- Investors are willing to hold LTC, which suggests the price could be close to 2021 highs.

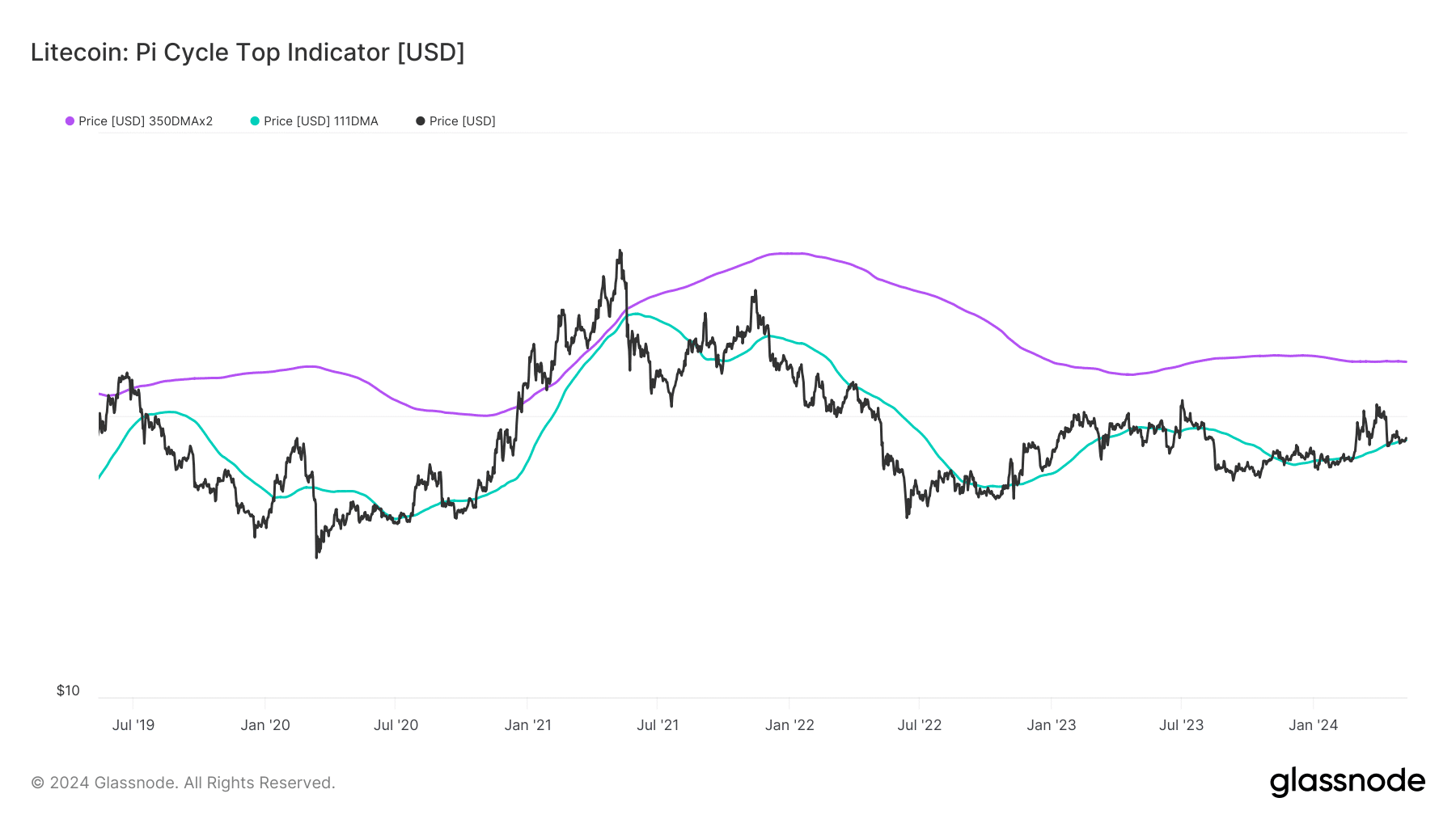

