- The charts of Mana, Sand and AXS have revealed a notable supply cluster.

- Emphasis on the main accumulation areas that can define the next trend of the main meta bus tokens.

Meta Bus was once a big innovation of the digital ecosystem, and projects such as Decentraland (Mana), Sandbox (SAND) and AXIE Infinity (AXS) led to charging.

But over the past few years, over -advertising around Methabus has been greatly cooled. In fact, the price of major methus tokens suffered serious stagnation as investors’ interests were consistently reduced.

Now, as a sign of new participation and price activity, the important question is -Metavus tokens are preparing for a comeback?

Cost Standard Analysis -Signs of Accumulation or Distribution of Meta Bus Token?

Investigating the cost -standard distribution metrics for mana, sand and ax, resulting in some important insights into investor behavior. The chart has seen a significant supply cluster at a high price level with a clear price action since early 2025. The main overhead supply is a continuous overhead supply, and it suggests that many owners have purchased at a higher price level and are still in loss.

- Mana -The price decreased from $ 8.50 to about $ 3 in late 2024 until March 2024. The cost -based cluster indicated that the main part of the supply was concentrated between $ 6.50 to $ 8.00 and potentially served as a resistance zone.

Source: Glass Node

- Sand: During the same period, you can observe similar patterns from $ 0.90 to about $ 0.25. The biggest accumulation area is around the $ 0.60 mark, which represents a potential challenge to the attempt to reclaim the lost land.

Source: Glass Node

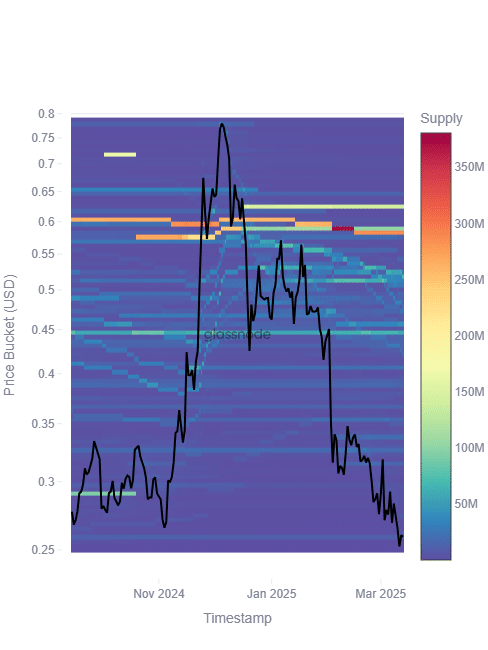

- AXS: AXS, one of the most popular play tokens before, reflects the decline. The supply was largely clustered from $ 0.55 to $ 0.70 and the price was about $ 0.30 on the chart.

Source: Glass Node

Investor feelings -Are you still cautious?

The chart also suggested that Meta Bus tokens have not yet escaped the long -term reduction. Despite the small signs of purchasing activities at an affordable price level, supply pressure was still high.

This can mean that short -term prices can face strong sales pressure of holders who want to destroy.

In addition, the hot chain did not show the main influx of new users. True metaban resurrection will require institutional interest and a wide range of adoption of methus-related platforms-still lacking factors.

Can Meta Bus tokens recover?

Metabus tokens need to meet some conditions to restore the amount of exercise.

- Increasing demand for higher trading volume and methbus platform -current price measures are still speculative without actual user participation.

- Reduced overhead supply-you can see that long-term holders are reducing sales pressure.

- Investors’ interests in Web3 and Metaverse Development -If a major company announces a new investment in space, tokens like Mana, Sand and AXS can benefit.

As it stands, Meta Bus tokens are trying to stabilize. But their recovery is not guaranteed. The chart has been implicitly suggested at a low level, but no meaningful brake out has yet occurred.

Therefore, investors must monitor carefully and key resistance zones before they expect a full -fledged meta -class resurrection.