- MATIC is struggling to find its footing after nearly all of its shareholders lost their earnings.

- The MVRV indicator showed that the token is in a bearish phase and needs a 13% upside to break out.

The situation for Polygon (MATIC) has worsened since the recent market correction. To be very specific, the token price crashed to $0.43 on July 5th.

To put this in perspective, the last time MATIC reached this level was in July 2022, when the cryptocurrency market was in a full-blown downtrend.

MATIC’s recent decline was consistent with the overall market, but in one respect it looked all its own.

Now, one would generally expect most or at least some of the top 20 crypto holders to see some form of profit at some point. But is that the case for MATIC?

Polygon finally leaves ‘Green Land’

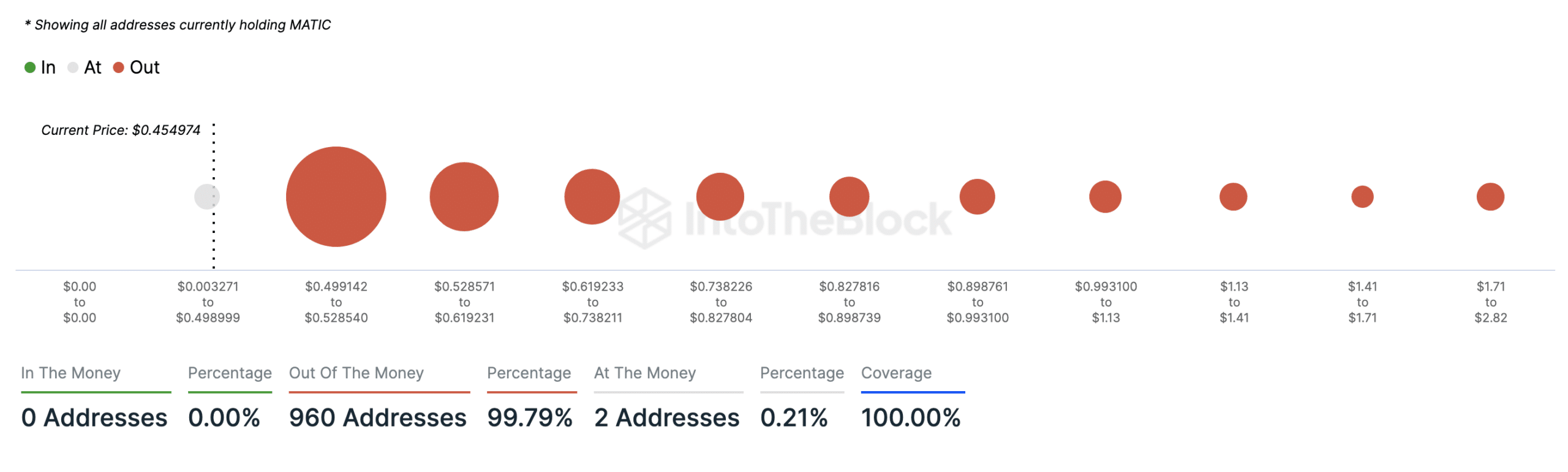

Well, the bad news is that MATIC can’t boast the same. According to IntoTheBlock, 97% of the project’s active addresses currently have no money. In simple terms, this means they are losing money on their tokens.

The remaining 3% did not make a profit, but reached the break-even point, meaning there were no unrealized profits among active MATIC holders.

In March, Polygon’s native token price reached a yearly high of $1.27, making many holders rich. However, since then, the altcoin has been in decline.

At the time of writing, the cryptocurrency was able to return to $0.46, but it never faced a huge sell barrier at its lowest price of $0.49.

Source: IntoTheBlock

In this area, 550 addresses bought 20.47 million MATIC. Therefore, if the price approaches this level, investors are likely to be willing to sell.

If this is true, the token value could drop back to $0.43. However, if buying pressure increases, the bulls may try to break this wall.

If successful, MATIC may retest $0.51 on the charts, but that is unlikely to happen anytime soon.

Will the bears continue to stay here?