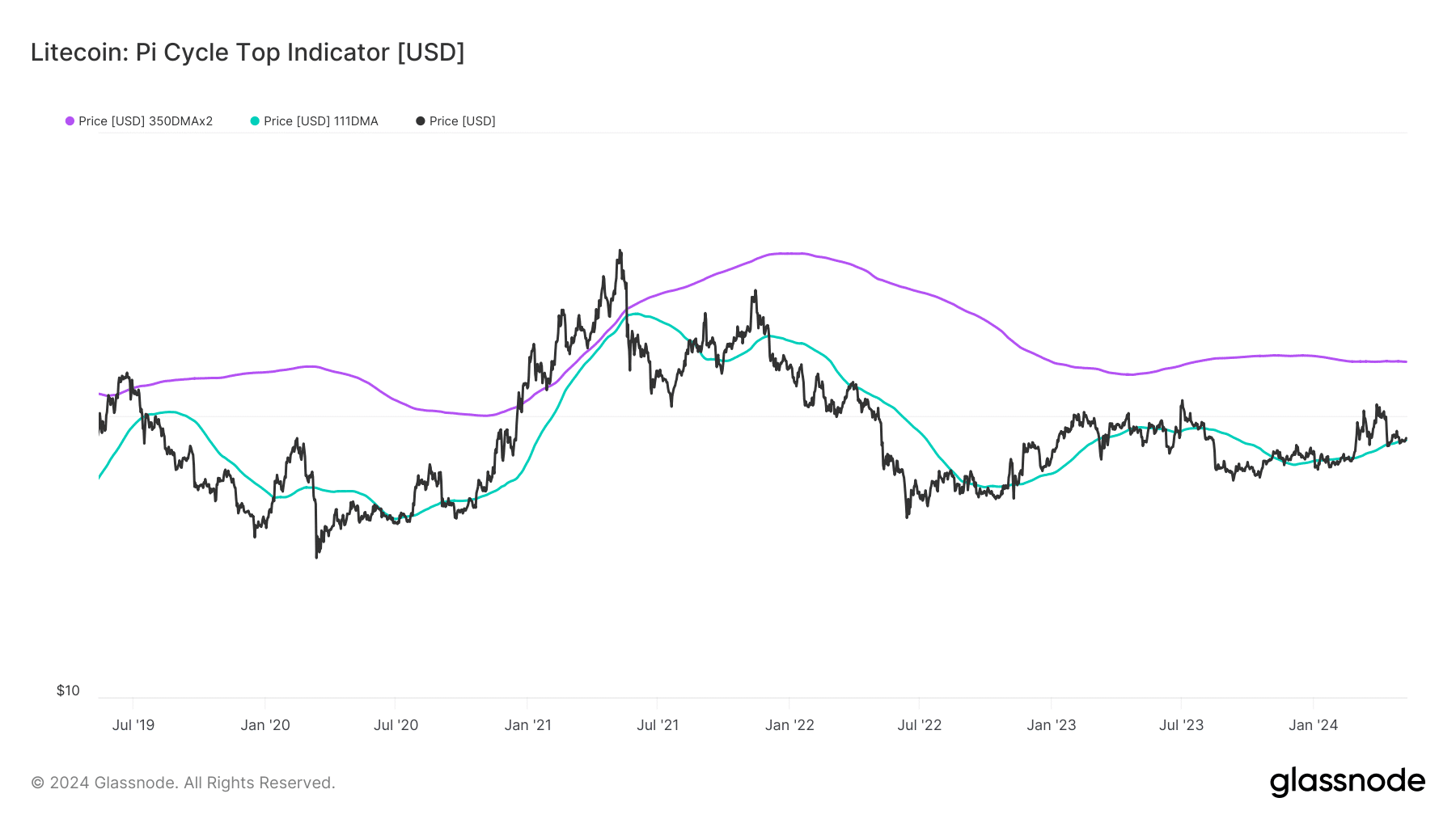

- Pi Cycle Top shows that the LTC is not overheating yet.

