An unknown Ethereum whale has been accumulating ETH at a rapid pace since early February. Over the past 23 days, wallet 0x7a95c has acquired $411 million worth of ETH and stETH, mostly from Binance.

shared data CryptoSlate Spotonchain tracks ETH flowing into wallets throughout the month, showing consistent purchases between 3,000 and 34,000 ETH.

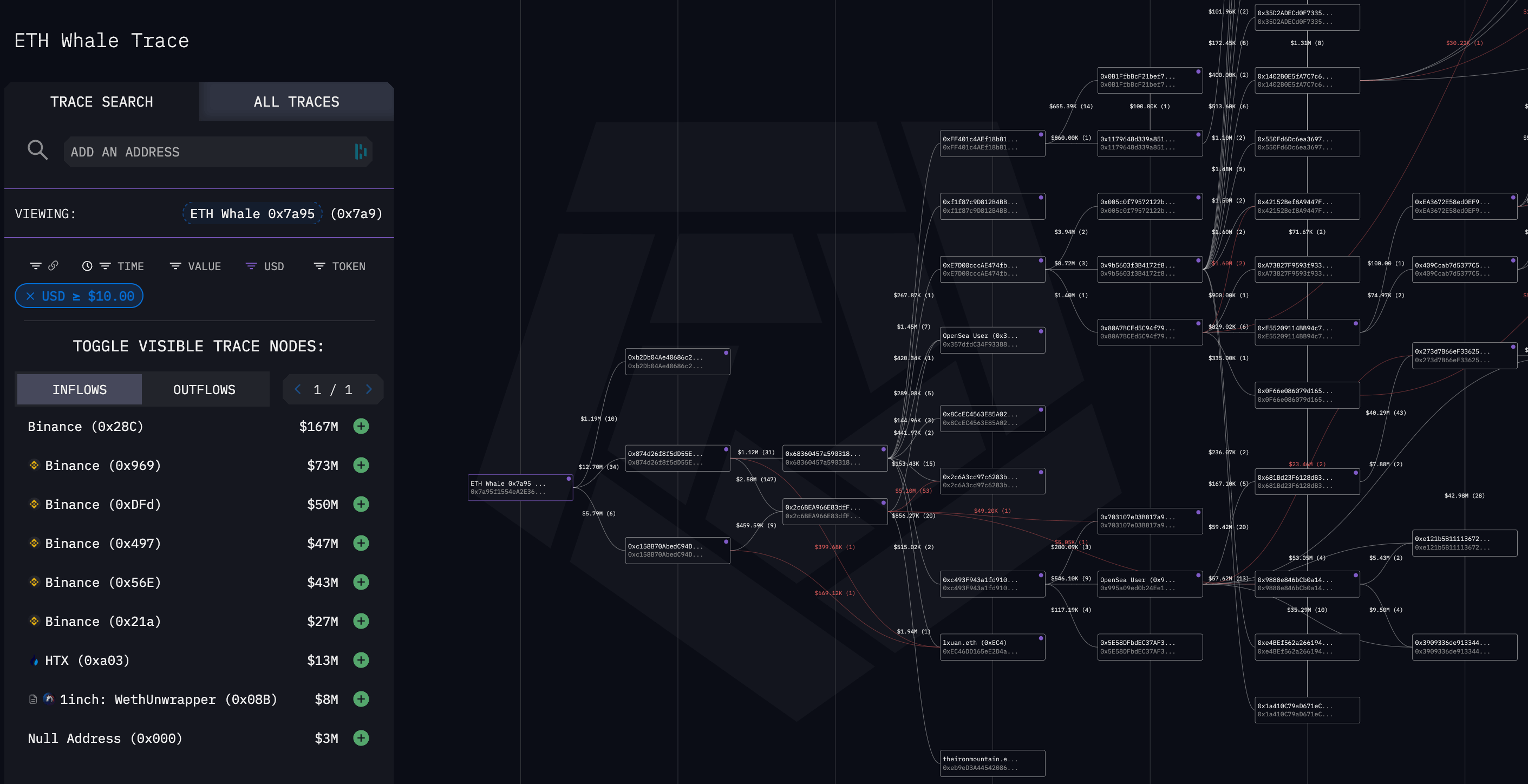

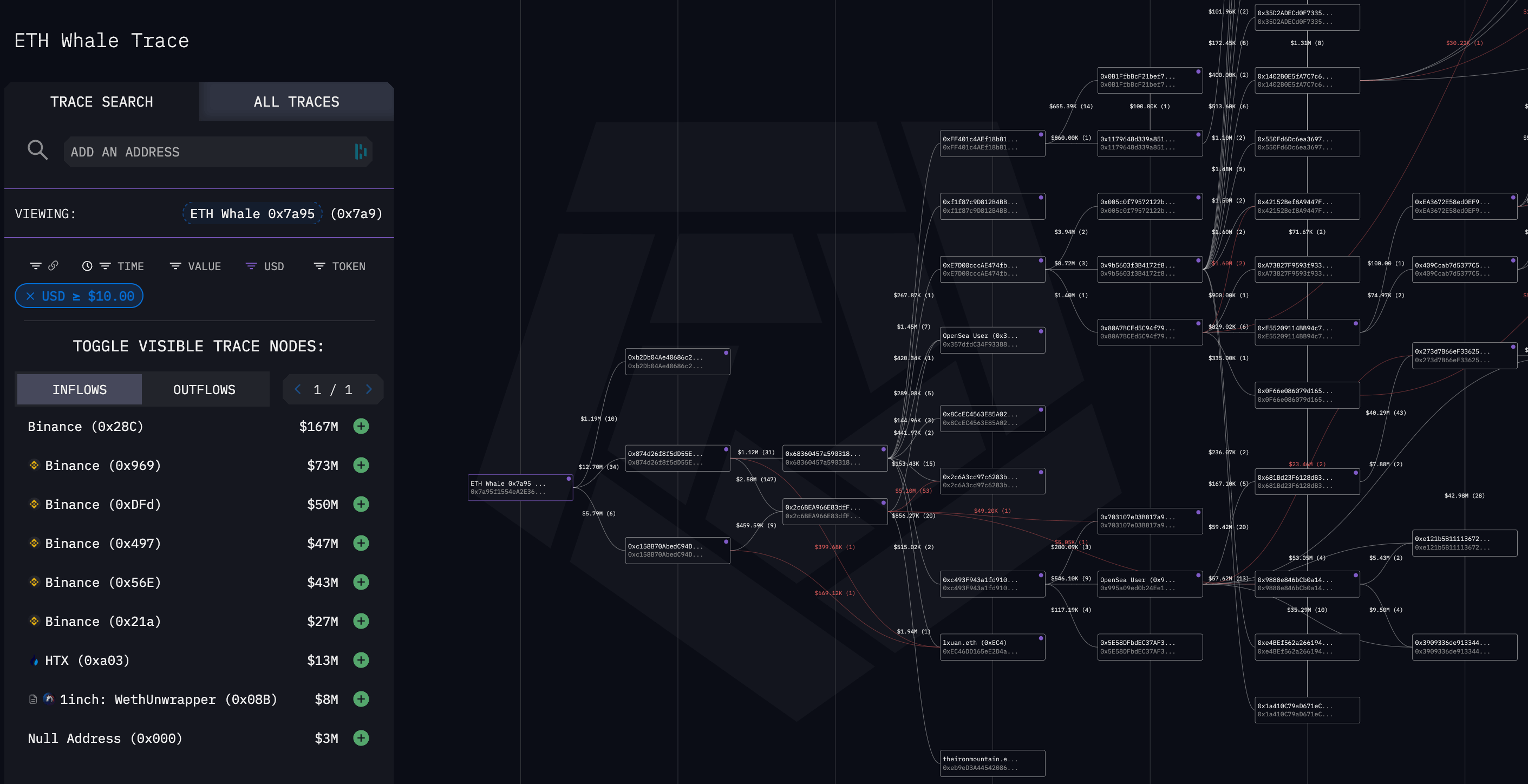

CryptoSlate Analysis tracking inflows and outflows from the wallet shows connections with several other exchanges and DEXs. Almost all funds entering the wallet came from Binance, including $21 million from HTX and 1inch. However, in terms of leaks, various addresses are connected, including Wintermute, Uniswap, 1inch, AlphaLab Capital, Native Pool, and Paraswap.

An examination of Spotonchain’s transaction history revealed that the whale transferred 7,915 ETH, worth approximately $23.52 million, from Binance to his wallet. This transaction, recorded at 16:38 on February 22, marks a continuation of the company’s notable accumulation pattern. The transaction details indicate a deliberate strategy by the whales to increase their Ethereum holdings.

Over the past four days, whales have reportedly purchased a total of 112,923 ETH through Binance and 1inch, with an average acquisition cost of $2,892 per ETH and an investment of $326.5 million. After these transactions, the whale’s Ethereum holdings now stand at 132,585 ETH and 5,485 STETH, with a cumulative value of $411 million. The portfolio currently shows unrealized gains of $21.13 million, highlighting the financial benefits of this strategic move.

The accumulation pattern includes several other important transactions. Notably, 17,198 ETH was withdrawn from Binance in the previous transaction, contributing to the increase in the whale’s Ethereum reserves.

