On-chain data shows that selling pressure from long-term Bitcoin holders is dissipating following the group’s recent long sell-off.

Long-term Bitcoin holders have sold off massively over the past four months.

As analyst James Van Straten explains: post At X, long-term holders have significantly reduced their distributions over the past 10 days. Here, “long-term holders” (LTH) refer to Bitcoin investors who have held the coins for more than 155 days.

LTH comprises one of the two main segments of the BTC sector, the other group being known as “short holders” (STH). STH is, of course, for investors who have purchased within the last 155 days.

Statistically, the longer an investor holds a coin, the less likely they are to sell it at any point. Therefore, LTH represents a more committed part of the BTC market.

STH, on the other hand, is a fickle hand that can sell as soon as it sees FUD or a profit opportunity. Therefore, sales through STH are generally not very noteworthy. However, selling of LTH rarely occurs, so this may be something to watch out for.

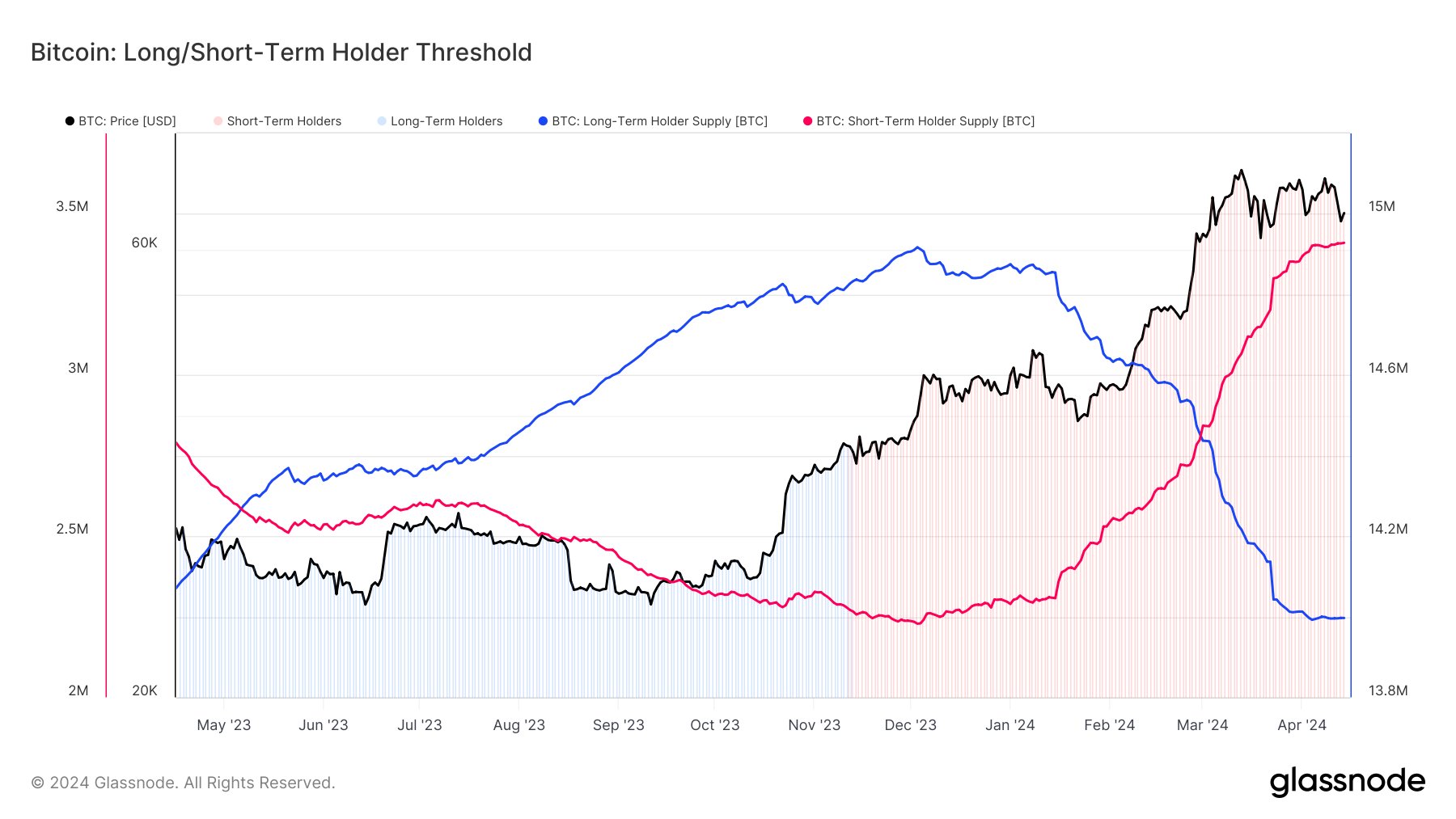

One way to track the behavior of these Bitcoin cohorts is through the total supply they have in their respective combined wallets. The chart below shows STH and LTH supply trends over the past year.

How the supplies held by these two cohorts have changed during the past twelve months | Source: @jvs_btc on X

As you can see in the graph above, the supply of Bitcoin LTH has been increasing for most of 2023. At the same time, the supply of STH naturally decreased.

What is important to note here is that an increase in LTH supply does not mean that HODLers were buying at the time. Instead, some STHs were purchased before 155 days and held on long enough to finally qualify for the cohort.

There is therefore a lag of 155 days between accumulation and the registered increase in LTH supply. But when it comes to selling, no such time delay exists because the LTH transferring the coins on the blockchain immediately leaves the group and becomes part of STH.

The chart shows that this year the trend of increasing supply of these diamond hands has reversed and LTH has been sold instead. Over the past four months, these investors have distributed 700,000 BTC.

The sell-off of Grayscale Bitcoin Trust (GBTC), which has continued to see coin outflows since the U.S. SEC approved a spot exchange-traded fund (ETF) in January, was excluded. These coins are mature enough to become part of LTH.

With prices weakening recently, LTH supply has stagnated, which means sales have finally stopped for these HODLers, at least for now. Given these new trends, it remains to be seen how the value of BTC will develop from here.

BTC price

After Bitcoin’s recent downtrend, its price fell to the $63,200 level.

Looks like the price of the asset has gone down recently | Source: BTCUSD on TradingView

Kanchanara from Unsplash.com, featured image from Glassnode.com, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.

Source: NewsBTC.com