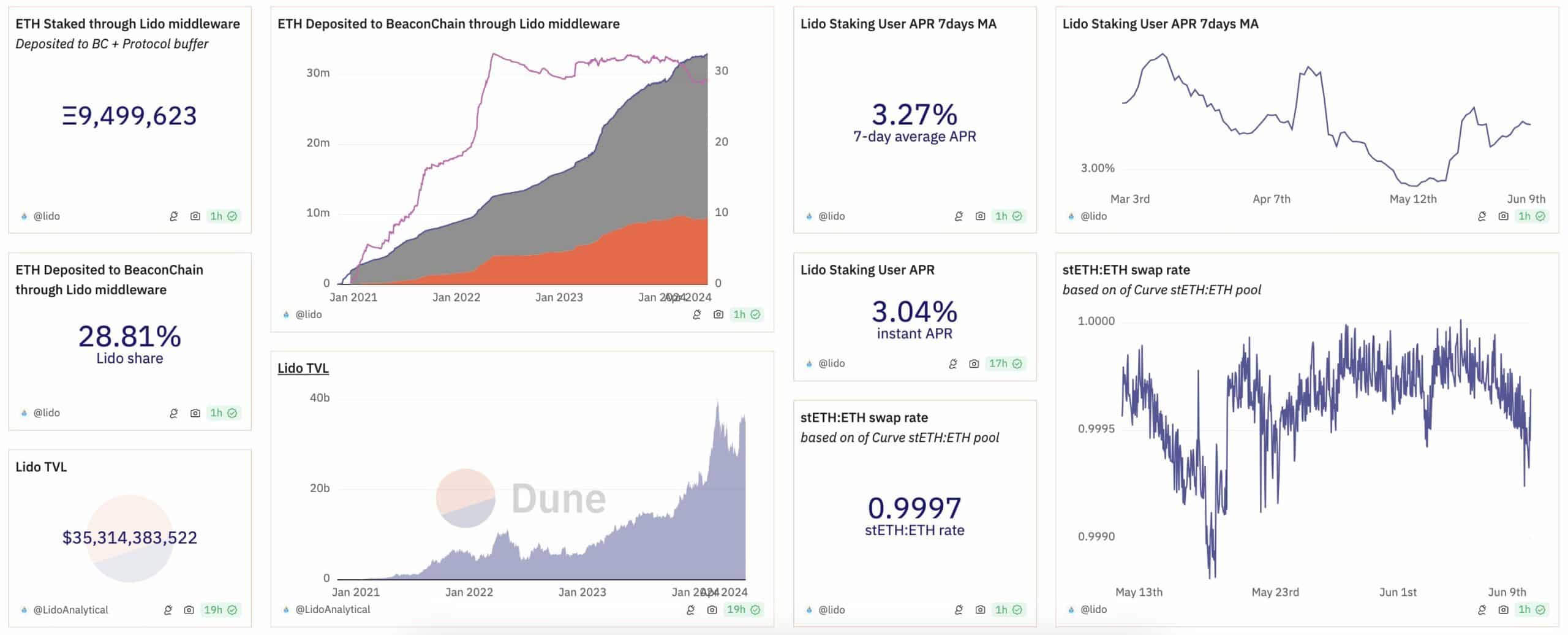

However, if you look at Lido’s performance last week, you can see a mixed picture. Total Value Locked (TVL) decreased slightly by 1.70% to $35.39 billion due to a slight decline in ETH price, but there were some positive indicators as well.

For example, Lido continues to attract stakers, with a net increase of 19,392 ETH staked, representing an increase of 0.26%. This means that the total amount of ETH staked on the platform is 9,513,384 ETH.

