- A critical support level was identified at $1.88, which coincides with the 78.6% Fibonacci retracement level.

- External factors, including increased adoption of liquid staking and the Ethereum staking mechanism, could further fuel LDO’s upward trajectory.

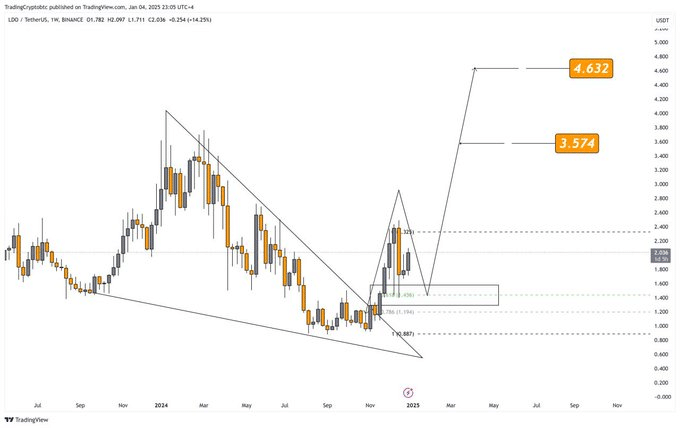

The recent price action of Lido DAO (LDO) has sparked interest within the cryptocurrency trading community as the token has shown significant potential for upward momentum.

LDO’s current trajectory, emerging from a falling wedge pattern, indicated a bullish breakout opportunity reinforced by important support and resistance levels.

falling wedge pattern

The descending wedge pattern on the LDO weekly chart suggested a bullish reversal.

Defined as a narrowing range of price action, this pattern typically signals a decline in bearish momentum and the start of a potential breakout.

In this case, the wedge breakout of LDO coincided with a sharp spike in volume, confirming buyer confidence.

Source: TradingView

As a result, the critical support level was identified at $1.88, which coincides with the 78.6% Fibonacci retracement level. This level acted as a springboard for the token, propelling it towards the $2.40 resistance area.

LDO was rejected at $2.40, but later fell to $1.40, showing strong buyer interest, resulting in a 50% recovery.

Specifically, the next threshold is a daily closing price above $2.70. Achieving this milestone could pave the way for further bullish momentum by hitting potential targets of $3.574 and $4.632 as seen on the chart.

This can be important in ascertaining the strength of the breakout.

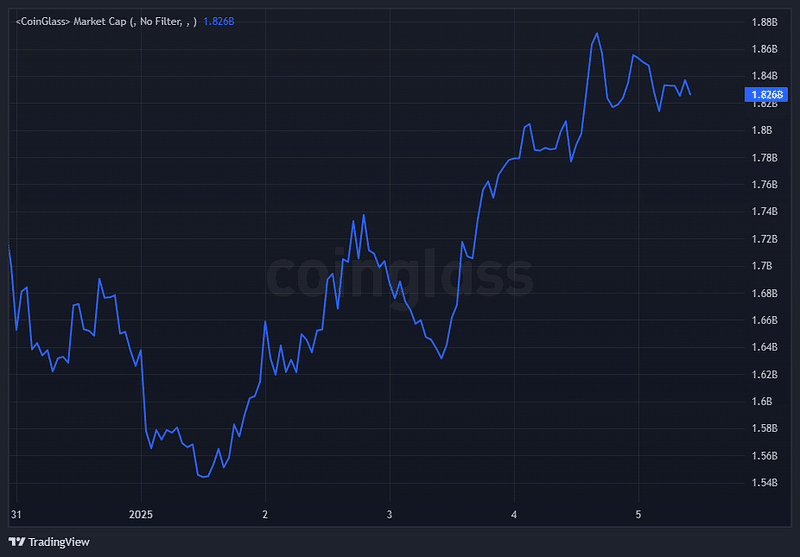

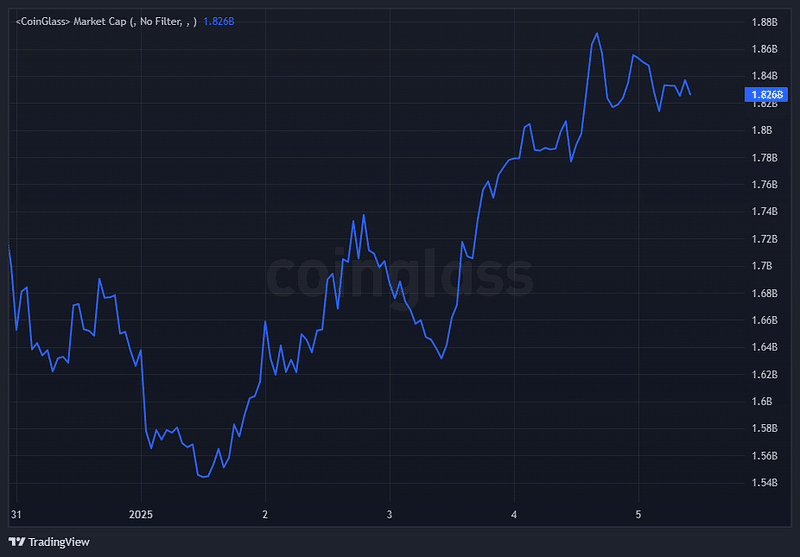

total market capitalization

LDO’s total market capitalization is $1.28 billion at press time, reflecting its important role in the decentralized finance (DeFi) ecosystem.

