- At the time of writing, MANTLE seemed to have a weak swing structure in daytime.

- The decline of less than $ 1.03 showed a weak rescue on the daily chart.

Mantle (MNT) saw a 13%drop in prices on Friday, February 21. The trading volume is now relatively powerful in recent weeks. This suggests that Altcoin may not be able to recover quickly.

Mantle’s price behavior showed several weak signals.

Source: TradingView’s MNT/USDT

The main swing levels of the weekly period are $ 1.51 and $ 0.56 (white) in April and 2024, respectively. Since then, MNT has made the lowest at $ 0.549 to a low low level and $ 1.39 (yellow).

This showed that the weekly swing structure is weak. The daily market structure was also weak. Recently, the decline of less than $ 1.03 has confirmed that the weak market rescue is stopped.

In addition, the price fell to 75% of the previous range formation (purple) of $ 0.83 and tested. In the future, $ 0.915- $ 0.956 is expected to serve as a supply zone. Swing traders can find low time zone analysis to enter short -term transactions.

Technical indicators agreed to this discovery. The CMF is -0.1 and emphasized significant capital outflows. DMI emphasized the strong weakness in the daily chart with ADX and -DI more than 20. This agreed with the weak market structure mentioned earlier.

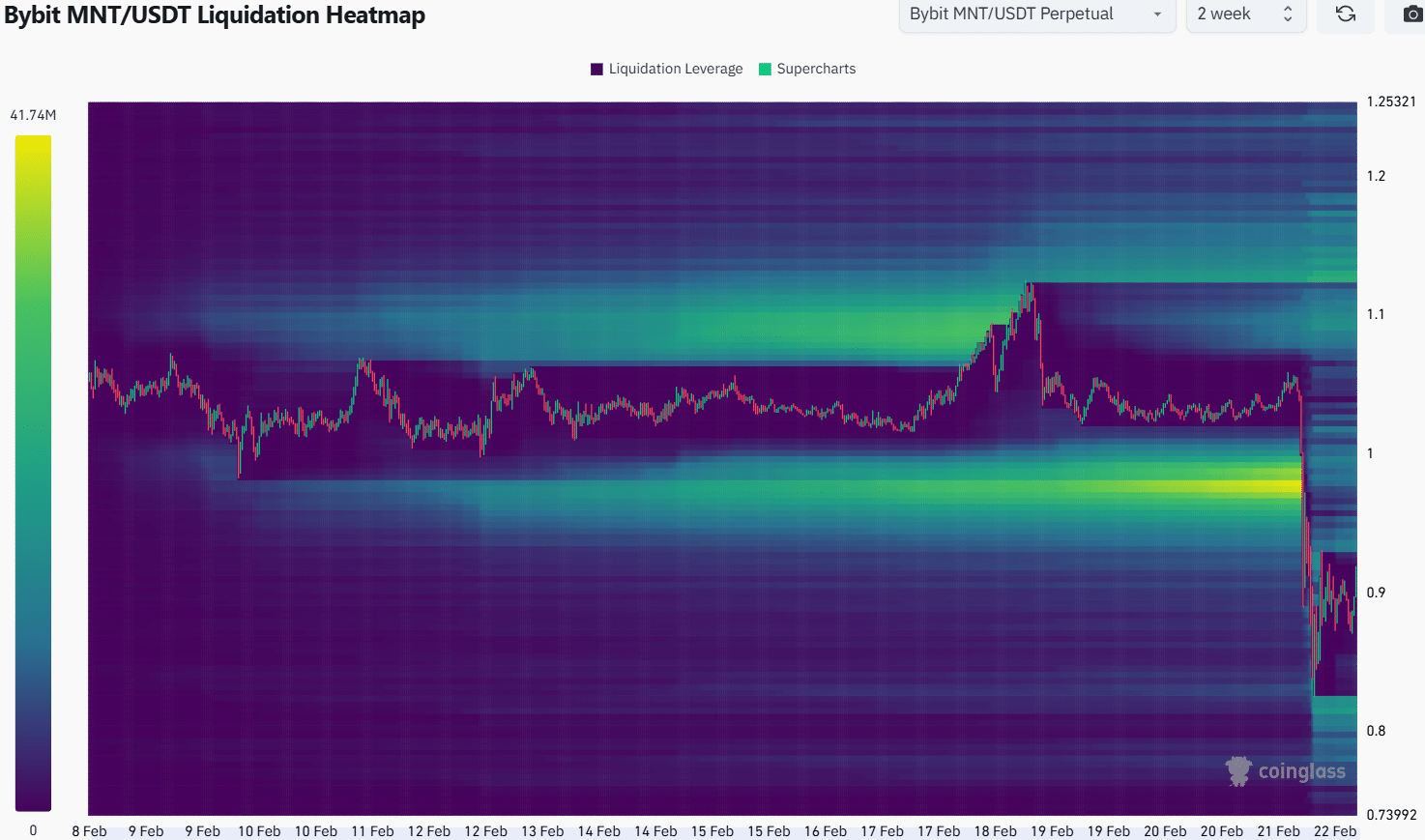

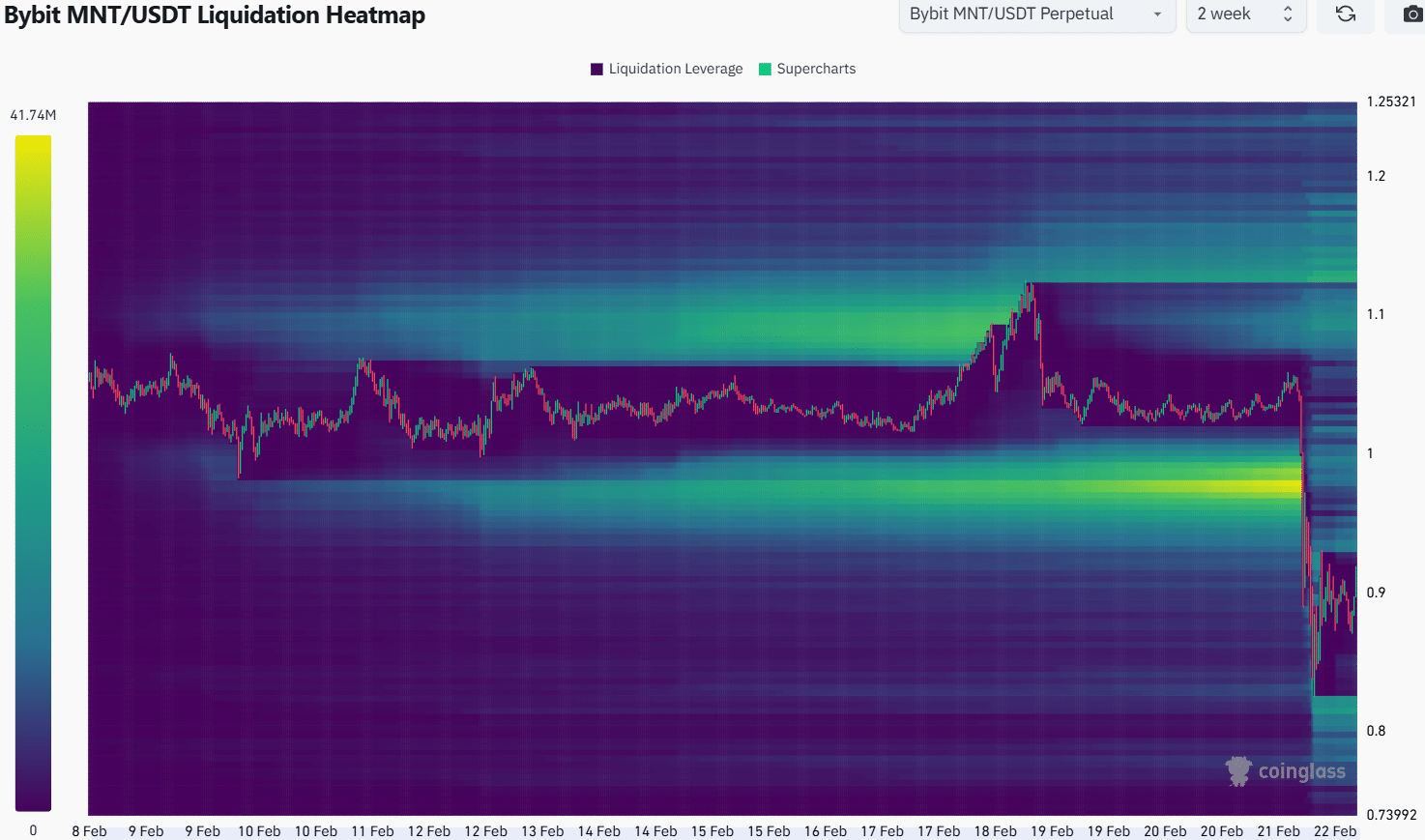

Source: COINGLASS

The liquidation heat map reveals that there is no $ 1 liquidity cluster during Altcoin’s recent losses. This long liquidation cascade would have contributed to $ 0.83 recently.

After such a powerful movement, the price will be integrated around $ 0.9 mark. This will give time to the level of liquidation above and below the construction price. Then the price can be visited two pockets before the next impulse moves.

I’m not sure which one will be tested first, but the swing trader can wait to move to $ 0.95-$ 1.03 before entering the country. If you move more than $ 1.1, the weak setting will be invalidated, so it can be used to set the stop loss order.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.