Market Outlook #245 (13th November 2023)

Hello, and welcome to the 245th instalment of my Market Outlook.

In this week’s post, I will be covering Bitcoin, Ethereum, Chainlink, Polkadot, ImmutableX, Perpetual Protocol, DIA, Saito and Cellframe.

As ever, if you have any requests for next week, let me know.

Bitcoin:

Weekly:

Daily:

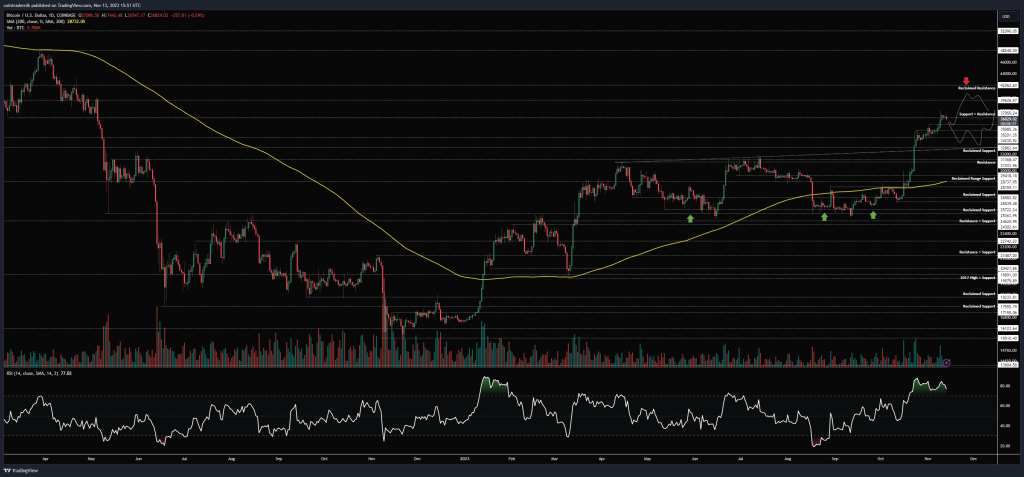

Price: $36,982

Market Cap: $721.671bn

Thoughts: If we begin by looking at BTC/USD on the weekly chart, we can see that price rallied again last week off the weekly open, on higher volume than the previous week, pushing through the 38.2% fib retracement of the bear market at $36k into $37.1k, poking marginally above that but closing at the level. We see no signs still of momentum exhaustion on this timeframe, and given the close I am leaning towards continuation of this squeeze higher to fill in the rest of the gap into $39.6k this week. There is, of course, also the possibility that multiple ETFs are approved this week (though a slim chance), and in that case it is likely we push all the way into the 50% fib retracement and reclaimed resistance at $42k. Either way, there is nothing on the weekly timeframe that suggests a longer-term top is in, and if we do dip early this week I would expect it to be shallow.

However, if we drop into the daily, I have marked out two possible trajectories I am considering from here. The first is as above: we get a shallow pull-back towards resistance from last week at $36k, find support and continue higher into the resistance levels between $39.6k and $42k; the second trajectory is if this divergence in momentum is validated and we close back inside $35.2k and turn it into resistance, where I would then expect the rest of the lows of that week to be swept into $32.9k and price to then mark out a bottom around there. Exciting times ahead, regardless.

Ethereum:

ETH/USD

Weekly:

Daily:

ETH/BTC

Weekly:

Daily:

Price: $2110.58 (0.0571 BTC)

Market Cap: $254.658bn

Thoughts: If we begin by looking at ETH/USD, we can see from the weekly that the pair rallied hard last week, turning trendline resistance into support at the weekly open and then pushing into resistance at $2037, wicking above that just shy of the yearly high but closing back marginally above $2037. If this level now turns support, I would expect ETH to start playing catch up, with fresh yearly highs above $2172 finally opening up the move into the 38.2% fib retracement at $2425, which I have had marked out for a fair while. That’s the level I expect the pair to squeeze into over the next couple of weeks if we can now hold above $2037. If we close the weekly back below $2037, I would expect a bit more of a pull-back towards $1850 to mark out a higher-low before another run at yearly highs. Dropping into the daily, we can see that unlike BTC there is no momentum divergence here, and on this timeframe the pair is finding support at $2037 early this week, pushing off that level back towards last week’s high. Close the daily above $2172 and there is quite literally no resistance for another $250 move…

