Maximize Bitcoin Returns with ETF Data

Since the introduction of the Bitcoin exchange-traded fund (ETF) in early 2024, Bitcoin has experienced multiple months of double-digit gains, reaching all-time highs. However, as impressive as these achievements are, there are ways to far exceed Bitcoin’s returns by leveraging ETF data to make trading decisions.

Bitcoin ETF and its impact

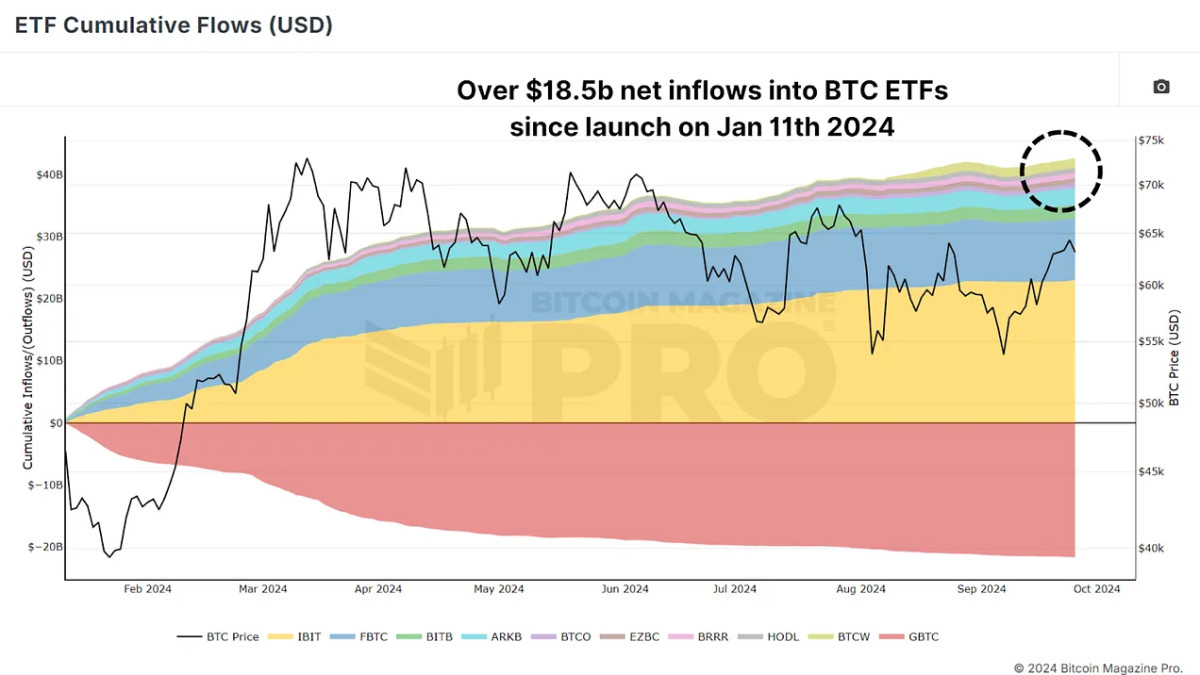

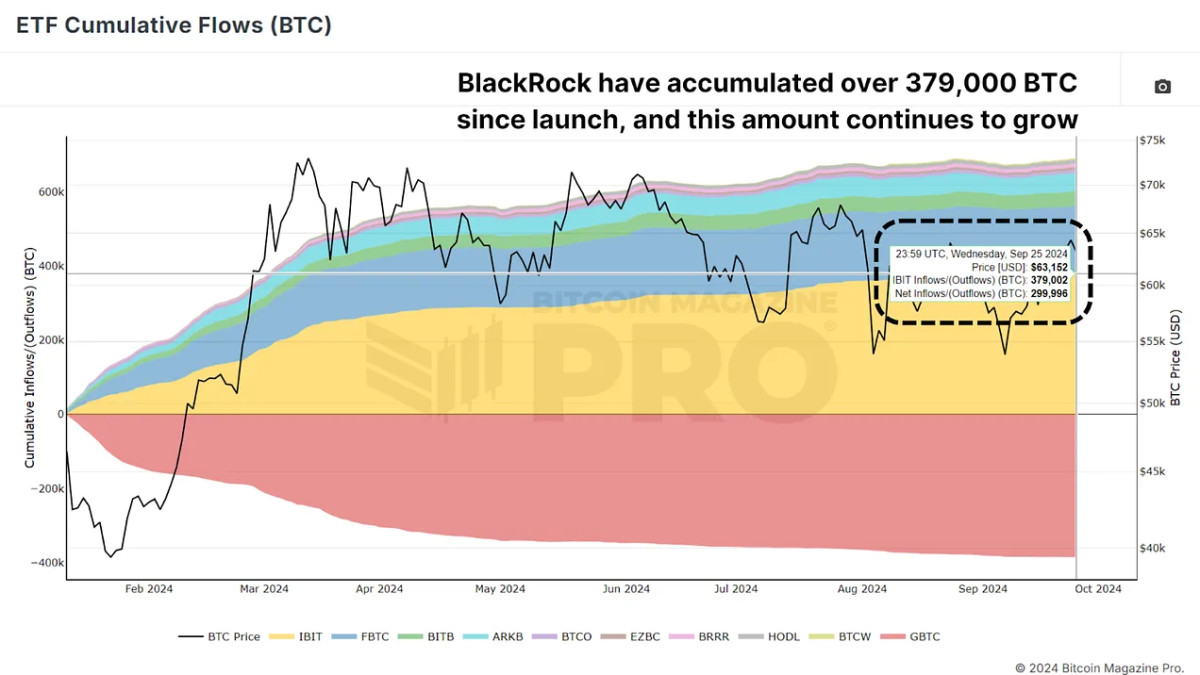

Launched in January 2024, the Bitcoin ETF quickly accumulated a large amount of Bitcoin. Tracked by a variety of funds, these ETFs allow institutional and retail investors to gain exposure to