- Bitcoin is Mt. Gox redemption is under pressure, and experts like Alex Thorn highlight the potential impact on Bitcoin Cash.

- The contrasting redemption strategies of Mt. Gox, Gemini and FTX have raised questions about market stability and investor sentiment.

2024 has been considered one of the luckiest years for Bitcoin (BTC), especially with the launch of the Bitcoin ETF reaching an all-time high of $73,000 and the anticipated Bitcoin halving event.

However, as the cryptocurrency community prepares for the full and final approval of a spot Ethereum (ETH) ETF in July, BTC appears to be taking a backseat.

In fact, at the time of writing, ETH has surged 1.58% in the last 24 hours, while BTC is flashing a red candlestick trading at $61,000 on the daily chart.

What is the background to Bitcoin’s downfall?

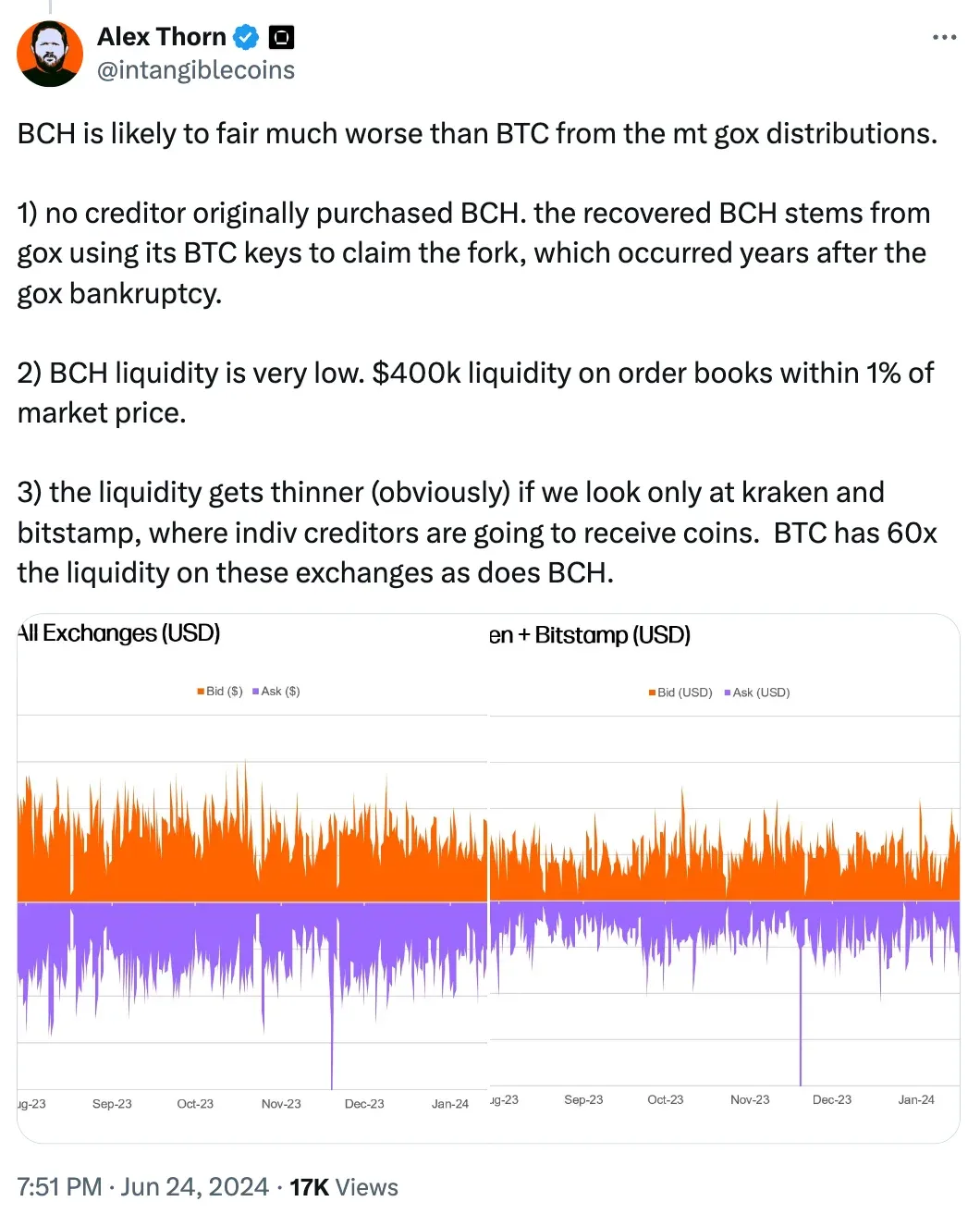

While many are blaming the Mt.Gox redemption plan as the cause of Bitcoin’s decline, Alex Thorn, head of company-wide research at Galaxy Digital, offered a different perspective.

