- The MOVE cryptocurrency is up more than 12% in 24 hours after a surge in buying pressure.

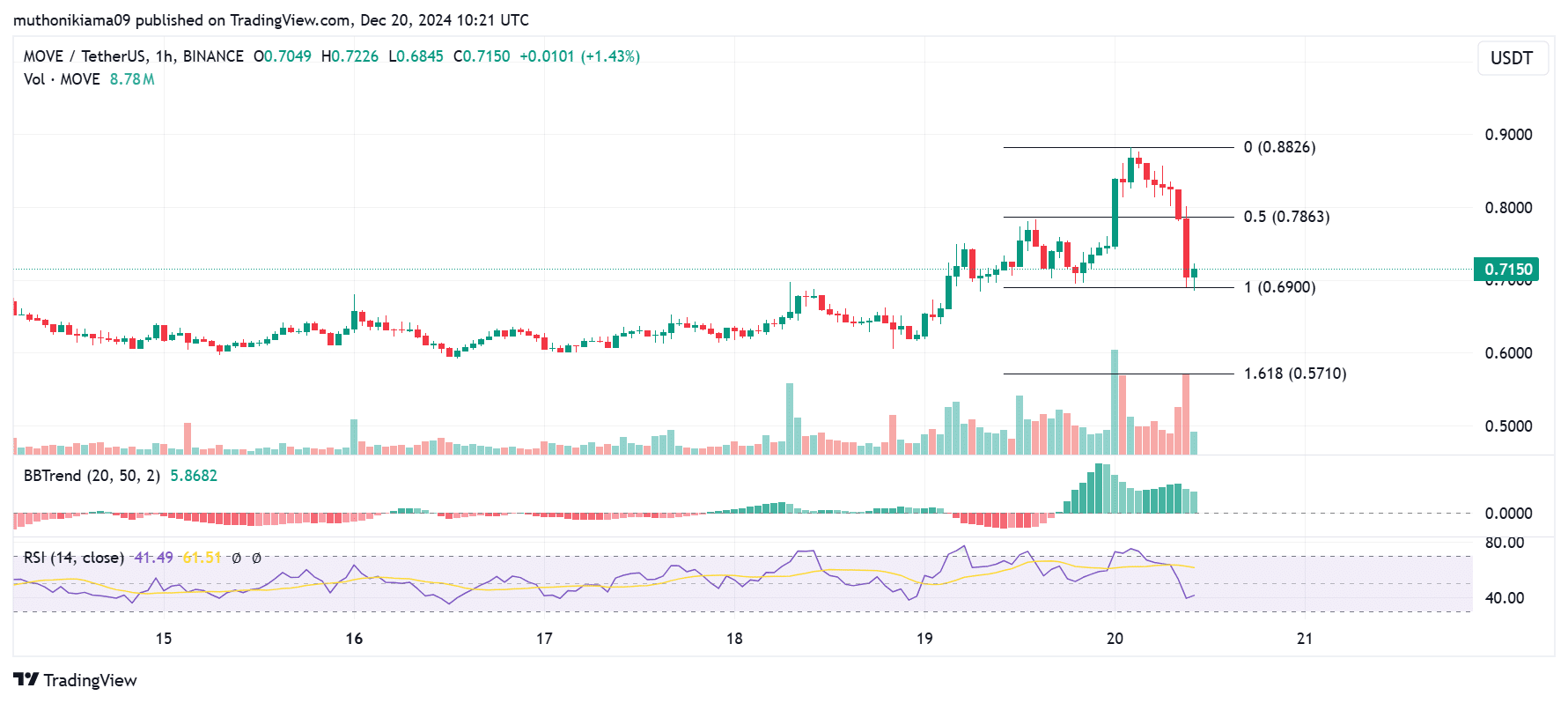

- A falling RSI on the hourly chart indicates that traders who buy during the rally may take profits.

Movement (MOVE) outperformed the rest of the overall market after posting a gain of over 12% in 24 hours. At press time, MOVE was trading at $0.797 with a 137% surge in trading volume. CoinMarketCap.

MOVE’s upward trend has seen its market capitalization surge past $1.79 billion, with the altcoin now ranking as the 61st largest cryptocurrency by this metric.

