- MicroStrategy has outperformed other major stocks in terms of price performance.

- As of this writing, the BTC price is hovering around $65,000.

Bitcoin (BTC)’s recent rally has created a bullish mood in the market over the past few days. In addition to altcoins, crypto-related companies have also risen.

MicroStrategy Stock Outperforms Everyone

MicroStrategy stock in particular has seen significant gains, with the company’s strategic decision to accumulate Bitcoin as a core component of its stores proving exceptionally profitable.

As a result, MicroStrategy stock (MSTR) outperformed tech giants like Nvidia, Tesla and Microsoft. The world’s largest corporate bitcoin holder saw its shares surge 15% on Monday, closing at $1,611.

This impressive rally coincided with Bitcoin’s price surge to $65,000.

MicroStrategy has shown an impressive growth trajectory, outperforming Bitcoin significantly over the past year. While Bitcoin experienced a modest 13% gain on the weekly chart, MSTR stock has surged by over 22% over the same period.

The difference in performance is even more striking when considering a wider time frame. Since the beginning of 2024, MSTR’s stock price has soared by an astonishing 135%, outpacing Bitcoin’s 44% gain over the same period.

Moreover, MSTR stock is up an impressive 258% on the yearly chart.

A key catalyst for MicroStrategy’s outstanding performance is its significant Bitcoin holdings. The company’s strategic investment in Bitcoin has proven to be highly profitable, generating significant shareholder value.

To enhance accessibility and expand its investor base, MicroStrategy recently announced a 10-for-1 stock split. This corporate action is designed to make MSTR stock more affordable to both existing and potential investors, including employees.

The stock split is scheduled to take effect on August 1, and the shares are scheduled to be distributed after the market closes on August 7.

Michael Saylor is proud

Michael Saylor recently tweeted about MicroStrategy’s outstanding performance, showing a chart showing the stock up a whopping 1,203% since August 10, 2020.

The surge outpaced major tech companies such as Nvidia (1,050%), Tesla (167%), Amazon (22%) and Apple (108%).

Saylor, who attributes MicroStrategy’s success to its Bitcoin strategy, encouraged companies looking to compete with Nvidia to adopt a similar approach. The company has been aggressive in acquiring cryptocurrencies since 2020, amassing $7.538 billion worth of Bitcoin.

To fuel these purchases, MicroStrategy raised significant funds through debt issuance. In order to increase its Bitcoin holdings, the company successfully increased its debt issuance from $500 million to $700 million in June.

