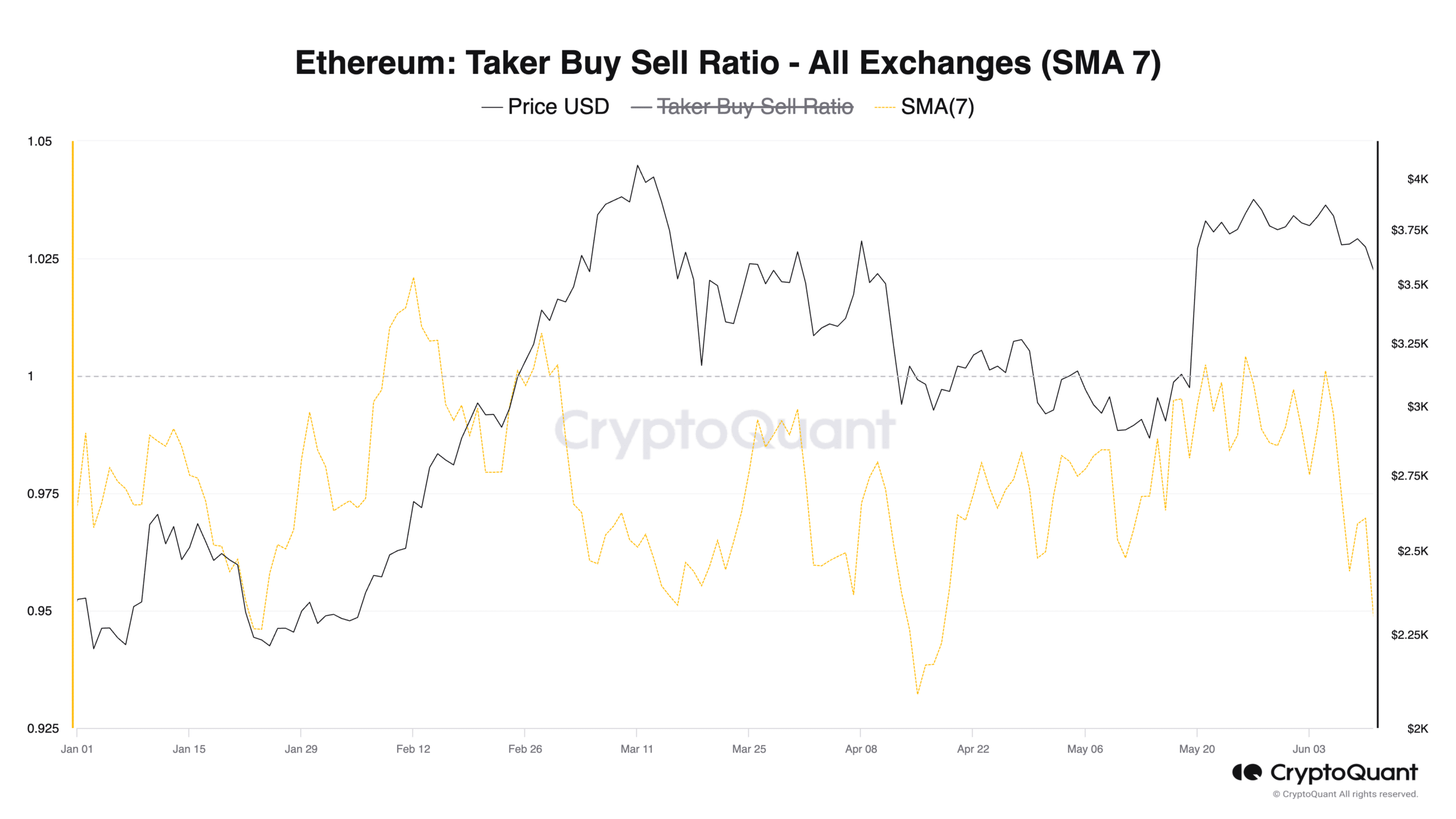

- of Ethereum teaThe aker buy-sell ratio has remained below 1 since June 5.

- This means that there is more selling than buying in the futures market.

Ethereum (ETH)’s Taker Buy Sell Ratio, assessed using the 7-day simple moving average (SMA), has been trending downward since June 5, according to data from CryptoQuant.

Since then, the metric has returned values less than 1, according to on-chain data providers. As of this writing, ETH’s Taker Buy Sell Ratio was 0.96.

Source: CryptoQuant

The taker buy sell ratio of an asset measures the ratio between buy and sell volumes in the futures market. A value greater than 1 means high buying volume, and a value less than 1 means high selling volume.

When the value of this indicator decreases in this way, it indicates that there are more sell orders than buy orders in the futures market for the asset in question.

In a recent report, anonymous CryptoQuant analyst ShayanBTC commented on the impact this will have on the price of ETH. According to ShayanBTC,

“This trend suggests that most futures traders have been selling Ethereum aggressively for speculative purposes or to take profits. A sharp decline in this indicator is a bearish signal and suggests that the current downward retracement may persist if this trend continues.”