Bitcoin without owning it directly. These ETFs have accumulated billions of dollars worth of BTC, and tracking this accumulated flow is essential for monitoring institutional activity in the Bitcoin market and helps gauge whether institutional players are buying or selling.

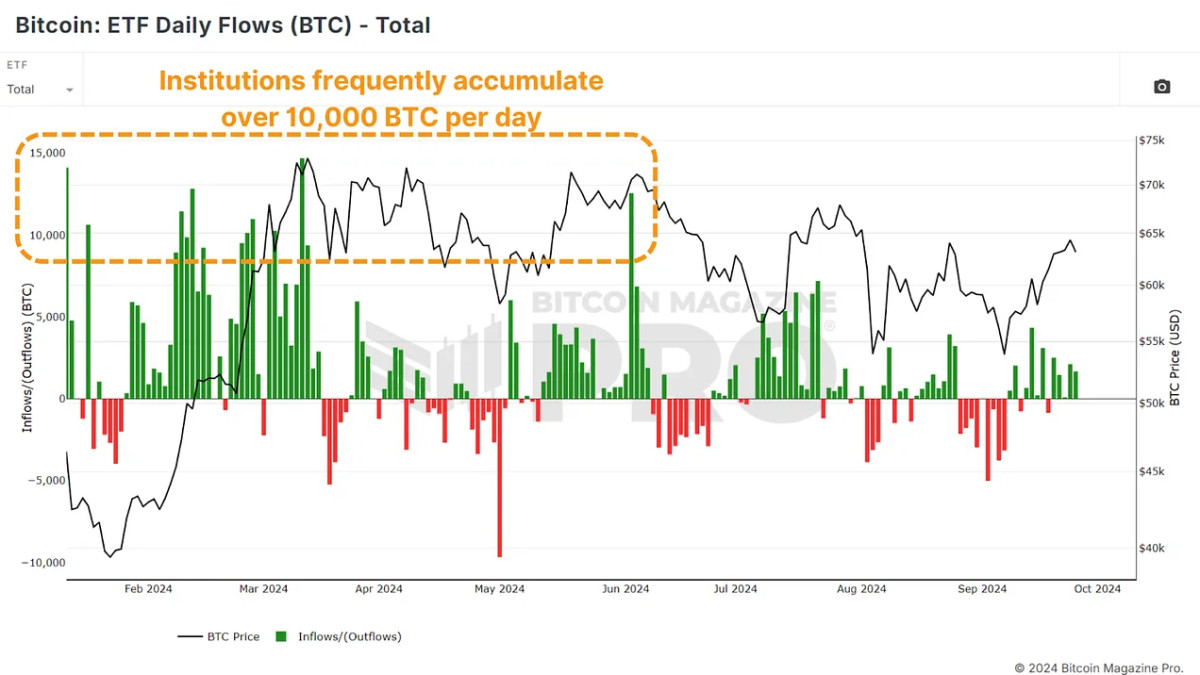

ETF daily inflows denominated in BTC indicate that large investors are accumulating Bitcoin, while daily outflows indicate that they are exiting positions during the relevant trading period. For those looking to outperform Bitcoin’s already strong 2024 performance, this ETF data provides strategic entry and exit points for Bitcoin trading.

