- The Litecoin consolidation zone breakout highlights the potential for a larger rally in the second half of November.

- Litecoin hash rate has reached a new ATH and open interest shows increased activity in the derivatives sector.

It’s been a very interesting week for the markets with several ATHs and Litecoin (LTC) not far behind. The cryptocurrency has broken the pattern with an overall upward trend over the past 10 days.

Litecoin has been consolidating in a rising pattern, supported by support and resistance. This week it broke resistance several times. This indicates that momentum may be building for a bullish explosion as the liquidity rotation takes root.

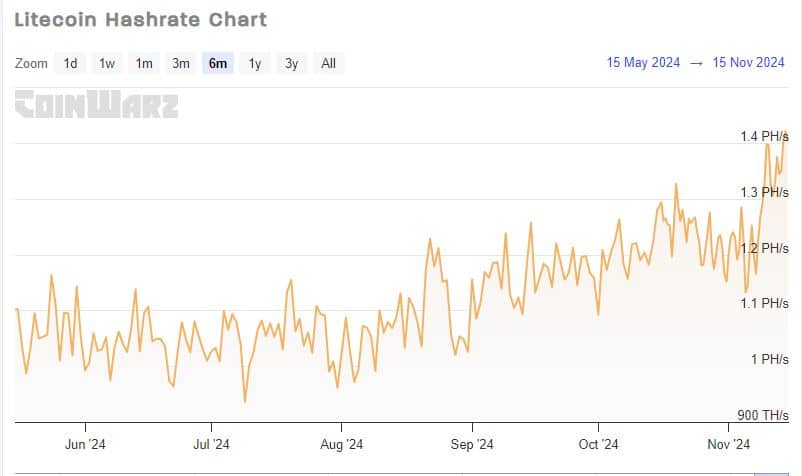

Litecoin hash rate soars to new highs.

In addition to maintaining the recent uptrend, there are several other signs that suggest things are heating up for LTC. For example, the Litecoin hash rate soared to a new all-time high of 1.42 PH/S.

Source: Coin Wars

The hash rate ATH suggests that miners’ profitability is increasing, possibly due to the surge in network activity.

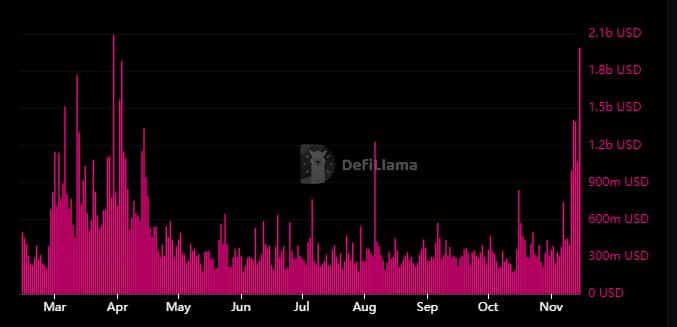

On-chain volume has been increasing since early November. According to DeFiLlama, LTC token trading volume hit its lowest point in November at just under $250 million.

It has since experienced significant improvement, reaching a monthly high of $1.98 billion in the last 24 hours at the time of observation.

Source: DeFiLlama

The recent volume surge is the highest the network has experienced in the past six months. This, combined with resistance to the downside, may indicate that bullish momentum remains strong.

