- Long-term holder confidence in Litecoin has increased over the past few months.

- According to one indicator, LTC is overvalued and a price correction is imminent.

As the market turns bullish, Litecoin (LTC) It has been trading above critical levels. Could this development start LTC’s journey towards $100? Let’s take a closer look at the coin’s condition to see if it is possible.

Litecoin is trading above key levels

Litecoin bulls have been having a great time in the market as the coin’s price has gained more than 3% over the past week. The bullish trend has continued over the past 24 hours as the coin’s value has surged by another 3%.

At the time of writing, LTC was trading at $65.58 and had a market cap of over $4.9 billion, making it the 19th largest cryptocurrency.

Despite the price increase, only 22% of Litecoin investors reportedly made a profit. Into the block. However, the trend may change as the coin successfully tests important support levels.

Popular cryptocurrency analyst Crypto Tony recently wrote: tweet LTC’s successful test of support shows that it could lead to a price bounce. In fact, a price bounce could lead LTC to the $100 resistance level in the coming days or weeks.

Source: X

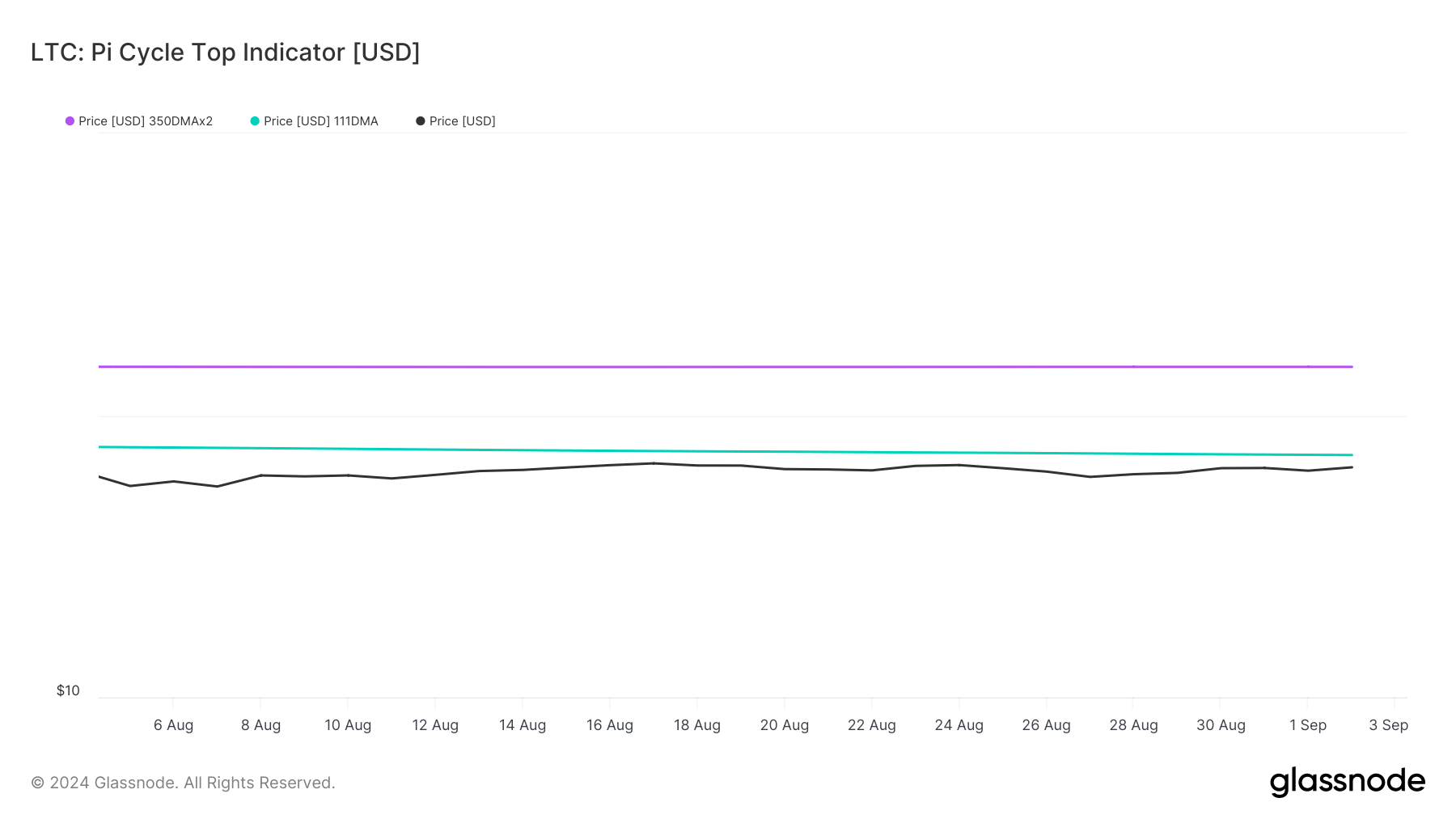

Data from Glassnode also points to a similar possibility. According to the Pi Cycle Top indicator, the possible LTC market high was around $148. This suggests that it would not be too difficult to expect LTC to rise to $100 in the coming days.

Source: Glassnode

Could LTC Be the Breakthrough?

According to AMBCrypto’s analysis, long-term holders (investors who have held LTC for more than a year) have shown increased confidence in the coin over the past few months, as the graph shows.

To be precise, over 78% of LTC holders were long-term investors.

Source: IntoTheBlock

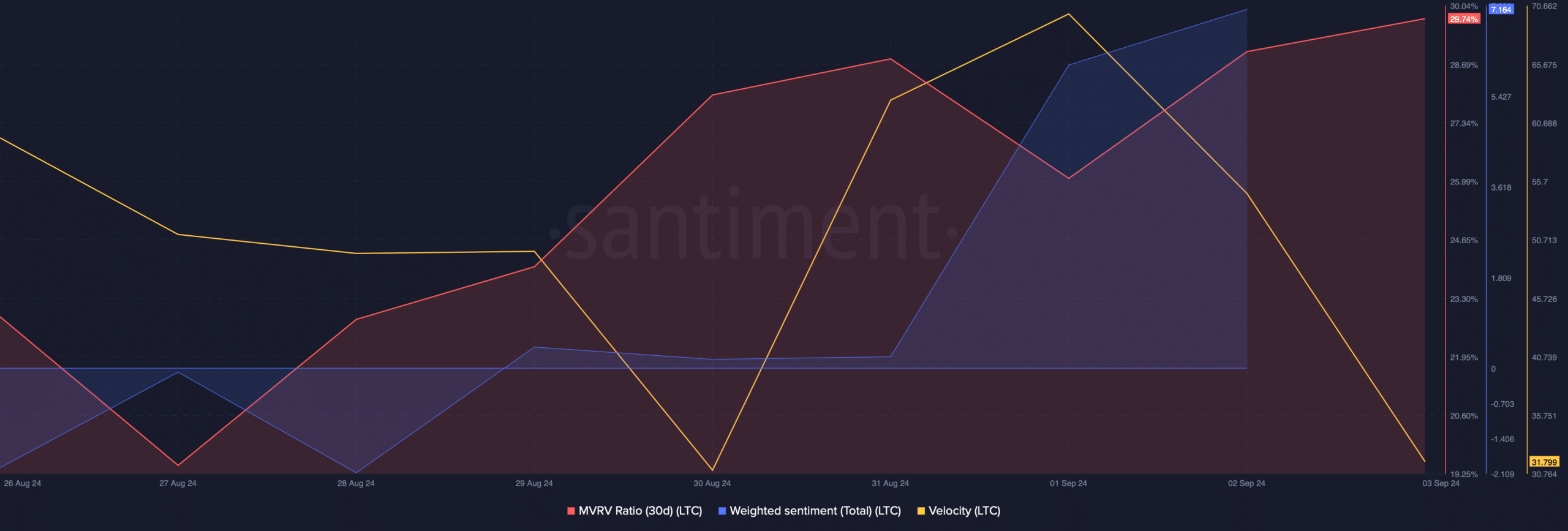

Our analysis of Santiment’s data showed that LTC’s MVRV ratio has increased significantly. Additionally, the weighted sentiment has followed a similar path, meaning that bullish sentiment surrounding the coin has been dominant in the market.

But not everything looked positive.