Additionally, whale activity extends beyond Ethereum purchases, as evidenced by the withdrawal of 40 million USDT from Binance. This presents a broader strategy that potentially includes leveraging stablecoin reserves to further increase Ethereum holdings. Whale’s trading and holdings, particularly its strategic use of ETH and STETH, reflect a sophisticated approach to digital asset investing, emphasizing diversification and timing to capitalize on market movements.

Rumors of an SEC-approved spot Ethereum ETF helped Ethereum cross the $3,000 mark twice this month. Concerns have been raised about theoretical issues related to centralization of staked Ethereum among spot ETFs, but potential approval is currently unclear.

Unconfirmed rumors about Justin Sun’s relationship

Earlier this month, Lookonchain analyzed similar transactions with wallets suspected to belong to investors and suggested the whale could be Justin Sun. However, all information appears to be contextual and the wallet does not have a corresponding active address on the Tron blockchain. Nonetheless, interestingly, the 0x7a95 wallet has never interacted with USDC and appears to only use USDT for stablecoin transactions. Although Circle said in a 2023 letter to Senator Elizabeth Warren that Justin Sun had no accounts associated with them, a wallet identified by Arkham Intelligence as belonging to Sun was traded for USDC as recently as February 22.

The only link to Justin Sun that can be identified by CryptoSlate It was two tangentially connected wallets and a 1inch settlement contract. Addresses 0x874d and 0x158B received $21 million from 0x7a95, and both transferred funds to 1-inch settlement contract 0xA888. A wallet tagged Justin Sun, 0x1387, received $58 million from the same 1-inch contract a year ago. However, all of 0x7a95’s transactions occurred much more recently.

CryptoSlate We are monitoring the wallet and associated addresses as additional information comes to light.