- Maker’s exchange holdings and exchange supply ratio are hitting annual highs.

- MKR surged 30.8% last week.

Cryptocurrency markets have seen a strong rally since the US presidential election, with Bitcoin (BTC) hitting a new ATH of $89,000. In this bull market, most altcoins and memecoins have reached h.

However, some have achieved modest price recoveries while still maintaining overall bearish sentiment. One such altcoin is Maker (MKR), which has seen a modest price recovery.

In fact, at the time of writing, Maker was trading at $1490. This represents an increase of 1.90% on the daily chart. Likewise, the altcoin is up 30.8% on the weekly chart and 11.38% on the monthly chart.

Despite this rise, MKR remains approximately 76.56% below the ATH recorded four years ago. This means that altcoins are significantly underperforming, with most investors still feeling bearish. This is evidenced by the surge in exchange reserves and exchange supply ratios.

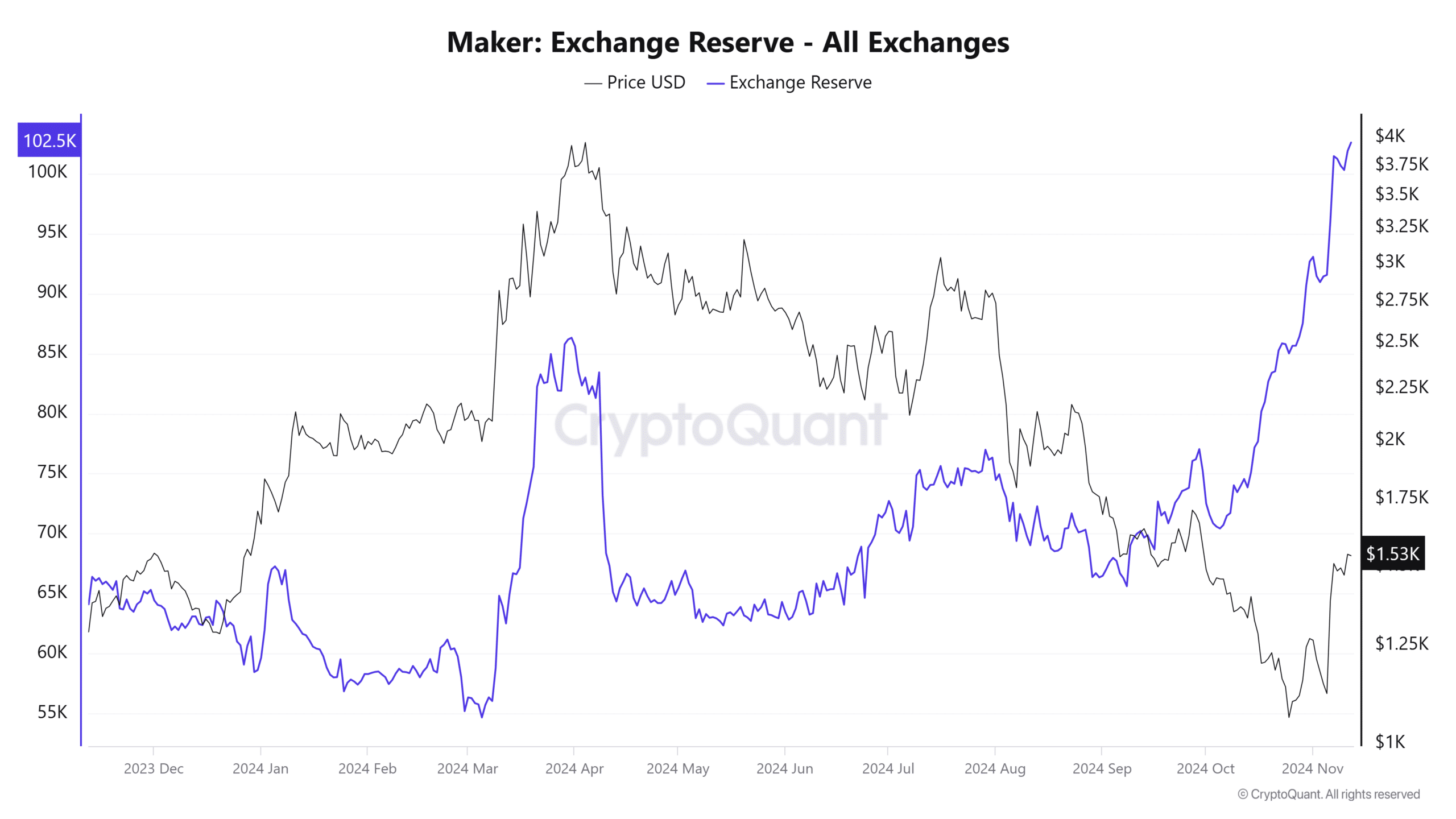

Maker Exchange holdings hit annual high

According to AMBCrypto’s analysis of CryptoQuant data, Maker’s exchange holdings hit a yearly high at press time.