Per Thorn, Bitcoin Cash (BCH) was more affected. He expanded on his views, taking to X (formerly Twitter) to say:

Source: Alex Thorn/X

Here, Thorn is the 2014 Mt. It is mentioned that the massive hack that Gox suffered resulted in a loss of 740,000 BTC (equivalent to $15 billion today).

From July 2024, repayments will be made in Bitcoin and BCH, which could increase selling pressure on these cryptocurrencies as creditors receive newly acquired assets and potentially sell them.

possible solution

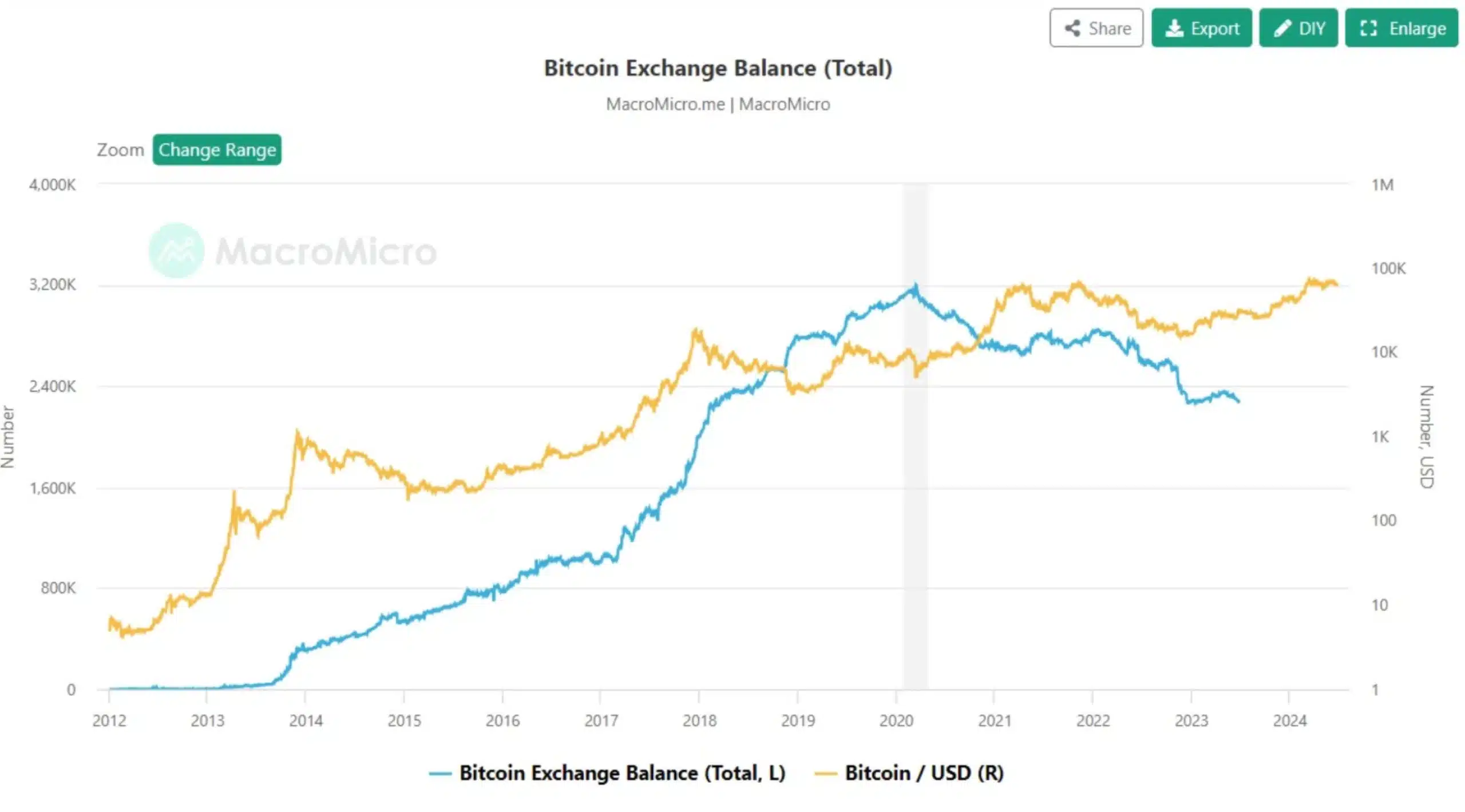

To keep an eye on this situation, many executives have suggested relying on Bitcoin exchange balances as a reliable indicator of Bitcoin price strength.