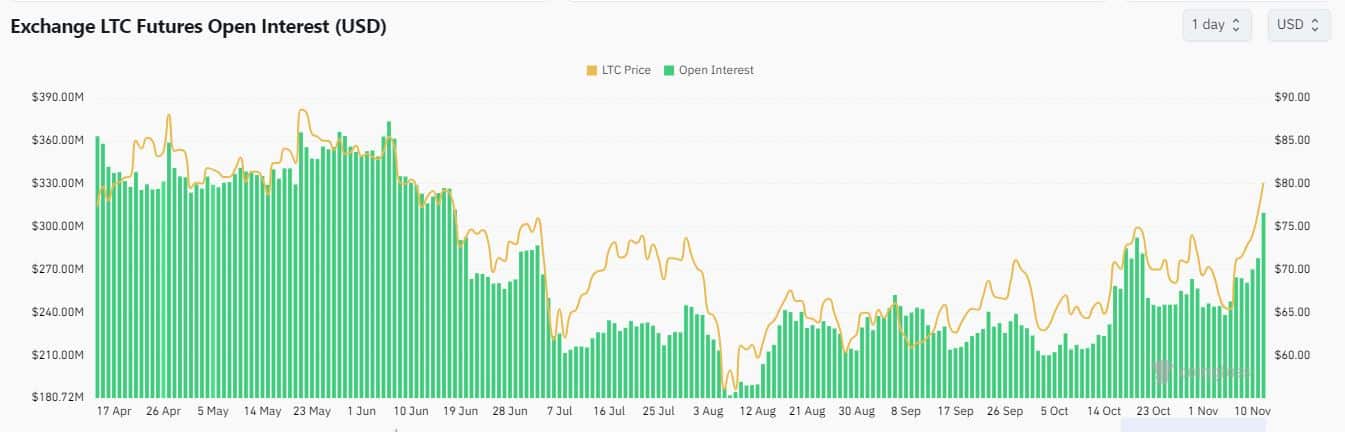

LTC open interest soars to 5-month high

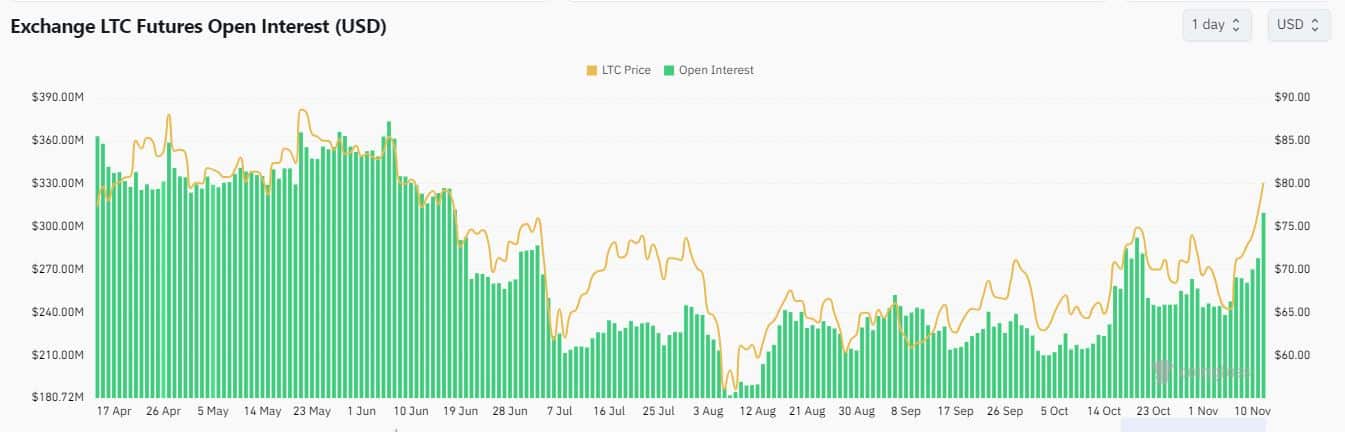

Demand for Litecoin has also increased in the derivatives sector. For context, open interest levels across all exchanges hit a high of $309.87 million in the last 24 hours at press time.

The last time LTC open interest was this high was mid-June.

Source: Coinglass

Despite these observations, open interest was still only a fraction of potential, especially compared to April levels. The cryptocurrency recorded over $708 million in open interest in March 2024.

Read Litecoin (LTC) price prediction for 2024-2025

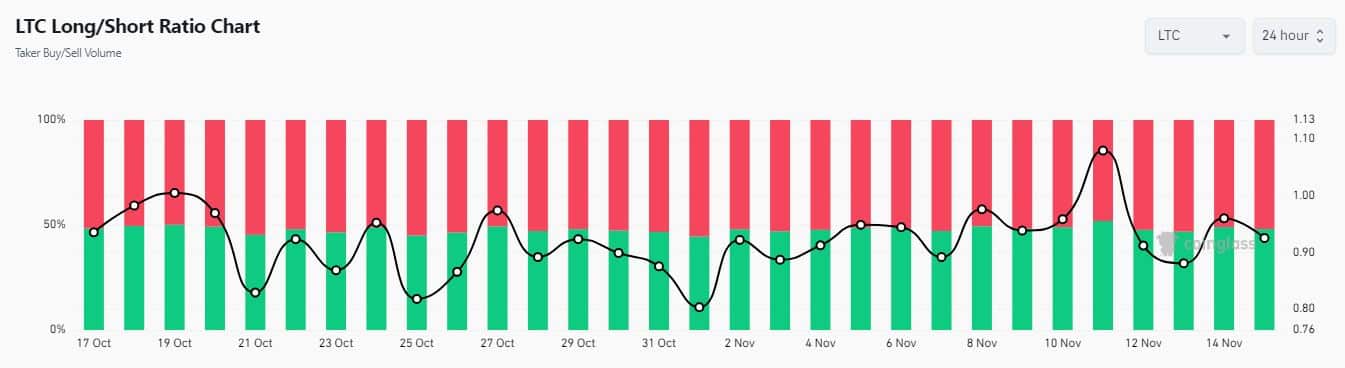

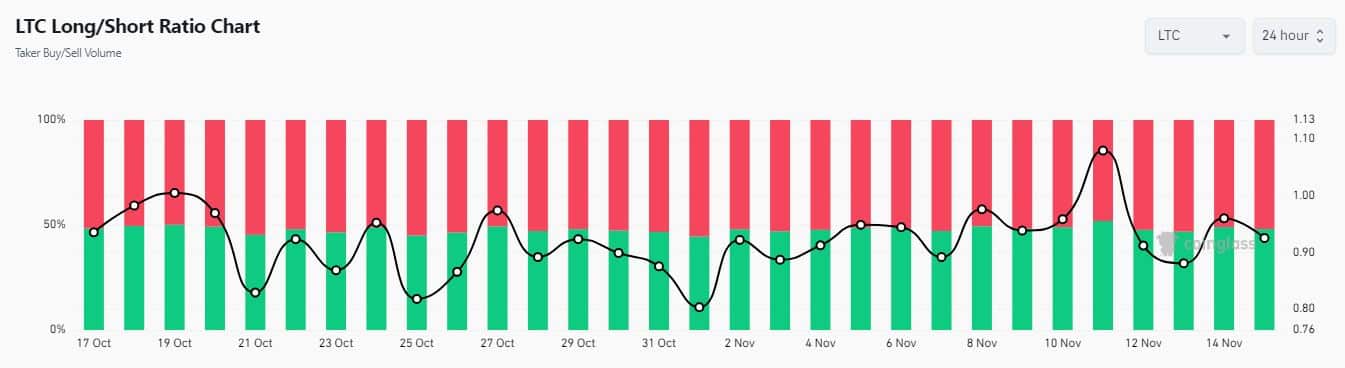

Since open interest cuts in both directions, it was necessary to evaluate buying versus selling. Over the past three days, the ratio of long positions to short positions has been higher.

Source: Coinglass

The data above suggests that more traders are switching to the bullish camp. It indicates a surge in bullish optimism. However, a surge in selling pressure over the weekend could lead to another unexpected downturn for LTC.