The appeal of traditional luxury goods such as diamonds is fading, and new competitors have emerged that challenge long-held perceptions of value and investment.

Once the epitome of luxury and a symbol of enduring love, diamonds are facing an existential crisis as synthetic alternatives gain popularity. Meanwhile, Bitcoin, a digital currency once viewed with skepticism, is gaining momentum as a viable investment option. This change in preference marks an important turning point for the luxury goods and investment markets.

Diamond prices are plummeting

For decades, diamonds were considered one of the world’s most powerful and successful industrial cartels, dominated by South Africa’s DeBeers Consolidated Mines. The company controlled more than 90% of the global diamond market for most of the 20th century.

However, this monopoly began to collapse in the 21st century. The rise of synthetic diamonds poses a serious threat to traditional diamond producers.

Growing interest in synthetic diamonds has turned the diamond industry upside down. They offer the same aesthetic appeal and physical properties as natural diamonds at a fraction of the cost. Consumers are increasingly attracted to these alternatives because of their economic, environmental and ethical benefits.

This shift is evident in retail spaces like Macy’s, where synthetic diamonds are gaining more attention than natural diamonds.

“For most people, a diamond is a diamond,” said Mary Carmen Gasco-Buisson, Pandora’s chief marketing officer. “What you want is incredible brilliance and beauty and meaning that can be put into a diamond,” she said.

Once called “synthetic,” lab-grown diamonds have been rebranded by the Gemological Institute of America to reflect their authenticity as luxury goods. The Federal Trade Commission’s recognition of these products as true diamonds further legalized them, leading to a surge in global sales.

“Laboratory-produced diamonds have essentially the same chemical, optical, and physical properties and crystal structure as natural diamonds. Like natural diamonds, the carbon atoms are tightly bonded. They react to light in the same way and are as hard as natural diamonds. “The main difference between lab-grown diamonds and natural diamonds is their country of origin,” the Gemological Institute of America said.

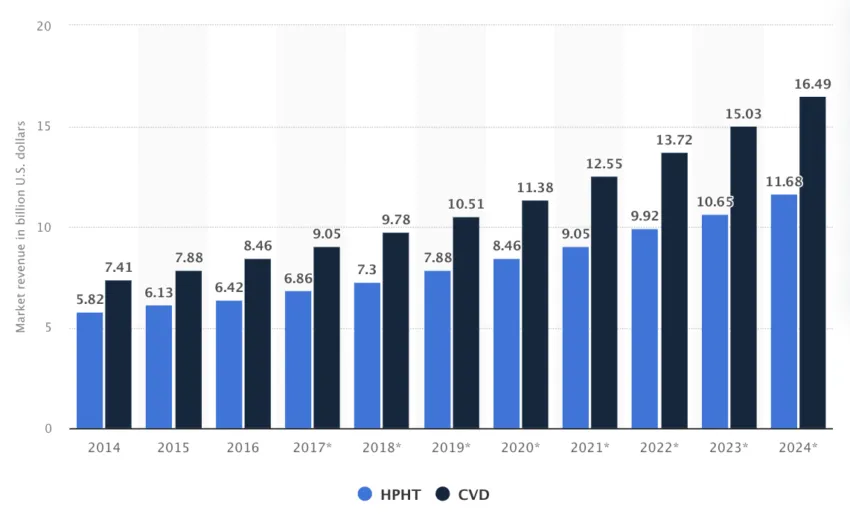

For example, in 2022 alone, synthetic diamond sales reached $12 billion, a 38% increase over the previous year.

The decline in the diamond market, exacerbated by global inflation and changing consumer preferences, has wider implications for investment strategies. As traditional luxury goods lose their luster, investors are turning to alternative assets like Bitcoin.

Bitcoin (BTC) will surpass $1 million

Bitcoin’s rise as an investment option has been as dramatic as diamond’s fall. Once a niche digital currency, Bitcoin has captured the attention of both institutional and individual investors. Its limited supply and decentralized nature make it an attractive hedge against inflation and market volatility.

Bitcoin’s potential has been further highlighted by expectations of the approval of a spot Bitcoin exchange-traded fund (ETF), which could trigger massive capital inflows into the cryptocurrency.

“I don’t think the (current) rally is a very special one. It is a gathering of ants. “The real rally is when (Bitcoin) hits $1 million, and that’s when spot (Bitcoin) ETFs get approved, and in a very short period of time, tens of billions, maybe even hundreds of billions of dollars are flowing into Bitcoin.” Samson Mow, CEO of JAN3, said:

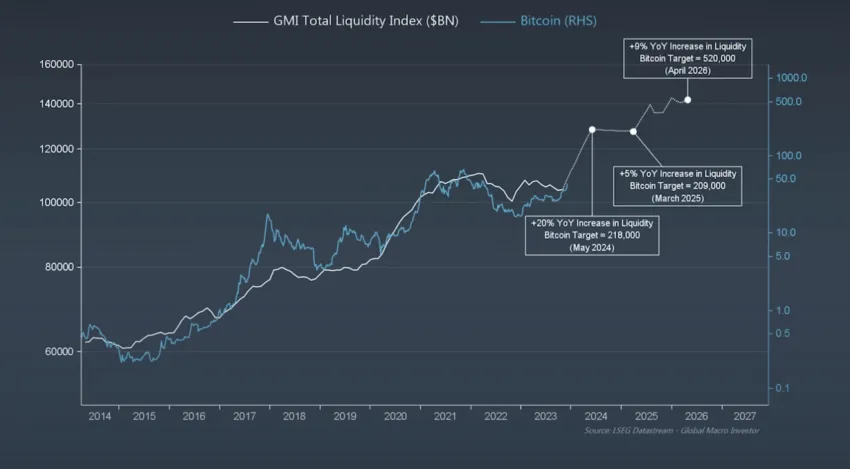

Likewise, Raoul Pal, CEO of Real Vision, predicted a parabolic surge in the value of Bitcoin. This optimistic outlook is based on the interplay of supply and demand dynamics, macroeconomic trends, and the growing acceptance of Bitcoin as a legitimate asset class.

“These cycles can be strange, and this one feels more like the 2017 cycle than previous cycles. And there wasn’t a lot of central bank printing in that cycle… Central bank balance sheets are (currently) rising. We saw a 20% growth and what happened to liquidity was that the cryptocurrency completely exploded. “I think so now.” Pal said.

Read More: BTC Price Prediction in 2024: What Happens After Bitcoin ETF Approval?

Bitcoin’s rise and diamond’s decline reflect broader changes in social values and investment strategies. While diamonds represent a static form of luxury, Bitcoin offers dynamic growth potential. This shift is not about choosing one or the other, but about understanding what constitutes value and wealth in modern society.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.