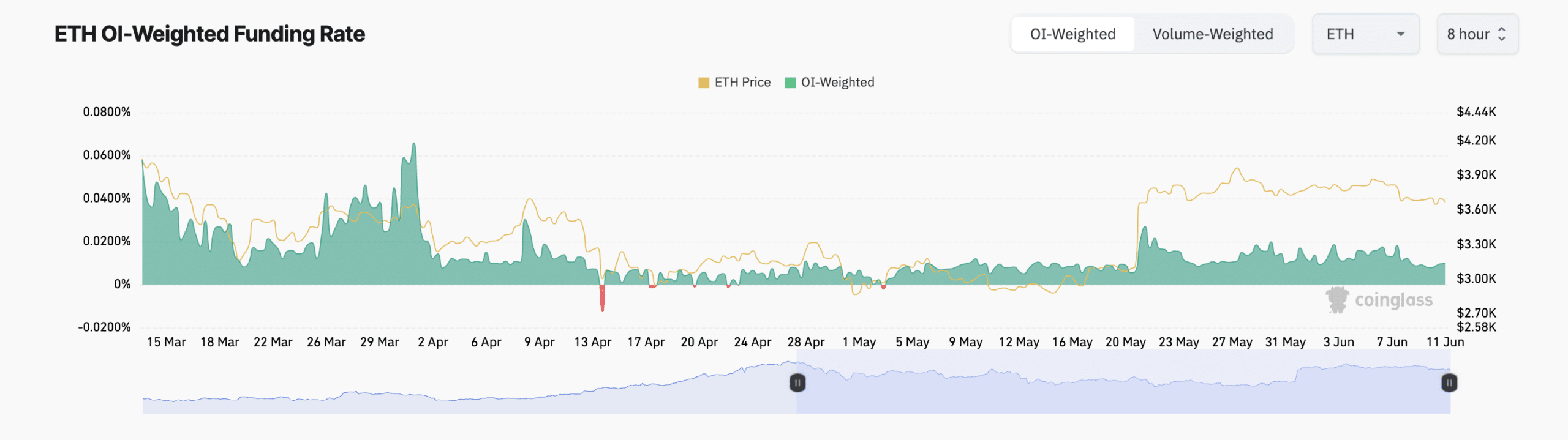

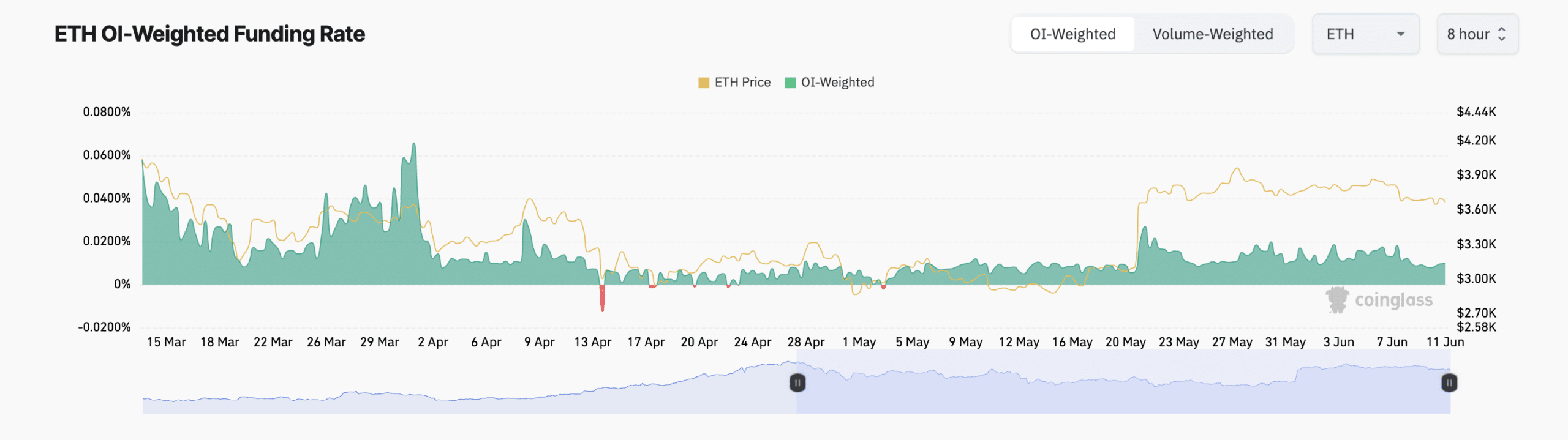

ETH funding rate remains positive

The above position was confirmed by a brief decline in ETH futures open interest after June 5.

At press time, ETH futures open interest was said to be $16.37 billion, down 2% since then. coin glass data.

A coin’s futures open interest measures the total number of outstanding futures contracts or positions that have not yet been closed or settled.

A drop like this means some futures traders are closing positions rather than opening new ones. This is often considered a shift in sentiment from bullish to bearish.

Read Ethereum (ETH) price prediction for 2024-25

However, despite the bearish bias towards the coin among some market participants, the majority of ETH futures traders have opened positions in hopes of continuing the price rise.

This is based on the coin’s funding rate reading, which has only returned positive values since May 3, according to Coinglass data.

Source: Coinglass

Funding rates are used in perpetual futures contracts to ensure that the contract price remains close to the spot price. If positive, it means there is significant demand for buy positions.