- The price of LTC has fluctuated slightly over the last 24 hours.

- Bearish sentiment surrounding the coin dominated the market.

Litecoin (LTC) Investors were not satisfied because LTC did not follow the bull market trend. However, once prices reach a critical level, things can soon turn in their favor, which historically has been the case with bull markets.

What is Litecoin doing?

According to CoinMarketCap, the price of LTC has risen slightly over the past 24 hours, while several cryptocurrencies have shown promising gains. At the time of this writing, LTC had a market capitalization of over $5.6 billion and was trading at $75.59.

However, the coin has a trick up its sleeve that could lead to a bullish rally in the coming days.

According to the latest data, the price of LTC has rallied strongly in 2021, mimicking the pattern seen previously. The price of the coin was on the verge of a breakout above the diagonal trend line, hinting at a possible move northward. Price movements are large.

Source: X

Are gang rallies inevitable?

Since the patterns on the LTC chart suggested a bullish rally, AMBCrypto checked Litecoin’s on-chain metrics to see if that outcome was actually possible.

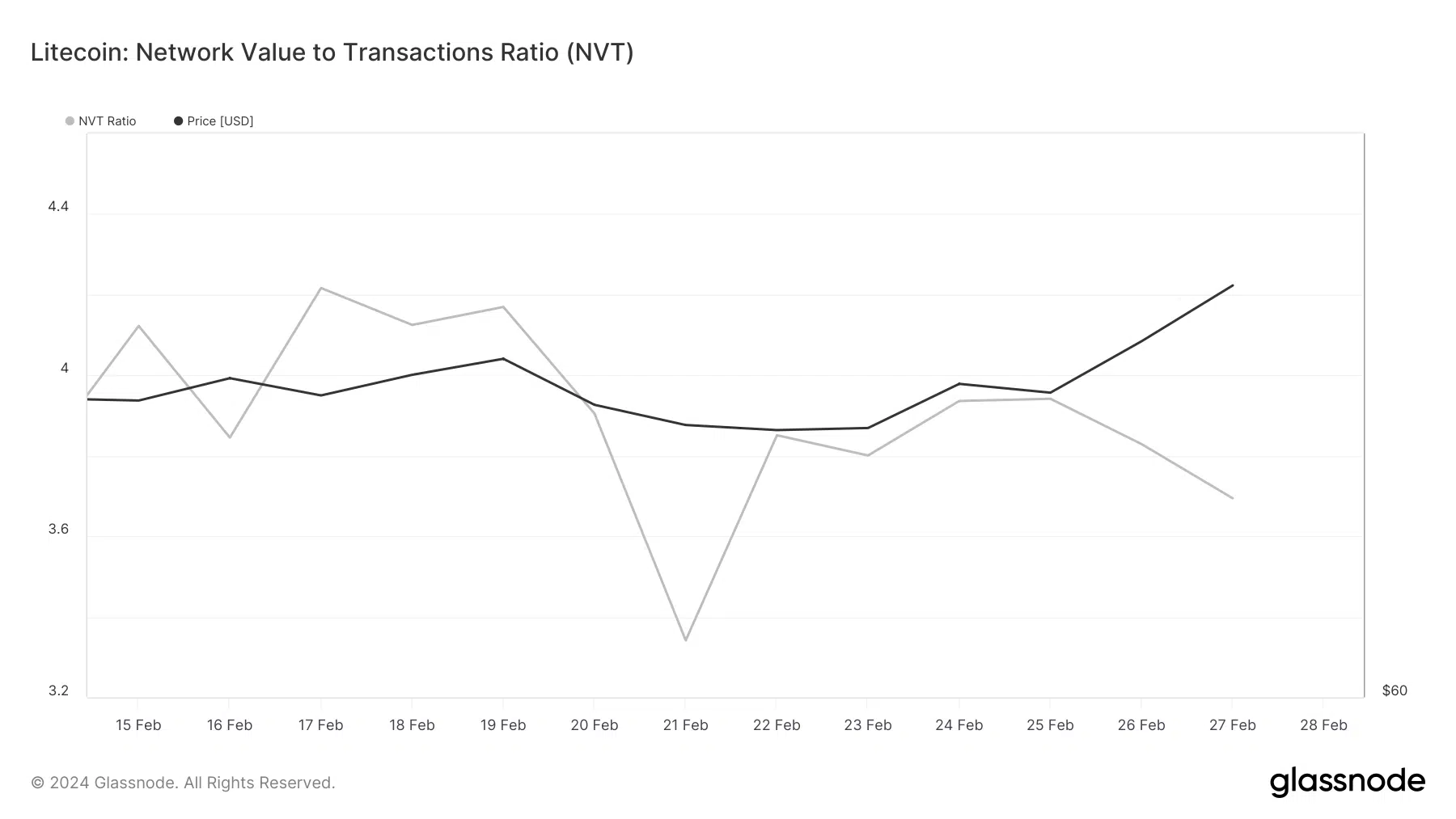

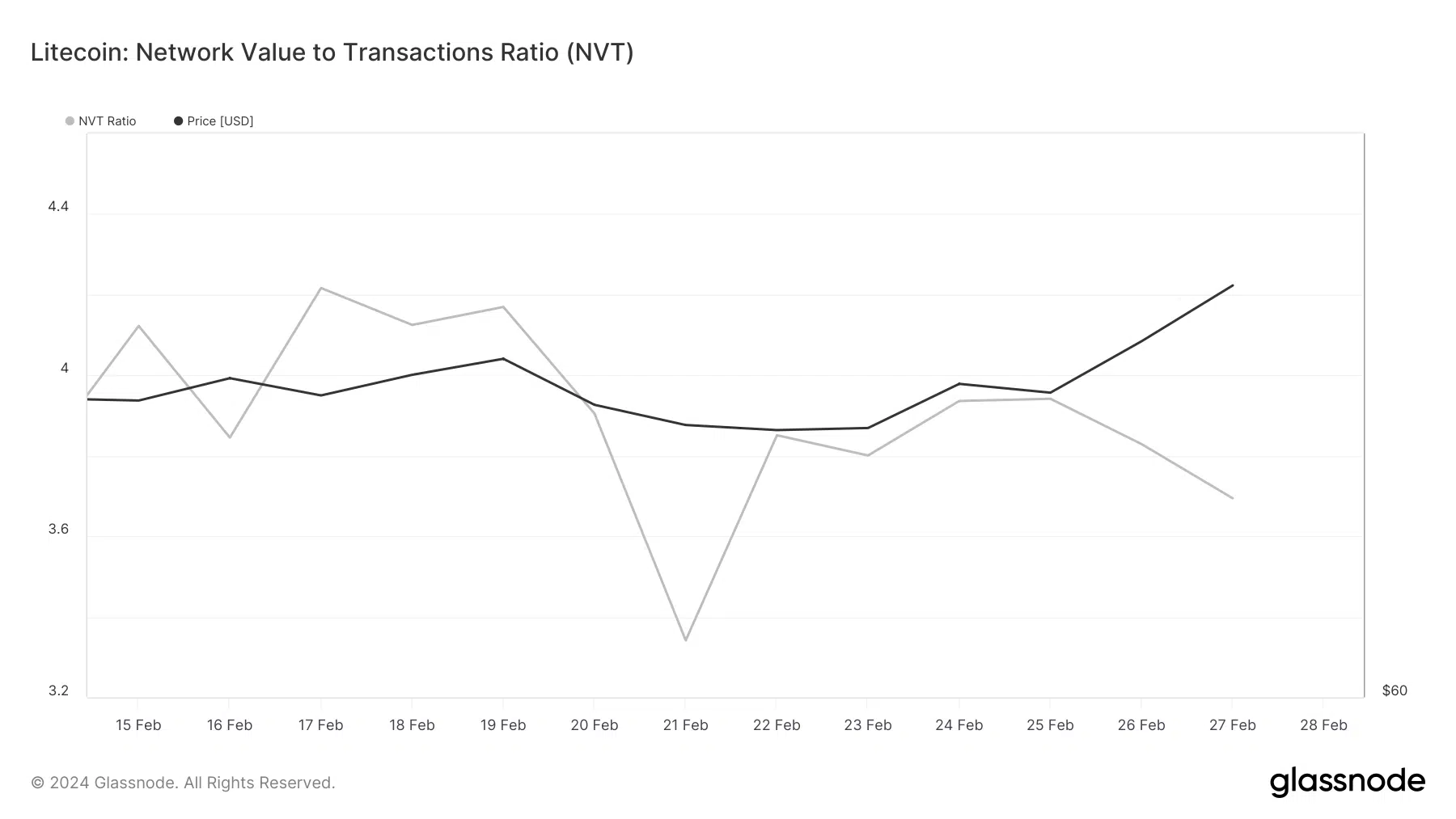

Analysis of data from Glassnode shows that LTC’s Network Value to Transactions (NVT) ratio has been declining. First of all, the NVT ratio is calculated by dividing the market capitalization by the transferred on-chain transaction volume measured in USD.

Whenever the indicator falls, it means that the asset is undervalued and a rising price trend is likely.

