This article is also available in Spanish.

Ethereum is down at time of writing, reflecting its overall performance. The nearly 2% decline in the cryptocurrency market was due to contraction in Bitcoin, Ethereum and top altcoins. Currently, the total market capitalization has decreased to $2.17 trillion. If pressure comes, it could record more losses, reversing September’s gains.

Ethereum under pressure, is support available at $2,350?

Last week alone, CoinMarketCap data showed show Ethereum fell 10%, taking losses below the previous support level of $2,400 and now resistance. While it may seem like the sharp decline for most of this week has dampened participation, some traders are accumulating at spot rate levels.

Related Reading

Into the Block data On October 3, 1.89 million Ethereum addresses were seen purchasing 52 million ETH in a range of approximately $2,311 to $2,383. The fact that many buyers are choosing to buy at the $2,350 average means that this is a support level that traders should watch closely.

Given the number of ETH accumulated, sellers would have to work harder to break below this level, which would push the coin to its August low of $2,100. Comparing traders’ actions with the September range, the $2,350 level corresponds to approximately the 61.8% and 78.6% Fibonacci retracement levels.

What’s next for ETH?

Technically, cryptocurrency prices, including ETH, tend to find support around this Fibonacci retracement area. Therefore, a medium- to long-term trend is likely to form depending on how the price reacts between the $2,100 and $2,350 area.

Related Read: What’s Holding Bitcoin Back? Analysts say $71,000 is the magic number.

A refreshing bounce around this new support line and Fibonacci retracement area would be a huge boost. In this case, the bull target is $3,500, so ETH could rise above $2,800.

Conversely, a sharp decline below the August and September lows could easily lead to panic selling. Among these, ETH may fall below $2,100 to $2,000 and may fall to $1,800, confirming losses in early August.

When considering price action conditions, sellers have the upper hand. Over the last few trading sessions, centralized exchanges have experienced massive outflows.

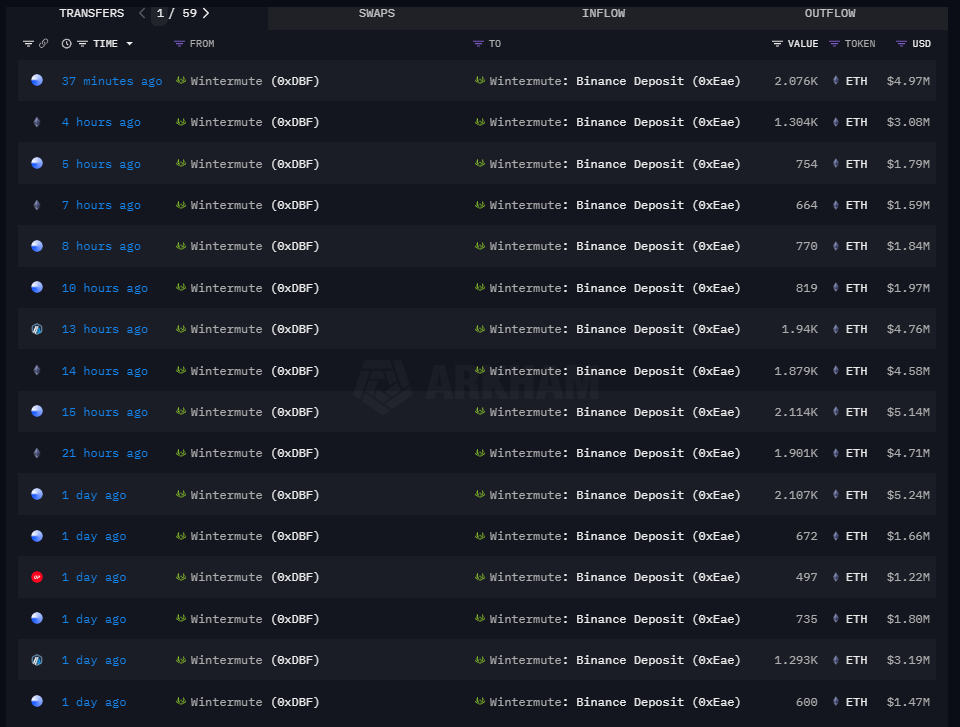

Earlier today, The Data Nerd exposed Cryptocurrency market maker Wintermute has moved 14,221 ETH to Binance, indicating a possible sale. In August, other major market makers, including Wintermute and Jump Capital, sold over 130,000 ETH, driving the price down.

Featured image by DALLE, chart by TradingView