One of the factors that triggered MOVE’s rally was a surge in buying activity as short-term traders looked to profit during the rally. However, buying volume appears to have subsided during lower hours, which could trigger a decline if sales pick up.

The Relative Strength Index (RSI) has fallen to 41 at press time, close to oversold territory. This could be ahead of a short-term upward correction, but it could also suggest that traders who bought during the uptrend are starting to sell.

Source: TradingView

The green Bollinger Bands trend indicator shows that the bulls have the upper hand despite a surge in selling activity. If buyers re-enter the market, the price may return to the key resistance level of $0.882.

On the other hand, if the bearish trend continues and buyers fail to intervene, MOVE could fall to the important support level of 1.618 Fibonacci level ($0.57).

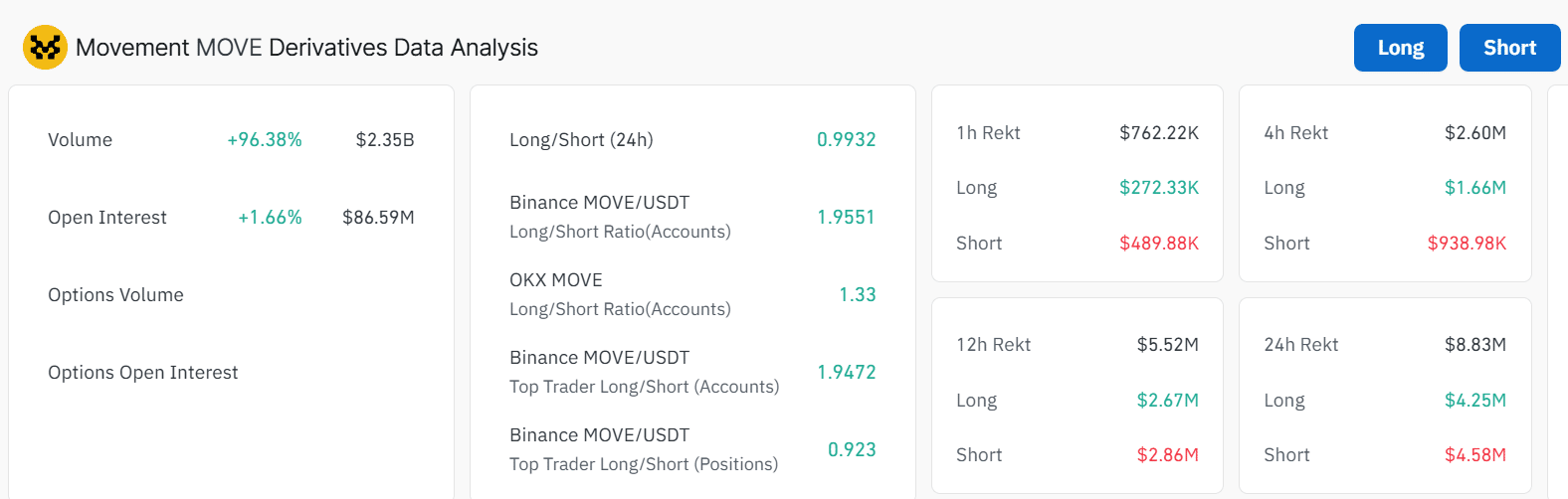

Derivatives data analysis

Looking at derivatives market data for the MOVE cryptocurrency, we see a significant surge in speculative activity that can cause volatility.

The token’s open interest rose to $86 million after rising slightly by 1.6% in 24 hours. At the same time, trading volume in the derivatives market increased 96% to $2.35 billion.

Volatile price movements led to a surge in liquidations of both long and short positions, with more than $8 million liquidated in 24 hours.

Source: Coinglass

The long/short ratio of 0.99 shows neutral market sentiment with slightly more short positions. However, in these balanced markets, the risk of a short or long squeeze is reduced, which reduces volatility.