Turning to ETH/BTC, we can see that price wicked into 0.051 last week and found strong support, bouncing off that level all the way into prior support turned resistance at 0.0577 before rejecting and closing the week marginally below the 200wMA and the May 2021 lows at 0.0551. Nonetheless, that was quite the show of strength from bulls off that low and if we see continuation higher this week and price closes above the 200wMA and prior range support at 0.0551, in my view the cyclical bottom is likely to be in, with price then likely to push towards the trendline resistance. If we drop into the daily, we can see how we now have bullish structure with higher-highs and lows, and early this week price is finding support above 0.0551, pushing back into 0.0577 as we speak. Given how strong the push was last week off the bottom, I would expect to see 0.0577 give way if retested this week, and price to squeeze into 0.0594 before finding resistance. Bears need to see 0.0577 act as resistance once again here, with any close back below 0.0551 now looking like continuation of the longer-term downtrend. Let’s see how the week plays out.

Chainlink:

LINK/USD

Weekly:

Daily:

LINK/BTC

Weekly:

Daily:

Price: $15.33 (41,455 satoshis)

Market Cap: $8.495bn

Thoughts: If we begin by looking at LINK/USD, we can see that the pair continued its ascent last week and shows little sign of slowing, pushing through the 200wMA for the first time since April 2022 and closing right at the 23.6% fib retracement of the bear market at ~$16. Whilst volume still looks good and there is no momentum exhaustion on the higher timeframes yet, I would be wary to jump in right here around resistance. If we drop into the daily, again we can see no signs of divergence up here but I would be looking for a pull-back into $13.30 – or close to it – before looking for leveraged longs. That also aligns with a 200wMA retest, if we get it. However, if we don’t get that, we can look to play the squeeze into $21 by buying the first shallow pull-back after a daily close above $16.60 with invalidation below today’s low.

Turning to LINK/BTC, we can see more reason why we should not be quick to jump in with leverage here if you are sidelined, as the pair is pressing up against the 2022 highs and the 200wMA at 45k-47k satoshis. Weekly close above this would open up another 15% of upside into the next resistance, but would also signal a longer-term reversal and continuation into the 38.2% fib retracement at 76k satoshis, around which there are multiple levels of resistance. If we briefly look at the daily, we can see how there is some minor divergence up here but price is finding support at present above prior resistance at 40k satoshis. Unless we now close below that, it is likely we at least retest 45k here. Break and close above that level and obviously things look even more promising for LINK, with only air between there at 57k satoshis. However, either deviate above 45k and close back inside it, or just find resistance below it on a retest this week and break below 40k and I think we are likely to move 15% lower into 35.4k satoshis. The trend, however, is still very much pointing up moving into 2024.

Polkadot:

DOT/USD

Weekly:

Daily:

DOT/BTC

Weekly:

Daily:

Price: $5.61 (15,156 satoshis)

Market Cap: $7.268bn

Thoughts: Beginning with DOT/USD, we can see from the weekly that after two years of bear market the pair looks to have bottomed, breaking above 2023’s trendline resistance a couple of weeks ago and turning it into support last week, from which price rallied into the weekly close at $5.70, reclaiming multiple support levels. We are now consolidating between reclaimed support at $5.34 and resistance at $6, and if we pull back from here I would be looking for the formation of a higher-low above $4.42. If we don’t pull back here, I would expect to see any acceptance above $6 lead to another rally into $7.08, where there is historical resistance, with a weekly close above $6 also turning structure bullish on this timeframe. Above $7, the cyclical reversal is on and we can look at that $10-11 area next.