Source: Santiment

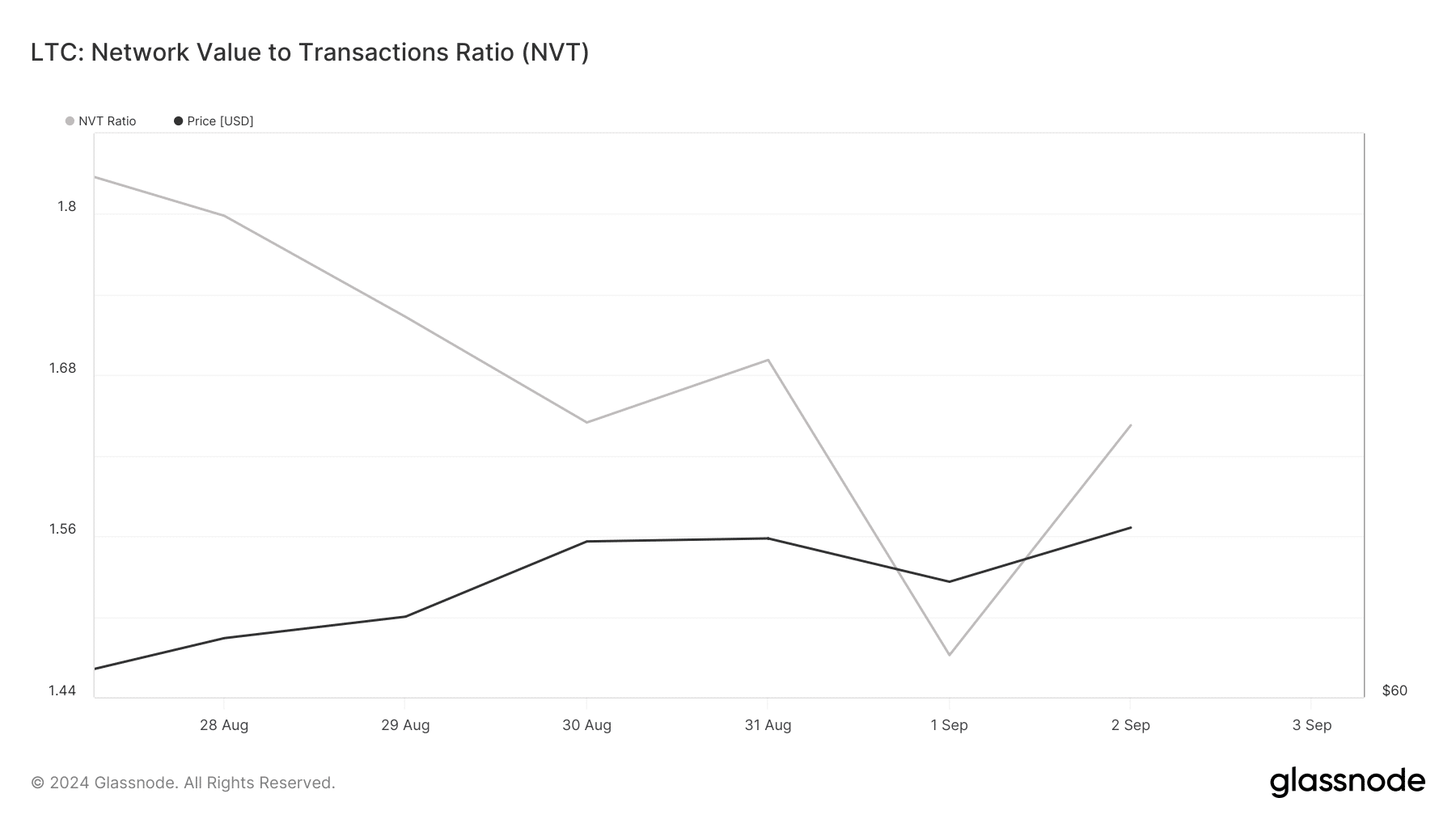

For example, Litecoin’s velocity has dropped. This means that LTC has been used less frequently in transactions over a period of time. In addition, the NVT ratio has increased.

Whenever this indicator rises, it indicates that the asset is overvalued, which suggests a price correction.