Reaching $250 would mean the Litecoin (LTC) price would have to increase by more than 150% from its value at press time. As of this writing, the coin has changed hands for $80.61.

This value has adjusted by 15.60% over the last 30 days. However, AMBCrypto’s assessment of Litecoin’s preliminary risk suggests that better days are ahead.

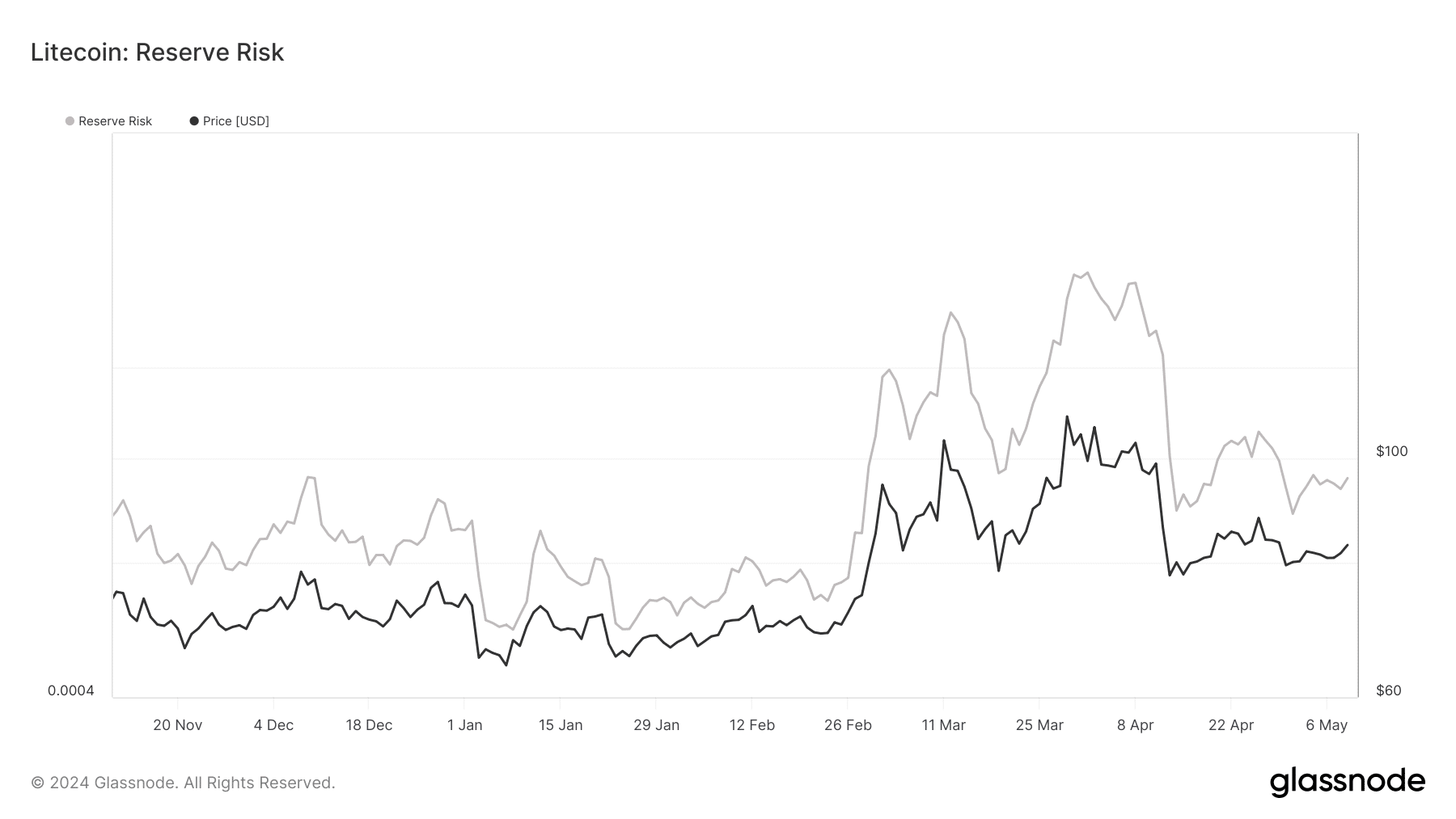

Reserve Risk has the nickname “HODL Banking.” For the uninitiated, HODL stands for Hold On to Dear Life. Describes a situation where cryptocurrency investors refrain from selling regardless of price fluctuations.

the risk is high

Reserve risk lets traders know whether long-term holders are confident about the price. If the price is high and confidence is low, it means that the risk/reward ratio may not be worth betting on.

However, the increasing reserve risk and lower valuation indicate exceptional confidence in the long-term value of the coin, and this was the situation with Litecoin.

Source: Glassnode

Depending on the circumstances, this metric may continue to increase. In this case, the LTC price could retest back to $100. But breaking $100 means the coin could rise another 100%.

In this case, you can jump up to $250. The last time Litecoin changed hands at that price was in November 2021.

Since then, its value has continued to decline. However, AMBCrypto found another indicator supporting the price increase. This time it was the Pi Cycle Top indicator.

LTC shows signs of expansion.

This chart has two lines (one green) representing the 111-day simple moving average (SMA). The other one is colored purple and represents the 350-day SMA.

Historically, prices have peaked when the shorter SMA reaches the same level as the larger SMA. Evidence of this came in the fourth quarter of 2021, when the price of Litecoin fell from $385 to $136 after 136 months.

However, at press time, data showed that the 111-day SMA was at a low point compared to the 350-day SMA. This indicates that LTC still has a lot of room to grow before the bull market ends.

Source: Glassnode

Although this may not be immediate, the position of this indicator reinforces the prediction that Litecoin could rise to $200 or $250 within a few months.

