- MANA and AXS have shared a similar price trajectory over the past few weeks.

- Examining other indicators revealed who the crowd favored more.

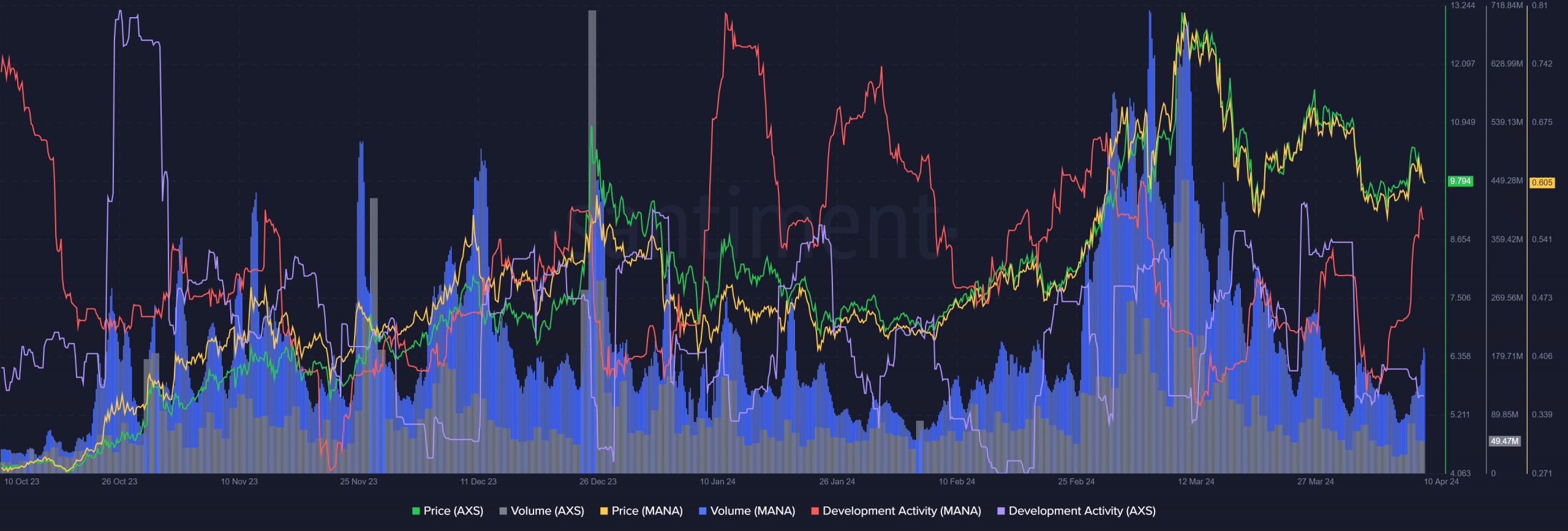

A recent Santiment post from X (formerly Twitter) highlighted the vast differences between Decentraland (MANA) and Axie Infinity (AXS) in terms of development activity. These two tokens are worth taking a look at, as they were among the most popular tokens in the virtual reality and gaming sectors in 2020.

MANA’s development activities far surpassed those of Axie Infinity. In fact, according to Santiment, Decentraland’s 30-day development activity is 168.33, compared to Axie Infinity’s 19 days. Therefore, AMBCrypto decided to dig deeper and investigate whether the latter was lagging in other metrics as well.

MANA’s lead in development activities is not new.

Source: Santiment

The price action of both tokens has been very similar in recent months. In particular, the two have been climbing the charts hand in hand since the end of February. Therefore, it can be argued that the same market factors drove the prices of both tokens.

However, trading volumes also varied greatly. MANA has consistently seen higher trading volume than AXS. Likewise, MANA’s lead in development activities is not limited to just the past month.

In fact, MANA’s development activity has been higher than AXS since mid-December, according to Santiment data. This difference was particularly notable in late January.

Investor sentiment toward Decentraland is also favorable.

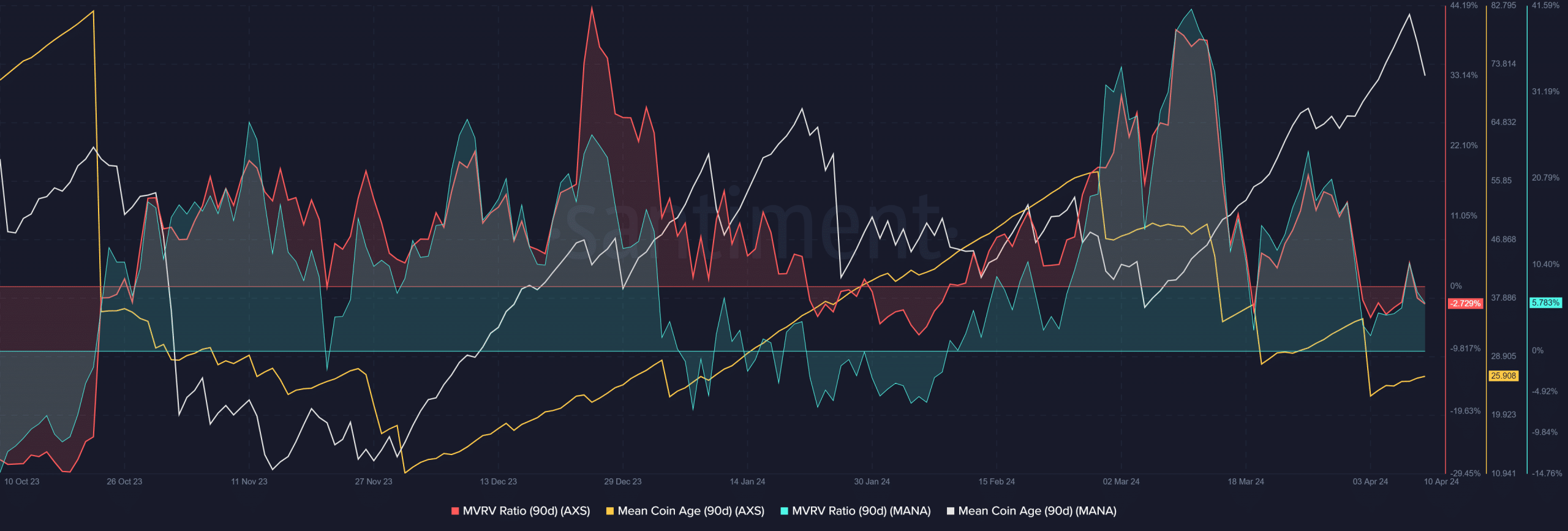

Source: Santiment

High development activity means the project has more features, problems can be solved, and fraud is less likely to occur. This significantly increases investor confidence. Faith in MANA is also highlighted by its average currency age of 90 days. This indicator has been showing an upward trend for the token since late November.

Meanwhile, AXS’s average age of currency has been declining since early March. AXS’s MVRV ratio also suggested a slightly undervalued asset.

Is your portfolio green? Check out Decentraland Profit Calculator

Lastly, MANA holders, unlike AXS holders, were making small profits at press time.

Although the price action was very similar, on-chain indicators highlighted key differences in how users view the two projects. Simply put, MANA and Decentraland currently have an advantage over AXS.