A simple strategy based on ETF data

The strategy is relatively simple. Buy Bitcoin when ETF inflows are positive (green bars) and sell when there are outflows (red bars). Surprisingly, this method can produce outstanding results even during Bitcoin bull periods.

This strategy, while simple, has consistently outperformed the broader Bitcoin market by capturing price momentum at the right moment and avoiding potential downturns by following institutional trends.

the power of compound interest

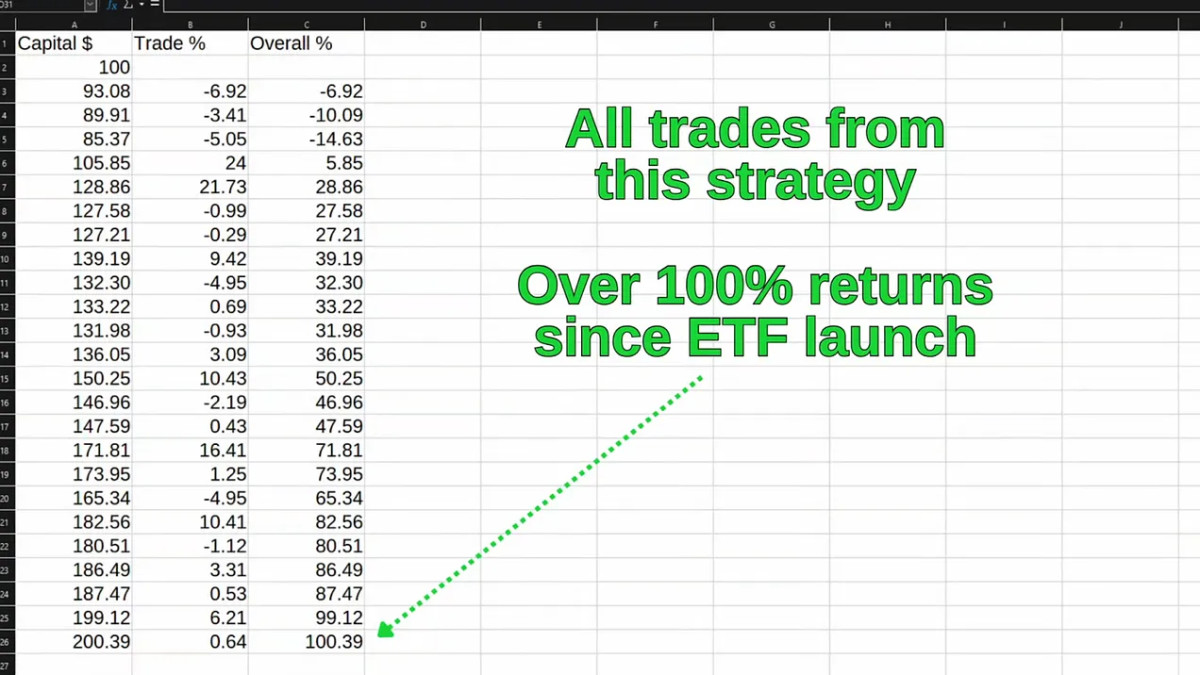

The real secret to this strategy lies in the power of compound interest. Compounding profits over time can significantly improve your returns, even during periods of consolidation or mild volatility. Imagine starting with $100 in capital. If you make a 10% profit on your first trade, you now have $110. The next trade generates an additional 10% profit on $110, for a total of $121. When you add up these gains over time, even small wins accumulate into significant profits. Losses are inevitable, but compounding wins far outweigh the occasional downturn.

Since the Bitcoin ETF was launched, this strategy has delivered returns of over 100% over a period of time, with returns of around 37% just for holding BTC. Even compared to buying Bitcoin on ETF launch date and selling it at the exact all-time high price. , which would have returned approximately 59%.

Can we expect further increases?

Recently, we have started to see a continuation of the positive ETF inflow trend, suggesting that institutions are once again accumulating Bitcoin in large quantities. We have seen positive inflows every day since September 19th, and as you can see, these often precede price increases. The BlackRock and IBIT ETF alone has accumulated over 379,000 BTC since its inception.

conclusion

Market conditions can change and there will inevitably be periods of volatility. However, the consistent historical correlation between ETF inflows and Bitcoin price appreciation makes it a valuable tool for those looking to maximize Bitcoin returns. If you’re looking for an easy set-it-and-forget-it approach, buy-and-hold may still be right for you. However, if you want to leverage institutional data to actively increase your returns, tracking Bitcoin ETF inflows and outflows could be a game changer.

To learn more about this topic, check out our recent YouTube video here. Beating Bitcoin Using ETF Data (Must Watch)