Source: Glassnode

Is your portfolio green? Check this out: LTC Profit Calculator

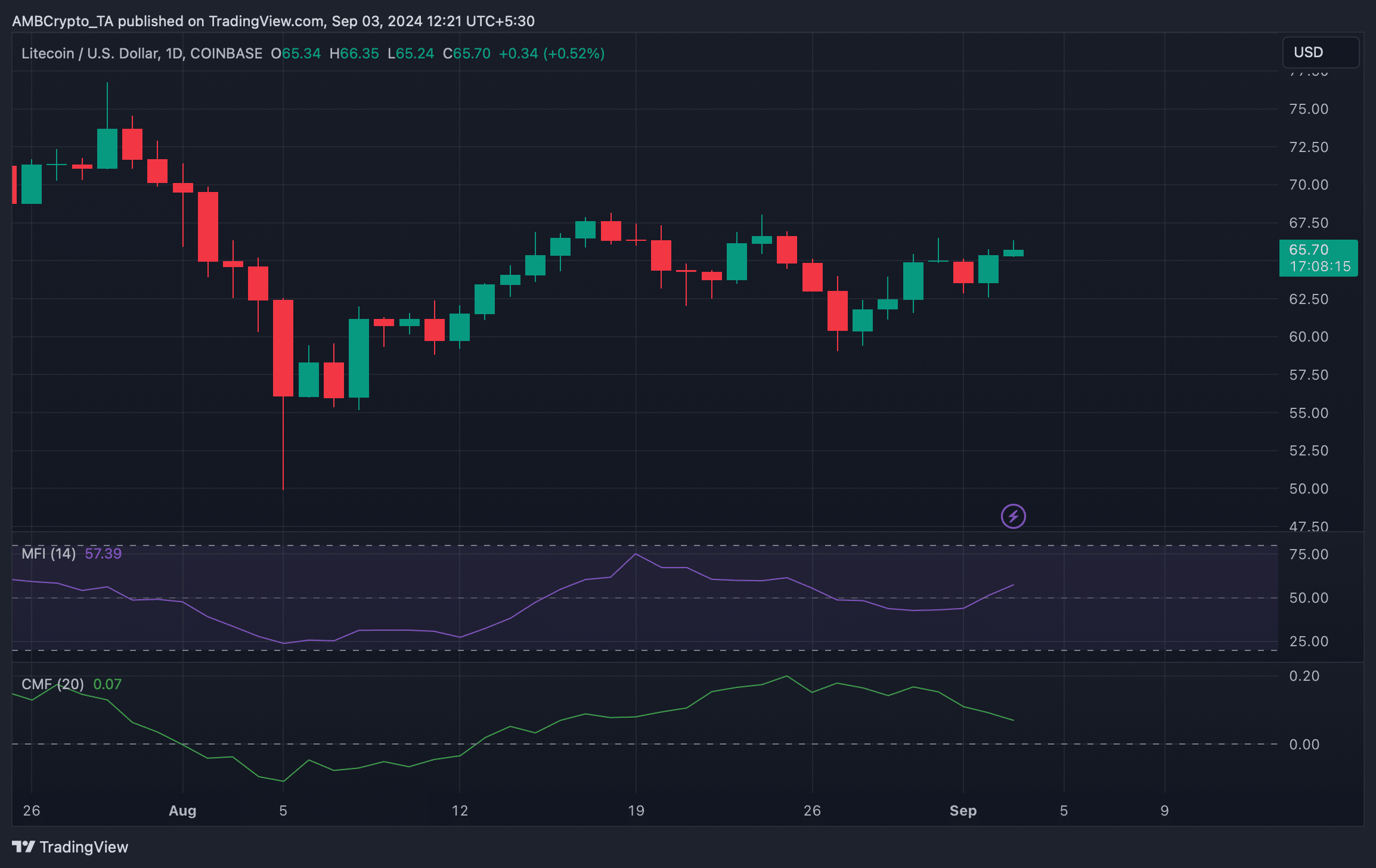

Therefore, AMBCrypto checked the daily chart of Litecoin to get a better idea of which direction it is heading. According to the analysis, Chaikin Money Flow (CMF) has been in a sharp downtrend, indicating that a price correction is imminent.

However, the Money Flow Index (MFI) is rising, which is favorable for buyers, giving hope for continued price appreciation.

Source: TradingView