Source: Glassnode

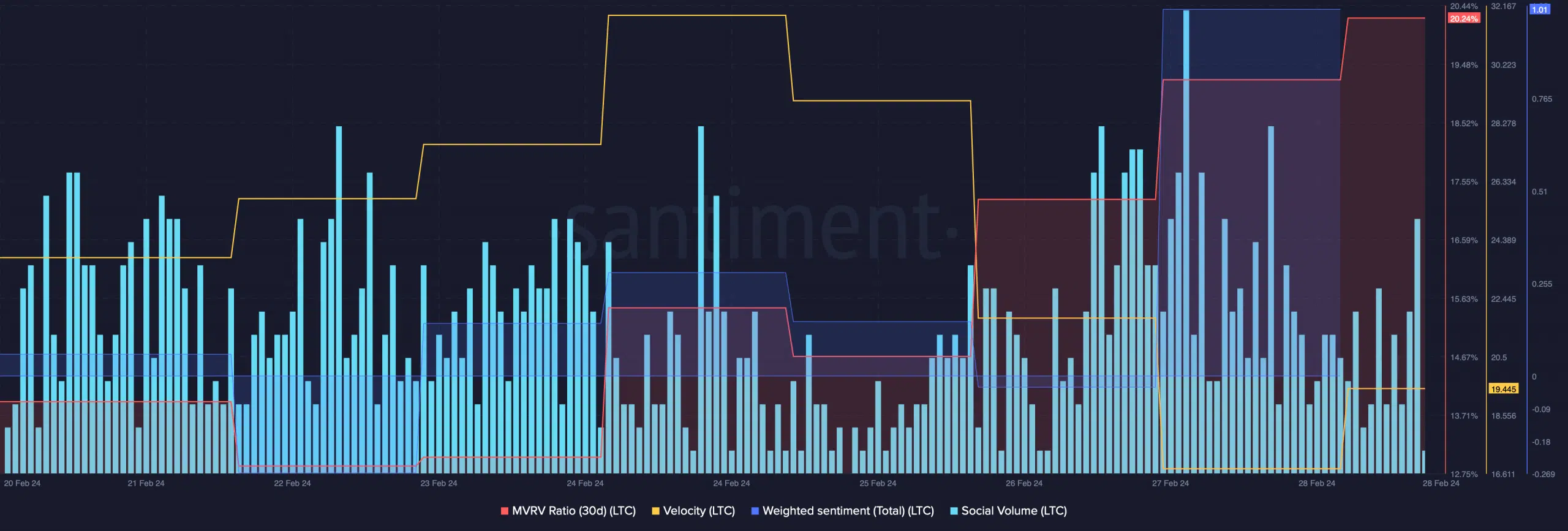

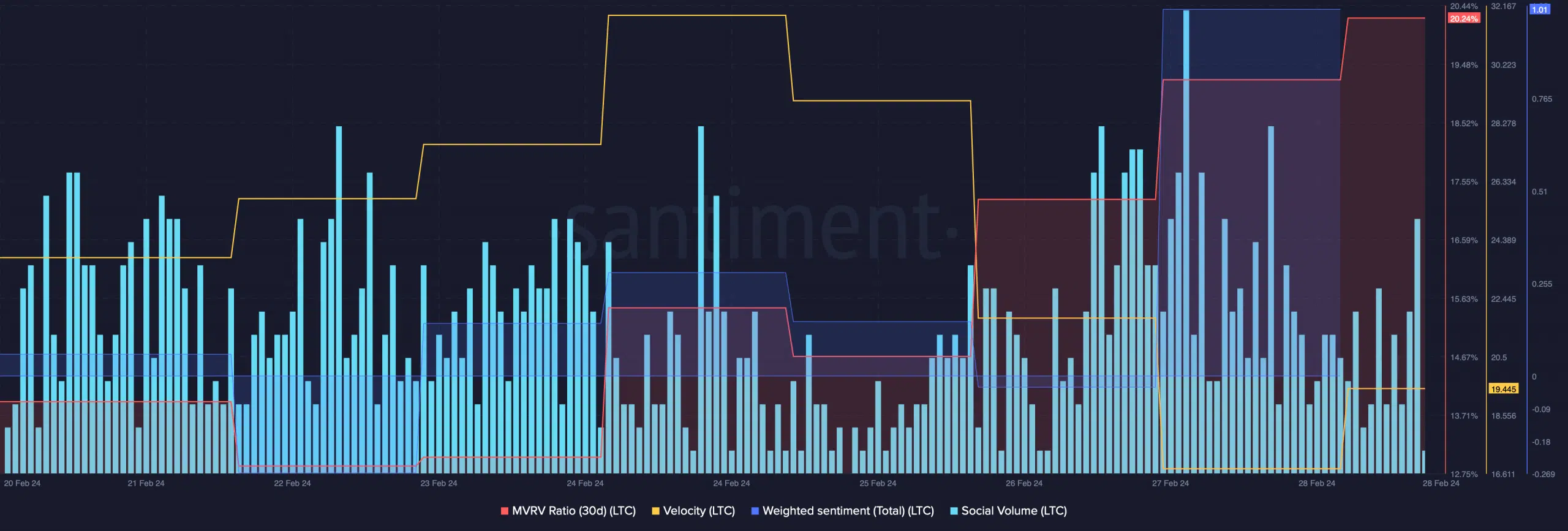

Apart from that, some of the other indicators also looked bullish for the coin. For example, Litecoin’s MVRV rate has risen. Reflecting its popularity, social volume also maintained a high level.

Additionally, the weighted sentiment graph has turned positive, meaning that bullish sentiment surrounding the coin is dominant in the market. However, we saw a slight decline in network activity last week as speeds plummeted.

Source: Santiment

read Litecoin (LTC) Rice Prediction 2024-25

Litecoin’s MACD also showed a bullish crossover, suggesting that a bullish rally is possible. However, the Relative Strength Index (RSI) was about to enter overbought territory. This could put selling pressure on the token, which could result in a decline in the price of the coin in the future.

Another bearish indicator was the Bollinger Bands, which also hinted at increased selling pressure as the price of LTC touched the upper limit of the indicator.

Source: TradingView