- LMWR has surged 62.13% in the last 24 hours.

- Market indicators suggest that LimeWire remains undervalued.

LimeWire (LMWR) has posted a strong rally since hitting a local low of $0.1707 a week ago, reaching a five-month high of $0.47.

However, following this price surge, a market correction occurred. In fact, as I write this, LimeWire is trading at $0.3975. This is an increase of 62.13% over the last 24 hours.

During the same period, altcoin trading volume surged 672.12% to $56.92 million, and market capitalization surged 51% to $114.42 million.

Likewise, it rose 103.46% and 226.74% on the weekly and monthly charts. Despite this price increase, LMWR remains approximately 79.53% below its all-time high of $1.92.

The question that arises after the recent plunge is whether LimeWire can sustain the rally.

Can LMWR sustain its rally?

According to AMBCrypto’s analysis, LMWR is currently experiencing strong upward momentum. As such, buying pressure for altcoins is increasing as buyers dominate the market.

Source: TradingView

This dominance of buyers can be confirmed by the rising Stoch RSI. It soared to 99 after showing a strong crossover a week ago. This surge shows that buying pressure is higher than selling pressure.

This phenomenon is further evidenced by the positive CMF. At press time, LimeWire’s Chaikin Money Flow (CMF) was 0.06, meaning buyers outweigh sellers.

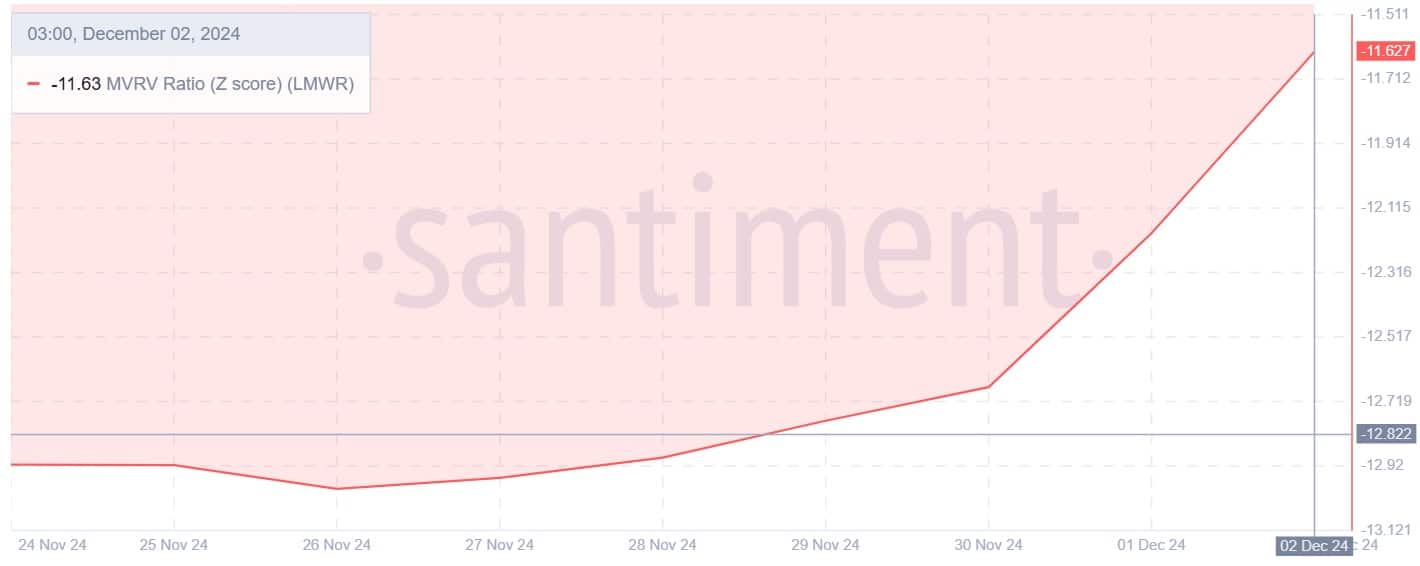

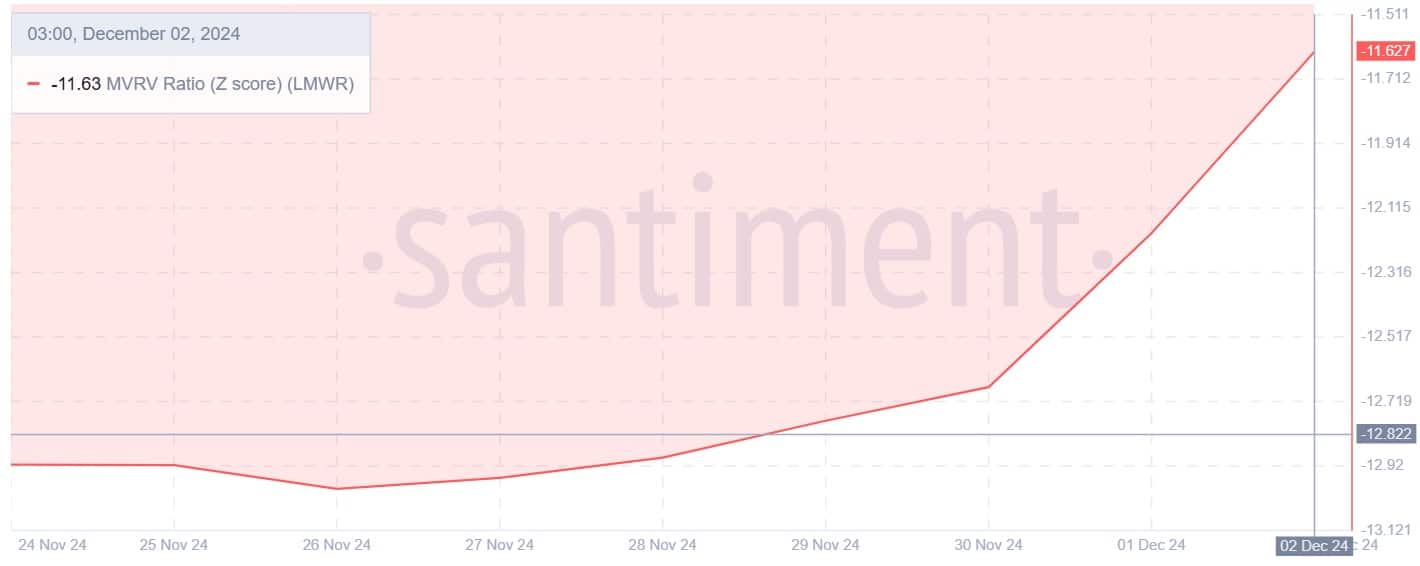

Source: Santiment

Looking more closely, LimeWire’s MVRV Ratio Z-score remains below 0, even as it rises. As such, the MVRV score rose slightly from -12.19 and stands at -11.63 at the time of this writing.

A negative MVRV score means that the current price of LMWR is below its average cost basis, meaning that the market is undervaluing the altcoin.

Historically, negative Z scores create buying opportunities. Therefore, market recovery is preceded by undervaluation as it creates more buying pressure and reduces the influence of sellers.

Therefore, this suggests that LMWR is undervalued and has room for growth as the market has not yet realized its true value.

Simply put, LimeWire is potentially undervalued. These low prices created buying opportunities, which led to strong buying pressure. LMWR could gain more from the price as buyers dominate the market amid bullish sentiment.

Therefore, if the current situation holds, the altcoin will find the next resistance around $0.70.