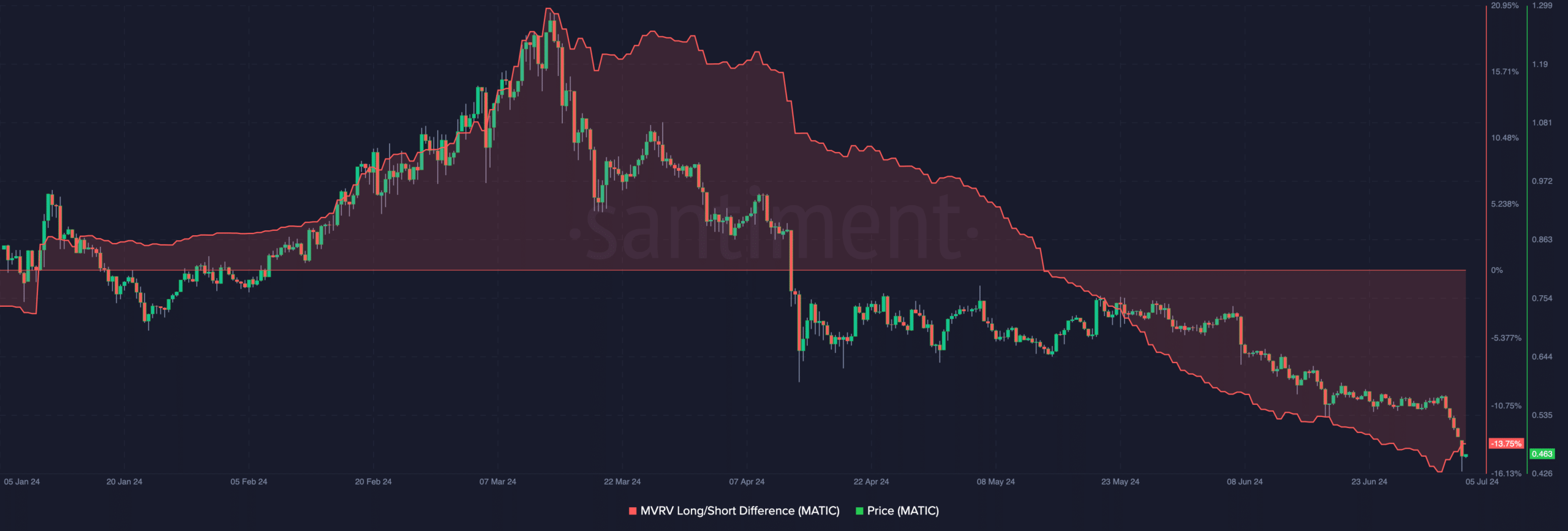

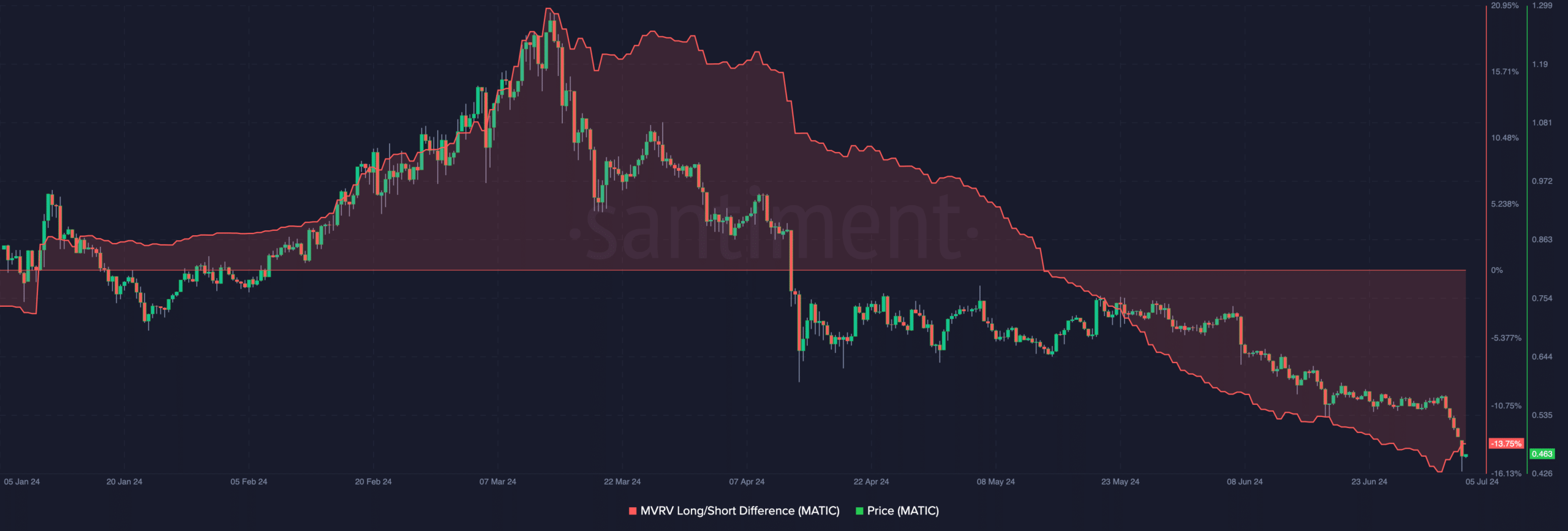

AMBCrypto also assessed whether MATIC had fallen back into a bearish phase. To do this, we looked at the long/short difference in Market Value to Realized Value (MVRV).

This metric calculates the difference between the MVRV ratio of long-term holders and the MVRV ratio of new token accruers.

If the indicator is positive, it means that the token is in a bullish phase. However, if the reading is negative, it means that it is in a bearish phase.

For this project, the MVRV long/short difference is -13.75%, indicating that MATIC is in the bears’ hands. The price needs to rise by 13% to get out of this zone.

Source: Santiment

Read Polygon’s (MATIC) price prediction for 2024-2025

When this happens, the token may try to retest its previous high, but if it fails to do so, the price may fall again.

This time it could fall to $0.40.