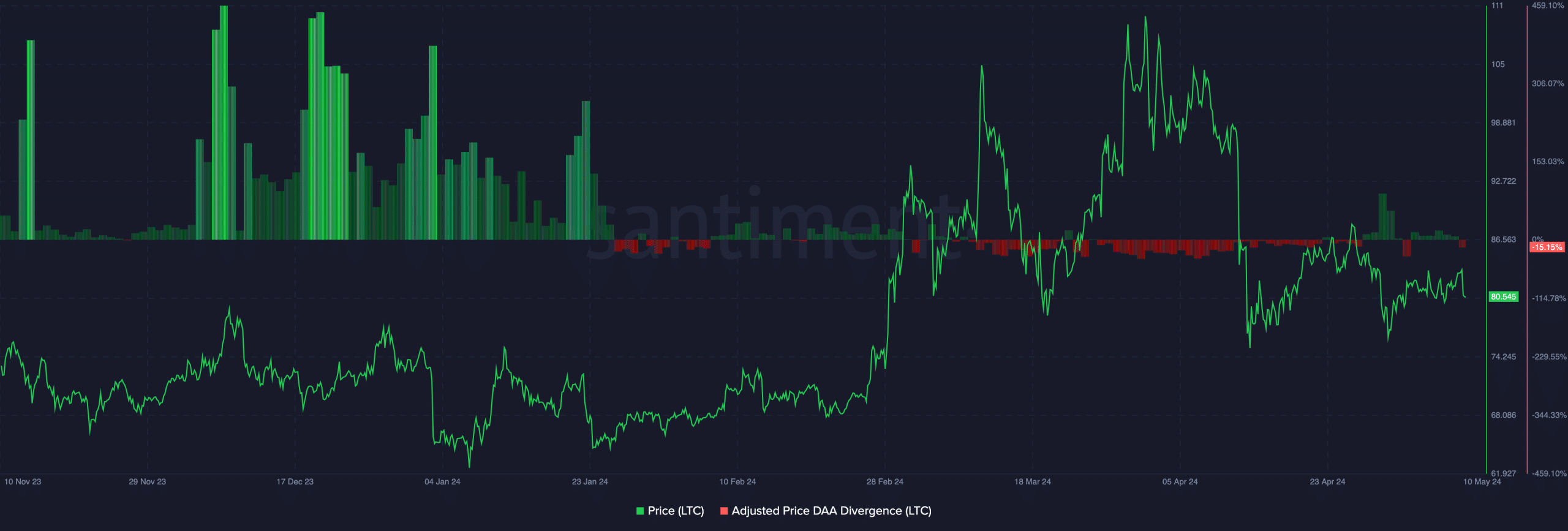

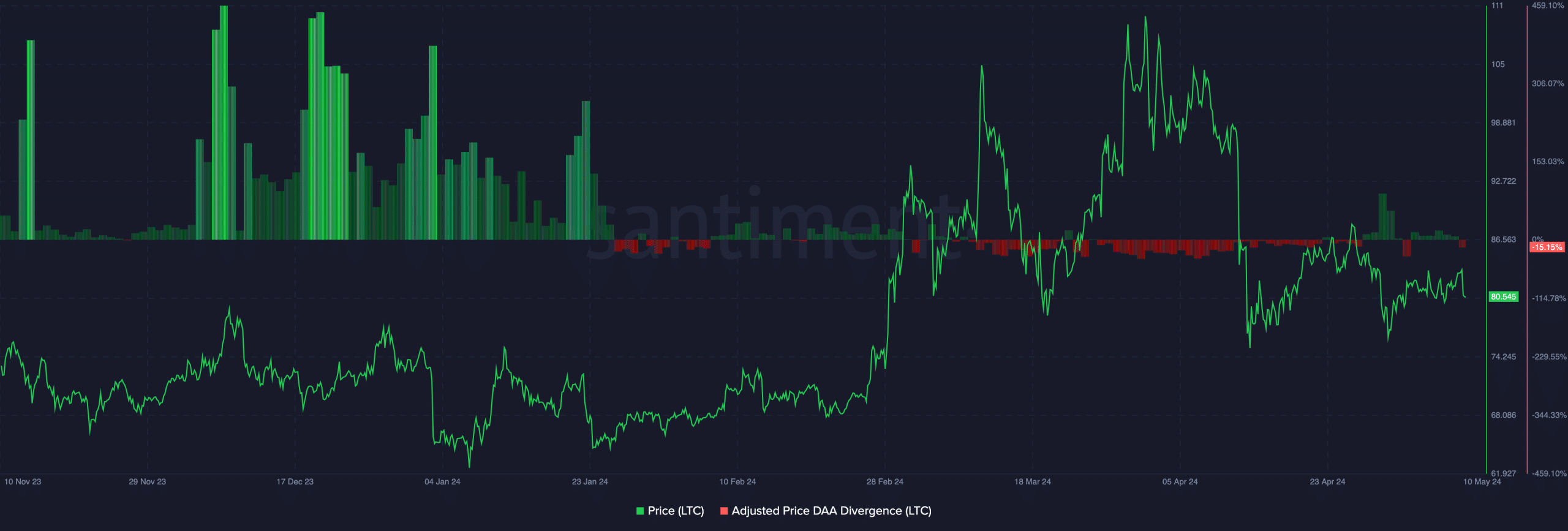

Meanwhile, data from Santiment shows that the adjusted price-DAA differential was -15.15%. DAA stands for Daily Active Addresses. The number of unique cryptographic addresses interacting with the network.

When price is combined with DAA, traders can get an idea of entry and exit points. A negative reading on the price indicator means that the price of Litecoin has recently risen more than the active address.

Source: Glassnode

Read Litecoin (LTC) price prediction for 2024-2025

From a trading perspective, this is a buy signal. LTC may therefore have provided a rare accumulation opportunity.

However, market participants may need to pay attention to complementary indicators before doubling down on their entry price.