- LINK has made impressive progress in network activity, but the whale’s exit has slowed its surge.

- Can retail capital and Trump’s advocacy give LINK the boost it needs?

Just two weeks ago, Chainlink (LINK) lit up the charts with a massive 21% daily surge thanks to a $1 million purchase from World Liberty Financial (WLF).

This explosive rally, fueled by the “Trump pump,” has put LINK in the spotlight as a key player at the intersection of politics and cryptocurrency. But as soon as the hype soared, it soon waned. And this had a corresponding impact on altcoins as well.

At the time of this writing, LINK is back to around $22.8, with a bearish MACD crossover hinting at further declines. So the question is – what will happen to altcoins in the coming year?

LINK’s comeback is worth the FOMO

Over the past four years, Chainlink has made incredible progress. The number of addresses on the network jumped from 213,000 to 690,000. Also in December, total value locked (TVL) surpassed $1 billion for the first time.

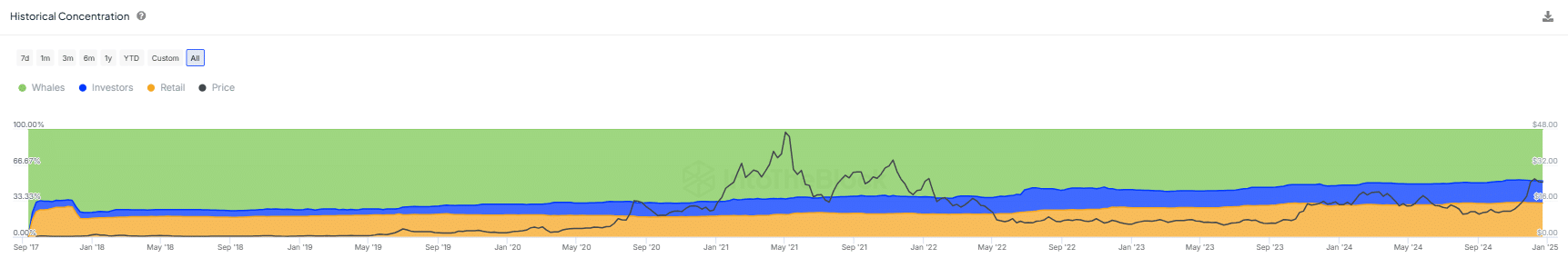

What’s even more interesting is the change in LINK’s token distribution. It was once dominated by large holders controlling 70% of the supply, but that figure has since fallen to 48%. Meanwhile, retail investors have also gone one step further and currently hold 32% of LINK supply.

Source: IntoTheBlock

But why is this important? Recent AMBCrypto report It highlighted the increasing centralization of Ethereum (ETH), with whales wielding massive control and preventing the price from breaking the $4,000 barrier. Therefore, LINK’s move toward a more balanced distribution could set it apart in the long run.

But there’s a problem. Despite LINK’s decentralization efforts, the price has struggled to recover from the all-time high of $53 set three years ago. Despite strong volume and network growth, LINK did not make the top 10.

This, along with a noticeable number of whale wallets exiting, means that external market factors could be putting downward pressure on LINK’s price.

That said, the recent “Trump pump” has acted as a powerful catalyst, triggering a new wave of FOMO among new players. So the question is –

Will it last?

Over the past 30 days, LINK has soared thanks to impressive double-digit growth that outperforms many of its competitors. Zooming out, the price has increased by 50% year to date (YTD), putting it on par with Ethereum.

But where Chainlink really stands out is its broader appeal. President-elect Donald Trump’s endorsement has sparked renewed interest, and a decline in whale manipulation has paved the way for a more organic market.

Additionally, LINK’s Oracle network is expanding its use cases into a variety of fields. industryMakes this a real utility.

Is your portfolio green? Check out the LINK Profit Calculator

With all of these factors in play, Chainlink is establishing itself as a top contender in the altcoin race. It attracts both short-term traders looking for a solid diversification play and long-term HODLers looking for consistent growth.