However, popular commentator Matthew Hyland criticized the significance of the decline in exchange supply as “overestimated” in a recent post on He explained in detail.

“The supply side IMO is overrated. During the entire bear market, BTC on exchanges fell, but BTC prices continued to fall. “It’s important in the long run, but over the years it turns out it’s not.”

Source: Matthew Hyland/X

Well, it’s important to remember that this isn’t the first time Mt. Gox has done something like that.

Source: Pat/X

It’s not just Mt. Gox!

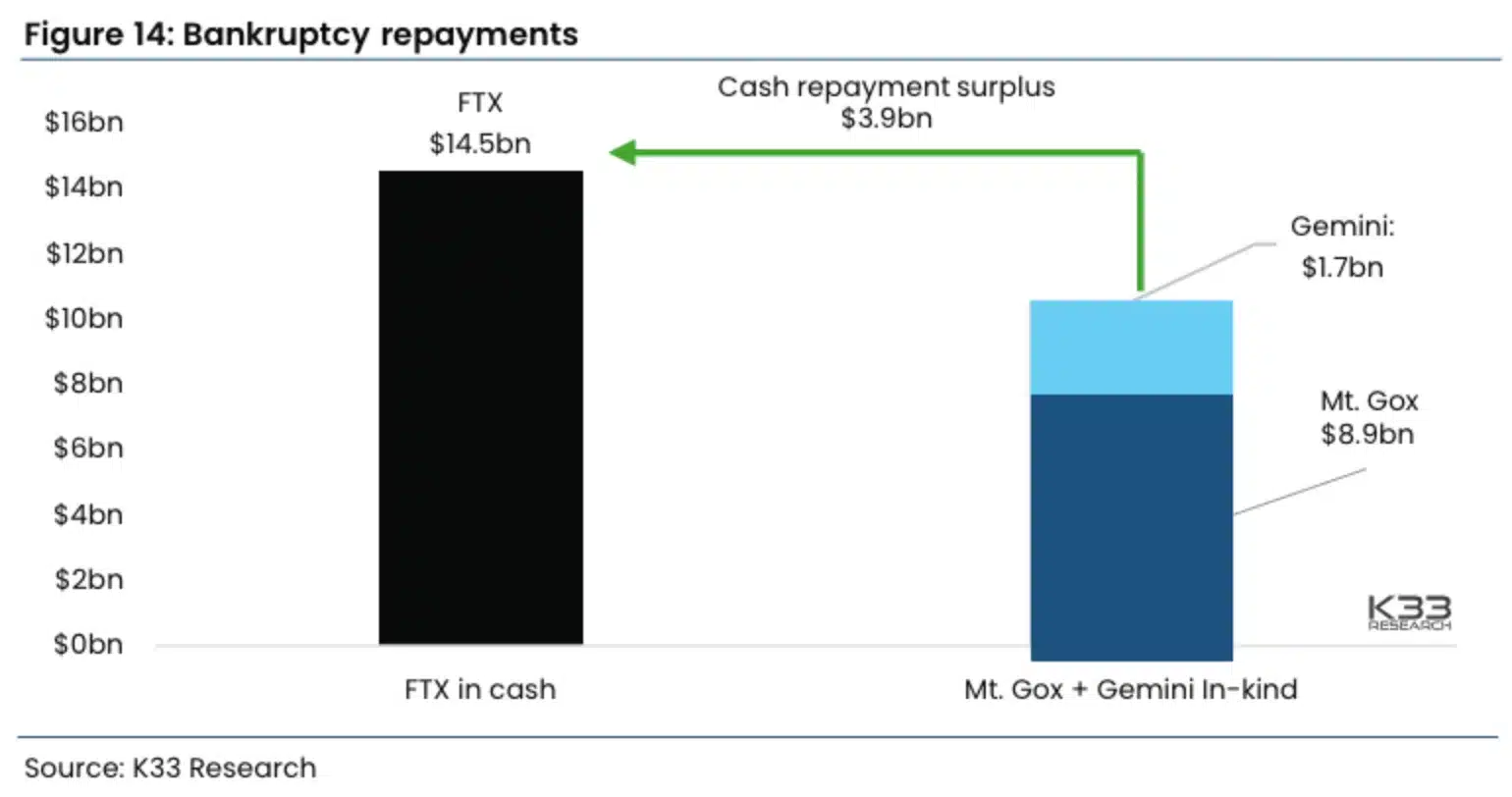

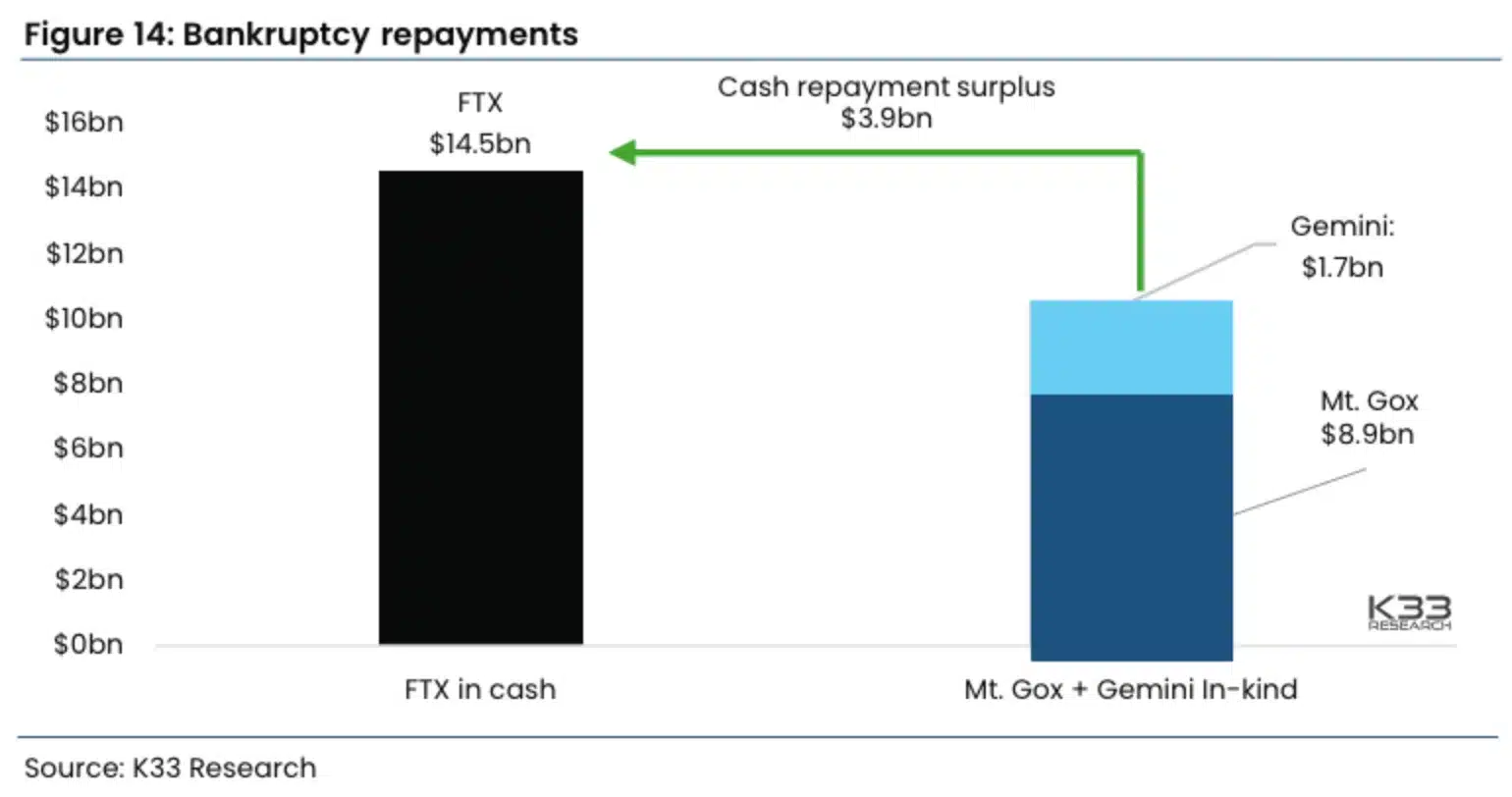

Mt. In addition to Gox, Gemini also announced plans to refund users affected by the suspension of the Gemini Earn program.

The founders took to X (formerly Twitter) to highlight that Earn users received $2.18 billion in digital assets on May 29.

Additionally, cryptocurrency exchange FTX, which went through bankruptcy proceedings last year, also announced a plan to clear its debt.

However, the impact of these repayments on market sentiment may be different from other creditor agreements, according to analysts at K33 Research.

Mt. plans to repay creditors with cryptocurrency. Unlike institutions like Gox or Gemini, FTX plans to implement cash-based redemptions.

Source: K33 Research

These differences in repayment methods can affect investor views and market stability in various ways.