- LINK has implemented strategic tools to attract institutional investors.

- However, there may be issues with your primary network.

Chainlink (LINK) has hit $12 twice in the past two months, but has faced resistance each time. While in the first case there was a solid retracement, this time the green candle appeared more quickly.

Priced at $11.28 at press time, the bulls’ next challenge will undoubtedly be breaking the $12 barrier. According to analysts, this could happen before the end of the fourth quarter cycle.

Bitcoin’s retest of $62,000 resistance is contributing to overall optimism thanks to the overall hype of October, but there may be more fundamental factors driving investors to bet on LINK’s future value.

LINK is developing strategic partnerships

To strengthen its institutional presence, Chainlink Labs has partnered with: taurus A leading digital asset infrastructure provider. teaHis strategic collaboration aims to improve LINK’s transaction bandwidth, a critical factor in maintaining blockchain competitiveness.

If successful, this could generate strong institutional interest, significantly increasing LINK’s visibility and laying the foundation for long-term value growth.

However, despite these initiatives, stakeholders began to withdraw from LINK’s network. The same goes for the chart below.

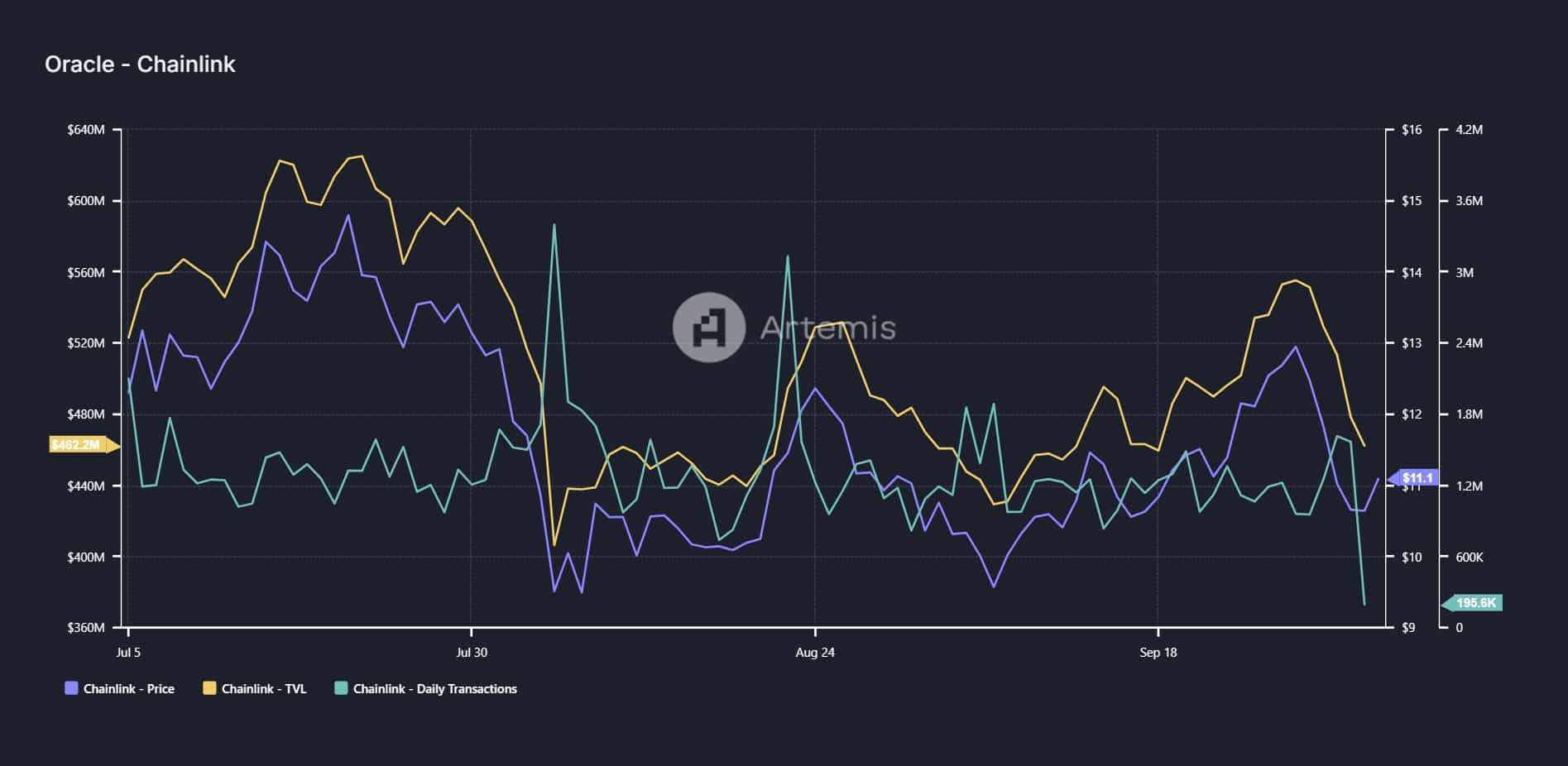

Source: Artemis Terminal

Due to September’s volatility, LINK’s DeFi platform lost a significant portion of its total value locked (TVL), falling from a high of $555 million a week ago to $462 million at press time.

The number of daily transactions, which hit 1 million in mid-July, also dropped to 195,000, the lowest in three months.

Simply put, these collaborative projects are emerging from a time of internal crisis at LINK. If this strategy works as intended, LINK could face a short-term price correction crisis.

Support from big players

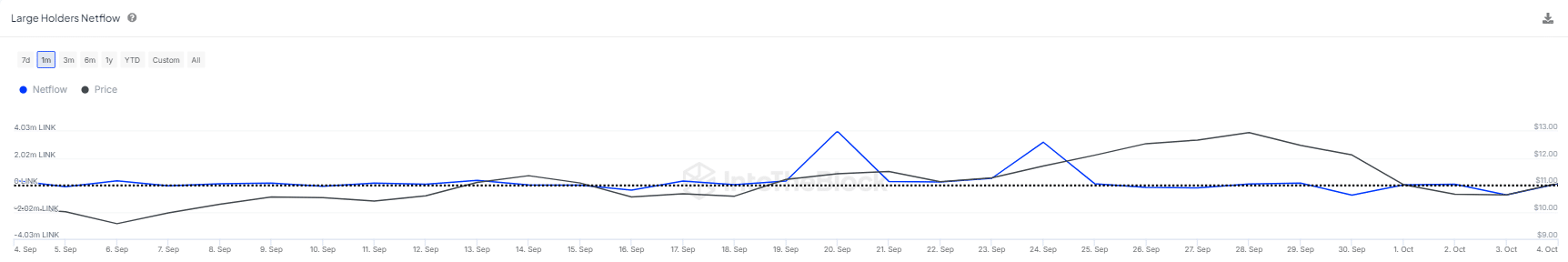

Whale wallets, which make up 49% of the large holder cohort, hold 489 million LINK coins. They actively influenced the value of LINK throughout September.

Earlier this month, these whales were unloading their assets. However, a noticeable change has occurred recently as large holders have started accumulating tokens once again.

Source: IntoTheBlock

The resurgence of whale accumulation helped LINK turn key $10 resistance into support. If this important reversal is achieved, a break through the $12 barrier appears possible.

Is your portfolio green? Check out the LINK Profit Calculator

However, the problems within the LINK network, reflected in reduced user activity, are in sharp contrast to the LINK network. guess LINK could soar to $40 by the end of the next bull cycle.

Overall, the current situation appears to be somewhat optimistic. If partnerships can restore trust among institutional players, a breakthrough could soon follow. This is something the Chainlink network currently lacks.