Turning to DOT/BTC, the pair has been in a downtrend for 910 days, losing 88% of its value from the all-time high during that period. Price fell within touching distance of the all-time low at 11.8k satoshis a few weeks ago and bounced, reversing sharply last week to close marginally below prior support at 15k satoshis. We still have bearish weekly structure and a firm downtrend here, but momentum is looking more promising after this rally. Bulls now want to see a higher-low form above the all-time low and price to then close back above 17.8k satoshis from there to begin looking like a longer-term bottom is in. If we drop into the daily, we can see that we are also sat marginally below the 200dMA, which as capped the pair since early 2022 – acceptance above that and turning it into support would be a promising sign for a sustained reversal, with 25.6k satoshis the next major resistance above that.

ImmutableX:

IMX/USD

Daily:

IMX/BTC

Daily:

Price: $1.22 (3286 satoshis)

Market Cap: $1.516bn

Thoughts: As IMX has only been trading for around 18 months, both pairs look virtually identical and so I will focus here on the Dollar pair.

Looking at IMX/USD, we can see that price formed a bottom in September below the $0.52 support level, deviating into $0.48 before rallying sharply on high volume into the 200dMA and rejecting. Price then formed a higher low in October above $0.52 and has since been rallying non-stop, breaking through the 200dMA at $0.70 and reclaiming that level as support, then continuing higher as far as support turned resistance at $1.31, which capped the pair earlier this year. This led to a sharp rejection and swift pullback into $0.80, which held firm as support, and the pair has v-reversed back above $1.10 since. We have the makings of some momentum exhaustion up here as we come into this 2023 resistance zone, but given the sharp reversal off that initial rejection, I would expect to see $1.31 give way on the next attempt. If that occurs and we flip that level as support, regardless of momentum indicators I think it’s likely we take out the 2023 high at $1.60 and run into $1.80 resistance. Beyond that, the rest of IMX’s first bull cycle awaits in 2024…

Perpetual Protocol:

PERP/USD

Weekly:

Daily:

PERP/BTC

Weekly:

Daily:

Price: $0.70 (1889 satoshis)

Market Cap: $50.764mn

Thoughts: Beginning with PERP/USD, we can see that price has been held within this broader range between all-time lows and resistance at $1.37 for over 500 days, more recently forming a higher-low above reclaimed support at $0.51 and pushing into resistance at $0.75. This $0.50-0.75 range has held for the best part of three months now and given the volume on the impulse candle off the bottom I am now looking for a weekly close above $0.75 to confirm continuation to the top end of the range later this year. Longer-term, a weekly close above $1.37 is what we are looking at for the next phase of the cycle to begin, but for now as long as we are above $0.50 the pair looks bullish.

Turning to PERP/BTC, we can see that price had formed a range above the all-time low at 1516 satoshis and below prior support turned resistance at 1942 for months earlier this year before that high volume breakout candle in September. The pair then retraced all of that candle back into the all-time low last week, bouncing above it but remaining capped by 1942 satoshis. The first sign, therefore, that a reversal is underway would be a weekly close back above 1942. If we see that, I would expect price to push up into 2600 satoshis, retesting that area as resistance – and above that we come into the most important level on the chart to turn back into support at 3600 satoshis. Bullish above that all-time low, of course. Briefly dropping into the daily, we can see that price is now contending with the 200dMA, the trendline and horizontal resistance, so clearing this cluster with some force would be promising indeed. Accept above 1950 and I think we’re ready for the next wave.