Source: Sand Analysis

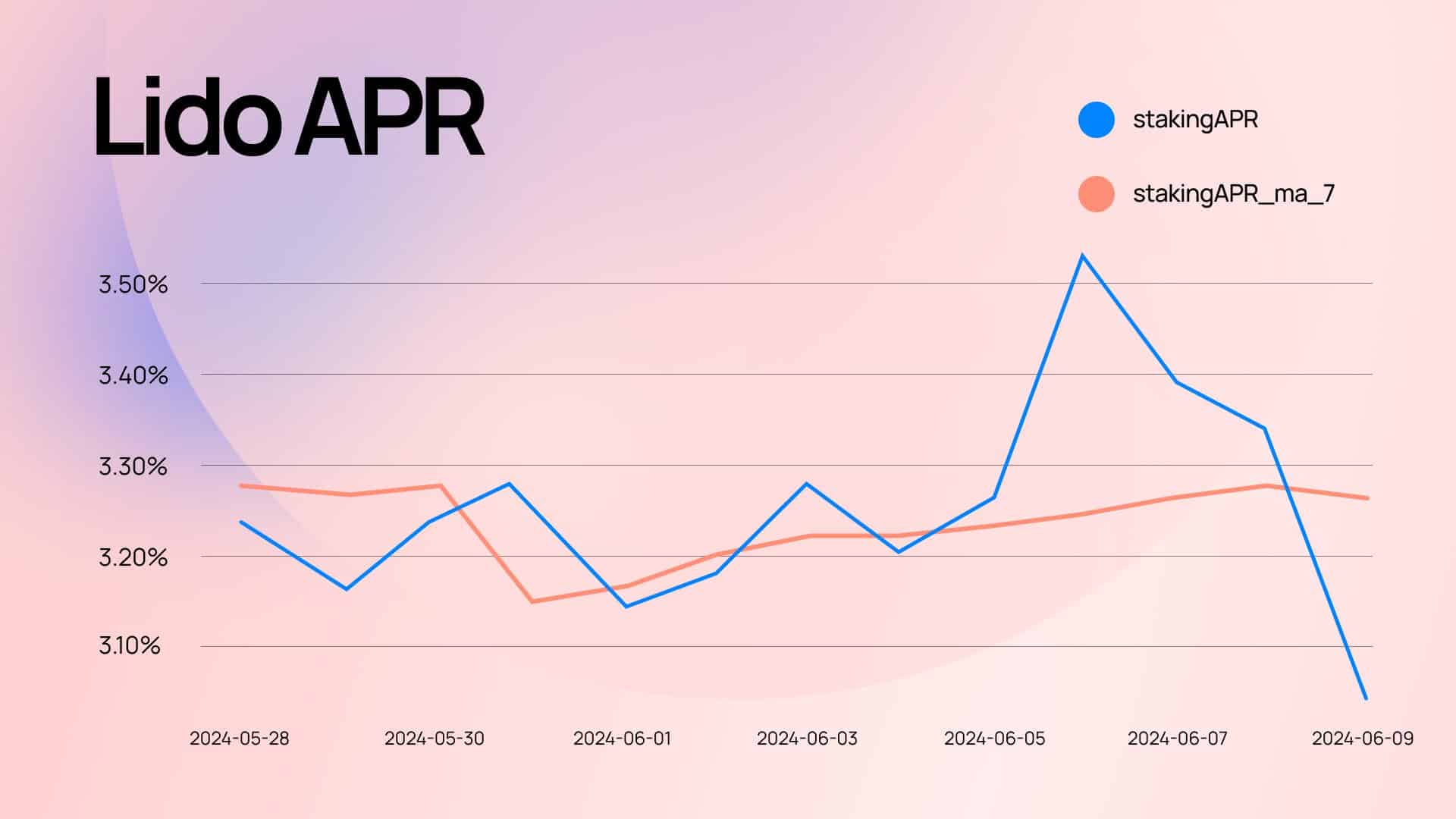

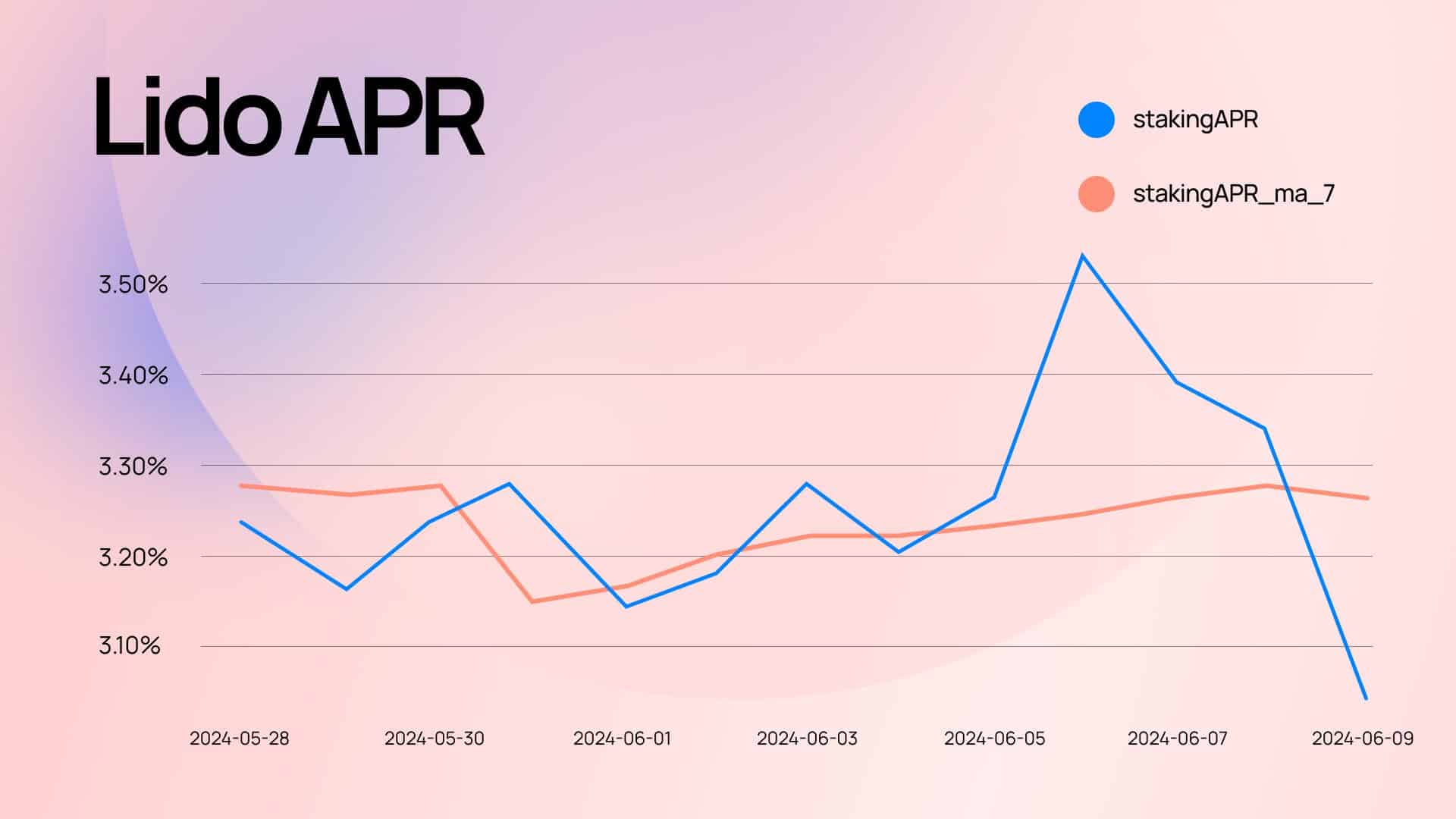

Additionally, the 7-day moving average (7d MA) for stETH’s Annual Percentage Rate (APR) showed a positive trend, rising 0.09% to hit 3.27%. This means that staking rewards for Lido users could potentially be higher.

Rather, trading activity showed a cooldown, with the 7-day trading volume of wrapped stETH (wstETH) decreasing by 19.7% compared to the previous week. This brought it to a value of $1.03 billion on the charts.

Source: Lido

Looking at the data

Interestingly, the data also revealed movement within the Lido ecosystem. The total amount of wstETH bridged to Layer 2 (L2) solutions decreased by 2.86% to 136,893 wstETH, while the amount bridged to Cosmos saw the smallest decrease of 0.16% over the past 7 days.