Source: X

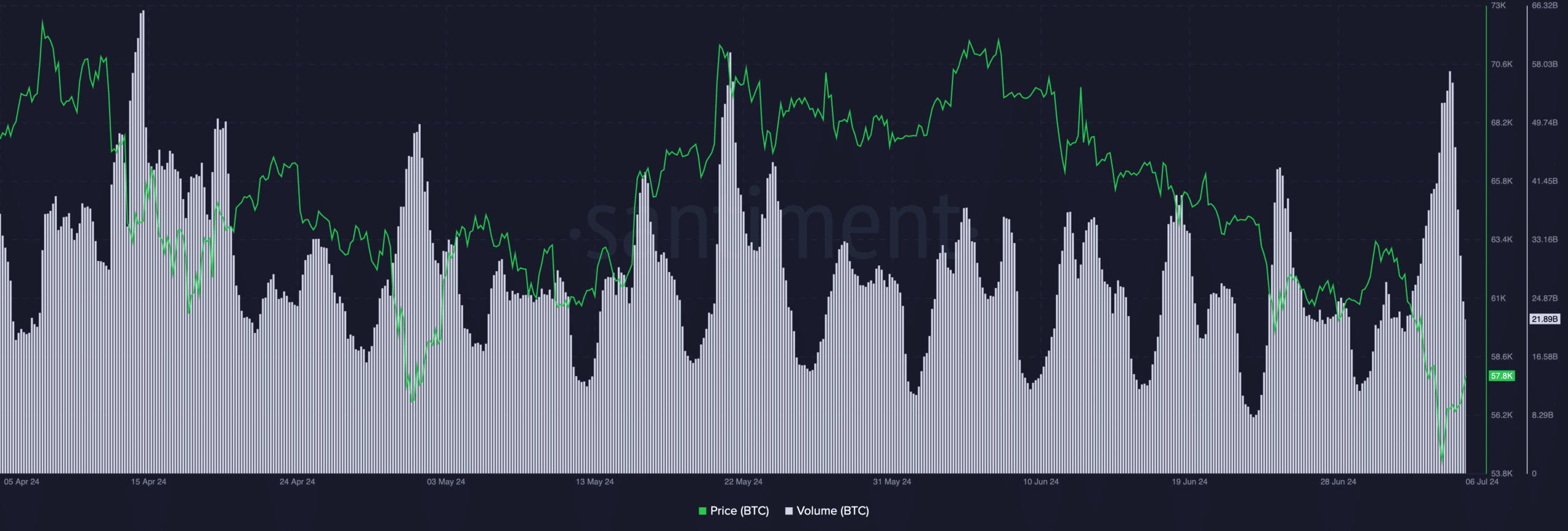

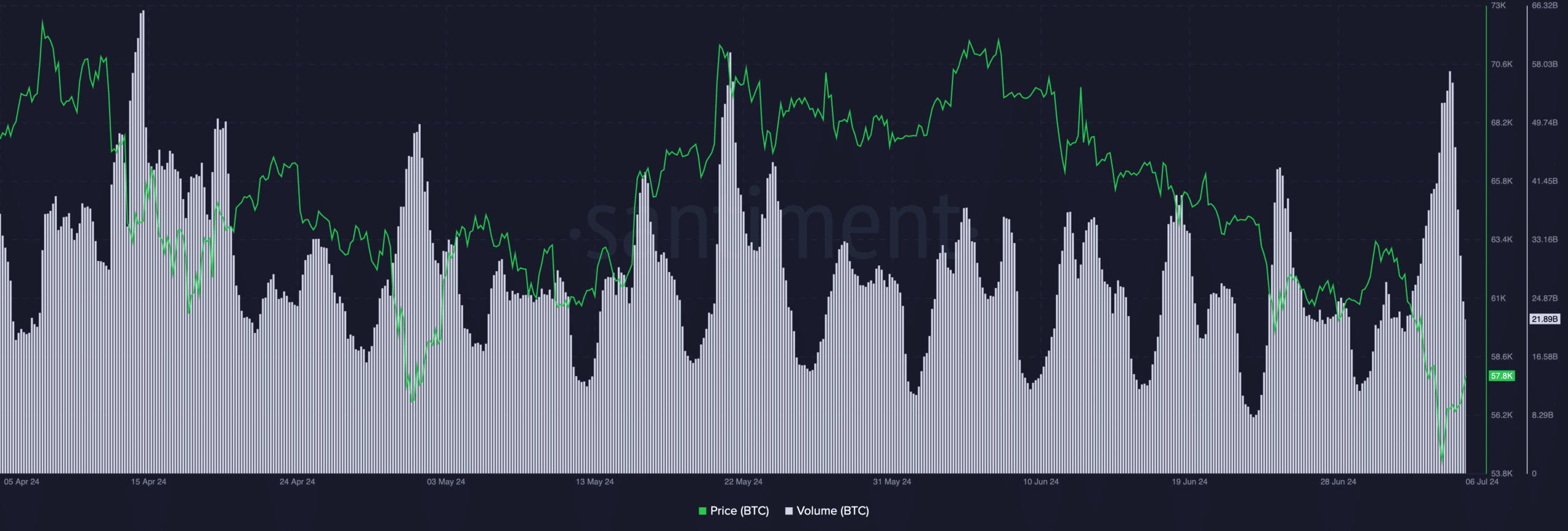

At the time of writing, BTC was trading at $65,321.79, with volume down 0.91% over the last 24 hours.

Source: Santiment