Source: CryptoQuant

According to our observations, altcoin holdings on exchanges have surged over the past week after falling slightly in late October.

This surge in foreign exchange reserves shows a growing lack of trust among investors. This is a bearish signal because investors and holders are anticipating a decline in price and are preparing to close their positions to minimize losses.

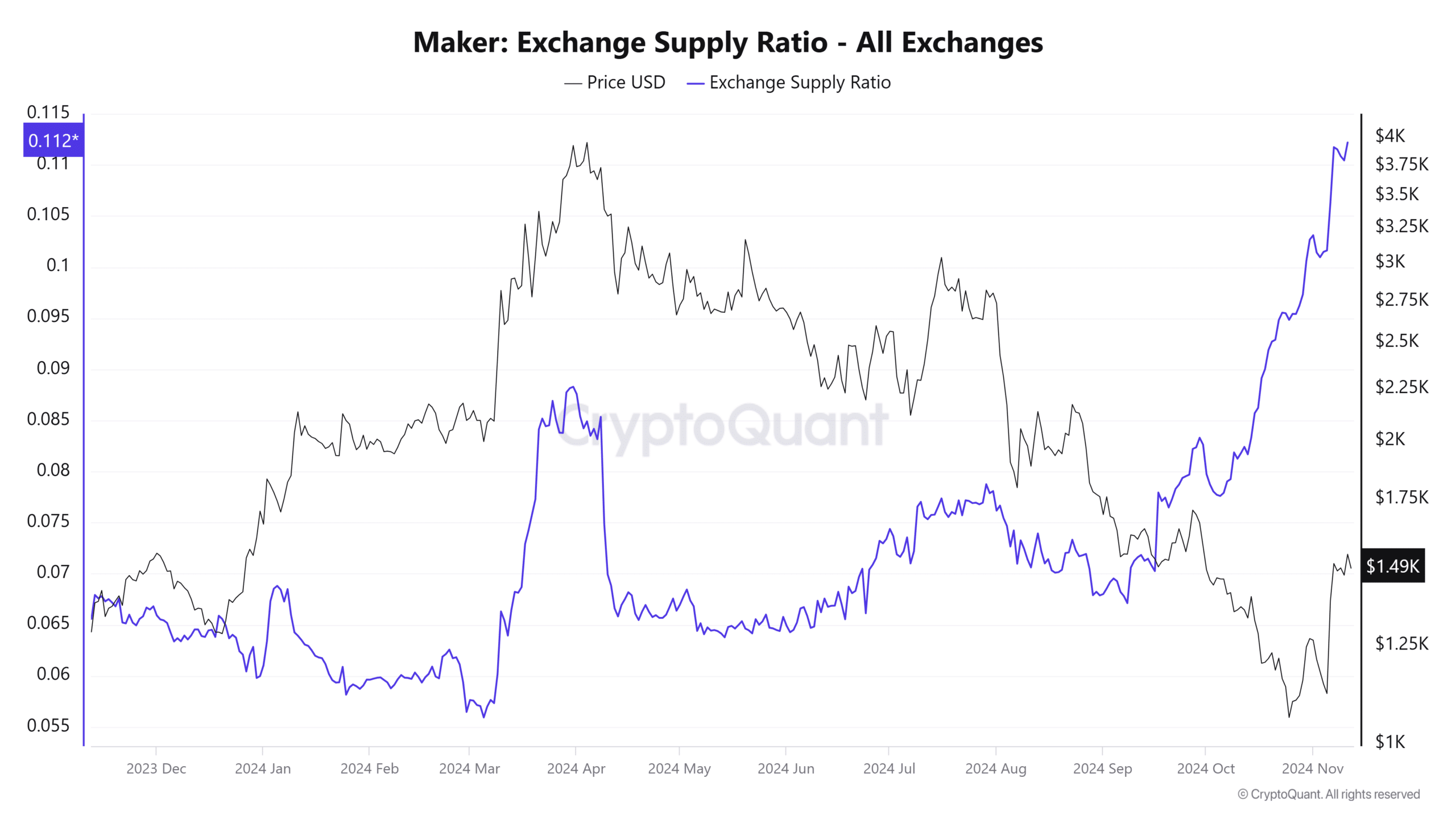

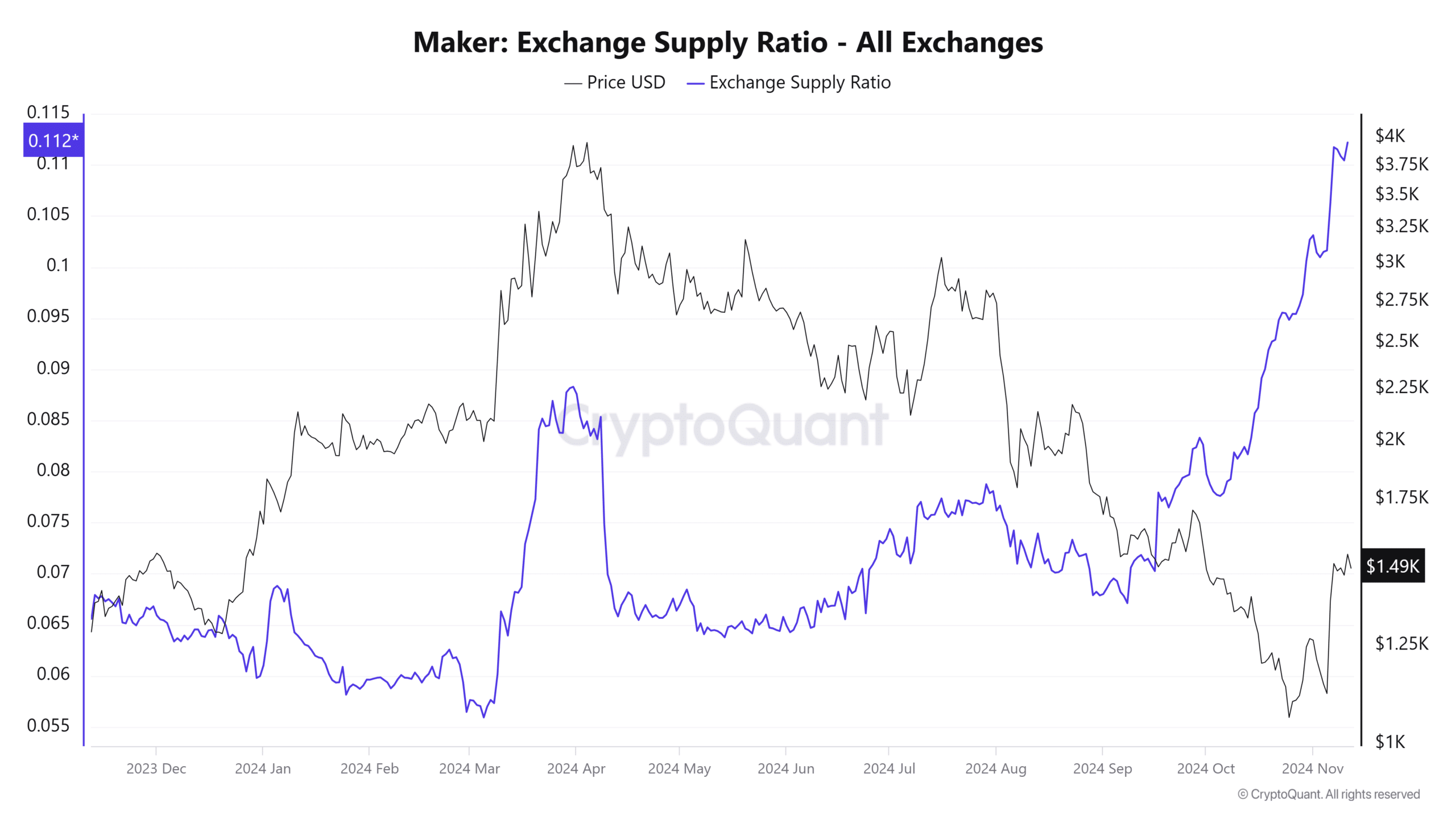

Source: CryptoQuant

The increase in transfers to exchanges is further evidenced by a surge in exchange supply ratios. It also broke an annual high.

When these two indicators hit one-year highs, you know the market is extremely bearish and most investors expect prices to fall.

What does the MKR price chart mean?

Generally, when foreign exchange reserves and the foreign exchange supply ratio soar, it means that investors are weak. So, despite the price surge over the past month, the market is still not entirely convinced of a potential upside.

This was further evidenced by the fact that ADX rose and RVGI fell.

Source: TradingView

Looking at ADX, it has surged from a low of 31 to 35 on the weekly chart. This means that upward momentum is weakening and downward momentum is strengthening.

The same phenomenon is seen in the bearish crossroads of the Relative Vigor Index. The signal line has crossed RVGI, indicating that the uptrend is losing momentum and waning in strength.

This serves as a selling signal that the seller is trying to gain too much control. When this happens, investors tend to sell short.

Read Maker’s (MKR) price forecast for 2024-2025

With these indicators showing a possible trend reversal, it is likely that MKR will fall before the market becomes strong enough to see another uptrend.

So, if this bearish sentiment holds, Maker will find support around $1320. However, if the bulls dominate the market with the recent uptrend, MKR will attempt the $1600 resistance level.