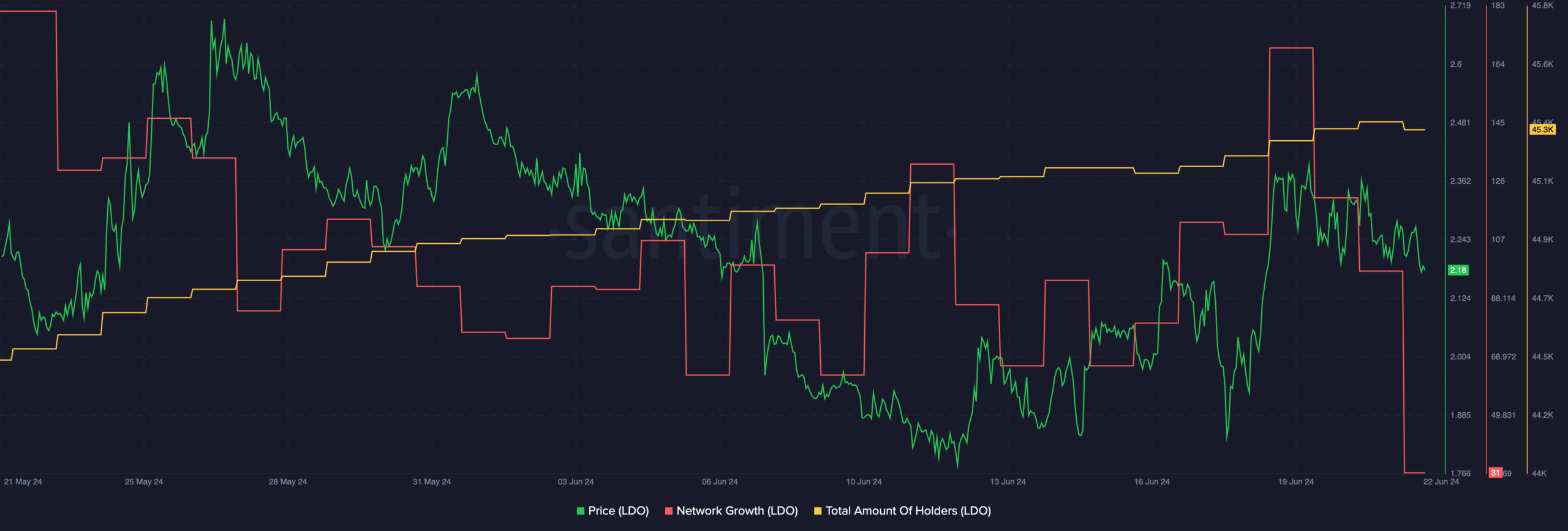

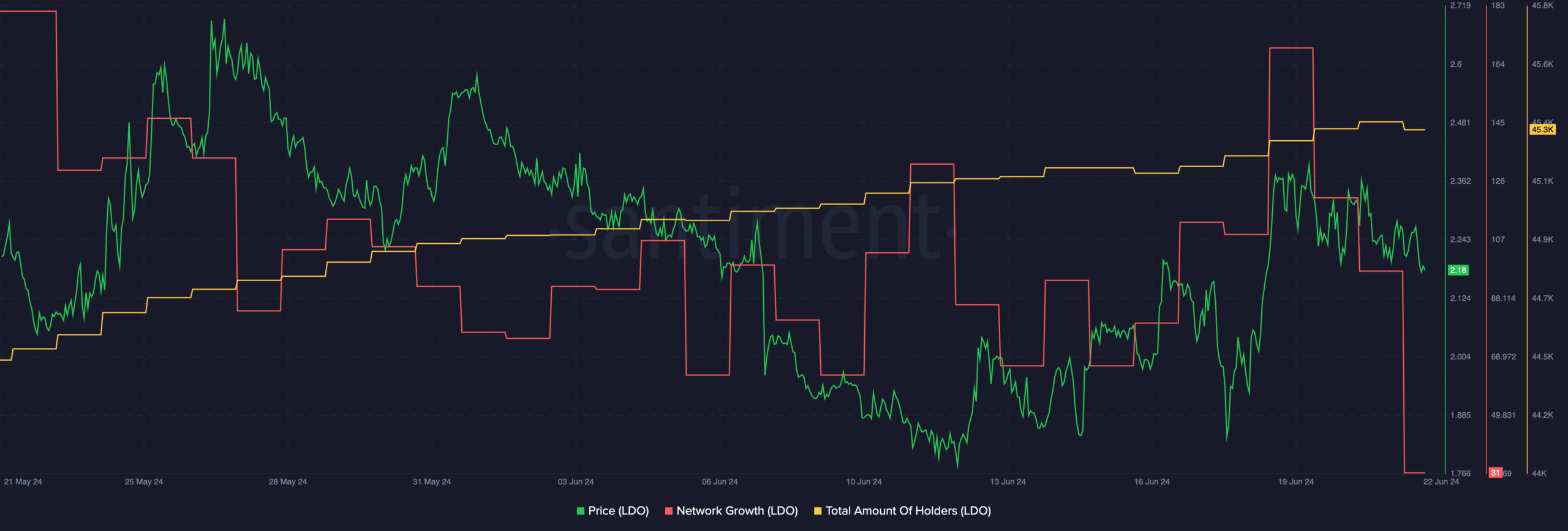

At press time, LDO was trading at $2.18, down 4.11% in price over the past 24 hours. During the same period, LDO trading volume also decreased by 34.57%. Moreover, network growth around LDOs has decreased significantly, meaning that new addresses are losing interest in LDOs.

Realistic or not, the market cap of LDO in BTC terms is:

That said, the overall number of addresses holding LDOs has continued to increase over the past few days. This can be interpreted as a signal that tokens are accumulating on a smaller scale despite price fluctuations.

Source: Santiment