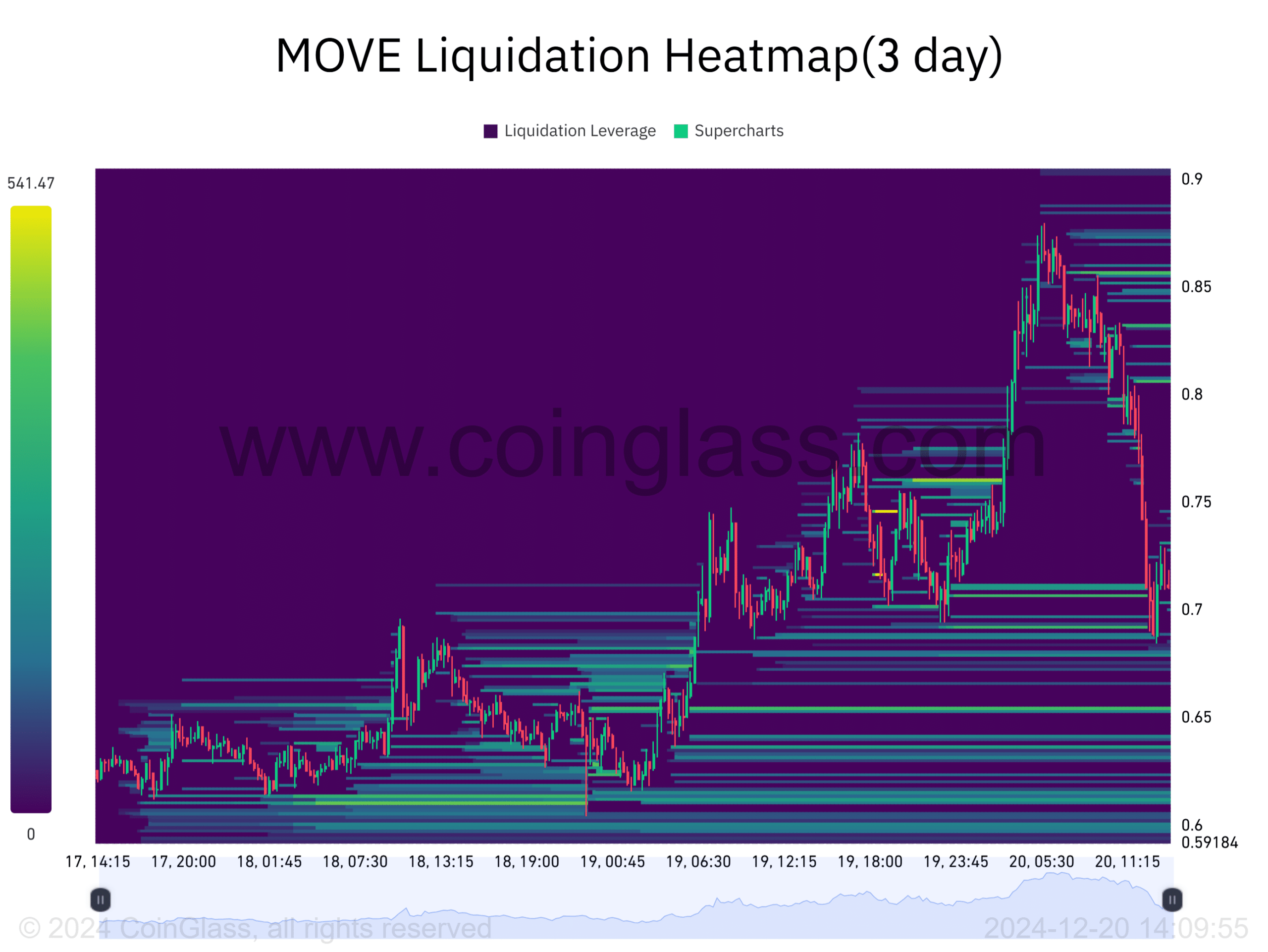

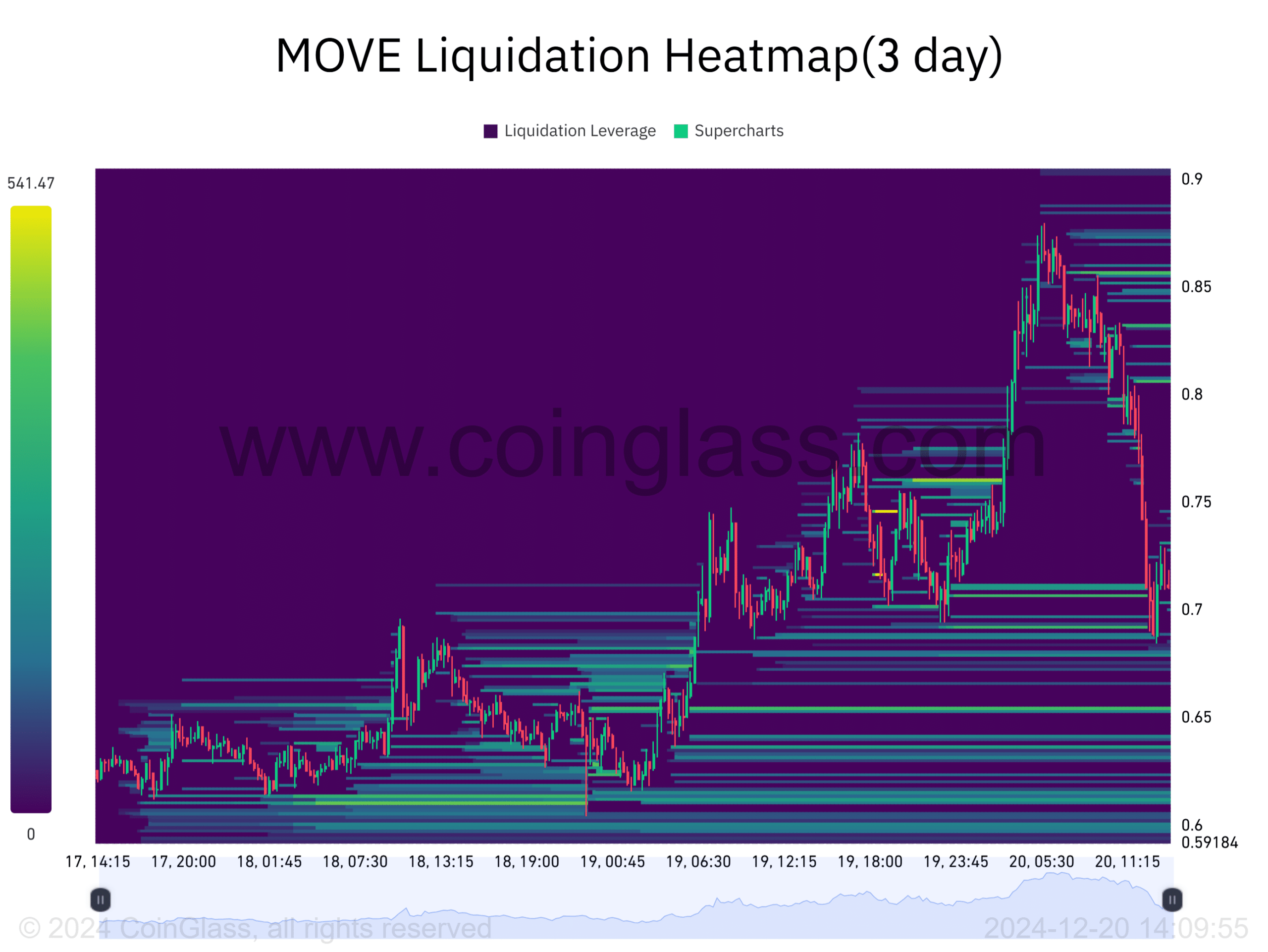

MOVE’s liquidation heatmap shows:

The liquidation heatmap for the MOVE cryptocurrency with a 3-day conversion confirmation period shows that the upward trend has resulted in a series of short-term liquidations. As these positions were wiped out, the upward trend accelerated through forced purchases.

Source: Coinglass

Is your portfolio green? Check out our Moving Profit Calculator

On the other hand, there is a liquidation cluster below the price that could push MOVE lower. Two areas that traders should watch out for are $0.65 and $0.67.

If MOVE falls to this level, long positions may be closed and selling activity may accelerate, accelerating the downtrend.