Share this article

![]()

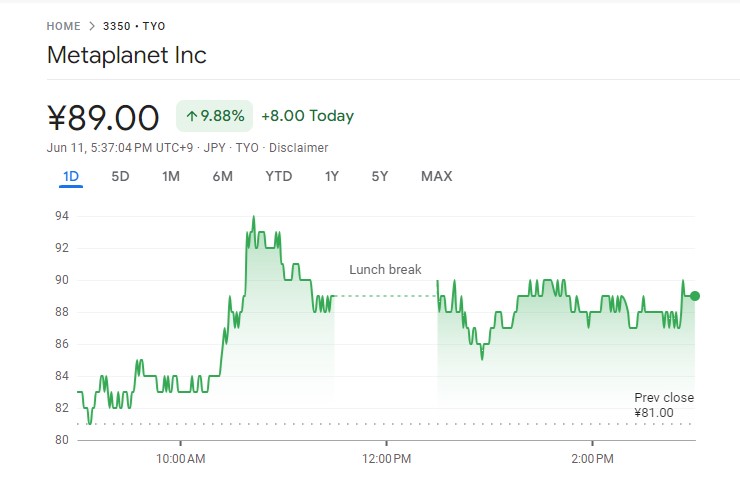

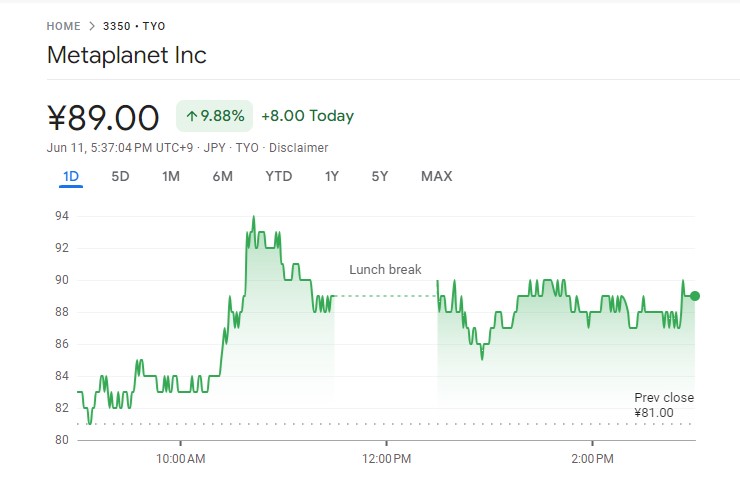

Shares of Metaplanet, a public company listed on the Tokyo Stock Exchange and often compared to MicroStrategy, surged 9.88% after the company announced its third Bitcoin acquisition, according to data from Google Finance.

Metaplanet said on Monday it had added 23.351 bitcoins (BTC), worth about 250 million yen ($1.58 million), to its holdings. With this acquisition, the company now holds over 141 BTC worth approximately $9.54 million.

The new move, which was approved by the company’s board of directors, is also the third Bitcoin acquisition in two months. The company previously made purchases on April 23 and May 10.

The company’s average Bitcoin acquisition cost is approximately 10.27 million yen, or approximately $65,300 per unit. Despite the recent decline in the price of Bitcoin to around $67,500, Metaplanet’s investment strategy appears to be paying off.

The company’s stock price rose to 89 yen at the close on Tuesday, up significantly from 19 yen on April 9, when Metaplanet first announced its Bitcoin investment focus.

Metaplanet has realigned its corporate strategy to focus on Bitcoin as its primary treasury reserve asset. This pivot came in response to difficult economic conditions in Japan, characterized by high government debt, persistently negative real interest rates and a weak yen.

Yesterday, Canada-based DeFi Technologies revealed that it has started adding BTC to its treasury. The company purchased 110 BTC, worth more than $7.5 million at the time of purchase. The stock ($DEFTF) soared 11% following the announcement.

According to a report by BitcoinTreasuries.net, global listed companies hold a total of 308,688 Bitcoins, with MicroStrategy leading the way, owning 214,400 BTC, accounting for more than half of the market capitalization.

Share this article

![]()

![]()