These figures establish LDO as a key player in liquid staking, and are further supported by their contribution to Total Value Locked (TVL) of $35 billion across DeFi platforms.

Source: Coinglass

Additionally, in recent weeks, LDO’s market capitalization has shown resilience despite widespread market corrections, highlighting continued interest from institutional and individual investors.

The upward trajectory of market capitalization coincided with LDO breaking out of the falling wedge, reinforcing the bullish narrative.

Going forward, a continued rise in market capitalization could indicate continued adoption and investor confidence.

Meanwhile, external factors such as increased interest in liquid staking protocols and Ethereum’s staking mechanism could further strengthen LDO’s market capitalization.

Unlike analytics, it is a good idea to pay attention to macroeconomic events that could impact overall cryptocurrency market sentiment.

Lido traders hope for rally

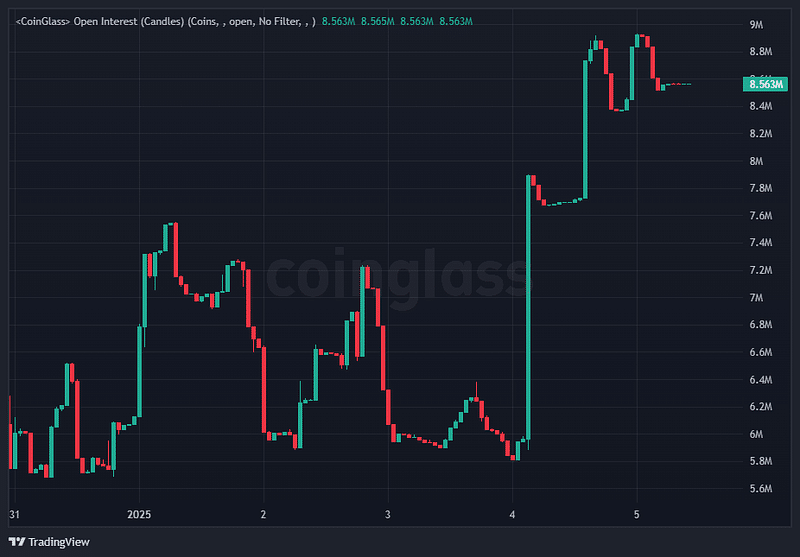

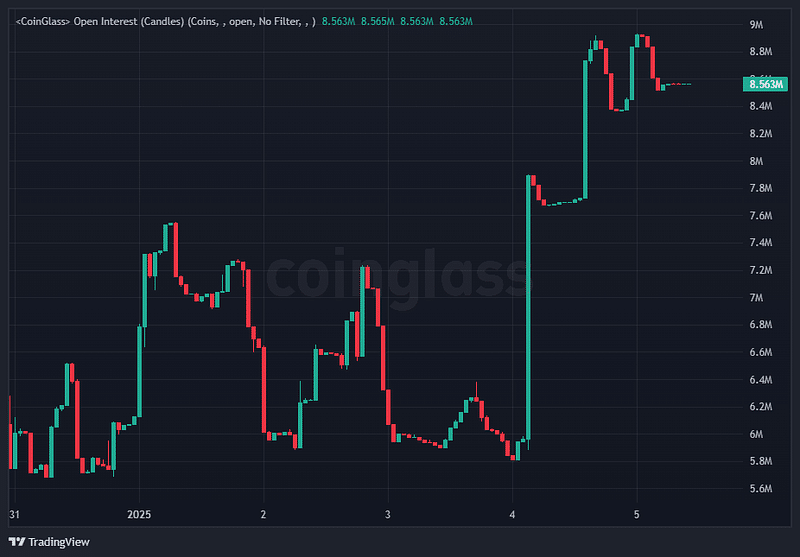

Open interest, which reflects the total number of open contracts in the derivatives market, provides valuable insight into the trading dynamics of LDOs.

The recent surge in Open Interest coincides with the token’s bounce from the $1.40 support level, indicating increased participation from both long and short positions.

Source: TradingView

The increase in open interest coupled with the price recovery suggests renewed confidence among traders anticipating further volatility.

The lack of large liquidations, especially during the $1.40-$2.40 rally, highlights a balanced market sentiment where neither bullish nor bearish positions are overwhelming order volume.

If open interest continues to rise, this could signal growing speculation about LDO’s ability to maintain its bullish momentum.

Traders should also closely monitor funding rates. This is because a sharp rise means long positions have become overheated and could potentially lead to a short-term correction.

Conversely, a stable or decreasing funding ratio will support steady price growth.

LDO had a promising bullish outlook at press time based on the technical and market analysis provided.

Tokens emerging from a falling wedge pattern showed a reversal in bearish momentum, driven by strong volume and key Fibonacci retracement levels.

Read Lido DAO (LDO) price prediction for 2025-2026

The $1.88 support level has served as a pivotal foundation for the recent price recovery, while potential targets at $3.574 and $4.632 represent significant upside opportunities.

The $1.85 billion market capitalization highlights LDO’s central role in the DeFi ecosystem, underpinned by its contributions to TVL.