DIA:

DIA/USD

Weekly:

Daily:

DIA/BTC

Weekly:

Daily:

Price: $0.30 (811 satoshis)

Market Cap: $33.26mn

Thoughts: If we begin by looking at DIA/USD, we can see from the weekly that the pair has been in a downtrend since April 2021 but that the volatility has drastically diminished on the most recent moves lower, with some momentum exhaustion coming into play. Price formed a double bottom at the all-time low at $0.215 in May and September, marginally sweeping that low before pushing off it to turn weekly structure bullish as price closed back above reclaimed support at $0.26. Since then, the pair has continued to push up, last week closing above $0.296. We are now sat right below support turned resistance at $0.33, but this is the last level of major resistance before a huge range opens up into the next areas of resistance up near $0.50. If we see that weekly close through $0.33, I will look to buy spot on a retest if I can get it and look for $0.49 as a first target, followed by $0.58 and $0.78 as the final target, given how significant that level is historically. Longer-term, above that level, I think we are in the midst of a bull cycle for DIA and can just look to buy pull-backs, but that is likely months away yet.

Turning to DIA/BTC, the pair is still capped by trendline resistance from that April 2021 high. A couple of weeks ago, the pair formed a fresh all-time low at 704 satoshis but we have clear trend exhaustion down here, and the pair has since reclaimed support at 788 satoshis which had previously held for several months. Whilst we could look to buy spot here for a cyclical (12-18 month) position with invalidation on a close below 704, I would prefer to be a little more patient here and wait for the trendline breakout and acceptance above 1000 satoshis for that. DIA has never experienced a bull cycle despite having traded for 3 years, so this is definitely one to keep an eye on. The cyclical position also differs from the short-term trade outlined in the Dollar pair, so depending on your preferences there are two ways to play this.

Saito:

SAITO/USD

Daily:

SAITO/BTC

Daily:

Price: $0.0085 (23 satoshis)

Market Cap: $18.063mn

Thoughts: As both pairs for SAITO look very similar, I will focus here on the Dollar pair.

Looking at SAITO/USD, we can see that price recently formed a low at $0.0065 and has rallied off that low above trendline resistance that has capped the pair all year. Whilst this breakout is promising for bulls, the pair remains below the 200dMA and is now sat around support turned resistance at $0.0086. This area is particularly significant historically for SAITO, having also been the May-June 2022 bottom and the original support level when trading began, so a strong reclaim of this level as support would, in my view, make it likely that the bottom is in here. Confirmation of this would be a weekly close above $0.01. In that scenario, I think the pair pushes up into the 360dMA and prior support around $0.0125 before finding any further resistance and then makes a run for the 2023 high at $0.023, beginning its next bull cycle. Obviously, if we see the pair reject here and close back below that trendline, this has been a deviation / failed breakout and we can expect the bottom to be retested at the very least…

Cellframe:

CELL/USD

Weekly:

Daily:

CELL/BTC

Weekly:

Daily:

Price: $0.225 (610 satoshis)

Market Cap: $6.493mn

Thoughts: Beginning with CELL/USD, we can see from the weekly that the pair remains capped by trendline resistance from the all-time highs and the earliest trading days, having spent most of its price-history in a downtrend but also having consolidated for over 500 days above the all-time lows. Price has recently turned weekly market structure bullish by closing above $0.185 and is now consolidating below $0.245 as resistance, with any acceptance above this level opening up another retest of that trendline overhead, as well as prior support at $0.37. I am very much still in my spot position here and am looking for a weekly close above the trendline and above $0.37 to confirm that the first phase of CELL’s first bull cycle is beginning. Fresh all-time lows remain my invalidation here and I am looking to hold this for the bulk of the cycle.

If we turn to CELL/BTC, we can see that the pair has been flat for the past 168 days above the all-time low but below prior support turned resistance at 770 satoshis. More important than that, however, is the level above it at 1150 satoshis. That is also the August 2021 bottom and so a weekly close above 1150 would turn weekly structure bullish and reclaim that historical level as support. If you are on the sidelines looking for an entry, you could look to enter either above that level or incrementally between here and there. I am personally focused here on the Dollar pair for my overall positioning.

And that concludes this week’s Market Outlook.

I hope you’ve found value in the read and thank you for supporting my work!

As ever, feel free to leave any comments or questions below, or email me directly at nik@altcointradershandbook.com.

You must be logged in to view this content.

You can register for access to the Premium Content via the sign-up form below or here.