- Michael Saylor predicts that Ethereum will be classified as a cryptocurrency asset security.

- Charles Hoskinson was quick to respond to Bitcoin maxi’s comments.

The United States is taking steps to regulate the cryptocurrency market, starting with platforms such as Kraken, Coinbase, and Uniswap. Now it appears that attention is turning to Ethereum (ETH). As expected, opinions are divided regarding these efforts.

Although some are opposed to the Securities and Exchange Commission (SEC) classifying ETH as a security, MicroStrategy’s chairman michael sailor I believe not.

Michael Seiler’s argument

Ethereum, the world’s largest altcoin, should be classified as a cryptocurrency asset and not a commodity, according to the executive. speaking Speaking at the MicroStrategy World 2024 conference, Saylor added:

“By the end of May we will find out that Ethereum will not be accepted. It will then be clear to everyone that Ethereum is considered a cryptocurrency asset security and not a commodity.”

He continued:

“After that, you will see that everything further down the stack – Ethereum, BNB, Solana, Ripple, Cardano – is an unregistered crypto asset security.”

What Saylor is arguing here is that none of the aforementioned tokens are included in a spot ETF, approved by Wall Street, or recognized as crypto assets by mainstream institutional investors.

Charles Hoskinson intervenes.

Needless to say, Saylor’s comments didn’t sit well with everyone. Cardano co-founder criticizes executive remarks Charles Hoskinson I went to X (formerly Twitter) and commented:

“Michael, if your only argument for Bitcoin is that governments value and love Bitcoin and all altcoins are hated by governments, then you’re on the wrong side of history, my friend.”

His response highlighted the widespread notion among Bitcoin maximalists that cryptocurrencies other than Bitcoin may be considered illegal or fraudulent. This criticism addressed a broader debate within the cryptocurrency community regarding the legality of alternative digital assets.

However, this is not the first time Hoskinson has taken a stance on altcoins. A month ago, a Forbes article labeled several cryptocurrencies as “crypto zombies.” The list included Cardano (ADA), Ripple (XRP), and Bitcoin Cash (BCH).

answer In response to the aforementioned criticism, Hoskinson said:

“Hello @tezos @Algorand @bitcoincashorg @Ripple_XRP1 @StellarOrg @BobSummerwill According to Forbes, we are all cryptocurrency zombies. “I think it’s because we have all the brains.”

Ben Armstrong, also known as BitBoy Crypto, expressed concern about Cardano and said, “ADA is truly dead.” Cleans the surrounding air, hoskinson I answered.

“I’m sorry, Ben. Once Ada gets on the train, there will be no more discussion about cryptocurrencies. I wish you the best of luck in the coming years.”

Investors’ interests are not affected.

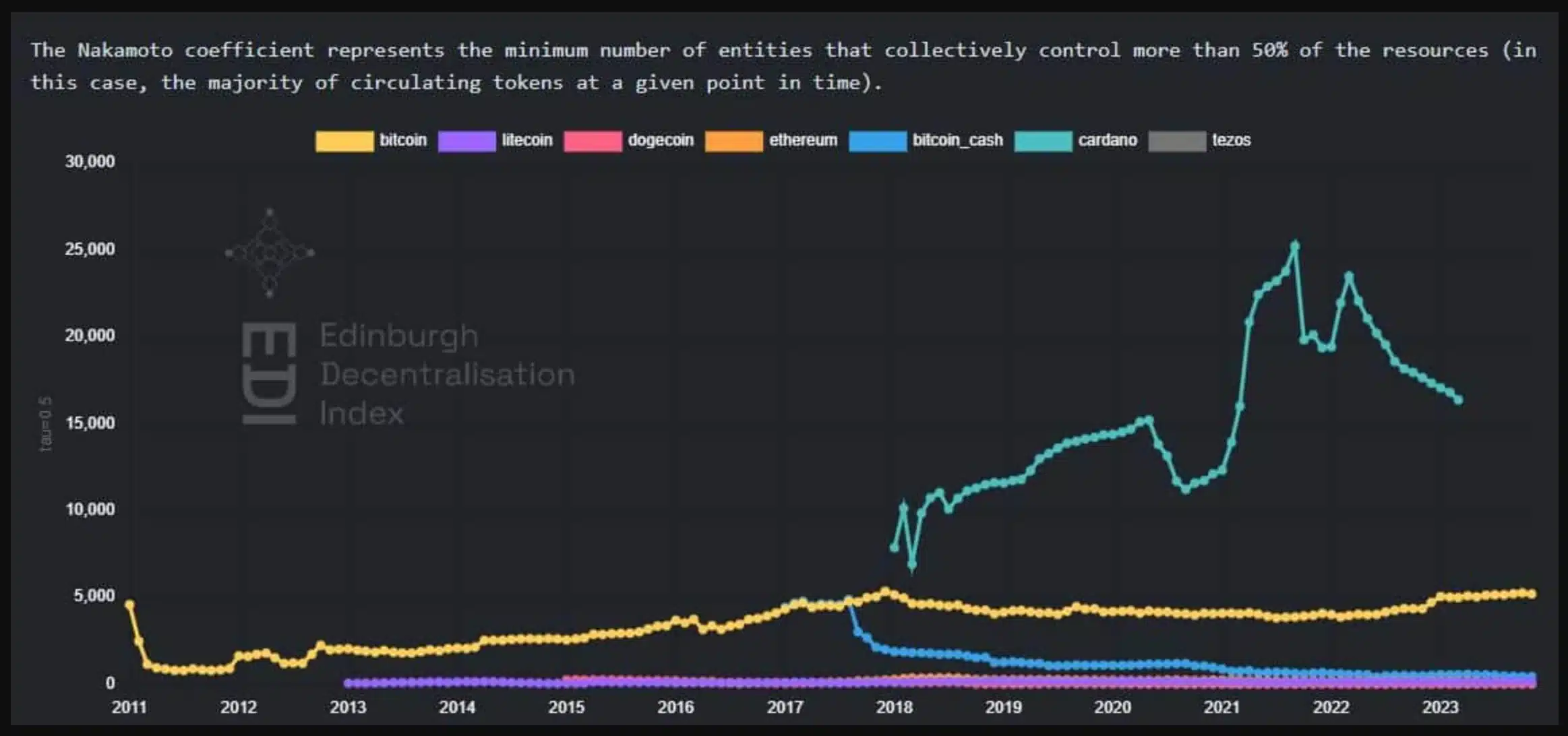

These comments emphasize that such speculation is merely speculation. In fact, recent research shows that Cardano has a higher Nakamoto coefficient than other altcoins, indicating greater decentralization.

Source: EDI